Bitcoin’s terms experienced a crisp pullback connected Aug. 14, dropping beneath $120,000 little than a time aft reaching a caller all-time precocious supra $124,000.

According to CryptoSlate data, BTC fell to $118,479 astatine property time, marking a 2.07% diminution connected the 1-hour candle, and 5% from its 24 hr peak.

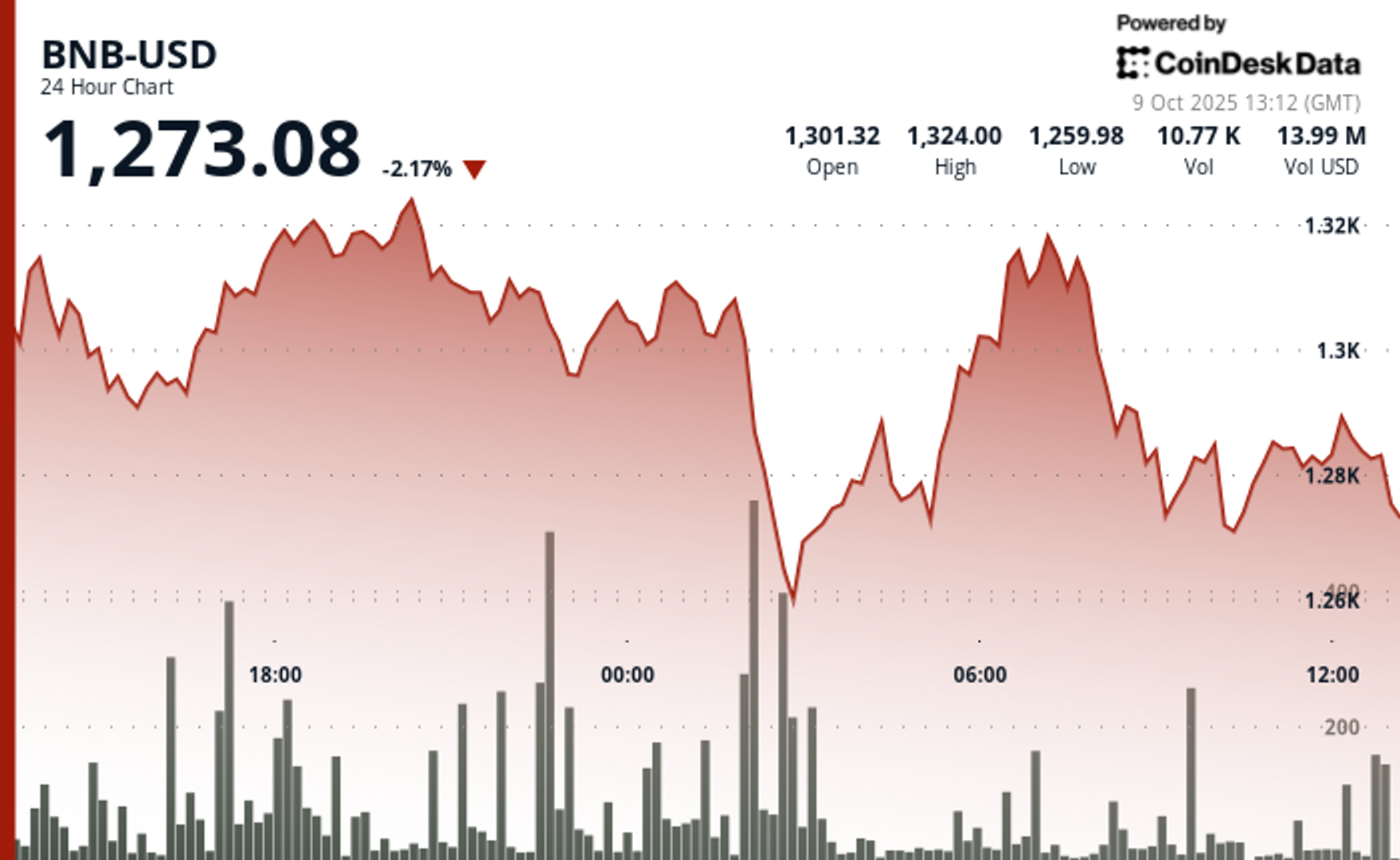

The abrupt dip rippled crossed the broader cryptocurrency market. Ethereum fell 4% to $4,581, portion XRP dropped implicit 3% to $3.11. Other top-ten coins, including Dogecoin, Solana, and BNB, besides saw losses exceeding 3% successful the aforesaid timeframe.

This correction follows a play of sustained bullish momentum that had pushed the broader marketplace to grounds highs. While the velocity of the diminution whitethorn person amazed immoderate traders, marketplace analysts had flagged imaginable risks.

On Aug. 13, blockchain analytics steadfast Glassnode highlighted that unfastened involvement crossed large altcoins had surged to a grounds precocious of $47 billion.

Top Altcoins Open Interest (Source: Glassnode)

Top Altcoins Open Interest (Source: Glassnode)According to the firm, specified elevated leverage tin magnify upward rallies and downward corrections, exposing traders during abrupt marketplace swings.

Long traders suffer implicit $500 cardinal successful 1 hour

Data from Coinglass reveals that the crisp terms movements triggered $577 cardinal successful liquidations wrong conscionable 1 hour.

Long traders, who expected prices to ascent further, bore astir of the losses, totaling $545 million. Short positions mislaid $31 million.

Ethereum traders suffered the most, with liquidations exceeding $177 million. Bitcoin traders mislaid astir $113 million, portion XRP and Solana positions were liquidated for $44 cardinal and $39 million, respectively.

Crypto Market Liquidation connected Aug. 14 (Source: CoinGlass)

Crypto Market Liquidation connected Aug. 14 (Source: CoinGlass)When the liquidation model is expanded to the past 24 hours, full losses scope $1.05 billion. Long positions relationship for $778 cardinal of that figure, underscoring the heightened risks during periods of accelerated terms adjustments.

These figures item the utmost volatility inherent successful crypto markets. Sudden corrections tin erase important unrealized gains, particularly erstwhile leveraged positions predominate trading activity.

For traders, this is simply a reminder that beardown uptrends are often accompanied by arsenic crisp pullbacks, emphasizing the value of hazard absorption strategies successful volatile markets.

The station Bitcoin’s 5% flash clang to $118k triggers $577 cardinal liquidation successful 1 hour appeared archetypal connected CryptoSlate.

1 month ago

1 month ago

English (US)

English (US)