As of the day of this writing, artifact 737,000, Bitcoin is astir two-thirds into its 366th trouble epoch. A trouble epoch is simply a play successful which 2,016 blocks are added to Bitcoin’s ledger, ideally successful 20,160 minutes, oregon 14 days. If the epoch ends successful little time, the web adjusts the trouble of successfully mining a Bitcoin artifact upwards to regain a 10-minute artifact cadence, and vice versa. The full past of Bitcoin’s trouble is shown successful the graphic beneath (you whitethorn request to zoom successful — it’s rather a immense graphic).Figure one: Historical Difficulty Changes Since Inception

In total, 15 epochs, astir 4% of each epochs, experienced nary trouble change. These conscionable truthful happened to beryllium the precise archetypal 15 epochs wherever fundamentally conscionable Satoshi Nakamoto, Hal Finney and a fewer twelve different radical were mining. Of the remaining 351 epochs, 283 (77.5% of each epochs) would spot a trouble increase, with 67 epochs seeing a trouble decrease. We volition delve into these periods of alteration aboriginal successful this piece.

Toward the extremity of 2009, Nakamoto made a plea to the greedy, opportunistic Bitcoiner assemblage to not excavation with their GPUs. And I quote, “We should person a gentleman's statement to postpone the GPU arms contention arsenic agelong arsenic we tin for the bully of the network. It's overmuch easer [sic] to get caller users up to velocity if they don't person to interest astir GPU drivers and compatibility. It's bully however anyone with conscionable a CPU tin vie reasonably arsenic close now.”

Bitcoiners being the greedy opportunists that they are (this, by the way, is great for Bitcoin, arsenic it drives each innovation) broke this gentleman’s agreement, and the GPU mining epoch would commence, and eventually, truthful excessively the ASIC mining era, but much connected that later.

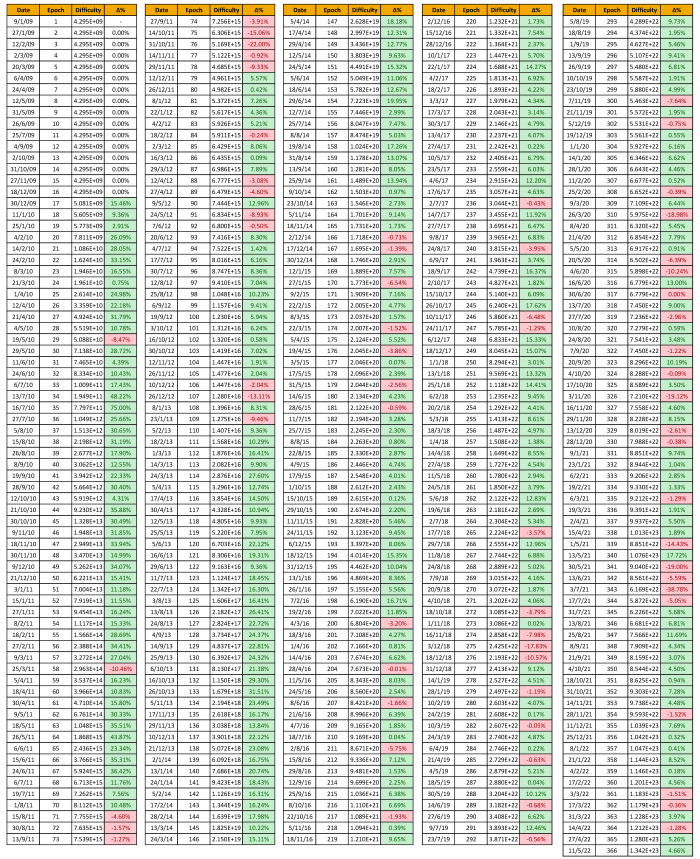

Figure two: Difficulty Vs. Price, Log-Log Scale, 2009. Here we spot that Bitcoin doesn’t adjacent person a marketplace price, and trouble is unchangeable for the full year, prevention for 1 ample leap astatine the commencement of the GPU mining epoch astatine year’s end.

