Options are pivotal successful gauging marketplace expectations, allowing traders to unafraid the close to bargain (call options) oregon merchantability (put options) Bitcoin astatine a predetermined price. The unfastened involvement – the sum of each progressive enactment contracts – and the ratio betwixt puts and calls tin bespeak the market’s sentiment and conviction. At the aforesaid time, measurement underscores the immediacy of trading activity.

Building connected our erstwhile CryptoSlate analysis, the Bitcoin options marketplace has continued to grounds subtle shifts successful sentiment since the opening of November.

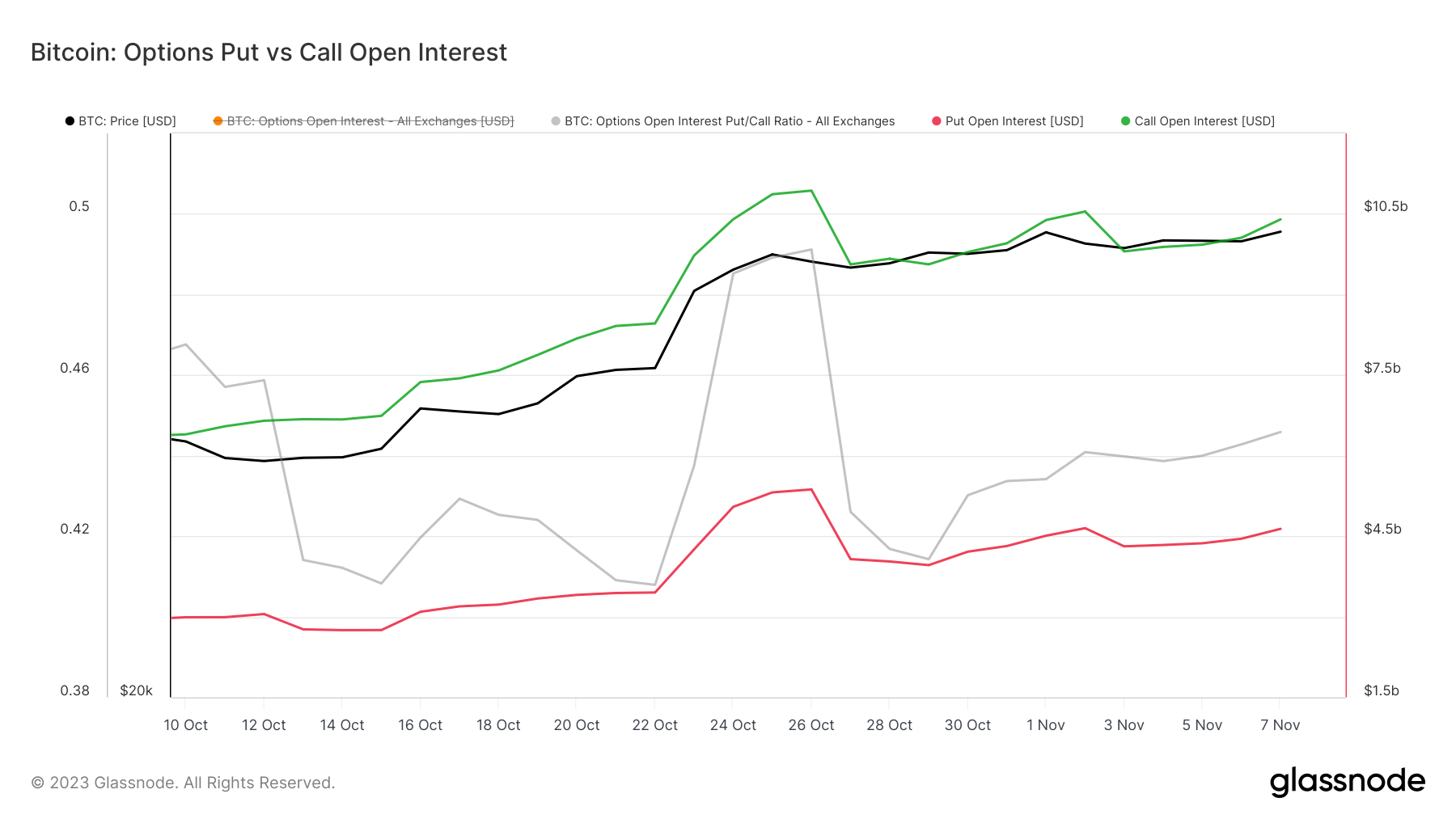

There has been a mean summation successful telephone unfastened involvement to $10.40 cardinal and a emergence successful enactment unfastened involvement to $4.63 billion. While the upward trajectory has persisted since October, the gait suggests a much cautious optimism among traders.

