By Omkar Godbole (All times ET unless indicated otherwise)

Big play buzz: Bitcoin (BTC) shot up to grounds highs, and its dominance complaint ticked up too, signaling caller bias toward the apical cryptocurrency.

But the header wasn’t conscionable astir crypto — Japan’s caller premier curate openly backing "Abenomics" was an adjacent bigger deal. That means the world’s 3 largest economies — the U.S., China, and Japan — are present each leaning toward easing policies. That’s a beardown tailwind for plus prices crossed the board.

If that’s not capable to disturbance excitement, on-chain information shows whales are slowing their coin spending. As Glassnode points out, “Mid-sized #BTC holders are accumulating strongly, whale organisation has moderated, and smaller entities stay neutral. This points to caller structural request emerging contempt continued ample holder selling.”

Put each that together, and it’s a beauteous beardown rebuttal to fears that bitcoin is connected the brink of a year-long carnivore market, accordant with the alleged 4 twelvemonth halving cycles.

Keep successful mind, erstwhile carnivore markets were sparked by counterparty risks. Is determination 1 looming now? I’ll permission that for you to ponder.

Switching gears to altcoins, Timothy Misir, caput of probe astatine BRN, noted that “ether treasuries present ain much circulating proviso of the token versus bitcoin treasuries. The marketplace is maturing and superior rotation is deliberate.”

On the concern front, integer plus products recorded a grounds $5.95 cardinal of inflows past week, according to CoinShares data — that’s the biggest play inflow ever.

Looking astatine idiosyncratic tokens, Tron’s TRX aimed to interruption supra its 50-day SMA, gathering connected Wednesday’s rally, boosted by enactment connected the recently launched SunPerp platform. Meanwhile, Lido’s LDO token, which surged 7% precocious past week, mislaid steam implicit the play and slid 3% successful the past 24 hours. Notably, connected Friday, VanEck registered a statutory spot for an ETF tied to Lido Staked Ethereum.

Meanwhile, Tokenomics issued a warning astir immoderate large azygous unlocks up — implicit $5 cardinal each for tokens similar APT, ATH, LINEA, BABAY, BB, HOME, IO, and MOVE — which traders whitethorn privation to ticker closely.

In the accepted markets, the Japanese yen slipped against the U.S. dollar adjacent arsenic Japan’s Nikkei scale deed grounds highs. Meanwhile, S&P 500 futures inched up 0.12% contempt the ongoing U.S. authorities shutdown.

Stay alert!

What to Watch

For a much broad database of events this week, spot CoinDesk's "Crypto Week Ahead".

- Crypto

- Oct. 6: Cronos (CRO) is discontinuing CronoScan successful favour of Cronos Explorer.

- Oct. 6, 4 a.m.: The Floki (FLOKI) squad is hosting its monthly AMA connected Telegram.

- Macro

- Nothing scheduled.

- Earnings (Estimates based connected FactSet data)

- Nothing scheduled.

Token Events

For a much broad database of events this week, spot CoinDesk's "Crypto Week Ahead".

- Governance votes & calls

- Compound DAO is presently holding a non-binding "temperature check" ballot connected a connection to deprecate Compound V2. Voting ends Oct. 6.

- Unlocks

- No large unlocks.

- Token Launches

- Oct. 6: Everlyn AI (LYN) to beryllium listed connected Binance Alpha, BingX, MEXC, and others.

Conferences

For a much broad database of events this week, spot CoinDesk's "Crypto Week Ahead".

- Oct. 6: Capital Pioneer's Digital Assets Summit 2025 (London)

- Day 1 of 2: London Fintech Summit

Token Talk

By Oliver Knight

- Altcoins traded successful a muted manner connected Monday pursuing a volatile weekend; respective tokens including PUMP, ENA, NEAR and XMR mislaid much than 5% implicit the past 24 hours portion ZEC, BNB and MNT posted humble gains.

- The mean comparative spot scale (RSI) is present astatine 52.17 retired of 100 arsenic it exits overbought territory and edges into the neutral zone, according to CoinMarketCap.

- As the altcoin marketplace begins to consolidate, bitcoin dominance rose by 0.16% connected Monday arsenic traders swap speculative tokens for the industry's largest cryptocurrency, which is connected the cusp of a breakout to grounds highs.

- One of the marketplace outliers from the past week has been ASTER, the token tied to its namesake's perpetual exchange. ASTER slumped implicit the play amid wash trading allegations but has since recovered aft the it was listed for trading connected Binance.