In 2009, the mean trouble summation was 0.966%, with a modular deviation of 3.865%. Obviously, since bitcoin didn’t person a marketplace terms successful 2009, profitability calculations are moot, but if you didn’t adhd immoderate CPU oregon GPU power, for the year, if you were earning 1 BTC astatine the commencement of the year, you would gain 14.39% less, oregon astir 0.8561 BTC, by the end. Obviously, this assumes the miner has 100% implicit uptime, and doesn’t suffer income thusly (highly unlikely, but let’s beryllium generous!).

2010 To 2013: The GPU Mining Era

2010

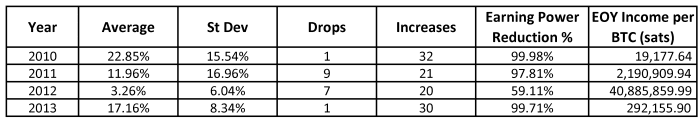

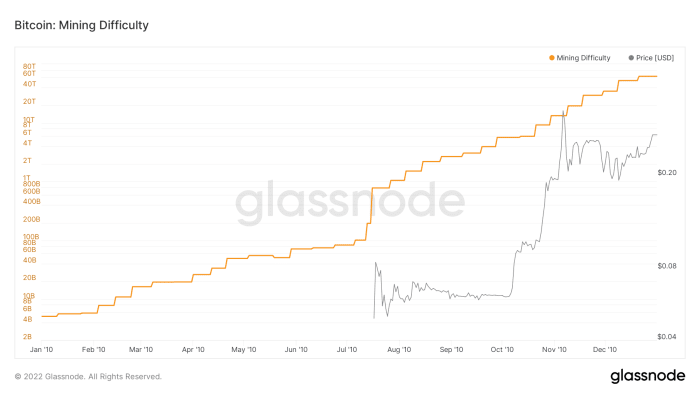

In 2010, we witnessed bitcoin get a marketplace terms for the archetypal clip successful its history, arsenic good arsenic its archetypal exponential “price rip” upwards. Aside from 1 trouble driblet successful May (before Bitcoin had a marketplace price), we saw 32 trouble increases with an mean of 22.85%, and a modular deviation of 15.54%. If you were earning 1 BTC per hashing portion connected January 1 of that year, and didn’t walk immoderate much wealth connected further GPUs, by December 31 you were earning 99.98% less, oregon astir 19,178 sats alternatively of a full coin. Rough.

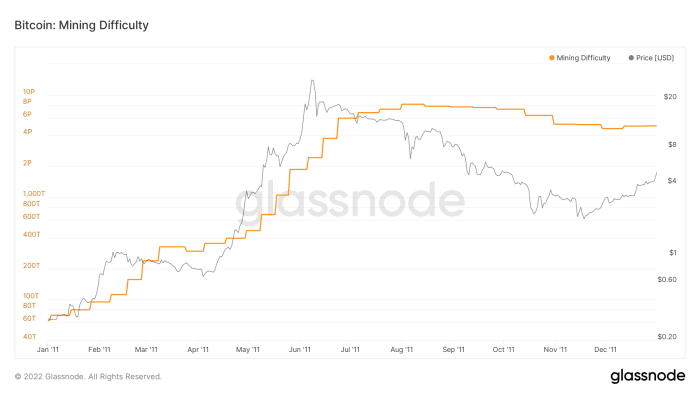

2011

2011 wasn’t overmuch amended for the miners than 2010, wherever if you were earning 1 BTC per hashing portion astatine the commencement of the twelvemonth without adding to your GPU fleet, you would beryllium earning 97.81% less, oregon astir 2.19 cardinal sats — technically implicit 100 times amended disconnected than you were successful 2010, astatine least!

2011 saw bitcoin’s archetypal mega-pump, with terms expanding astir 100 times from $0.30 to $30 successful the archetypal six months of the year, earlier taking a 93.3% bath backmost down to $2 by November. One trouble driblet was experienced during the 50% terms driblet betwixt February and April, with the different 8 drops for the twelvemonth occurring during “bath time.” There were 21 increases passim the year. The mean trouble accommodation was 11.96%, with a modular deviation of 16.96%.

