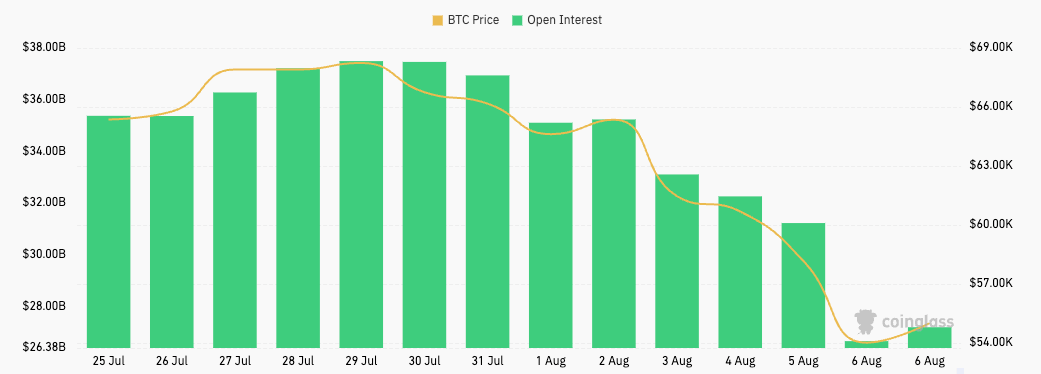

This week’s clang has led to immoderate of the highest losses we’ve seen since the illness of FTX, wiping retired billions from the crypto market. Bitcoin’s driblet to below $50,000 dramatically affected the futures market, with futures unfastened involvement plunging from $31.22 cardinal connected Aug. 5 to $26.65 cardinal connected Aug. 6.

Graph showing Bitcoin futures unfastened involvement from July 25 to Aug. 6, 2024 (Source: CoinGlass)

Graph showing Bitcoin futures unfastened involvement from July 25 to Aug. 6, 2024 (Source: CoinGlass)Such a sharp drop successful conscionable 24 hours was astir apt caused by forced liquidations of futures positions owed to borderline calls. When Bitcoin’s terms drops beneath captious levels needed to support collateral, it usually triggers a cascade of liquidations, and over-leveraged traders person their positions forcibly closed.

The wipeout successful futures unfastened involvement we’ve seen this week shows that a important fig of traders were betting connected Bitcoin’s continued emergence and were caught disconnected defender by the abrupt downturn, starring to a monolithic simplification successful leveraged positions.

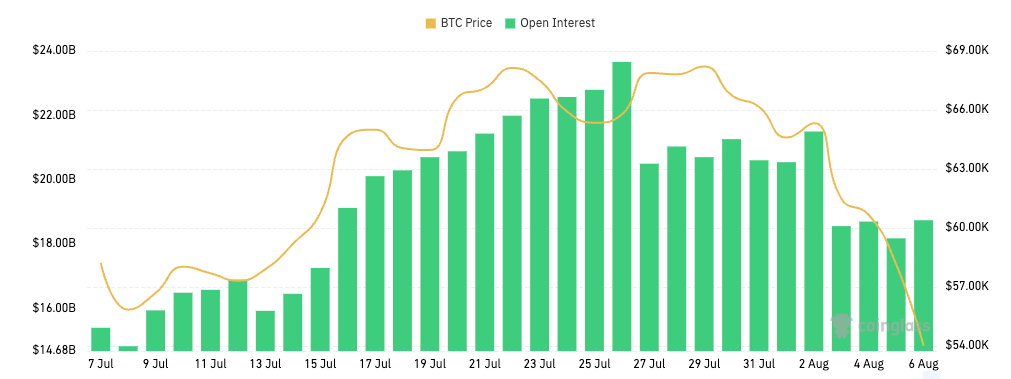

On the different hand, the options marketplace remained comparatively unchangeable during the terms downturn. Options unfastened involvement remained astir flat, fluctuating somewhat astir $18 cardinal during the weekend.

Graph showing Bitcoin options unfastened involvement from July 7 to Aug. 6, 2024 (Source: CoinGlass)

Graph showing Bitcoin options unfastened involvement from July 7 to Aug. 6, 2024 (Source: CoinGlass)Unlike futures, options don’t impact borderline calls that tin unit positions to adjacent immediately. Instead, they springiness traders the right, but not the obligation, to bargain oregon merchantability BTC astatine a predetermined price. This inherent diagnostic enables options traders to clasp onto their positions without the contiguous hazard of liquidation, adjacent during periods of utmost terms volatility.

However, it’s highly improbable that the stableness successful options OI we’ve seen implicit the past fewer days was owed to traders holding onto their positions.