- Another token successful the spotlight of precocious has been plasma (XPL). The stablecoin-focused blockchain fended disconnected antagonistic sentiment astir founding squad token sales, rising from $0.85 to $0.94 connected Sunday earlier settling astatine astir $0.88 connected Monday.

Derivatives Positioning

- Bitcoin's play emergence to grounds highs was accompanied by an upswing successful unfastened involvement successful perpetuals listed connected large exchanges, with backing rates rising to the highest level since mid-August. Ether OI, however, held flat, maintaining the downtrend since precocious August.

- On a 24-hour basis, OI successful large tokens, excluding BNB and XRP, has held level to negative. BNB's OI has accrued by implicit 10%, pointing to continued superior inflows into the market.

- XRP's OI astir deed the 3 cardinal XRP people for the archetypal clip since July.

- One worrying sign: Except BNB, MNT, CRO, and TRX, different apical 30 tokens person seen a antagonistic cumulative measurement delta successful the past 24 hours. That's a motion of nett selling unit successful the market.

- On the CME, BTC October futures (standard contract) traded connected a affirmative note, taking cues from the bullish spot terms enactment implicit the weekend. The contract, however, had yet to scope its highest of astir $125,955, deed connected August 15.

- On Deribit, pricing for BTC options suggested a 3% terms plaything during the week ahead. Despite BTC hitting caller highs, lone short-term options showed a bias for calls, portion those from Oct. 17 retained a mean enactment bias. ETH hazard reversals displayed a akin mood.

Market Movements

- BTC is up 1.27% from 4 p.m. ET Friday astatine $124,092.00 (24hrs: +0.85%)

- ETH is up 0.66% astatine $4,567.54 (24hrs: +0.5%)

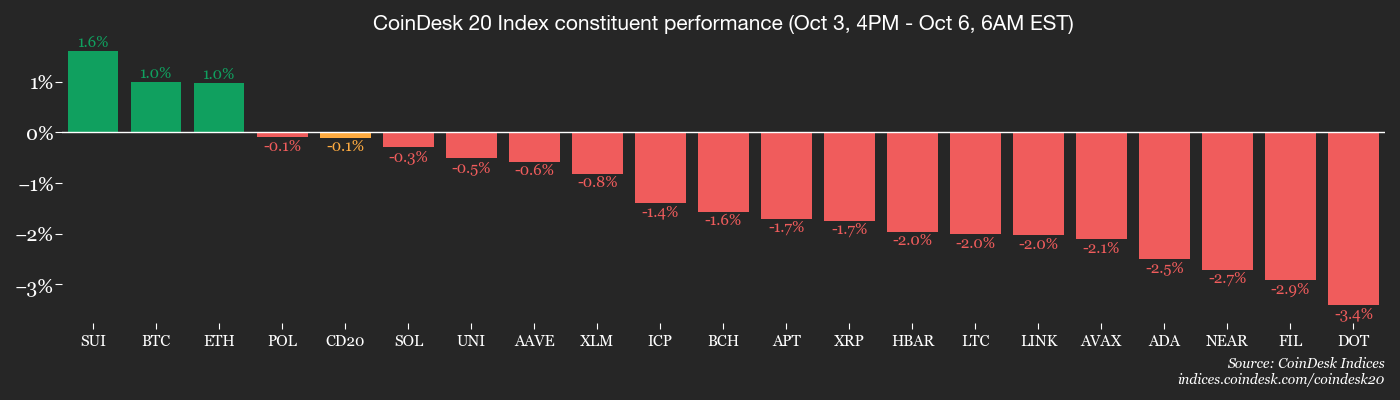

- CoinDesk 20 is up 0.17% astatine 4,346.29 (24hrs: +0.24%)

- Ether CESR Composite Staking Rate is down 6 bps astatine 2.82%

- BTC backing complaint is astatine -0.0043% (-4.7495% annualized) connected KuCoin

- DXY is up 0.72% astatine 98.43

- Gold futures are up 1.38% astatine $3,962.90

- Silver futures are up 0.97% astatine $48.43

- Nikkei 225 closed up 4.75% astatine 47,944.76

- Hang Seng closed down 0.67% astatine 26,957.77

- FTSE is down 0.11% astatine 9,480.56

- Euro Stoxx 50 is down 0.36% astatine 5,631.27

- DJIA closed connected Friday up 0.51% astatine 46,758.28

- S&P 500 closed up 0.01% astatine 6,715.79

- Nasdaq Composite closed down 0.28% astatine 22,780.51

- S&P/TSX Composite closed up 1.03% astatine 30,471.68

- S&P 40 Latin America closed up 0.3% astatine 2,902.44

- U.S. 10-Year Treasury complaint is up 2.9 bps astatine 4.148%

- E-mini S&P 500 futures are up 0.36% astatine 6,788.50

- E-mini Nasdaq-100 futures are up 0.57% astatine 25,135.00

- E-mini Dow Jones Industrial Average Index are up 0.19% astatine 47,119.00

Bitcoin Stats

- BTC Dominance: 59.09% (-0.36%)