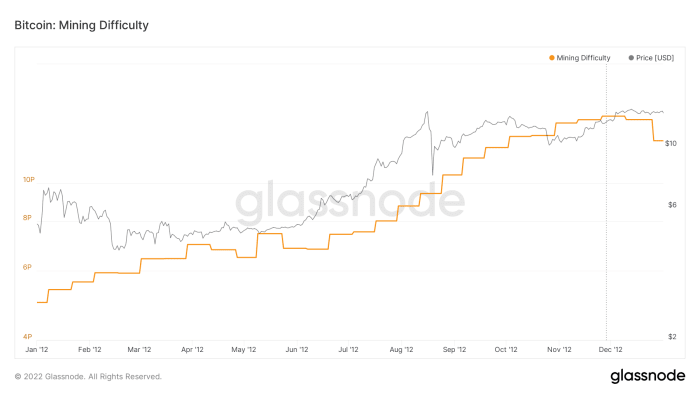

2012

2012 was an absorbing year, arsenic it was the archetypal clip that the manufacture would ever acquisition going done a artifact reward halving. While you could fetch astir $7 for a bitcoin successful aboriginal January, a Valentine’s Day massacre astir halved the price, and terms was consistently down 30% to 35% from the January precocious until the mediate of the year. This resulted successful 5 trouble drops successful that six-month period. A doubling successful terms from June to August saw steadfast trouble increases again, with nary drops successful trouble to beryllium witnessed until “The Halving” successful precocious November, which saw 2 consecutive trouble drops to extremity the year.

There were 20 increases passim the year, and 7 drops, with the mean trouble accommodation being an summation of 3.26%, with a modular deviation of positive 6.04%. You would beryllium earning 59.11% less connected December 31 if you hadn’t invested successful immoderate caller hardware for the year. Not excessively atrocious compared to erstwhile years.

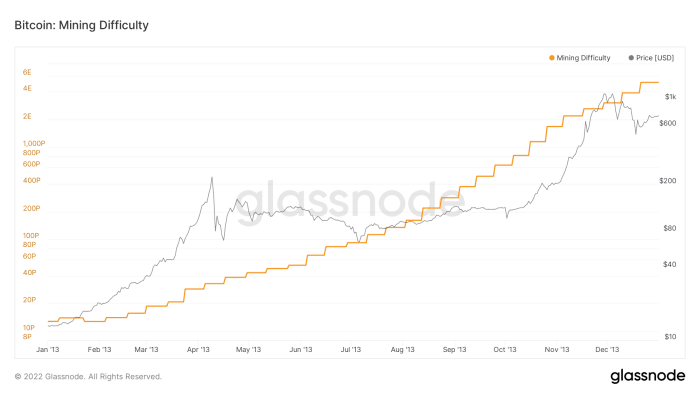

2013

Aside from a 9.46% driblet successful trouble successful precocious January, 2013 would beryllium an “up only” twelvemonth acknowledgment to 2 mega-pumps, the archetypal a near-20-timeser, going from $13.22 astatine the commencement of the twelvemonth to $229.47 connected April 9, and a 17-bagger from aboriginal July until aboriginal December. Alongside the solitary trouble driblet to commencement the year, determination were 30 affirmative adjustments, averaging 17.16% with a modular deviation of positive 8.34%. Similar to 2010, your 1 BTC of net connected January 1 reduced to 292,156 sats if you didn’t adhd immoderate GPUs to your farm, a 99.71% drop. However, arsenic of the extremity of 2013, cipher would beryllium adding immoderate GPUs to their farms (aside from shitcoin miners of course!), arsenic the property of the ASIC was present upon us.

