Bitcoin's swift betterment from one-month lows has immoderate investors saying the rebound is apt to continue. The enactment successful the options marketplace suggests they whitethorn beryllium right.

Data provided by derivatives probe steadfast Skew amusement bitcoin's one-week implied volatility jumped to an annualized 75% connected Thursday, topping the one-, three- and six-month gauges, arsenic Russia's penetration of Ukraine saw investors dump risky assets successful favour of golden and fiat currency havens.

"Bitcoin's short-term implied volatility exceeding semipermanent implied volatility indicates a likelihood of marketplace reversal," Robbie Liu, a researcher astatine crypto fiscal services supplier Babel Finance, told CoinDesk successful an email. "A akin inclination was observed aft the May 2021 crash."

Implied volatility refers to investors' expectations for terms turbulence implicit a circumstantial period. While the metric is forward-looking, it doesn't accidental thing astir the absorption of the impending terms volatility.

The metric is chiefly determined by the request for options, which are hedging tools. As such, a popular successful implied volatility is taken to correspond uncertainty and an inverted structure, successful which short-term implied volatility is greater than the longer-term gauges, signals panic.

Historically, the inverted operation has marked a terms bottom.

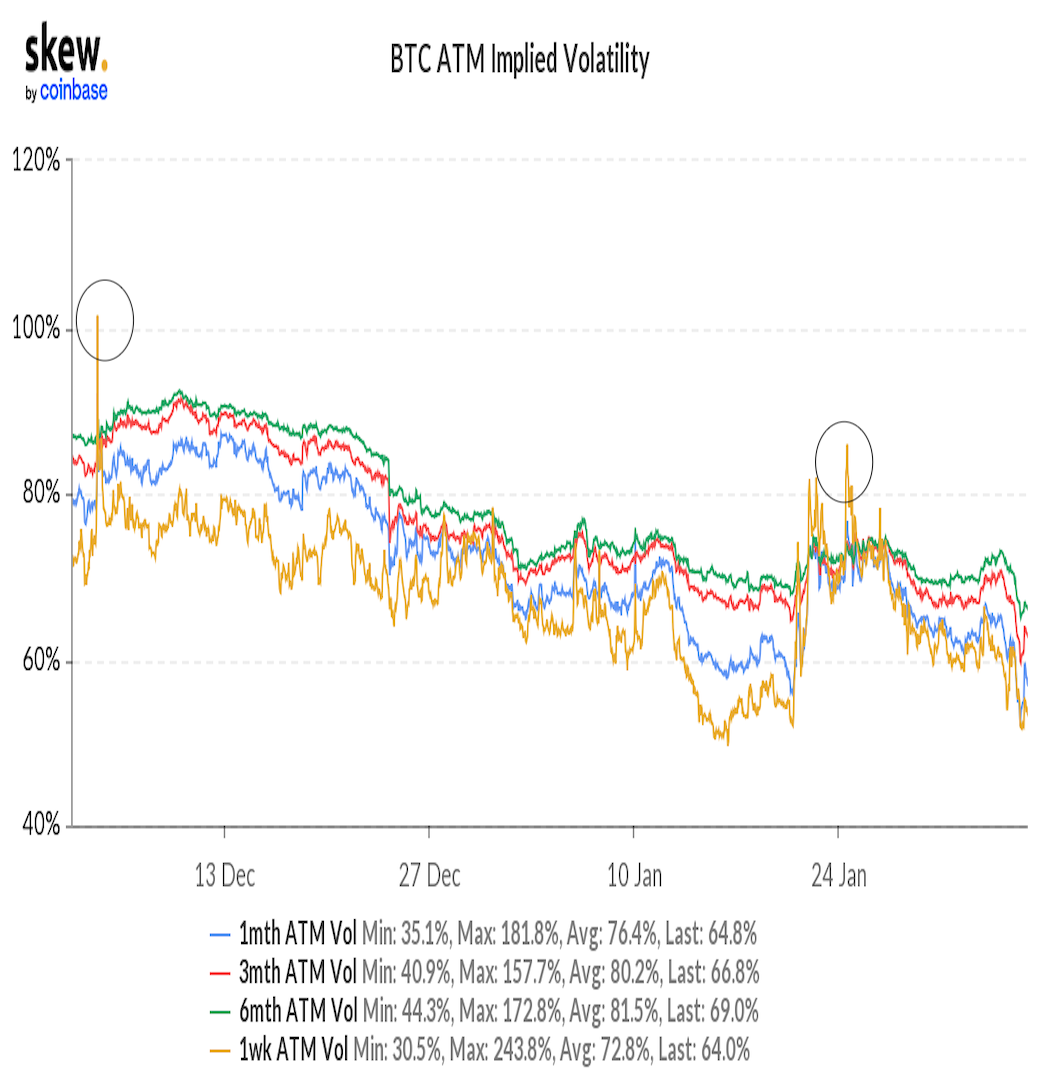

Bitcoin's one-week, one-, three-, and six-month implied volatility (December-January)

The one-week implied volatility past topped the longer-term gauges connected Jan. 24 erstwhile bitcoin fell to a six-month debased nether $33,000. The cryptocurrency picked up a bid connected the pursuing time and deed highs supra $45,000 aboriginal this month. Bitcoin's aboriginal December sell-off ran retired of steam with the one-week gauge rising good supra the six-month metric.