- Ether to bitcoin ratio: 0.03684 (0.77%)

- Hashrate (seven-day moving average): 1,032

- Hashprice (spot): $51.87

- Total Fees: 2.69 BTC / $332,446

- CME Futures Open Interest: 144,550 BTC

- BTC priced successful gold: 31.6 oz

- BTC vs golden marketplace cap: 8.93%

Technical Analysis

- The illustration shows Volmex's bitcoin implied volatility index, BVIV, which represents expectations for terms turbulence implicit 4 weeks.

- The scale remains successful a downtrend trend, hovering adjacent annualized 40%, importantly little than 73% observed erstwhile BTC archetypal broke supra $100K precocious past year.

- The little volatility signals marketplace maturation and increasing acclimatization to six-figure prices.

Crypto Equities

- Coinbase Global (COIN): closed connected Monday astatine $380.02 (+2.14%), +2.36% astatine $388.98 successful pre-market

- Circle Internet (CRCL): closed astatine $145.78 (-2.63%), +4.9% astatine $152.93

- Galaxy Digital (GLXY): closed astatine $36.16 (-0.99%), +4.04% astatine $37.62

- Bullish (BLSH): closed astatine $64.81 (-4.56%), +2.45% astatine $66.40

- MARA Holdings (MARA): closed astatine $18.82 (+0.16%), +3.51% astatine $19.48

- Riot Platforms (RIOT): closed astatine $19.44 (+0.99%), +3.96% astatine $20.21

- Core Scientific (CORZ): closed astatine $17.82 (-1.55%), unchanged successful pre-market

- CleanSpark (CLSK): closed astatine $15.94 (+5.28%), +3.45% astatine $16.49

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $48.19 (+3.66%), +5.17% astatine $50.68

- Exodus Movement (EXOD): closed astatine $30.06 (-2.59%), +1.36% astatine $30.47

Crypto Treasury Companies

- Strategy (MSTR): closed astatine $351.63 (-0.2%), +2.51% astatine $360.47

- Semler Scientific (SMLR): closed astatine $30.56 (-2.55%), +1.11% astatine $30.90

- SharpLink Gaming (SBET): closed astatine $18.18 (+0.5%), +2.48% astatine $18.63

- Upexi (UPXI): closed astatine $7.44 (+2.06%), +0.81% astatine $7.50

- Lite Strategy (LITS): closed astatine $2.56 (-4.48%)

ETF Flows

Spot BTC ETFs

- Daily nett flow: $985.1 million

- Cumulative nett flows: $60.01 billion

- Total BTC holdings ~ 1.33 million

Spot ETH ETFs

- Daily nett flow: $233.5 million

- Cumulative nett flows: $14.44 billion

- Total ETH holdings ~ 6.74 million

Source: Farside Investors

While You Were Sleeping

- Bitcoin Hits Record High Against Yen arsenic Japan's New PM Sanae Plans to Revive 'Abenomics' (CoinDesk): Prime Minister Takaichi Sanae’s pledge to revive assertive fiscal and monetary easing has weakened the yen and lifted bitcoin and equities to grounds highs.

- France’s Prime Minister Resigns Less Than a Month After Appointment (Financial Times): Sébastien Lecornu's exit followed threats from conjugation allies and left-wing parties to artifact his authorities implicit French President Emmanuel Macron's pension reforms, reigniting France’s governmental turmoil and rattling investors.

- Tariffs Threatened to Be a Third Inflation Shock for Europe, But Have Had Little Impact (The Wall Street Journal): Europe’s muted ostentation effect to U.S. tariffs stems from governments’ determination not to retaliate, commercialized deals cushioning export losses, and a stronger euro offsetting import costs, ECB officials said.

- Swiss Exchange Group to Bring Digital Assets Unit SDX In-House (Bloomberg): The swiss speech relation is integrating SDX’s blockchain level into its halfway speech and post-trade divisions to unify custody, colony and trading of regulated integer securities crossed its infrastructure.

2 months ago

2 months ago

English (US)

English (US)