Bitcoin incentivizes vigor innovations whereas proof-of-stake results successful exacerbated inequality since the much wealth you have, the much wealth you get.

Mickey Koss is simply a West Point postgraduate with a grade successful economics. He spent 4 years successful the Infantry earlier transitioning to the Finance Corps.

In a recent article titled “Bitcoin Is Not a Store-of-Value,” an writer going by the sanction of 0xStacker provided a seemingly well-reasoned critique of Bitcoin, equating its vigor usage to a flaw successful the strategy — a leak that precludes bitcoin from being classified arsenic a dependable store of value. I’m present to archer you that the vigor usage is not a flaw, but successful fact, the facet of bitcoin that volition thrust it guardant arsenic a reserve currency and store of worth for the full world. The solution touted successful the nonfiction points to proof-of-stake, of course, but the flaws inherent to that strategy marque it unsuitable arsenic a semipermanent store of worth oregon decentralized monetary base.

Bitcoin mining is astir arsenic competitory arsenic it gets with markets: You’re either purchasing cheap-enough energy to support profitability oregon you’re not. If you’re not, implicit clip you volition beryllium forced to merchantability your bitcoin and beryllium tally retired of business. The writer seems to presume that vigor prices volition proceed to ascent implicit time, making it much and much costly to mine, causing a web decease spiral if terms enactment doesn’t support up. If you presume we stay connected fundamentally scarce and perishable vigor sources and a strategy reliant upon perpetual wealth printing and inflationary policy, past the writer whitethorn person a point. But isn’t the full intent of Bitcoin to make a parallel strategy without a mindset of hostility to quality flourishing?

Fear Uncertainty And Doubt Repackaged With Math

First and foremost, bitcoin miners selling bitcoin isn’t an contented to me. Why would we privation a radical of perpetual HODLers keeping each coin they ever mine? Coin organisation is indispensable for a steadfast allocation of coins to spell to radical who privation to opt retired of the existent system. Bitcoin is archetypal and foremost astir decentralization and idiosyncratic empowerment. Do we knock golden miners for selling gold? This disapproval made truthful small consciousness to maine that it hardly registered arsenic thing to address.

The miners I know, including myself and those astatine the firm level, lone merchantability bitcoin arsenic a past resort. They excavation due to the fact that they privation bitcoin, not due to the fact that they privation fiat gross streams. The selling unit successful my eyes is simply a non-issue. It is indicative of the marginal outgo of producing bitcoin, which is 1 of the main aspects of bitcoin that springiness it worth erstwhile compared to fiat currencies. What’s the marginal outgo of producing an other dollar? About 5 clicks and a mates of strokes connected Jerome Powell’s keyboard.

In 0xStacker’s solution — proof-of-stake — stakers person nary adaptable costs speech from possibly income taxes. Because of the power they person implicit the web from staking, the large boys are incentivized to clasp onto their coin successful bid to exert much and much power implicit the network. Theoretically, a large staker oregon a cartel of them (like the large exchanges), could get unneurotic and wholly instrumentality implicit a proof-of-stake network. The incentives thrust centralization. The much you have, the much you get.

The writer past attempts to equate existent mining costs and iterate them out, utilizing existent numbers, to task a aboriginal marketplace headdress and the vigor expenditure required. This methodology is truthful nonsensical that it took maine a portion to adjacent recognize it. What I yet realized is that his equation is simply a mathematical practice of classical Bitcoin vigor FUD (fear, uncertainty and doubt). Luckily truthful galore radical person debunked this claim, it’s hardly worthy mentioning astatine this point. (Examples tin beryllium recovered here oregon here.)

A elemental anecdote to combat immoderate of his FUD points is the caller Antminer S19 XP. Compared to its predecessor the S19 Pro, you get a 27% summation successful hash complaint with a 4% decrease successful powerfulness consumption. A miner’s hash complaint whitethorn turn exponentially, but powerfulness depletion surely doesn’t.

He besides attacks the Lightning Network arsenic centralized and relying connected companies similar Strike. This is simply not true. Much similar Bitcoin, the Lightning Network is permissionless, open-source software; It has thing to bash with Strike. The Lightning Network is simply a Layer-2 application. Strike should beryllium considered Layer 3, utilizing the Lightning Network arsenic an enabling instrumentality for its business. Strike relies connected the Lightning Network, surely not the different mode around.

As the bitcoin terms grows, yes, fees volition turn arsenic well. Small purchases volition determination onto Lightning; ample purchases that request much information and finality volition stay on-chain. The hash complaint volition determination to immoderate level that miners are incentivized to support mining.

