Since June 22, Bitcoin has been trading supra the captious intelligence level of $30,000. This terms rally is simply a effect of accrued request for the integer asset, a request that is further exacerbated by the debased availability of Bitcoin connected exchanges.

One cardinal metric that underscores this inclination is the percent of Bitcoin’s proviso held connected exchanges. Data from Glassnode measures the full magnitude of coins held connected speech addresses and calculates the percent of the proviso connected exchanges.

When a ample magnitude of Bitcoin is held connected exchanges, it often indicates that investors are acceptable to merchantability their holdings, suggesting a bearish sentiment. Conversely, a alteration successful the magnitude of Bitcoin connected exchanges tin connote that investors are moving their assets to backstage wallets for semipermanent holding, signaling a bullish sentiment.

Moreover, the magnitude of Bitcoin connected exchanges straight impacts marketplace liquidity. High liquidity means that determination are a ample fig of marketplace participants, and buyers volition rapidly sorb immoderate ample merchantability orders. However, if the magnitude of Bitcoin connected exchanges decreases significantly, it could pb to little liquidity. This means that ample merchantability orders could drastically affect the marketplace price, starring to accrued volatility.

Therefore, tracking the magnitude of Bitcoin held connected exchanges tin supply invaluable insights into imaginable marketplace movements and capitalist sentiment.

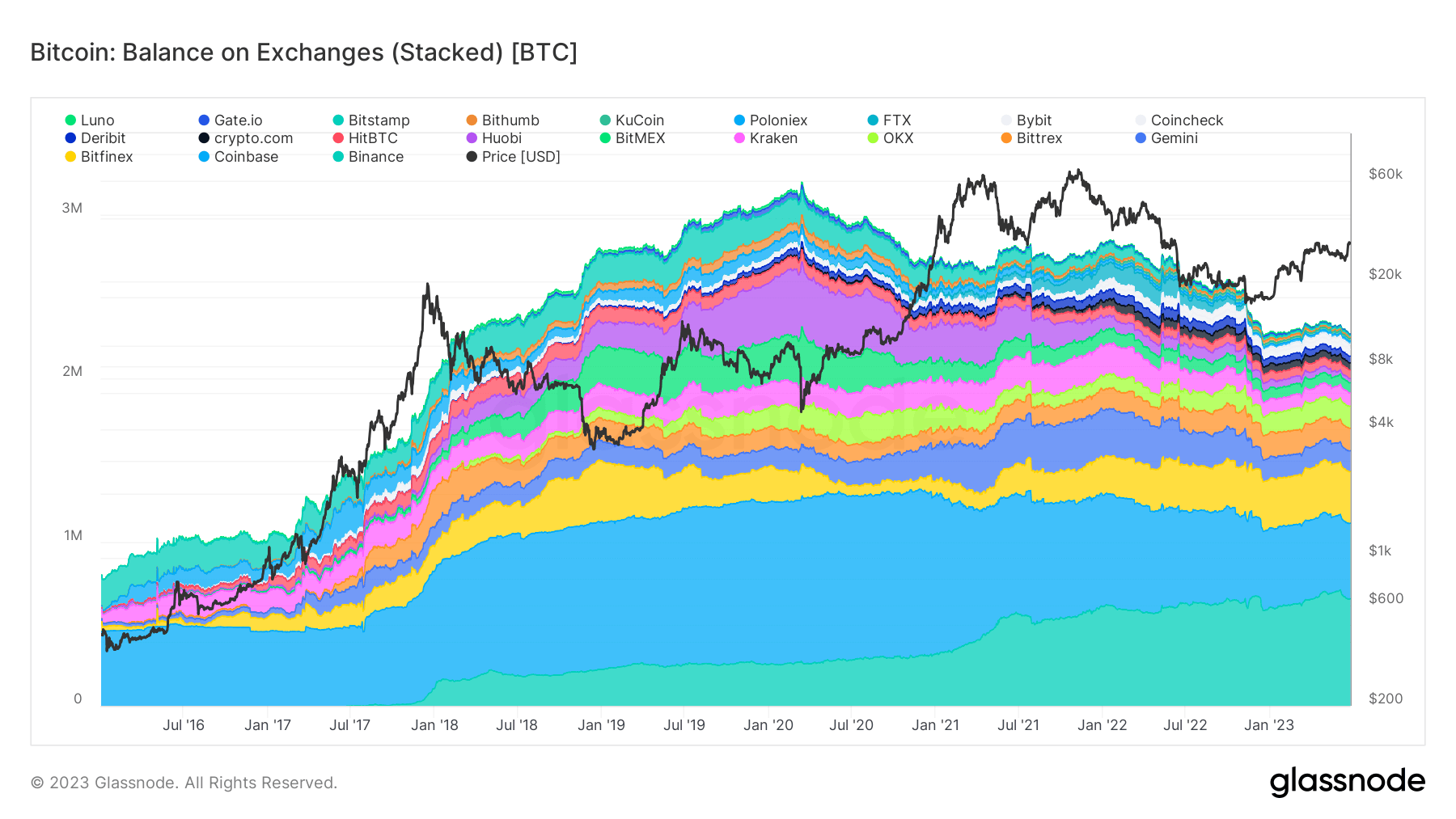

Graph showing Bitcoin’s stacked equilibrium connected exchanges from January 1, 2016, to June 26, 2023 (Source: Glassnode)

