An exploding hash complaint should not beryllium taken arsenic a beardown indicator of the Bitcoin terms rising.

Cover art/illustration via CryptoSlate

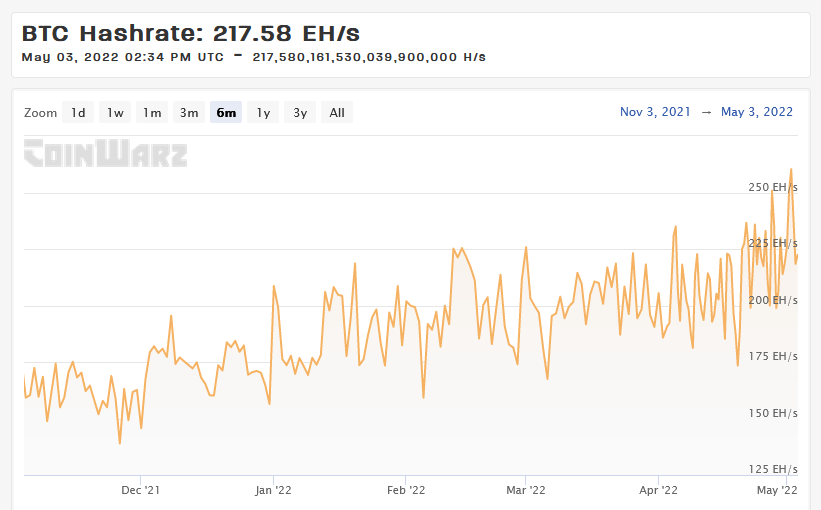

CoinWarz shows the Bitcoin hash complaint continues to explode, hitting a caller all-time precocious of 270 EH/s connected Monday earlier settling astir the 220 EH/s today.

A rising Bitcoin hash complaint indicates the fig of miners connected the web is growing. This is often taken arsenic a measurement of increasing miners’ assurance successful BTC.

Source: coinwarz.com

Source: coinwarz.comHowever, considering the looming menace of recession, immoderate adjacent accidental depression, bash the miners cognize thing we don’t?

Recession indicator flashes red

Satoshi Nakamoto created Bitcoin pursuing the 2008 recession to code cardinal slope currency debasement and make an alternate to the banking system.

As an alternate to TradFi, immoderate assumed Bitcoin would enactment arsenic a risk-off asset. Yet caller information from Bloomberg shows the correlation betwixt the Nasdaq and BTC has ne'er been higher. This suggests occupation up for crypto arsenic stocks descend during recessions.

How apt is simply a recession? An often-used indicator of recession is the yield curve. Typically, semipermanent indebtedness instruments wage higher yields than short-term indebtedness owed to the accrued hazard of lending implicit the longer term.

An inverted output curve, wherever semipermanent indebtedness pays little output than short-term debt, is simply a beardown indicator of a pending recession. Since 1955, a recession followed each instances of an inverted output curve except one.

In precocious March 2022, the dispersed betwixt the 2 and ten-year US authorities bonds tightened to conscionable 0.2%. A continuation of this inclination volition pb to the output curve inverting.

The economical outlook is antagonistic with different factors successful play, specified arsenic pending US involvement complaint raises and struggle successful Eastern Europe.

However, the rising BTC hash complaint suggests miners expect the terms of Bitcoin to spell up, antagonistic to what’s expected considering the authorities of the macroeconomic landscape.

What is the transportation betwixt Bitcoin hash complaint and price?

There is statement regarding the narration betwixt the Bitcoin hash complaint and its price.

On-chain Analyst Willy Woo argues that Bitcoin’s terms follows the hash rate. This enactment of reasoning contends that a rising hash rate, arsenic we are witnessing now, volition pb to the BTC terms rising.

However, others judge the hash complaint follows price, successful that it’s the terms that drives miners to privation to put successful costly mining equipment.

Since November 2021, the terms of Bitcoin has been trending downwards, yet implicit this period, the hash complaint has been increasing. This narration counts against the thought that the hash complaint follows terms due to the fact that a falling terms would spot a driblet successful the hash rate, which isn’t the case.

But past again, this signifier besides runs contrary to the conception that terms follows hash complaint due to the fact that if this were true, past the rising hash rates that we are seeing present would equate to the Bitcoin terms moving higher.

The lone decision to gully astatine this clip is that the correlation betwixt the hash complaint and the terms is weak.

3 years ago

3 years ago

English (US)

English (US)