The writer adjacent contradicts himself erstwhile attempting to beryllium the benefits of proof-of-stake mining:

“This means web usage is simply a spot much costly for the extremity user, but their usage of the web benefits each holders of ETH by burning immoderate of the supply. Additionally, due to the fact that determination is nary monolithic vigor outgo to staking, web validators bash not person to merchantability the incoming proviso of ETH successful bid screen costs. In fact, due to the fact that the proviso is deflationary, they are incentivized to hold.”

Bitcoin is excessively costly but ETH being costly is good due to the fact that they pain tokens and don’t usage energy…? It doesn’t marque sense. He adjacent states that the validators are incentivized to clasp tokens due to the fact that they don’t person adaptable costs. The cardinal quality present is that the magnitude of bitcoin you clasp does not impact web consensus. So, if validators are incentivized to hold, delight explicate however the biggest bagholders won’t dilatory instrumentality implicit the full network? It’s a dilatory and dependable march towards centralization.

He compares the instrumentality connected concern into bitcoin mining to staking, but fails to notation that the accrual of bitcoin done mining:

- Happens astatine a decreasing complaint with hash complaint growth.

- Does not turn your power implicit the web with the size of your bitcoin stack.

The miners request to supply worth to stay viable. Stakers conscionable person to stake.

The author’s nonfiction is littered with truthful galore mendacious points and comparisons that it’s honestly hard to adjacent code them all. Bitcoin has a $3 cardinal outgo for a 51% onslaught — bully luck getting your hands connected each that hardware and electricity. You indispensable person your ain concealed spot foundries and atomic powerfulness plants cipher knows about.

The author’s archetypal assertion that he’s not simply publishing FUD, information check: false.

Mining Incentives

In Bitcoin Magazine’s “To the Moon Issue,” Hass McCook III wrote a theoretical communicative titled “Bitcoin Mining successful the 22nd Century.” The nonfiction culminates successful a beauteous illustration of however Bitcoin’s incentives iterate into a satellite of quality flourishing:

“On Earth, 25% of the world’s vigor is dedicated to mining bitcoin, and owed to the mostly Bitcoin-driven aggravated contention successful the vigor markets, regular radical efficaciously person entree to precise low-cost if not escaped vigor … The world’s grid is emissions free. Of enactment is that humanity present uses a afloat 50 times much vigor than we did a period agone — each clean.”

Bitcoin is the inducement that tin assistance thrust down vigor costs and bring quality flourishing to the world. In a caller nonfiction by Level39, helium presents a method that uses somesthesia differentials successful water h2o to make electricity. The exertion has existed for implicit 100 years successful theory, nevertheless the incentives for existent improvement person not existed until the improvement of a decentralized, energy-based monetary strategy that could monetize energy existed. That strategy is bitcoin.

Profitability Assumption

One of the astir flawed assumptions successful my eyes is that bitcoin mining needs to beryllium profitable successful the archetypal place.

Assuming that miners volition ever beryllium elephantine warehouses afloat of computers, consuming vigor second-hand from the powerfulness companies, past yeah, bitcoin mining companies volition ever request to stay profitable. An absorbing treatment that I’ve heard floated connected podcasts precocious is the mentation that vigor companies volition statesman to get bitcoin mining companies oregon that bitcoin mining companies volition statesman to get vigor producers. Either way, it’s a win-win and helps to alleviate the request for bitcoin miners to beryllium profitable astatine all. The magic present lies successful the electricity request curve.

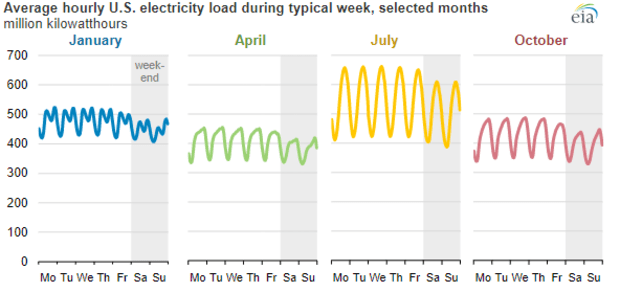

(Source): U.S. Energy Information Administration, U.S. Hourly Electric Grid Monitor.

The request curve fundamentally illustrates the alteration successful request for energy based connected the clip of day, astatine antithetic points passim the year. While this speech could get precise complicated, 1 of the large reasons that vigor tends to get much costly implicit clip is that the terms of your vigor not lone has to wage for the vigor you use, but besides for each the excess capableness that electrical companies person but cannot usage astir of the time. You see, electrical inferior companies request to support the energy capableness to conscionable the precocious request for energy arsenic depicted successful the period of July supra — positive immoderate excess information borderline — but that capableness goes mostly unused for the remainder of the year. Merging bitcoin mining and vigor accumulation could resoluteness this occupation completely. Instead of vigor consumers paying for unused capacity, inferior companies would usage astir 100% of their capacity, ramping mining up and down based connected vigor request passim the day, charging customers lone for the energy that they really use.

