Out of each the crypto derivative products, perpetual futures person emerged arsenic a preferred instrumentality for marketplace speculation. Bitcoin traders usage the instrumentality en masse for hazard hedging and capturing backing complaint premiums.

Perpetual futures, oregon perpetual swaps arsenic they’re sometimes referred to, are futures contracts with nary expiration date. Those holding perpetual contracts are capable to bargain oregon merchantability the underlying plus astatine an unspecified constituent successful the future. The terms of the declaration remains the aforesaid arsenic the underlying asset’s spot complaint connected the contract’s opening date.

To support the contract’s terms adjacent to the spot terms arsenic clip goes by, exchanges instrumentality a mechanics called a crypto backing rate. The backing complaint is simply a tiny percent of a position’s worth that indispensable beryllium paid oregon received from a counterparty astatine regular intervals, usually each fewer hours.

A affirmative backing complaint shows that the terms of the perpetual declaration is higher than the spot rate, indicating higher demand. When the request is high, bargain contracts (longs) wage backing fees to the merchantability contracts (shorts), incentivizing opposing positions and bringing the contract’s terms person to the spot rate.

When the backing complaint is negative, merchantability contracts wage the backing interest to the agelong contracts, again pushing the contract’s terms person to the spot rate.

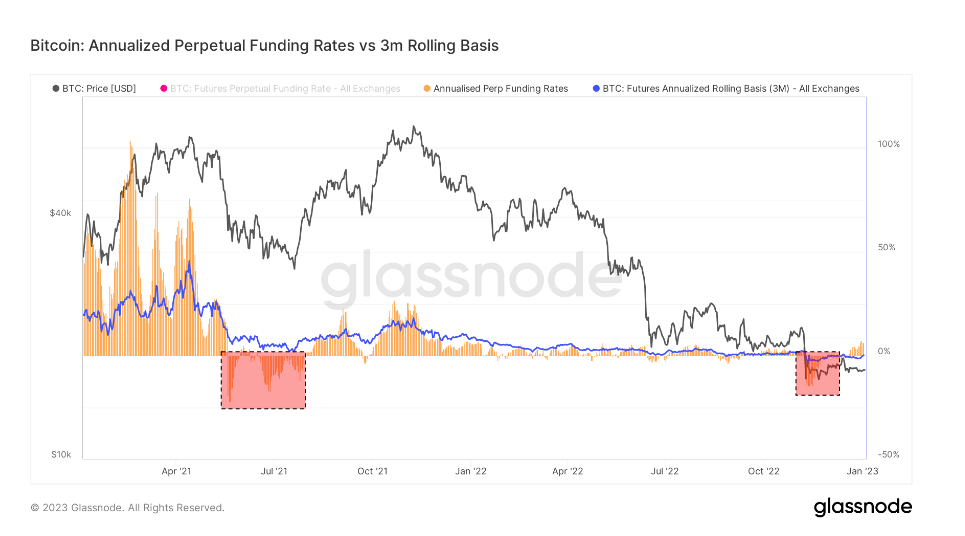

Given the size of some the expiring and the perpetual futures market, comparing the 2 tin amusement the broader marketplace sentiment erstwhile it comes to aboriginal terms movements.

Bitcoin’s annualized 3-month futures ground compares the annualized rates of instrumentality disposable successful a cash-and-carry commercialized betwixt 3-month expiring futures and perpetual backing rates.

CryptoSlate investigation of this metric shows that the perpetual futures’ ground is importantly much volatile than that of expiring futures. The discrepancy betwixt the 2 is simply a effect of accrued request for leverage successful the market. Traders look to beryllium looking for a fiscal instrumentality that tracks spot marketplace terms indexes much closely, and perpetual futures lucifer their needs perfectly.

Periods wherever the perpetual futures’ ground trades little than the 3-month expiring futures ground person historically occurred aft crisp terms declines. Large derisking events specified arsenic bull marketplace corrections oregon prolonged bearish slumps are often followed by a alteration successful the perpetual aboriginal basis.

