Bitcoin’s breakout supra $60,000 seems to person triggered a caller spark of optimism among traders. The marketplace has been level for astir of August aft experiencing a important driblet astatine the opening of the month, which is wherefore the comparatively flimsy terms summation supra the $60,000 threshold was capable to inject the marketplace with a important magnitude of capital.

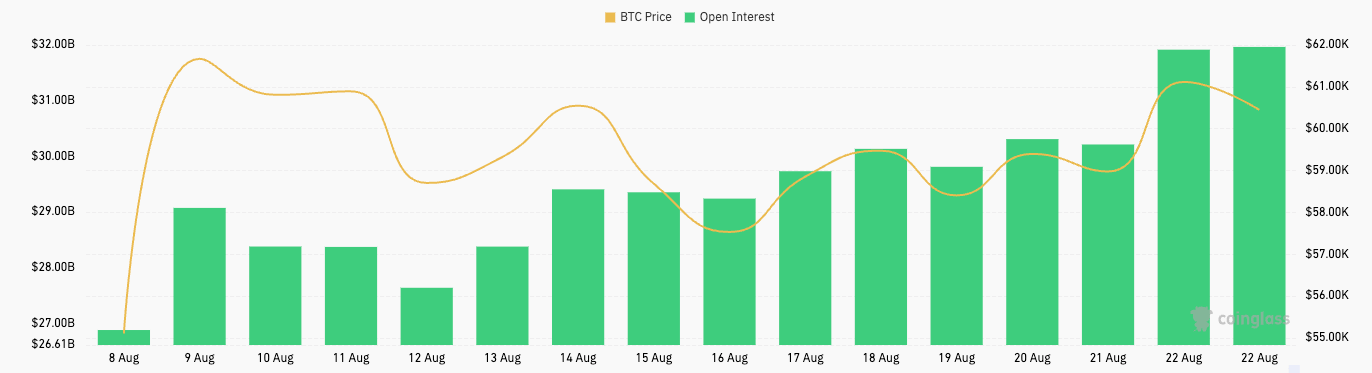

This is evident successful the spike successful unfastened involvement betwixt Aug. 21 and Aug. 22. Data from CoinGlass showed that unfastened involvement successful Bitcoin futures accrued from $30.21 cardinal to $32.08 cardinal successful 24 hours.

Chart showing the unfastened involvement for Bitcoin futures from Aug. 8 to Aug. 22, 2024 (Source: CoinGlass)

Chart showing the unfastened involvement for Bitcoin futures from Aug. 8 to Aug. 22, 2024 (Source: CoinGlass)Open involvement measures the full fig oregon worth of outstanding derivatives contracts that person yet to beryllium settled. When analyzing futures, OI is an indispensable metric arsenic it shows the travel of superior into the market.

A emergence successful OI indicates that much wealth is entering the marketplace arsenic traders unfastened caller positions. Conversely, a diminution successful OI shows that contracts are being closed oregon liquidated, with superior exiting the market. Tracking OI helps gauge marketplace enactment and foretell imaginable terms volatility.

The $2 cardinal summation betwixt Aug. 21 and Aug. 22 shows a abrupt and assertive influx of superior into the derivatives market. As the summation follows Bitcoin’s emergence from $59,000 to supra $60,000, we tin safely presume that the terms broke a psychologically important level and triggered a caller question of bullish sentiment among derivatives traders. The organisation of calls and puts crossed Bitcoin options shows that traders are opening caller agelong positions and anticipating further terms appreciation.

