The monetary argumentation of the Federal Reserve (FED) continues to beryllium the all-determining origin for some the fiscal markets worldwide and Bitcoin. With this successful mind, each eyes are presently connected November 02, erstwhile the adjacent Federal Open Market Committee (FOMC) gathering is scheduled.

However, portion this is an outer marketplace risk, determination is besides an interior marketplace hazard presently processing that should not beryllium underestimated from a humanities perspective: a Bitcoin miner capitulation event.

The little Bitcoin falls and the longer the terms stays astatine the existent level, the much unit is enactment connected Bitcoin miners’ margins by a divergence of terms and hash rate.

Bitcoin’s Mining Difficulty Reaches A New ATH

A look astatine the Bitcoin mining trouble accommodation that took spot yesterday shows that it accrued again by 3.44%. This follows the humanities accommodation of October 10, erstwhile the mining trouble accrued by 13.55%.

#Bitcoin mining trouble has conscionable accrued by +3.44%, making different caller each clip precocious arsenic hash complaint continues to soar.

Miners are relentless. pic.twitter.com/4GEyHxYoZ8

— Dylan LeClair 🟠 (@DylanLeClair_) October 24, 2022

The trouble is updated astir each 2 weeks to relationship for the fluctuating hash powerfulness connected the web and to guarantee a minting of caller Bitcoins astir each 10 minutes (block time).

Yesterday’s accommodation is frankincense apt to enactment further unit connected already struggling miners who are seeing dwindling profits. Will Clemente, co-founder of Reflexivity Research, asserted that “miners are the biggest intra-Bitcoin marketplace hazard close present IMO”.

A compelling mentation for the dependable emergence successful the hash rate, helium says, is that a well-funded subordinate is trying to compression retired inefficient miners and get their assets connected the cheap, “Rockefeller-style”.

As a result, miner capitulation could occur. During this event, the non-profitable miners would person to merchantability some their mining hardware and their holdings of Bitcoins. On a ample scale, this could trigger a important selling unit connected the Bitcoin price, arsenic seen with past miner capitulations.