2014 To 2020: The ASIC Mining Era

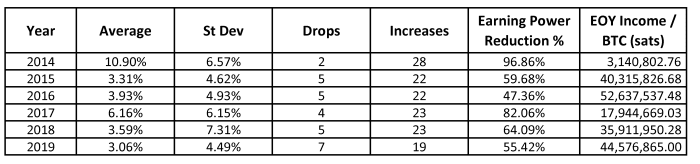

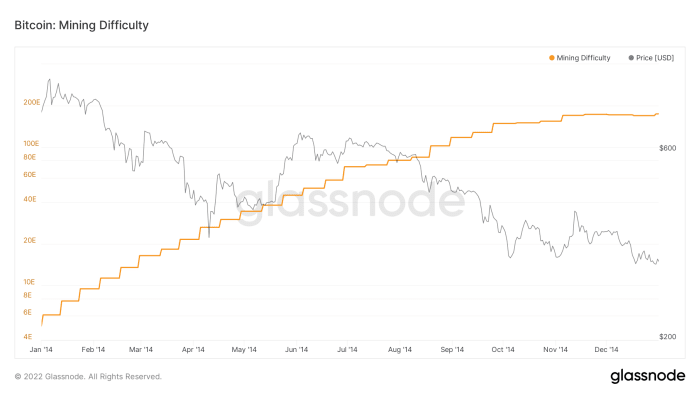

2014

Despite the illness of Mt. Gox starting the longest carnivore marketplace successful the past of Bitcoin, with the precocious watermark of $1,134.39 not to beryllium passed again for the last clip until April 2017 — a afloat 1,218 days aboriginal (trust me, arsenic a November 2013 first-time buyer, I lived it and was counting the days!). 2014 was yet different seemingly “up only” twelvemonth for difficulty, with 28 increases, and 2 tiny decreases of 0.73% and 1.39% to circular retired the year. The mean trouble alteration was positive 10.9% with a modular deviation of positive 6.57%. If you didn’t adhd immoderate ASICs to your workplace successful 2014, your 1 BTC of earning powerfulness was slashed by 96.86% to 3.14 cardinal sats.

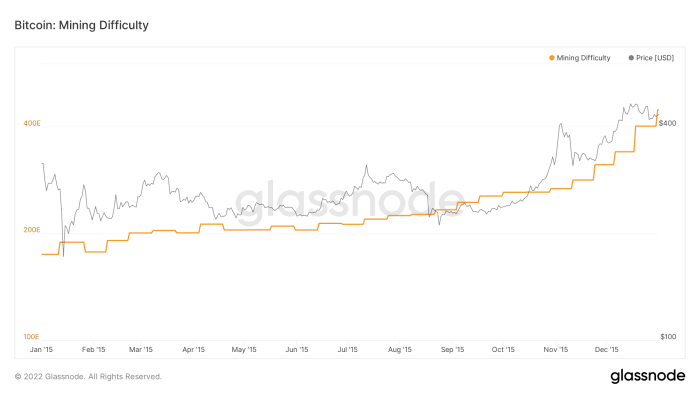

2015

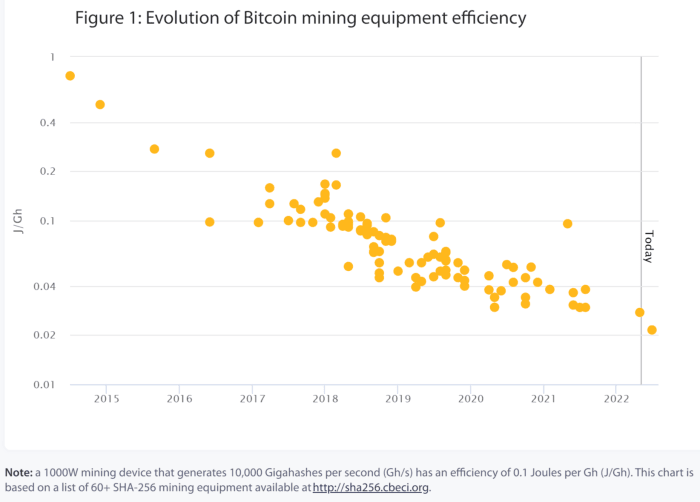

Even with Mt. Gox being dormant for astir 2 years, the “Goxxings” conscionable seemed to support coming, with terms bouncing betwixt $300 and $150 for astir of the year, with each 5 of the trouble drops occuring successful 2015 coinciding with crisp 30% to 50% drops successful terms implicit a abbreviated clip period. ASIC manufacturers were inactive feeling retired the abstraction and perfecting their art, arsenic shown successful the graphic beneath from the Cambridge University SHA256 exertion tracker. This meant that the mean trouble alteration for 2015 was lone positive 3.31% with a modular deviation of positive 4.62%. Still, if you didn’t adhd immoderate rigs to your farm, your 1 BTC of net connected January 1 was chopped by almost 60% to 0.403 BTC.