Graph showing Bitcoin’s stacked equilibrium connected exchanges from January 1, 2016, to June 26, 2023 (Source: Glassnode)The percent of Bitcoin’s proviso held connected exchanges has been connected a downward trajectory since the extremity of April erstwhile it reached its year-to-date (YTD) precocious of 12.16%.

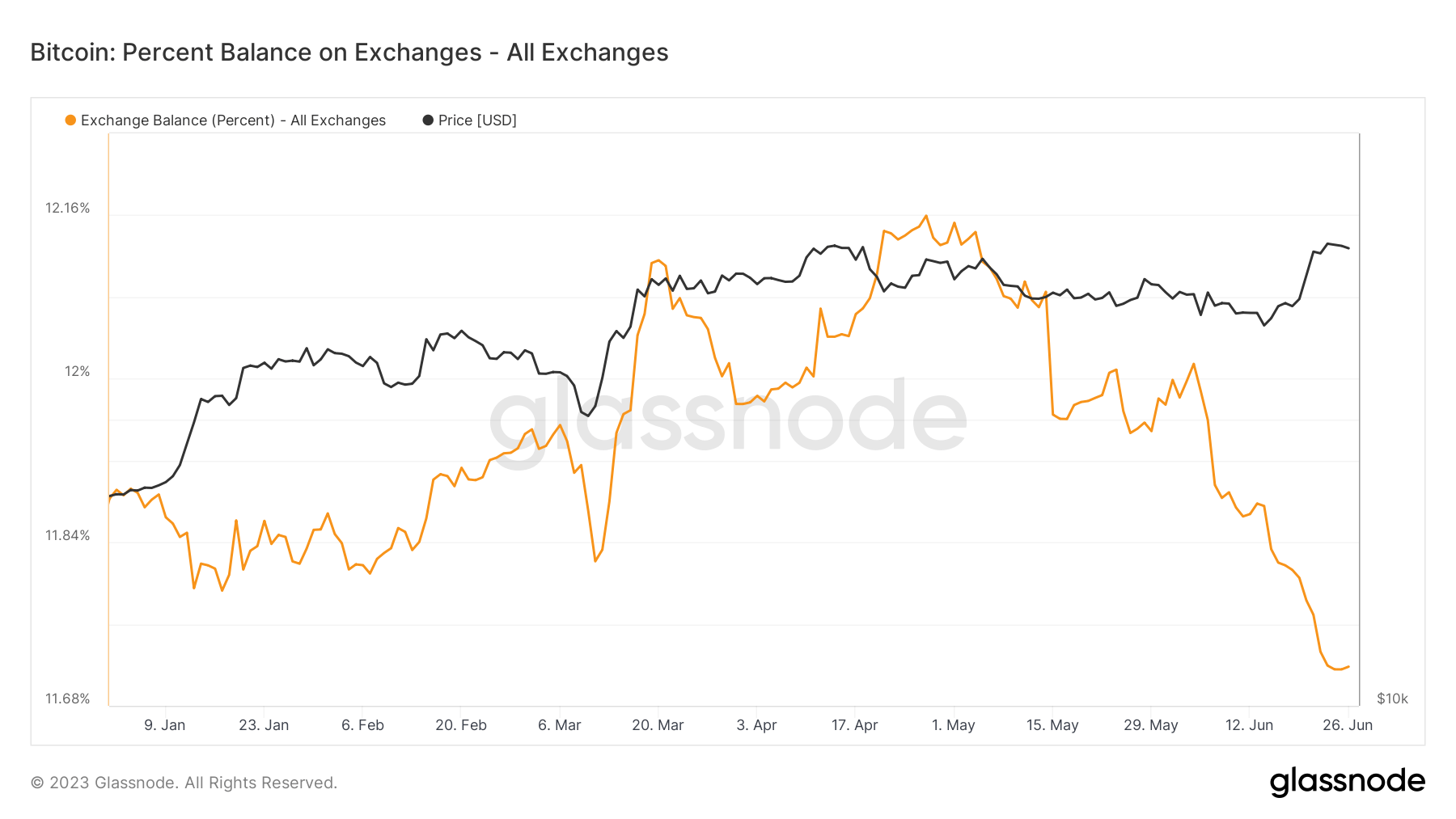

Graph showing the percent of Bitcoin proviso held connected exchanges YTD (Source: Glassnode)

Graph showing the percent of Bitcoin proviso held connected exchanges YTD (Source: Glassnode)However, a broader position reveals that the magnitude of Bitcoin held connected exchanges has been successful diminution since March 2020, erstwhile it reached an all-time precocious of 17.51%.

