In a station shared connected X with his 700,000 followers, marketplace seasoned CRYPTO₿IRB (@crypto_birb) outlined what helium believes could beryllium 1 of Bitcoin’s last large pullbacks earlier an eventual surge to a six-figure terms target. In his ain words: “BTC LAST DIPS BEFORE $273K? Here’s why:” He backed up this assertion with a bid of concise slug points covering marketplace trends, method signals, and humanities data.

One past dip to $75,000? | Source: X @crypto_birb

One past dip to $75,000? | Source: X @crypto_birbLast Chance to Buy Bitcoin Cheap?

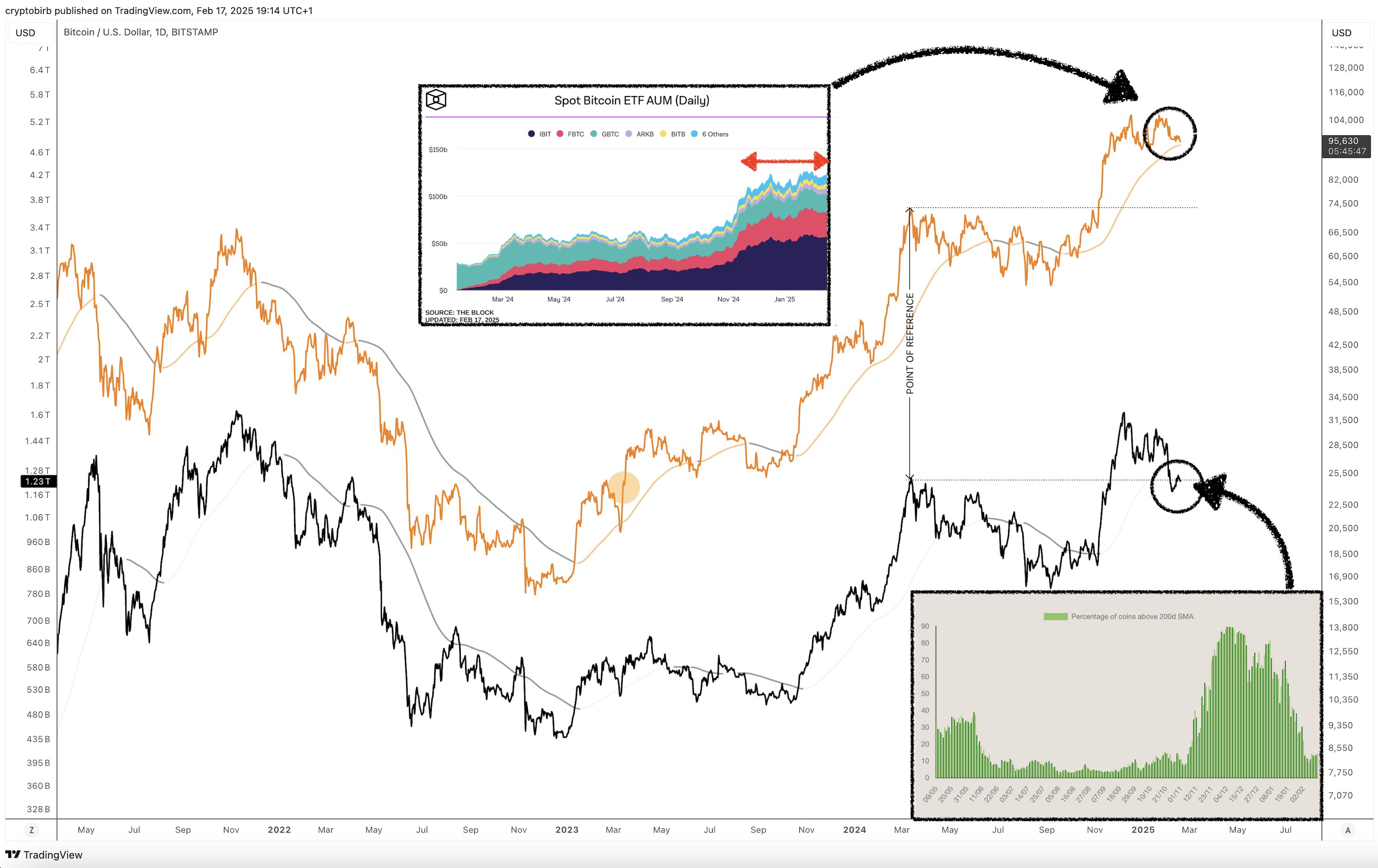

CRYPTO₿IRB’s analysis begins with a statement of the “Bull Market” environment, noting that some the 200-week and 50-week moving averages are rising. These semipermanent trends often bespeak a broader displacement successful marketplace sentiment.