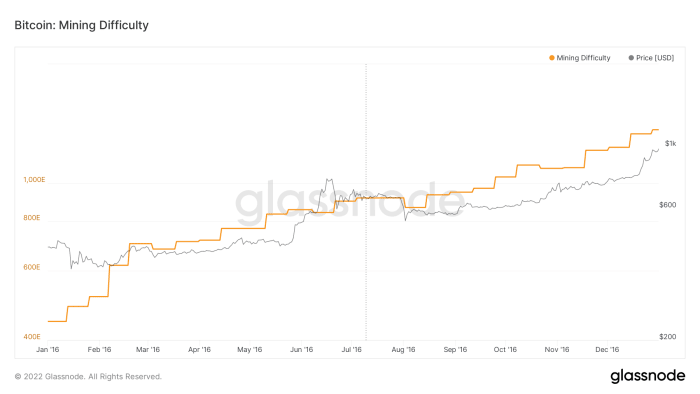

2016

2016 was 1 of the astir peculiar years successful mining history, arsenic it witnessed a halving arsenic good arsenic the merchandise of the AK-47 of mining rigs, the Antminer S9, which would bask profitable work for six years up until the precise caller large terms driblet witnessed successful May 2022.

Price maturation for the twelvemonth was sluggish, prevention for the past fewer months which saw important growth, and the goxxings would inactive proceed during 2016 contempt the speech collapsing much than 2 years prior. All of this would effect successful 22 trouble increases, and 5 drops, 3 of which occurred anterior to the halving.

The mean alteration was positive 3.93% with modular deviation of positive 4.93%, resulting successful a simplification of BTC income of 47.36% for the year.

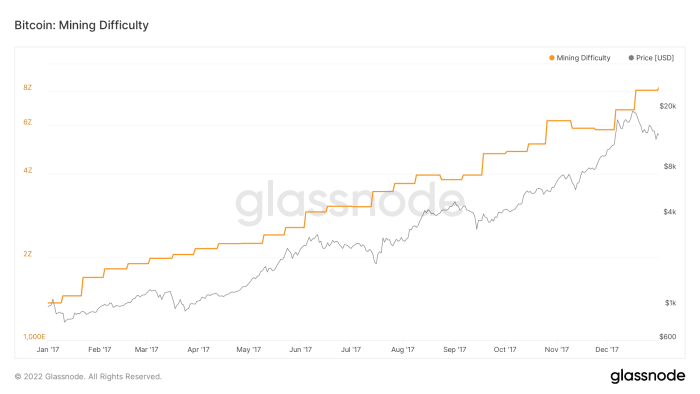

2017

2017 saw 2 large events, a 20-times tally up successful terms passim the year, and the solution of “the blocksize war” toward the precise extremity of the year. I evidently cannot bash justness to the blocksize warfare successful 1 paragraph, truthful I volition punctuation the blurb of Jonathan Bier’s seminal March 2021 publication “The Blocksize War: The Battle Over Who Controls Bitcoin’s Protocol Rules”:

“[The Blocksize War] was astir the magnitude of information allowed successful each Bitcoin block, nevertheless it exposed overmuch deeper issues, specified arsenic who controls Bitcoin’s protocol rules.”

The eventual solution was the instauration of a caller fork of Bitcoin, known arsenic Bitcoin Cash (BCH), which could besides beryllium mined utilizing the SHA-256 protocol. Huge increases successful the terms of BCH toward the extremity of the twelvemonth were capable to coax miners distant from mining the Bitcoin web and excavation connected the BCH web connected 3 occasions aft its motorboat successful August, with a tiny driblet successful July taking the tally to 4 downward adjustments for the year.

There were inactive 23 increases for the twelvemonth however, and with an mean alteration of positive 6.16% with modular deviation of positive 6.15%, these changes resulted successful a simplification of income of 82.06% for the year. More mining rig manufacturers would participate the crippled this year, but nary melodramatic improvements successful rig ratio were achieved.