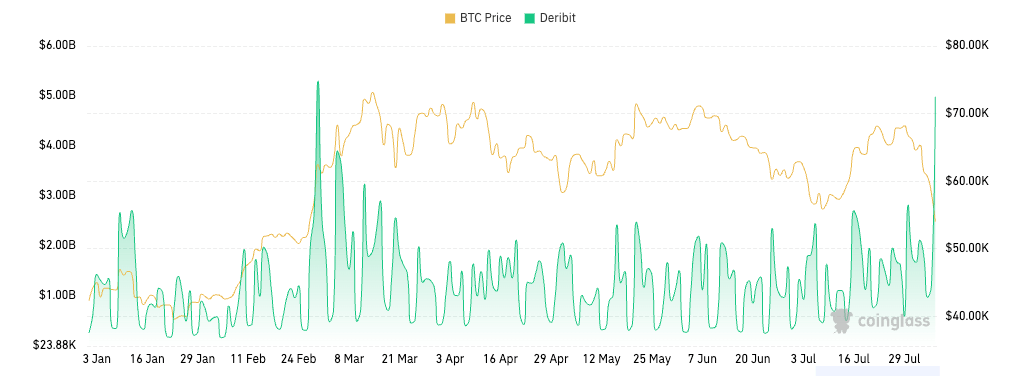

Options trading measurement connected Deribit surged from $1.22 cardinal connected Aug. 5 to $4.98 cardinal connected Aug. 6. This is the second-highest options measurement ever recorded, topped lone by the $5.30 cardinal successful measurement the marketplace saw connected Feb. 29 this year.

Graph showing Bitcoin options trading measurement connected Deribit from Jan. 1 to Aug. 6, 2024 (Source: CoinGlass)

Graph showing Bitcoin options trading measurement connected Deribit from Jan. 1 to Aug. 6, 2024 (Source: CoinGlass)Such a precocious spike successful measurement indicates heightened trading activity, wherever traders are actively engaging successful the market. Several factors could person contributed to this improvement wherever unfastened involvement remains unchangeable portion trading measurement increases.

Firstly, during periods of precocious volatility, traders participate and exit positions much frequently, which means opening caller contracts and closing existing ones astatine a accelerated pace. If the fig of caller contracts opened astir equals the fig of contracts closed, the OI volition stay comparatively unchanged portion the measurement spikes. A precocious turnover of contracts could effect from short-term speculation, hedging, oregon rolling implicit positions.

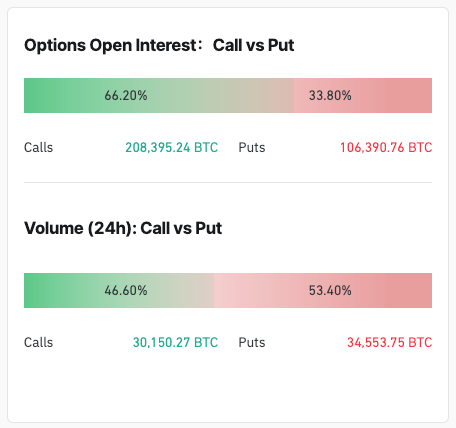

An absorbing facet of the options marketplace during this play is the skew towards calls implicit puts. With implicit 66% of the options unfastened involvement being calls, it shows a bullish sentiment inactive prevails among traders.

However, portion unfastened involvement shows a beardown bias toward calls, trading measurement is skewed toward puts. The 24-hour options trading measurement betwixt Aug. 5 and Aug. 6 came from puts. This tin beryllium explained by the contiguous reactions traders had to the terms drop. When Bitcoin experienced a crisp decline, traders apt rushed to bargain puts to hedge their existing positions oregon to speculate connected further terms declines successful the abbreviated term.

Screengrab showing the organisation of options unfastened involvement and trading measurement from Aug. 5 to Aug. 6, 2024 (Source: CoinGlass)

Screengrab showing the organisation of options unfastened involvement and trading measurement from Aug. 5 to Aug. 6, 2024 (Source: CoinGlass)In contrast, unfastened involvement reflects much of traders’ longer-term positioning. Most unfastened involvement being calls indicates that traders person built up these positions implicit time, maintaining a bullish outlook connected Bitcoin’s longer-term prospects. These positions are not arsenic rapidly adjusted oregon closed arsenic short-term trades, which is wherefore the unfastened involvement remains heavy skewed toward calls.

The station Bitcoin’s clang wipes retired $5 cardinal successful futures OI but options stay stable appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

![Why Crypto Market Is Going Up Today [Live] Updates, Reasons & Price Action](https://image.coinpedia.org/wp-content/uploads/2025/11/11142238/Crypto-Market-Today-Bitcoin-Holds-Around-105K-Altcoins-Stay-Cautious-While-UNI-WLFI-TRUMP-Thrive-1024x536.webp)

English (US)

English (US)