He besides references the latest information connected Bitcoin exchange-traded funds, pointing to full assets nether absorption (AUM) of $121 billion, alongside a important trading measurement of $746 billion. Another cardinal metric highlighted is the Net Unrealized Profit and Loss (NUPL), which helium places astatine 0.54, suggesting that much traders are successful nett than those astatine a loss. He observes a seven-week correlation to the S&P 500 astatine 0.25, signaling lone a mean linkage betwixt Bitcoin and the accepted equity marketplace implicit that period.

The expert past addresses the “Daily Trend,” indicating that helium sees Bitcoin oscillating wrong a scope of $90,000 to $110,000 for now. He situates the 200-day Simple Moving Average astatine astir $80,200 and emphasizes that this fig is trending upward. CRYPTO₿IRB besides explains that the proprietary 200-day BPRO indicator sits astatine astir $94,400, which helium views arsenic different motion of strengthening momentum, contempt a 50-day RSI astatine 42. An RSI beneath 50 often points to cooled marketplace momentum, yet helium notes that volatility appears stalled for the moment, with an Average True Range of $3,360 suggesting that terms swings person softened compared to erstwhile periods.

Turning to his “Trade Setup,” CRYPTO₿IRB highlights that helium sees definite bearish configurations connected his 12-hour BPRO CTF and HTF Trailer indicators. He describes marketplace conditions arsenic choppy, with absorption appearing astir the $99,700 to $103,100 range. This implies that if Bitcoin fails to interruption supra that absorption level, short-term pullbacks oregon sideways enactment could proceed until buyers regain control.

Regarding “Sentiment & Miners,” the expert points to a Fear & Greed Index speechmaking of 51, a level considered neutral. He remarks that fearfulness typically spikes conscionable earlier cardinal breakouts, implying that the lack of utmost fearfulness whitethorn bespeak a much sustained ascent erstwhile absorption zones are cleared. He besides classifies the ongoing marketplace rhythm signifier arsenic “belief,” suggesting that investors stay cautiously optimistic without the euphoria that often signals large tops. Another important origin is miners’ profitability, which helium estimates remains steadfast supra $88,400, a threshold that tin discourage excessive miner selling and assistance reenforce terms floors.

His commentary connected “Seasonality” underscores the humanities show of Bitcoin. He notes that February has seen an mean summation of 15.85% with affirmative returns successful 7 retired of 10 years. Overall, archetypal quarters thin to present astir a 25% mean gain. From 2010 to 2024, Bitcoin’s annualized instrumentality stands astatine astir 145%, reflecting the awesome semipermanent maturation that has characterized its history. CRYPTO₿IRB encourages traders to “BTFD Feb–March,” which is abbreviated for “buy the dip,” implying that helium expects charismatic introduction points to look earlier the marketplace perchance rallies again.