The percent of Bitcoin’s proviso held connected exchanges has present dropped to a five-and-a-half-year debased of 11.71%, reaching levels past recorded successful December 2017. This inclination indicates a displacement successful capitalist behavior, with much holders opting to store their Bitcoin disconnected exchanges, perchance successful anticipation of aboriginal terms appreciation.

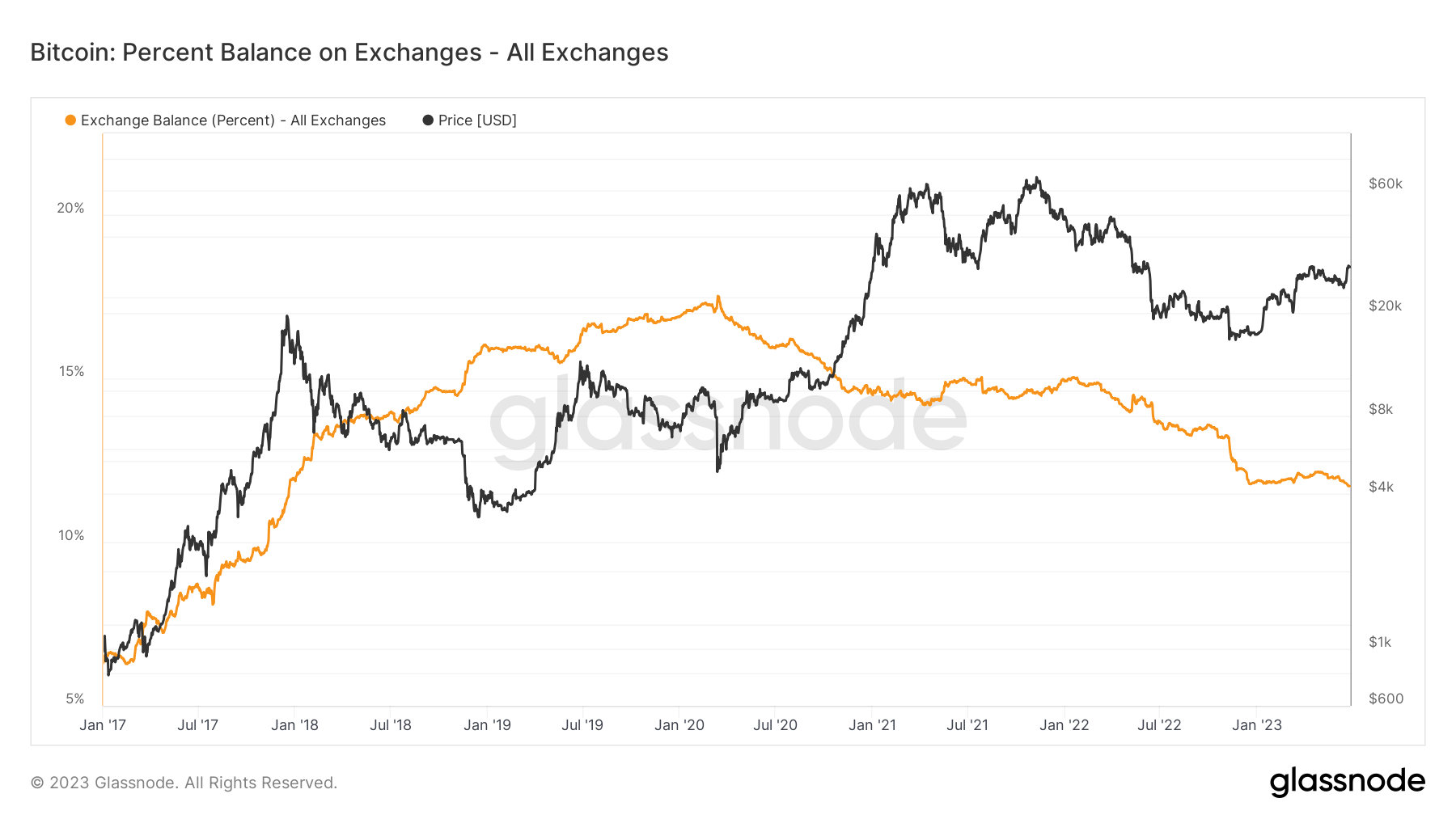

Graph showing the percent of Bitcoin proviso held connected exchanges from January 1, 2017, to June 26, 2023 (Source: Glassnode)

Graph showing the percent of Bitcoin proviso held connected exchanges from January 1, 2017, to June 26, 2023 (Source: Glassnode)The station Bitcoin’s speech equilibrium drops to 5-year debased arsenic terms hits $30K appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)