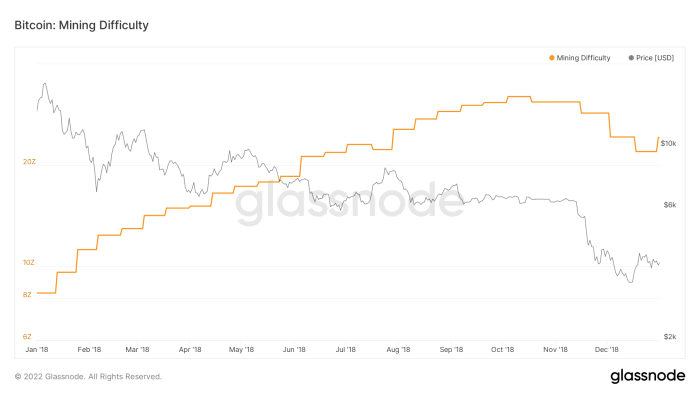

2018

2018 saw overmuch much contention successful the ASIC hardware space, with rig ratio astir doubling. Rigs were becoming truthful efficient, having an 80% drawdown successful terms implicit the twelvemonth did small to halt hash complaint growth.

There was an mean alteration of positive 3.59% with modular deviation of positive 7.31%, crossed 23 trouble increases, a driblet successful July erstwhile bitcoin’s terms was astatine astir $6,000, and 4 drops which occurred during the last terms capitulation from astir $6,000 to astir $3,000 precocious successful the year. The extremity effect was a simplification of income of 64.09% for the twelvemonth compared to your start-of-year earnings.

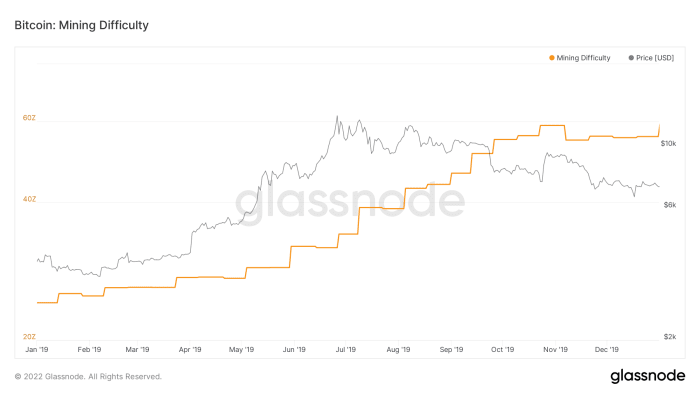

2019

After the brutal carnivore marketplace of 2018, traders saw a alleviation rally that took the terms from $4,000 astatine the commencement of the twelvemonth to astir $13,000 mid-year. Aside from 5 insignificant antagonistic trouble adjustments of little than 1% successful the archetypal fractional of the year, and 2 drops successful the 2nd fractional of the twelvemonth erstwhile bitcoin would instrumentality to a terms of $6,000, determination were 19 increases. The mean alteration of positive 3.06% with a modular deviation of positive 4.49% resulted successful a simplification of income of 55.42% for the year.

This was chiefly driven by adjacent much contention and ratio gains successful the ASIC hardware marketplace arsenic opposed to chasing price-cost arbitrage, with the 2019 fleet of caller rigs being much than doubly arsenic businesslike arsenic their 2017 peers. 2019 was besides the archetypal twelvemonth we saw modular mining techniques astatine ample scale, wherever miners would fundamentally crook shipping containers into portable ASIC farms, and simply vessel them to the world’s cheapest powerfulness sources. The ample driblet successful trouble successful precocious October was much apt from Chinese miners physically migrating to cheaper hydroelectric powerfulness sources owed to the bedewed season, than a miner capitulation implicit a tiny driblet successful price. This would go acold much evident successful the migrations of 2020.

