The bitcoin perpetual swap, the astir liquid and traded futures instrument, is simply a declaration that allows traders to speculate connected the bitcoin terms with leverage. While determination is ever an adjacent magnitude of agelong and shorts, the positioning of those contracts comparative to the spot bitcoin terms shows the bullish/bearish bias successful the derivatives market.

When the declaration terms of a perpetual futures declaration (a futures declaration that ne'er expires) is supra the spot marketplace bitcoin price, the perpetual futures backing complaint volition beryllium positive, meaning longs wage shorts a percent of their notional presumption size. The other is besides true.

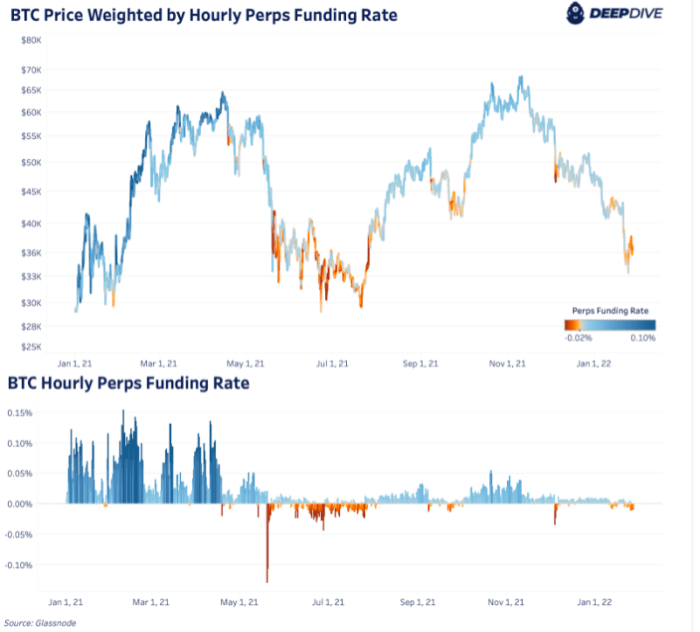

Typically, a bullish bias is contiguous successful futures markets. Throughout overmuch of 2021, perpetual futures contracts were persistently starring spot markets by a wide margin, indicating a beardown bullish bias from speculators. Recently, backing has flipped negative, showing that perpetual futures are trading beneath spot, and this isn't a effect of cascading liquidations driving price, but alternatively a flip successful sentiment and marketplace expectation.

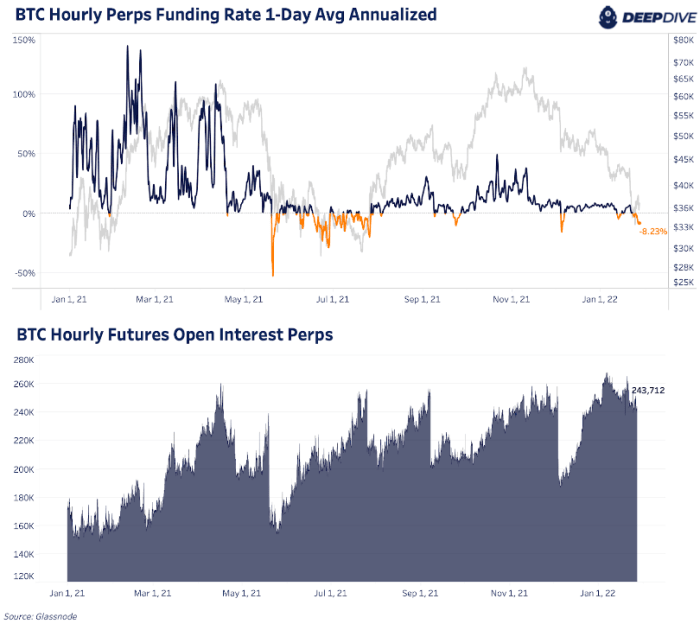

Over the past 24 hours, perpetual futures backing has been antagonistic 8.23% connected an annualized basis, meaning that shorts are paying longs 8.23% annualized connected their notional presumption size. While it is surely imaginable that expanding downside is to travel owed to an progressively uncertain macroeconomic outlook and Fed hawkishness, it is simply a bully motion for bitcoin bulls to spot antagonistic backing persist.

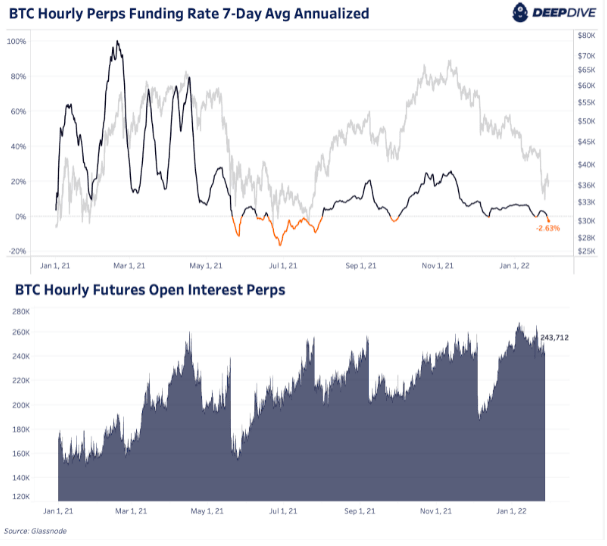

Below is the aforesaid illustration but averaged implicit a seven-day play to set for variance:

What to ticker retired for implicit the coming weeks is expanding antagonistic backing rates coupled with rising unfastened interest, akin to what was witnessed implicit the summertime of 2021.

3 years ago

3 years ago

English (US)

English (US)