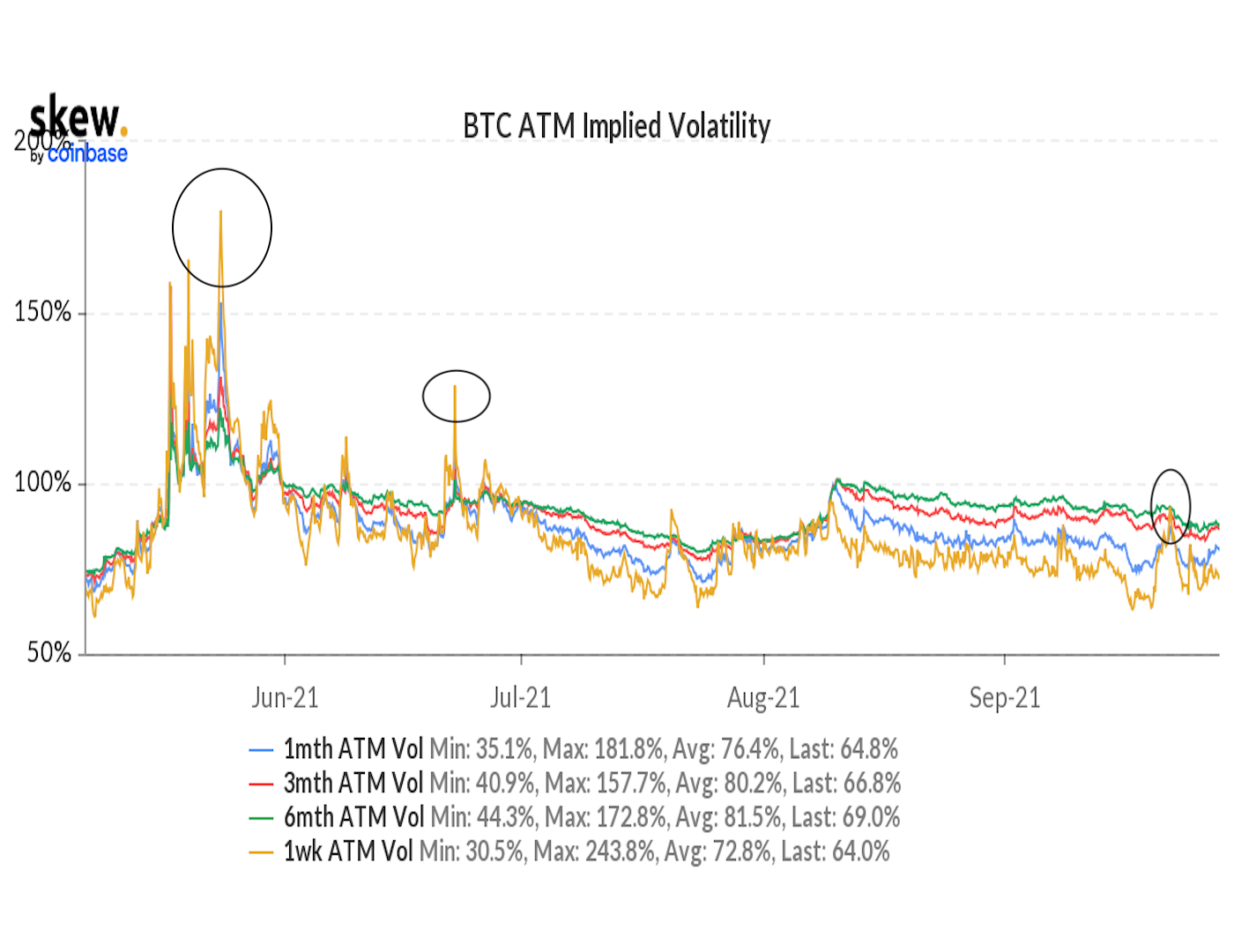

Bitcoin's one-week, one-, three-, and six-month implied volatility (May-September)

Bitcoin's precocious September 2021 bottommost and May-June 2021 bottommost coincided with short-term volatility expectations signaling panic.

If past is simply a guide, bitcoin whitethorn physique connected Thursday's rebound from lows nether $34,500. That said, the cryptocurrency remains susceptible to renewed hazard aversion successful stocks. "This is lone a short-term resurge and does not mean that BTC won't driblet beneath $34,000 successful the mid-term," Liu said.

At property time, bitcoin was trading adjacent $38,600, representing a 0.6% summation connected the day. Futures tied to the S&P 500 traded 0.5% lower, according to investing.com.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)