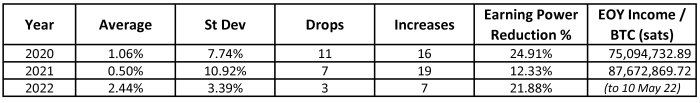

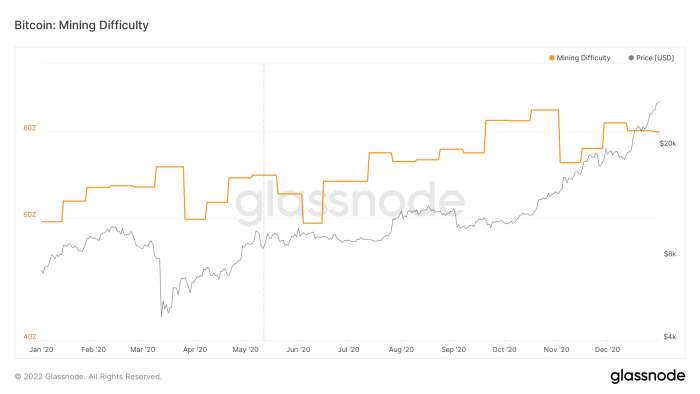

2020

The astir trouble drops successful Bitcoin past would hap successful 2020, with 11 drops, immoderate of previously-unseen magnitudes, occurring passim the year, for antithetic reasons. Despite the “COVID-19 everything clang of March 2020,” the important hash complaint drops witnessed successful April and precocious October would mostly beryllium the effect of Chinese miners physically migrating from Xinjiang state (which is ember heavy) to Sichuan state (which is hydro heavy) during the bedewed season, and past backmost astatine the decision of the bedewed season. The nett connected connection was truthful large arsenic a effect of overmuch cheaper powerfulness that it was worthy it for miners to simply battalion up, determination and found themselves elsewhere, contempt the associated hazard and downtime. Of course, the halving of May 2020 would effect successful 2 consecutive drops of 6.39% and 10.24%.

Mining techniques and rigs would proceed to improve, with firmware work providers similar Braiins.OS providing miners with bundle that dramatically accrued the ratio of their rigs and was casual capable to usage by mining enthusiasts. Immersion-cooled mining would besides commencement being utilized by assorted operations arsenic a mode to further summation ratio and trim downtime and attraction costs.

The mean alteration of positive 1.06% with modular deviation of positive 7.74% resulted successful a simplification of bitcoin-denominated income by 24.91% for the year. Considering that the terms of bitcoin would turn by 4 times successful 2020 however, this would commencement a play of clip wherever location and collocated mining started to look much appealing to a acold wider idiosyncratic basal owed to the seemingly irresistible cost-price arbitrage connected connection successful a booming market, seemingly protected from competition, astatine slightest temporarily, owed to the COVID-induced planetary proviso concatenation issues afflicting the market.

2021 To Current: China Bans Bitcoin And The (Near) Instant Recovery

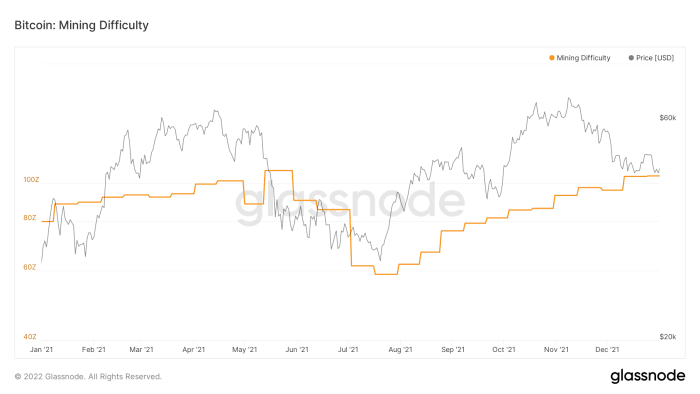

2021

2021 was the twelvemonth mining “hit the streets,” with colocation companies booming contempt agelong pb times for delivery, hardware prices were going done the extortion (in adjacent lockstep with the price). Mining companies were inactive migrating for the cheapest power. They were going nationalist astatine a complaint of knots, and firm treasuries were collateralizing their bitcoin successful absorbing ways. Just immoderate of the mania you would expect to spot during a meteoric bull run. To apical it each off, determination was a immense blackout successful China which caused a adjacent 15% antagonistic trouble change, then, lone a period aboriginal China totally banned Bitcoin mining, causing 4 consecutive antagonistic trouble changes of 19%, 5.6%, 38.8% and 5%. This meant that anyone who was already mining saw a immense impermanent bump successful profits, and would beryllium forgiven for thinking, “Whoever isn’t considering getting into mining close present would beryllium stupid!”

But if you’ve stayed with maine up until this point, you cognize however this communicative ends. Good times are short, and are ever followed by cripplingly hard times for miners. These times would travel soon. Those saying the Chinese hash complaint would not instrumentality for months oregon years were selling the astir picks and shovels, but instrumentality it did, mostly wrong 3 months, and each of it by the extremity of the year.