The incentives are inactive the aforesaid arsenic acold arsenic renewable improvement and adaptable costs go, nevertheless it eliminates the necessity for bitcoin miners to beryllium profitable. The enactment of mining bitcoin simply has to outweigh the accidental outgo of keeping the excess capableness offline. If determination are near-zero adaptable costs associated with generating electricity, similar successful hydro and nuclear, wherefore wouldn’t generators simply support capableness astatine astir 100% and soak up each the other energy into bitcoin? They wouldn’t adjacent request to sell, but simply usage bitcoin successful the beautiful, monetary-battery capableness that Michael Saylor loves to speech about.

This could pb to a monolithic build-out of clean, baseload energies, specified arsenic nuclear, and pb to cheaper, much reliable and abundant vigor for all. This energy-sponge conception is already helping to stabilize grids and trim emissions successful places similar Texas, Utah, Kenya and Oman. So portion Bitcoin is changing the satellite of energy, proof-of-stake coin-holders are incentivized to clasp due to the fact that the terms mightiness spell up, I guess.

Furthermore, ASIC chips tin beryllium utilized to regenerate the heating elements for applications, specified arsenic HVAC systems and h2o heaters. Why would you simply privation to nutrient vigor erstwhile you could excavation bitcoin astatine the aforesaid time? Sounds similar a truly anserine discarded of energy to me, and conjecture what, this is already happening successful Canada connected a beauteous ample scale, delivering vigor to 100 residential and commercialized buildings. Why would you not privation a h2o heater oregon furnace that mines bitcoin?

Came For The Number Go Up, Stayed For The Freedom Go Up

The writer besides seems to absorption greatly connected price, ignoring the freedom-oriented aspects of the decentralized and immutable ledger that is Bitcoin. Fundamentally, proof-of-stake is simply a strategy wherever the much wealth you have, the much wealth you get and the much power you gain.

The writer asks:

“Why would an capitalist take to store worth successful a token strategy that leaks worth erstwhile they could take 1 that doesn’t leak value, has higher request imaginable owed to being much eco-friendly, and has a deflationary proviso that leads to worth accrual successful the token (number spell up tokenomics)?“

Simply stated, it’s due to the fact that I don’t judge successful your system. It’s not and tin ne'er beryllium decentralized based connected the terms to tally a node alone. I cull the premise that anyone has the authorization to dictate my vigor usage successful the archetypal place, fto unsocial that your notions of what’s eco-friendly person immoderate benignant of nonsubjective oregon utile definitions successful the archetypal place. Do you privation to unrecorded successful a post-freedom, eco-fascist, dystopian society? This is however you get there. Energy usage is not bad. You tin person your barroom and devour it too, each portion redeeming the situation and moving your AC astatine afloat blast.

At a existent token terms conscionable beneath $2,000, the outgo to rotation up an Ethereum node close present is conscionable shy of $64,000, oregon 32 ETH. This is simply a steep terms tag for self-sovereignty and the quality to corroborate your ain transactions. A outgo that frankly astir of the satellite volition ne'er beryllium capable to pay. Furthermore, the staking reward ensures that the biggest bagholders tin ever accumulate much and much of the network.

Bitcoin has nary specified problem. You clasp your bitcoin arsenic agelong arsenic you are capable to. No magnitude of bitcoin volition ever let you to exert much power connected the web than anybody else. From the pleb with a fewer 1000 sats to Michael Saylor sitting connected his seven-figure upland of coin, we are each equal. The outgo of mounting up and moving a bitcoin node is astir $500 for a premium out-of-the-box solution. The hurdle to go a sovereign idiosyncratic is overmuch much attainable for the mean idiosyncratic with Bitcoin than with Ethereum. The nodes support the ledger; the nodes enforce the rules. A overmuch cheaper obstruction to introduction ensures that Bitcoin remains decentralized with the quality for galore much radical to tally their ain node and guarantee decentralization.

In my eyes we person 2 paths forward:

Give successful to the vigor FUDsters, judge rising prices and bash everything we tin to chopped depletion and summation reliance connected intermittent and unreliable sources due to the fact that utilizing energy is bad.

Or:

Leverage the Bitcoin web to bootstrap a caller property of quality flourishing and abundant vigor for everyone.

I’ll spell with enactment fig two. Bitcoin is simply a almighty and decentralized web successful a mode that proof-of-stake tin ne'er beryllium and volition ne'er become. Bitcoin’s vigor usage is simply a feature, not a bug.

This is simply a impermanent station by Mickey Koss. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)