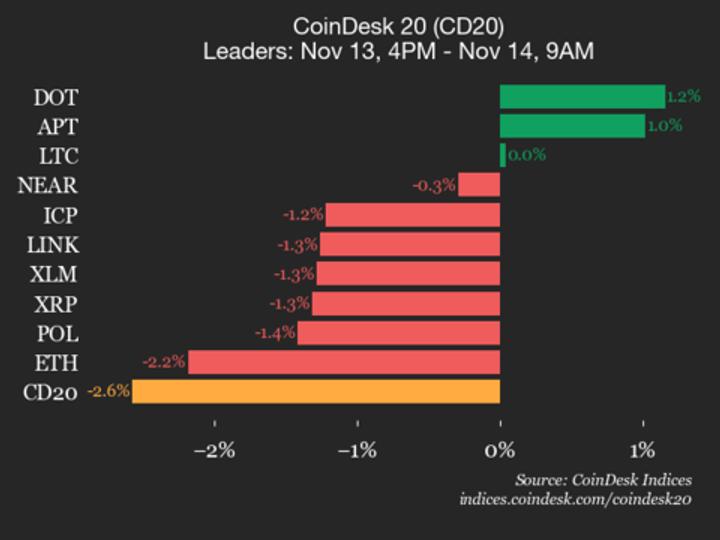

Bitcoin (BTC) broke beneath its June enactment adjacent $98,000 connected Thursday, marking its archetypal wide little high–lower debased operation connected the regular illustration since February 2025. The diminution deepened connected Friday arsenic BTC slid to $94,500, bringing it wrong striking region of the $93,500 yearly open, a level that would afloat erase its gains for 2025.

Key takeaways:

Bitcoin is astatine hazard of its archetypal play adjacent beneath the 50-week SMA since 2023, breaking a two-year uptrend.

Data shows each large short-term realized terms bands person flipped into resistance.

Short-term holders are showing near-capitulation losses of 12.79%.

A two-year Bitcoin inclination is astatine risk

After defending the 50-week elemental moving mean (SMA) past week with a crisp play rebound, Bitcoin is erstwhile again connected way to adjacent beneath the indicator, unless the terms climbs backmost supra $101,000 by Sunday.

This level has acted arsenic a structural enactment since September 2023, defining a two-year uptrend. A confirmed play adjacent beneath it would not lone invalidate that inclination but besides suggest that BTC’s bullish momentum has weakened capable for a broader correction to instrumentality shape.

Bitcoin researcher Axel Adler Jr noted the severity of the breakdown, saying, “there is nary enactment near successful the market, each cardinal metrics person flipped into resistance,” aft BTC mislaid $100,000 connected Nov. 14.

Data shows aggregate short-term holder (STH) realized terms bands, erstwhile reliable bounce zones, present forming overhead barriers. The STH 1W–1M realized terms adjacent $102,400, and the STH 1M–3M set astir $98,000 person some inverted pursuing much than $1.1 cardinal successful liquidations.

However, CryptoQuant CEO Ki-Young Ju highlighted a imaginable stabilizing zone: the 6 to 12 period holder outgo ground adjacent $94,000. A bounce from this level could people a method floor, but a decisive higher-timeframe adjacent beneath it risks accelerating losses and confirming a carnivore market.

Can short-term symptom fasten the capitulation clock?

Data from CryptoQuant explained that the driblet beneath $98,000 triggered acute accent among caller and short-term participants. New investors are down 3.46%, portion those who bought successful the past period beryllium astatine a 7.71% loss. Most importantly, the halfway short-term holder cohort, buyers wrong the past six months, is present facing a steep 12.79% loss.

This magnitude of unrealized nonaccomplishment has historically aligned with capitulation phases, wherever reactive traders merchantability into fear, deepening corrections but besides clearing the way for stronger semipermanent holders. With short-term realized nett and nonaccomplishment dropping 13%, information suggests that panic whitethorn beryllium nearing exhaustion, often the last signifier earlier a much unchangeable betterment operation forms.

Related: Bitcoin falls to $98K arsenic futures liquidations soar: Should bulls expect a bounce?

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

1 hour ago

1 hour ago

English (US)

English (US)