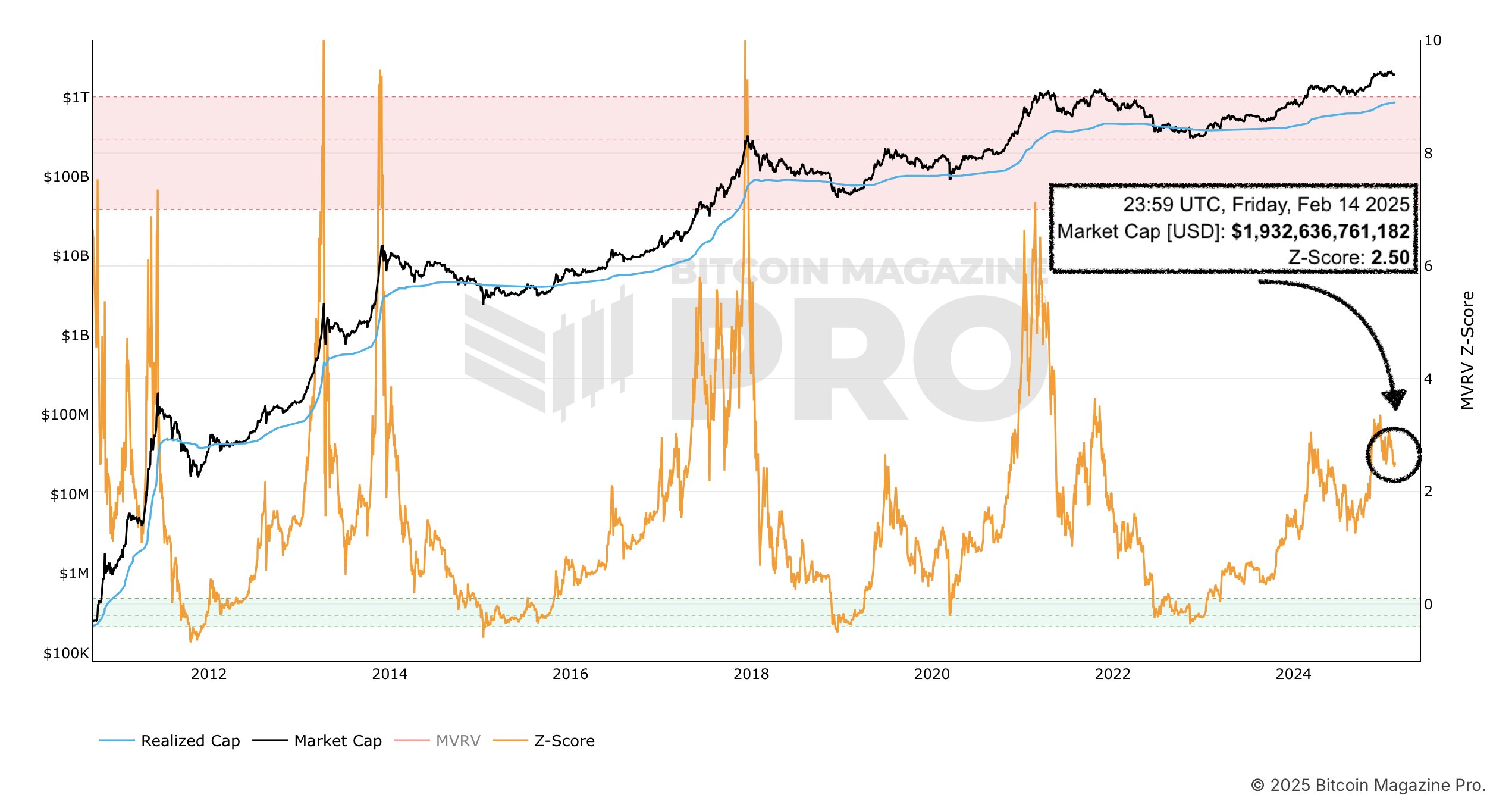

In explaining the “Macro Top,” helium looks to the MVRV Z-Score, a metric that compares marketplace worth to realized value. He warns that an MVRV Z-Score supra 7.0 traditionally signals an overheated market. Currently astatine 2.43, the people remains good beneath that information zone, which leads him to task a imaginable highest supra $273,000 (2.88x from $95.3k).

He states: “Bitcoin volition commencement forming apical implicit $273k+. According to MVRV Z-Score, the marketplace peaked lone erstwhile MVRV pushed & stayed for weeks supra 7.0 (2.8X from $97.5k). It’s the pre-rich phase.”

Bitcoin MVRV Z-Score | Source: X @crypto_birb

Bitcoin MVRV Z-Score | Source: X @crypto_birbAt property time, BTC traded astatine $95,553.

BTC price, 1-week illustration | Source: BTCUSDT connected TradingView.com

BTC price, 1-week illustration | Source: BTCUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

7 months ago

7 months ago

English (US)

English (US)