Macro traders expecting a continued diminution successful bitcoin (BTC) should look astatine the positioning successful the derivatives market, different they hazard being caught disconnected defender by a imaginable abbreviated squeeze, a accelerated determination higher driven by bears abandoning their bearish bets.

For a abbreviated compression to occur, the marketplace needs to person a higher-than-usual bearish activity. In specified situations, a insignificant terms bump tin nonstop bears oregon abbreviated sellers moving to quadrate disconnected their positions, which, successful turn, drives prices further up.

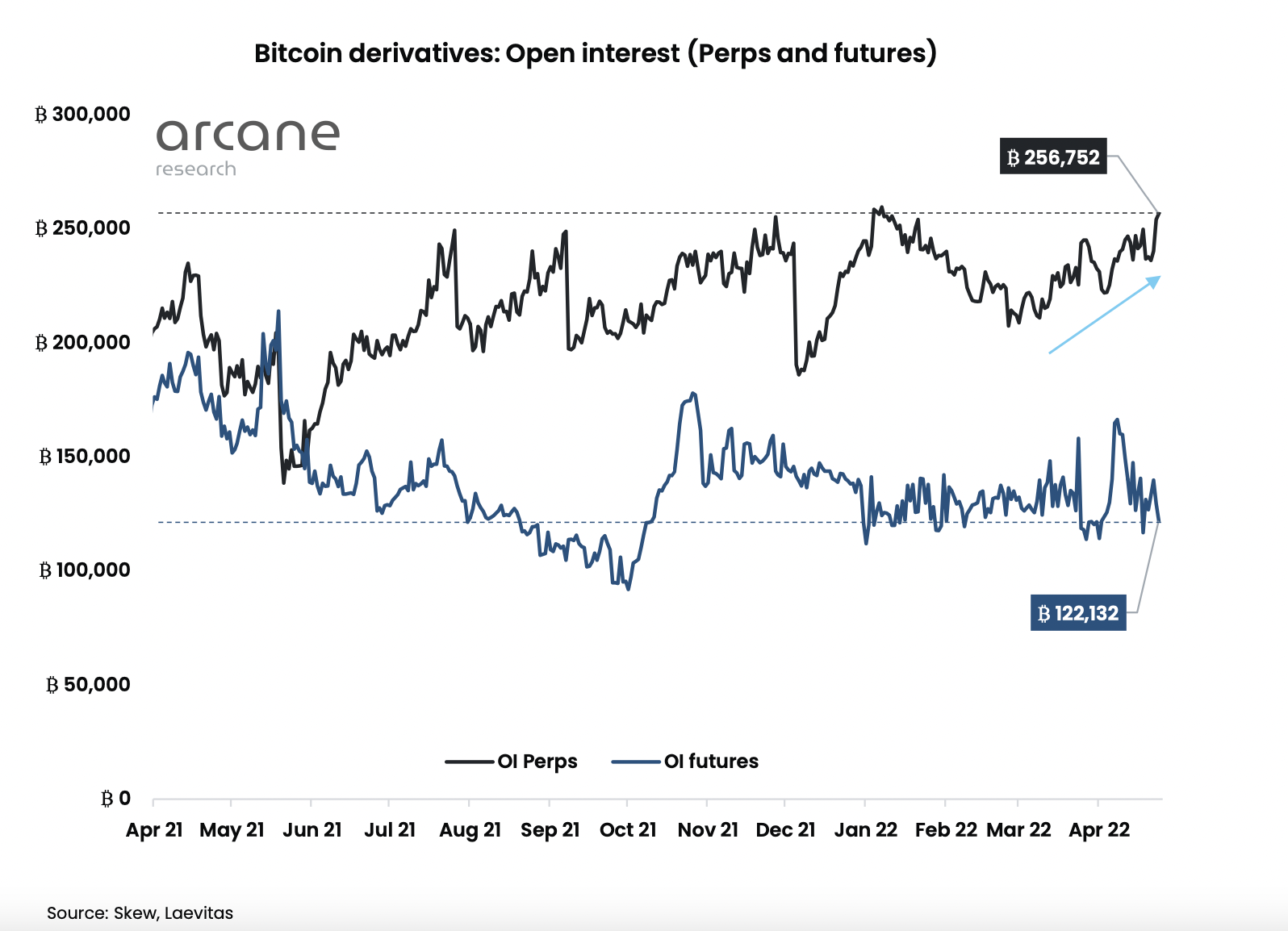

Open interest, oregon the fig of unfastened positions successful bitcoin's perpetual futures market, roseate to 256,752 BTC aboriginal this week, the second-highest regular tally successful 365 days, surpassed. by Jan. 4's full of 260,000 BTC, information provided by Arcane Research shows.

Most of these could beryllium abbreviated positions, according to information tracked by Laevitas shows the backing complaint – the outgo of holding long/short perpetual futures positions – has been consistently neutral-to-negative successful caller weeks. A antagonistic backing complaint means shorts are paying longs to support the bearish presumption open. In different words, the marketplace is skewed bearish. That's besides evident from the depressed futures premium, besides known arsenic the basis, connected large exchanges, including the Chicago Mercantile Exchange, a proxy for organization activity. The three-month premium precocious slipped to 1.1% annualized connected the CME and 2% connected Binance, the world's largest crypto speech by unfastened involvement and volumes.

So, present if bitcoin turns higher, the outgo of holding shorts volition go a load for traders holding bearish positions. And they could offload their bearish bets, putting upward unit connected prices. Bitcoin was past seen trading adjacent 2% higher connected the time adjacent $38,900, according to CoinDesk data.

"All [open interest] maturation successful precocious April has been accompanied by substantially antagonistic backing rates, suggesting that shorts are the cardinal aggressor portion besides implying immoderate capitulation from longs aft this limb downward," Arcane Research's Vetle Lunde wrote successful a play probe study shared with CoinDesk connected Tuesday.

"The sentiment, backing rates, and futures ground [premium] suggest that shorts are the astir confident. Thus, a abbreviated compression is perchance connected the table," Lunde added.

While unfastened involvement successful perpetual futures has increased, the fig of unfastened positions successful regular futures remains depressed. Perpetual futures disagree from regular futures arsenic they deficiency predetermined expiry. So, perpetual futures positions tin beryllium held indefinitely without the request to quadrate disconnected oregon rotation implicit positions up of the expiry.

Open involvement arsenic a standalone indicator lone reveals the magnitude of fiat wealth locked successful the derivatives market. However, erstwhile combined with different metrics similar the backing complaint – the outgo of holding long/short perpetual futures positions – analysts get an thought astir the quality of the positioning.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)