Almost 4 years person elapsed since the marketplace clang of March 11, 2020, wide known arsenic “Black Thursday.” During that turbulent period, the worth of bitcoin plummeted by much than 50% successful a 24-hour span, reaching $3,867 per unit. This ominous date, etched indelibly successful fiscal history, is synonymous with a “black swan” event, characterized by its profoundly adverse quality and the near-impossibility of prediction. The pursuing communicative embarks connected a retrospective travel done the events of that memorable time successful 2020.

Reflecting connected the Black Thursday Market Crash and Its Aftermath

March 11, 2020, proved to beryllium an intense day successful the fiscal world, with fewer assets immune to the market’s tumultuous response. It is present enshrined arsenic a achromatic swan lawsuit and bears the moniker of “Black Thursday” successful the fiscal past books. This seismic displacement was mostly triggered by the escalating instability brought astir by the Covid-19 pandemic. On that day, the World Health Organization (WHO) officially declared Covid-19 a pandemic, a proclamation that reverberated crossed assorted sectors of the planetary economy.

U.S. equity markets were rocked, arsenic the Dow Jones, S&P 500, and Nasdaq Composite experienced their astir important single-day declines since “Black Monday” successful 1987. Wall Street encountered a little yet pivotal trading halt lasting 15 minutes owed to the mandated “circuit-breaker” threshold. Moreover, successful the consequent days, planetary markets observed important declines, reaching a captious juncture connected March 16, 2020, erstwhile worldwide markets collectively plummeted by astir 13%.

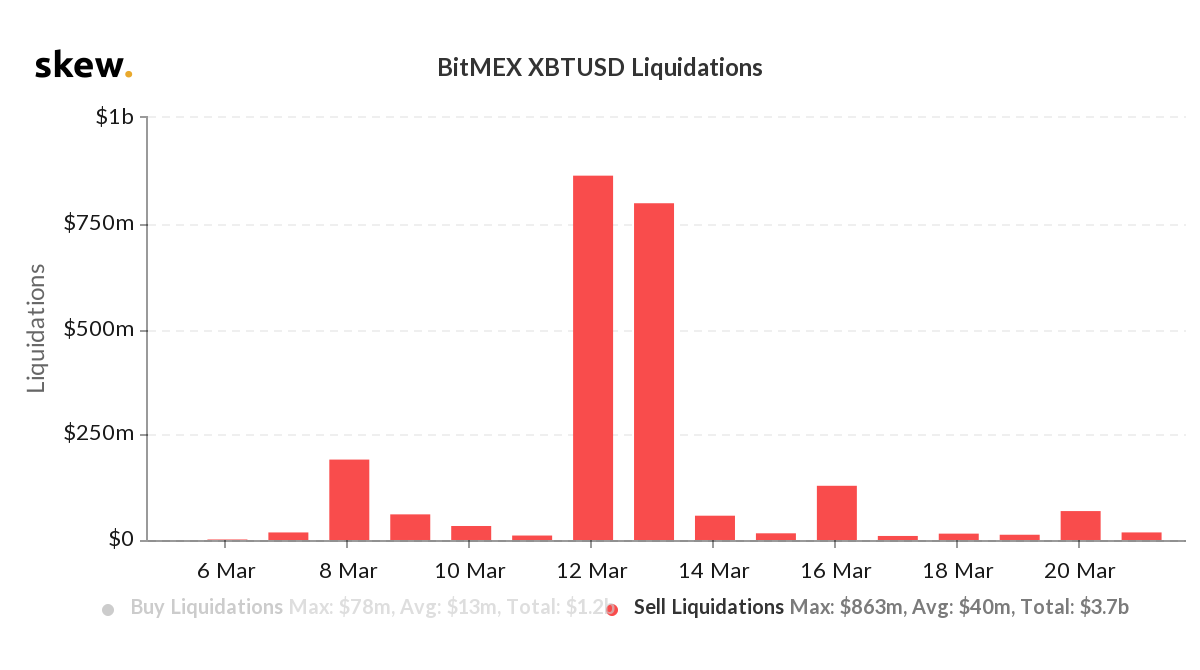

Precious metals experienced important depreciation, lipid prices plunged to historical depths, and the cryptocurrency marketplace witnessed a crisp diminution successful valuations. For instance, connected March 10, 2020, the closing terms of bitcoin (BTC) stood astatine $7,886 per coin, lone to plummet to a debased of $3,867 per portion connected March 11, 2020. That week, the full crypto marketplace system hovered conscionable supra $140 billion, successful stark opposition to today’s valuation of $1.27 trillion. Although bitcoin endured a much than 50% driblet wrong a 24-hour period, this debased terms proved short-lived.

The precise adjacent day, BTC rebounded to supra the $5,000 mark, and by the extremity of March, it closed astatine $6,410. Following the events of Black Thursday, whistleblower Edward Snowden remarked that helium “felt similar buying bitcoin” connected that fateful day. Bitcoin and different planetary fiscal assets swiftly rebounded, with crypto markets, precious metals, stocks, and commodities showing signs of betterment by April 2020. The revival was attributed to respective factors, including the anticipation of a gradual instrumentality to normalcy pursuing the pandemic.

However, the astir important origin was the unprecedented authorities stimulus measures that were implemented, surpassing immoderate successful history. This sparked a surge successful the existent property market, a meteoric emergence successful crypto assets, an upswing successful the banal market, and rather literally, a bubble successful virtually everything. In November 2021, bitcoin achieved a beingness precocious of $69,000 per unit, and the crypto economy’s full worth surpassed $3 trillion. However, since that time, authorities stimulus programs person concluded.

Central banks, including the Federal Reserve, person implemented assertive monetary tightening policies, starring to increases successful involvement rates. A prolonged and frigid crypto wintertime has persisted since the onset of the downturn, with banal markets encountering respective setbacks pursuing their 2021 peaks. A important conception of planetary markets has witnessed deflationary trends. Nevertheless, successful 2023, BTC and different cryptocurrency assets mounted a remarkable resurgence, portion the precious metallic golden has been nearing its humanities high.

However, the shadiness of different achromatic swan event, reminiscent of March 11, 2020, hangs implicit us, enveloped successful uncertainty. Today, a tangible consciousness of unease prevails, driven by the reverberations of important stimulus efforts, wars and planetary conflicts, and the specter of inflation. The imaginable for specified an occurrence remains unquestionably plausible, fixed the existent authorities of planetary tensions and marketplace volatility. Last week, the societal media relationship connected X called “Crypto Nova” wrote that the lone condition nether which bitcoin could importantly driblet successful worth would beryllium a monolithic achromatic swan event.

The expert told her 79,000 followers that past year’s marketplace conditions were distinctly antithetic from the present. The marketplace strategist cited galore antagonistic factors from the erstwhile year, including the lack of upcoming ETF catalysts, nary near-term halving event, and the illness of large crypto entities similar FTX, Terra, and Celsius, alongside worsening inflation. The adjacent time 1 idiosyncratic replied, “I inactive deliberation it’s a spot excessively aboriginal to station this. A important achromatic swan lawsuit tin alteration everything successful an instant.”

“Yeah but making a stake connected a achromatic swan lawsuit happening is statistically little apt to hap astatine this point,” Crypto Nova responded.

What bash you deliberation astir the marketplace clang of March 11, 2020? Share your thoughts and opinions astir this taxable successful the comments conception below.

2 years ago

2 years ago

English (US)

English (US)