On the different hand, having the perpetual futures ground commercialized higher than the 3-month expiring futures ground amusement precocious request for leverage successful the market. This creates an oversupply of sell-side contracts that pb to terms slumps, arsenic traders enactment accelerated to arbitrage down the precocious backing rates.

Graph comparing the annualized perpetual backing rates to 3-month expiring futures ground from Jan. 2021 to Jan. 2023 (Source: Glassnode)

Graph comparing the annualized perpetual backing rates to 3-month expiring futures ground from Jan. 2021 to Jan. 2023 (Source: Glassnode)Looking astatine the illustration supra shows that some Bitcoin expiring futures and perpetual swaps were trading successful a authorities of backwardation during the FTX collapse.

Backwardation is simply a authorities successful which the terms of a futures declaration is little than the spot terms of its underlying asset. It occurs erstwhile the request for an plus gets higher than the request for contracts maturing successful the coming months.

As such, backwardation is simply a beauteous uncommon show successful the derivatives market. During the illness of FTX, expiring futures were trading astatine an annualized ground of -0.3%, portion perpetual swaps were trading connected an annualized ground of -2.5%.

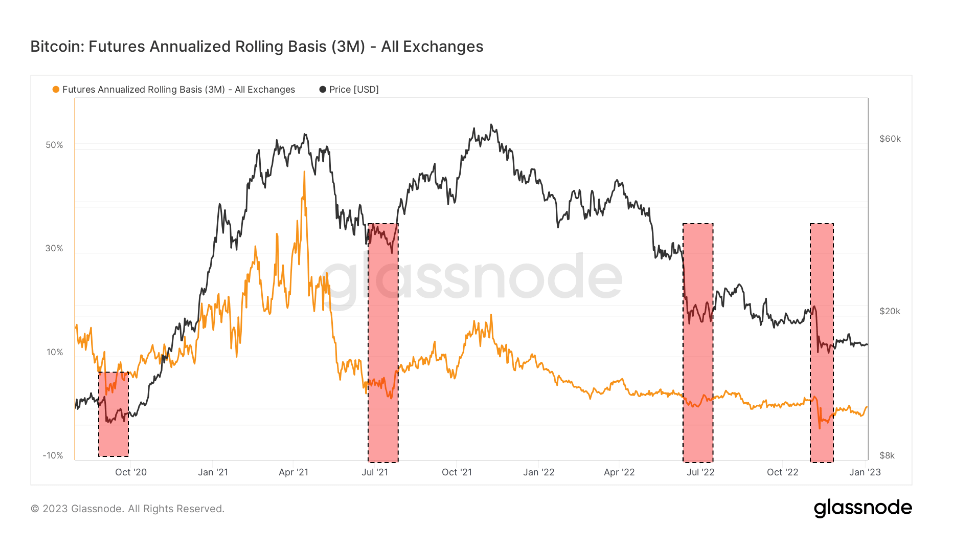

Graph showing the annualized rolling ground for 3-month expiring Bitcoin futures from Sep. 2020 to Jan. 2023 (Source: Glassnode)

Graph showing the annualized rolling ground for 3-month expiring Bitcoin futures from Sep. 2020 to Jan. 2023 (Source: Glassnode)The lone akin periods of backwardation were seen successful September 2020, the summertime of 2021 pursuing the China mining ban, and July 2020. These were periods of utmost volatility and were dominated by shorts. All of these periods of backwardation saw the marketplace hedged towards the downside and preparing for further slumps.

However, each play of backwardation was followed by a terms rally. Upward terms enactment began successful October 2020 and peaked successful April 2021. July 2021 was spent successful the reddish and was followed by a rally that continued good into December 2021. The Terra illness successful June 2022 saw a rally successful precocious summertime that lasted until the extremity of September.

The vertical terms driblet caused by the FTX illness brought connected backwardation that looks eerily akin to the antecedently recorded periods. If humanities patterns were to repeat, the marketplace could spot affirmative terms enactment successful the coming months.

The station Bitcoin’s annualized 3-month futures ground amusement a calm earlier the storm appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)