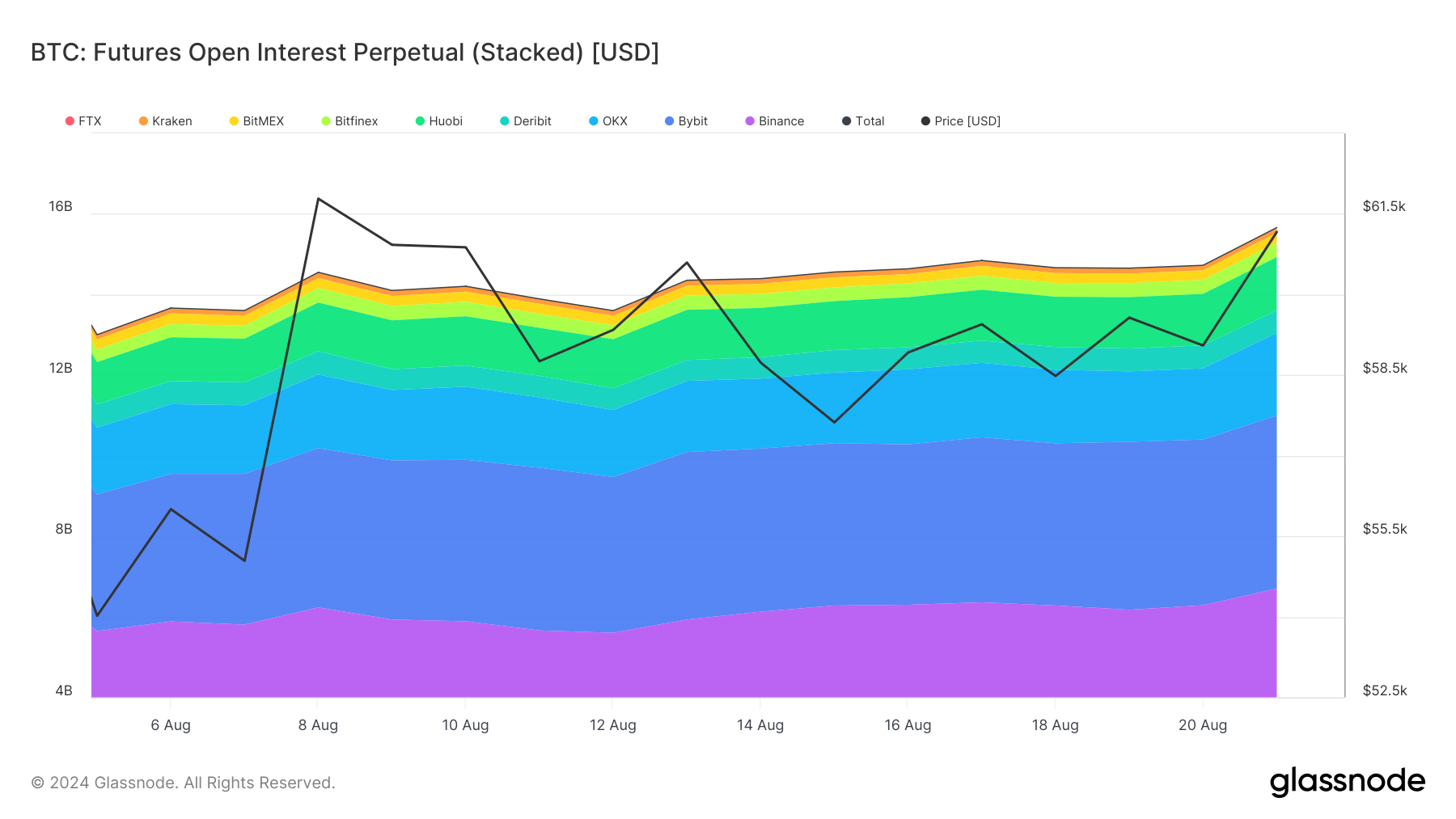

A akin inclination is observed successful perpetual futures arsenic well. Perpetual futures OI roseate importantly betwixt Aug. 21 and Aug. 22, pursuing a accordant summation implicit the erstwhile weeks. By Aug. 21, perpetual futures OI had reached $15.66 cardinal — a important summation from $13 cardinal connected Aug. 5.

Perpetual futures are a benignant of derivative that differs from accepted futures arsenic they bash not person an expiry date, allowing traders to clasp positions indefinitely. This diagnostic makes perpetual futures peculiarly charismatic for speculative trading, arsenic traders tin capitalize connected short-term terms movements without worrying astir declaration expiration.

Graph showing the unfastened involvement for perpetual Bitcoin futures from Aug. 5 to Aug. 21, 2024 (Source: Glassnode)

Graph showing the unfastened involvement for perpetual Bitcoin futures from Aug. 5 to Aug. 21, 2024 (Source: Glassnode)The parallel emergence successful accepted and perpetual futures indicates that the wide marketplace sentiment is bullish, with organization and retail investors expanding their vulnerability to Bitcoin. Traditional futures thin to pull much organization investors, arsenic regulated platforms similar the CME spot the highest OI and trading volume.

The summation successful CME’s OI from $8.76 cardinal connected Aug. 21 to $9.65 cardinal connected Aug. 22 confirms this organization interest. In contrast, perpetual futures are much fashionable connected platforms similar Binance, Bybit, and OKX, which chiefly cater to retail traders. The summation successful OI connected these platforms, peculiarly the important emergence connected Binance from $6.70 cardinal to $7.18 billion, indicates increasing retail participation.

The quality betwixt accepted and perpetual futures lies successful their expiration dates and however they bespeak marketplace sentiment. Traditional futures bespeak semipermanent marketplace expectations, arsenic they impact fixed declaration periods and often higher superior requirements.

On the different hand, Perpetual futures are much delicate to short-term marketplace trends owed to their deficiency of expiration and the usage of backing rates to support prices adjacent to the spot terms of Bitcoin. Therefore, changes successful perpetual futures OI tin awesome contiguous shifts successful marketplace sentiment and trader positioning.

The combined summation successful some types of futures OI suggests a broad-based bullish sentiment crossed antithetic capitalist classes. Bitcoin’s terms summation supports this narrative, intelligibly reflecting the influx of superior into the market.

However, the accelerated emergence successful OI besides raises the imaginable for accrued volatility. If the marketplace does not proceed its upward trajectory, the ample fig of unfastened positions could pb to crisp corrections arsenic traders unreserved to adjacent their positions, particularly successful the much speculative perpetual futures market.

The station Bitcoin’s ascent supra $60k causes futures unfastened involvement to surge $2B successful a day appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)