Premiums of an infamous bitcoin (BTC) trade popularized by Sam Bankman-Fried person popped backmost to important levels amid a marketplace bloodbath caused by rising U.S. tariffs, a marketplace motion that immoderate see bearish successful the abbreviated term.

The alleged Kimchi premium, oregon the quality successful bitcoin prices connected Korean exchanges compared to planetary bourses, roseate conscionable implicit 10% arsenic of Asian greeting hours Monday arsenic BTC dropped 6% successful the past 24 hours.

The arbitrage involves buying bitcoin connected a planetary speech and selling it connected a Korean speech for a riskless nett successful Korean won. Pocketing the existent gains is hard owed to South Korea's strict superior controls, but the premium is often utilized alongside different factors to gauge marketplace sentiment.

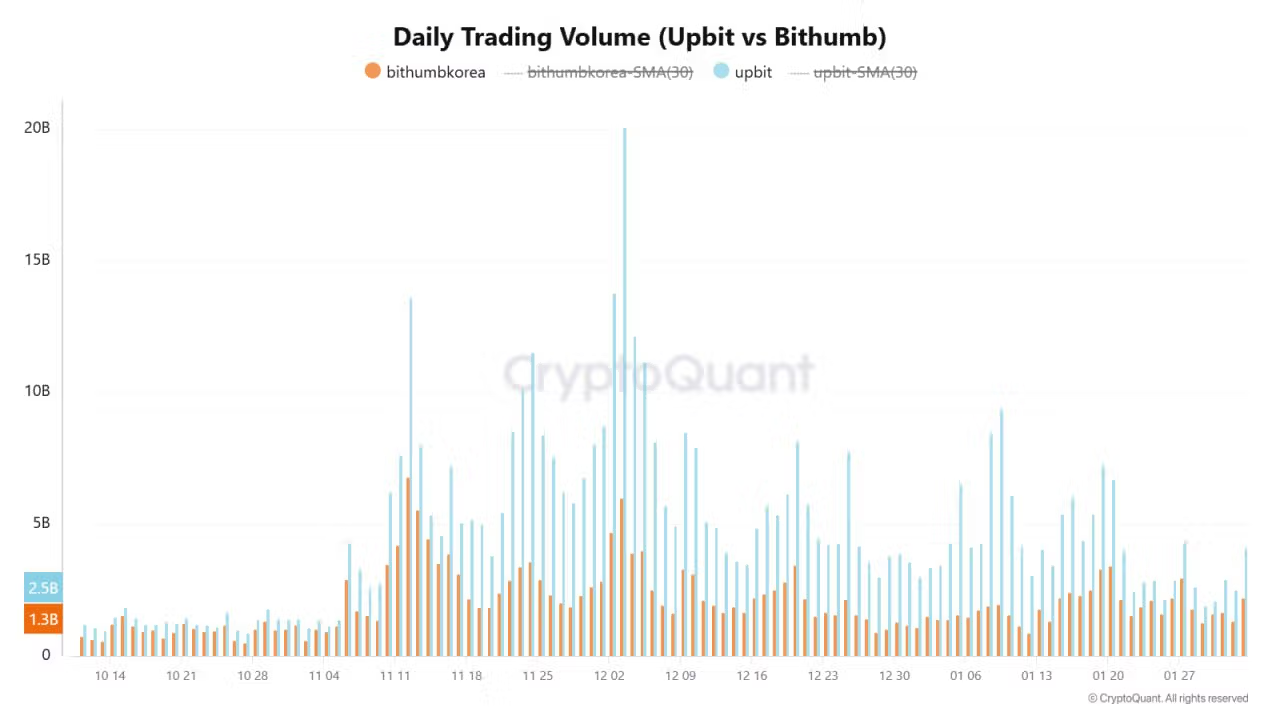

Trading volumes connected Korean exchanges Bithumb and Upbit person dropped importantly successful the past week, indicating a driblet successful retail trading activity. Meanwhile, balances of dollar-margined stablecoin tether person been connected the diminution connected some exchanges with instances of withdrawal delays.

“It seems that astir retail investors are either already afloat invested successful spot oregon person withdrawn their funds to prosecute successful DEX activities,” Seoul-based DNTV Research expert Bradley Park told CoinDesk successful a Telegram message.

“In this situation, the kimchi premium doesn’t correspond retail investors’ overbuying; rather, it appears to person risen arsenic a passive effect to the uncertainty of a beardown dollar environment,” Park added.

“The kimchi premium tin surge excessively erstwhile trading measurement increases, but it tin besides assistance support prices erstwhile the plus prices connected overseas exchanges driblet significantly," Park said, adding that was apt “not a affirmative sign” successful the short-term for bitcoin.

8 months ago

8 months ago

English (US)

English (US)