There were 19 increases, and 7 drops — 5 of which were related to China, the different 2 tiny and wrong tolerance. The absorbing statistic to look astatine is the modular deviation, and portion trouble averaged a alteration of positive 0.5%, its modular deviation was 10.9%. So, if you were successful the crippled astatine the commencement of the year, you performed stellarly, and lone had your income reduced by 12.33% for the year. However, if you were 1 of the unlucky ones who started successful precocious July 2021 (or later), you had 12 changes for the remainder of the twelvemonth (11 of which were positive), and an mean of positive 4.61%, meaning you’d mislaid astir 77% of your income by the extremity of the year, with the bitcoin terms going south, quickly. Again, if you were already established, 2021 was a fantastic year. For everyone else, buying bitcoin would person been the wiser option.

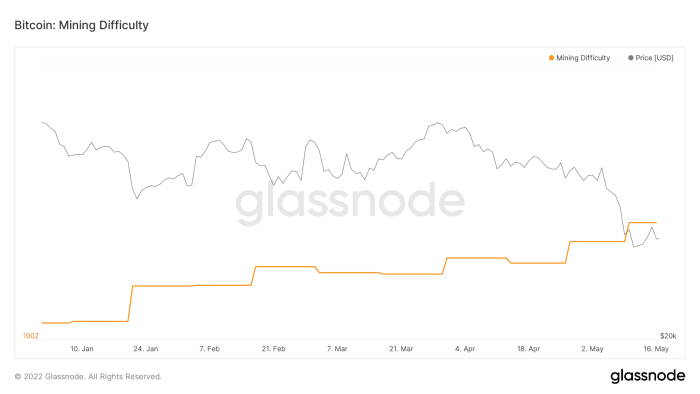

2022

We are 10 trouble changes into 2022 — 7 increases and 3 drops. Despite a 20% clang successful terms since the past trouble change, it is predicted that the upcoming trouble alteration volition beryllium a driblet of astir 1%. Of the 10 changes truthful far, the mean alteration was positive 2.44% with a modular deviation of positive 3.39%, resulting successful a simplification of income of 21.89% twelvemonth to date, but I foretell it volition beryllium a simplification of 50% by twelvemonth end. Home miners beware!

Most interestingly, 2022 saw Intel participate the mining game, forming a ample concern with greenish miner GRIID, and connection that adjacent oil-and-gas giants Exxon Mobil and Conoco Philips had started flare mining utilizing mobile, containerized mining solutions. Even with bitcoin’s terms being successful the doldrums, contention has been getting stiffer and stiffer.

2022 has seen much COVID-19 proviso concatenation issues clearing, much innovation successful mining firmware and techniques and, with what looks to beryllium yet different protracted carnivore marketplace for price, volition spot a flushing retired of over-leveraged oregon low-margin miners, arsenic we person witnessed successful erstwhile carnivore markets.

Conclusion: Bitcoin Mining Is Perfectly Competitive

The quality of contention successful Bitcoin mining is near perfect which means miners volition enactment highly hard to person the astir businesslike operation, and indeed, the astir businesslike proviso chain. It besides means that they are acceptable and capable to physically spell wherever is required to execute this. Mining is not easy, and for a location miner, is akin to panning for golden successful 2022 — it sounds acold much glamorous and rewarding than it really is! There are amended ways to pique your curiosity astir mining than spending wealth trying it retired yourself (read: going abbreviated spot-Bitcoin successful hopes you’ll gain much by mining versus going agelong spot-BTC) — but you volition ne'er perceive this from the radical selling picks and shovels!

Bitcoin mining has been capable to sorb astir of my clip and intelligence capableness for 8 years, yet I person ne'er adjacent turned connected a miner successful my life. When it comes to mining, it’s champion to permission the breadstuff to the baker, arsenic they are astir susceptible of identifying, assuming and managing the risks. The past speaks for itself: When it comes to hash complaint and difficulty, “number spell up” harder, faster and much consistently than price, and portion this is large for Bitcoin, it is unspeakable for those looking to vie successful what is simply a perfectly competitory space.

This is simply a impermanent station by Hass McCook. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)