Graph showing the unfastened involvement connected Bitcoin enactment and telephone options from Oct. 10 to Nov. 7, 2023 (Source: Glassnode)

Graph showing the unfastened involvement connected Bitcoin enactment and telephone options from Oct. 10 to Nov. 7, 2023 (Source: Glassnode)The put/call ratio of unfastened involvement has seen a flimsy summation from 0.433 to 0.445, indicating a subtle but noticeable shift. An summation successful the put/call ratio usually indicates a bearish sentiment. However, arsenic the ratio inactive remains good beneath 1, it’s much indicative of accrued hedging activity.

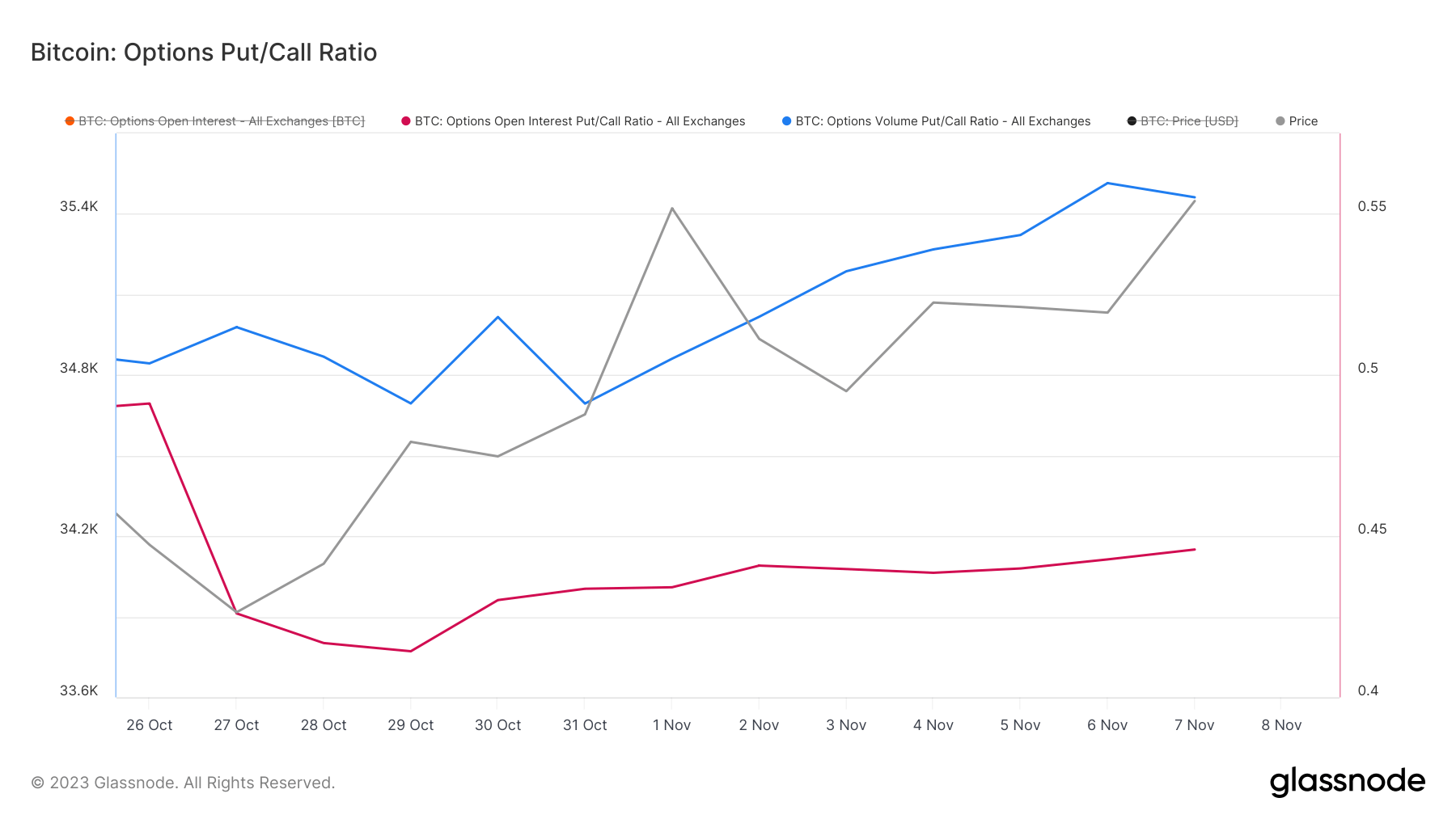

Graph showing the put/call ratio for Bitcoin options from Oct. 26 to Nov. 7, 2023 (Source: Glassnode)

Graph showing the put/call ratio for Bitcoin options from Oct. 26 to Nov. 7, 2023 (Source: Glassnode)This is further reinforced by the measurement ratio’s progression from 0.526 to 0.584, which emphasizes a antiaircraft stance amidst an wide bullish market.