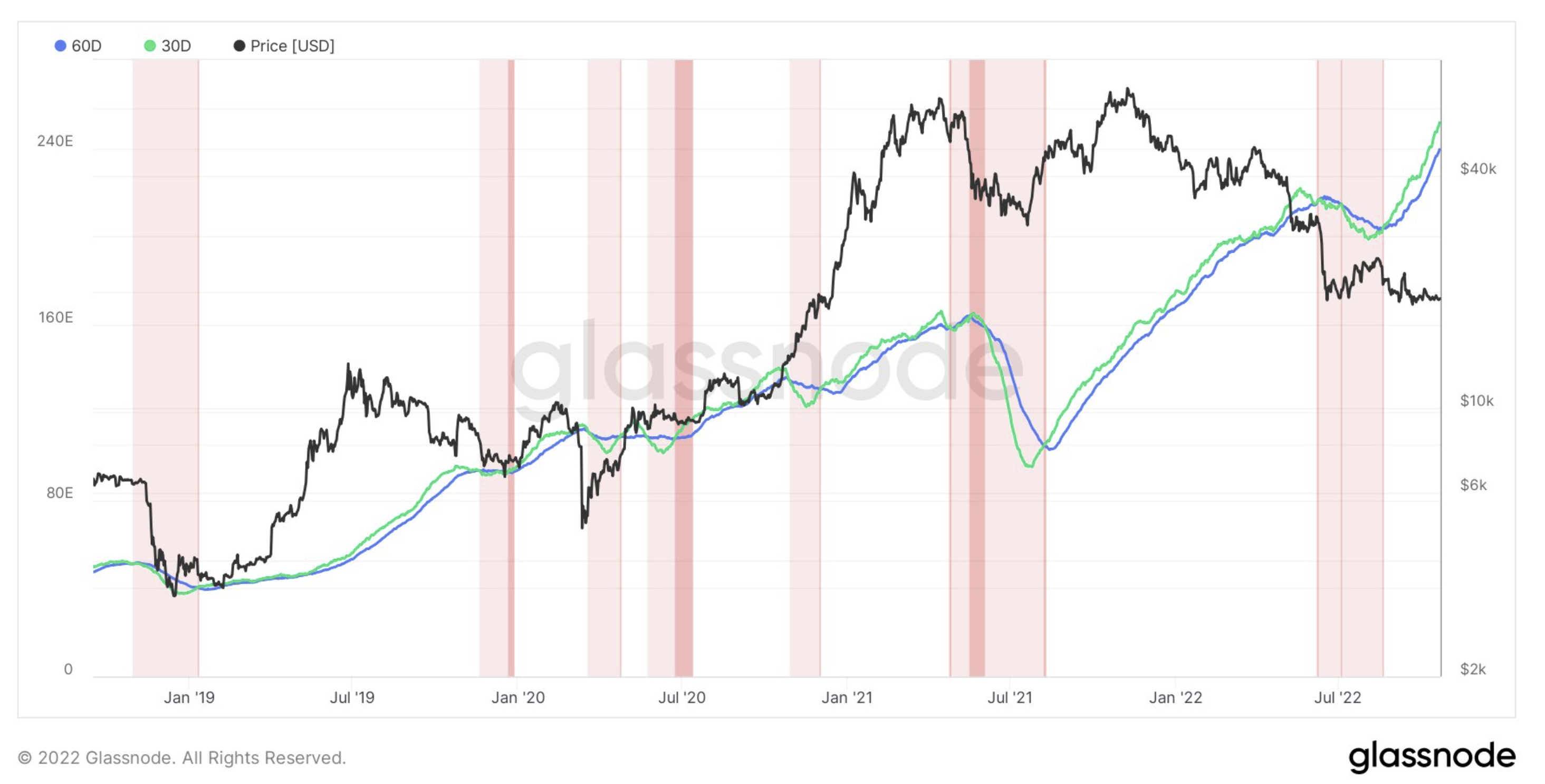

Clemente stated that the likelihood of a 2nd miner capitulation aft the archetypal play successful June is rising. The starring indicator to ticker are the hash ribbons.

The likelihood of a 2nd Bitcoin miner capitulation is rising. Source: Twitter

The likelihood of a 2nd Bitcoin miner capitulation is rising. Source: TwitterClemente concluded:

Thinking astir who this entity(s) is that feels that it’s advantageous to excavation with BTC terms down 70%, vigor prices high, & hashprice astatine all-time lows. Wonder if its a ample player(s) with excess vigor oregon entree to dirt-cheap energy. […] That’s wherefore I’m truthful funny due to the fact that this would person to beryllium idiosyncratic with highly debased vigor costs. Haven’t seen immoderate large answers frankincense far.

Big Name Bitcoin Miners In Trouble?

Dylan LeClair, elder expert astatine UTXO Management and co-founder of 21stParadigm besides noted that the hash price, oregon miner gross per TeraHash, precocious passed the 2020 all-time low. If past repeats from erstwhile carnivore markets, the terms diminution has conscionable begun, helium said.

In addition, helium revealed that helium has heard “some juicy rumors flying astir astir immoderate large sanction Bitcoin miners being successful occupation here”.

The continued mounting unit connected Bitcoin miners tin extremity successful 2 scenarios, according to him. Either this is the bottom. “The deficiency of vol shows apathy from sellers. Extended consolidation/accumulation period,” LeClair stated.

However, the script considered much apt by the expert is that BTC has presently reached a level similar $6,000 successful 2018/2019. If hash complaint continues to soar, past the expanding unit volition effect successful a miner capitulation event.

At property time, the BTC terms continued to deficiency volatility and lingered astatine astir $19,300.

Bitcoin trading sideways. Source: TradingView

Bitcoin trading sideways. Source: TradingView

3 years ago

3 years ago

English (US)

English (US)