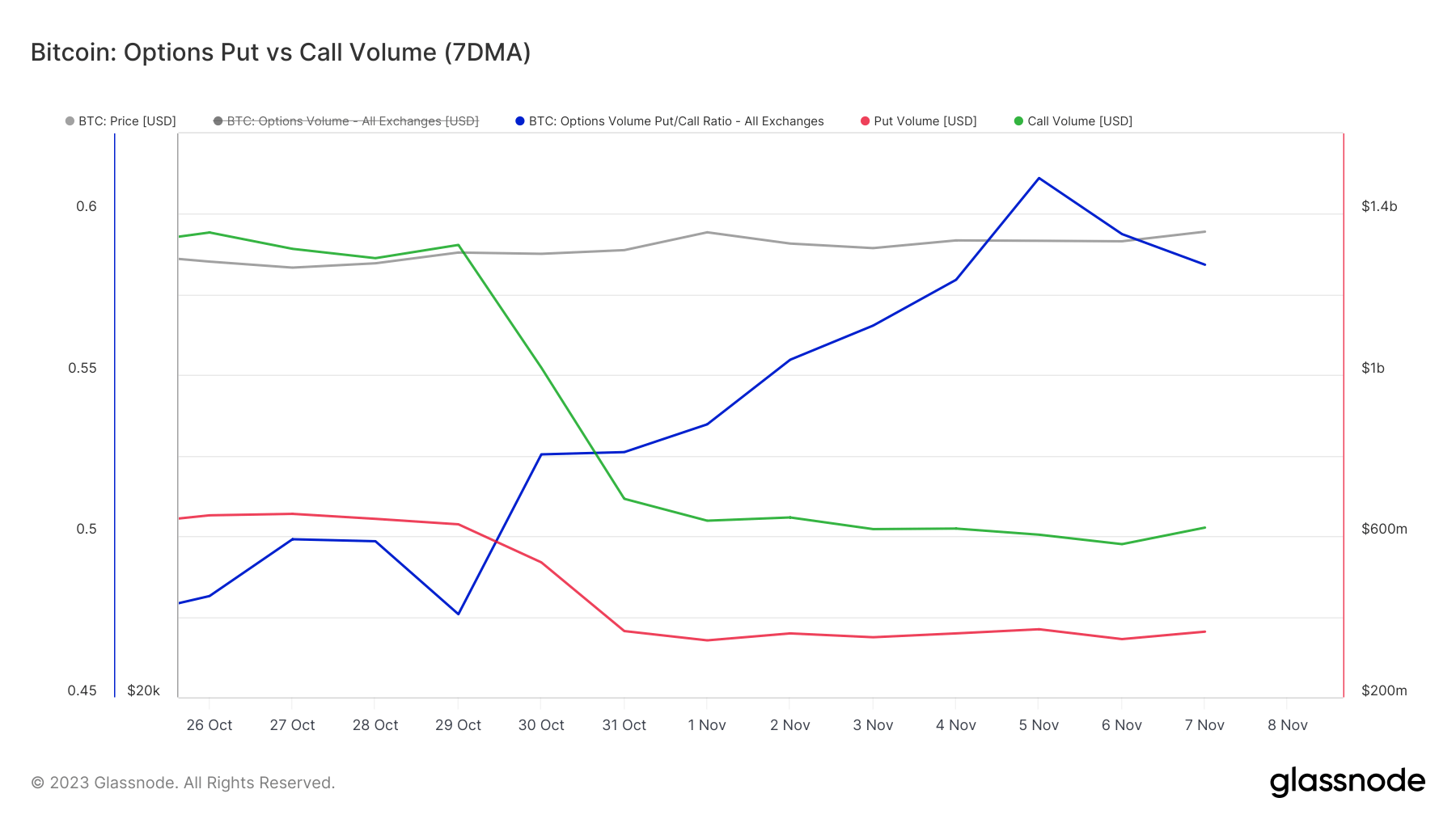

Graph showing the measurement of Bitcoin enactment (red) and telephone (green) options, arsenic good arsenic the options measurement put/call ratio (blue) from Oct. 26 to Nov. 7, 2023 (Source: Glassnode)

Graph showing the measurement of Bitcoin enactment (red) and telephone (green) options, arsenic good arsenic the options measurement put/call ratio (blue) from Oct. 26 to Nov. 7, 2023 (Source: Glassnode)Since the opening of the month, Bitcoin’s terms has edged up from $34,600 and breached supra $35,400, reinforcing this sentiment.

Contrasting with the all-time precocious telephone unfastened involvement from CryptoSlate’s past analysis, the existent figures uncover a marketplace that is optimistic yet much measured. The put/call ratio’s gradual summation reflects a marketplace that, portion inactive bullish, is becoming much cautious. The accordant summation successful some telephone and enactment unfastened interests points to an progressive market, with traders gearing up for imaginable terms escalations and simultaneously guarding against downward risks.

Looking astatine onslaught prices suggests that optimism is persistent, but traders are besides preparing for scenarios wherever the terms mightiness not conscionable their bullish expectations.

The station Bitcoin’s ascent supra $35,000 followed by amazingly measured market appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)