The bitcoin (BTC) bull, erstwhile confidently gazing into the future, is reconsidering its semipermanent bullish conviction.

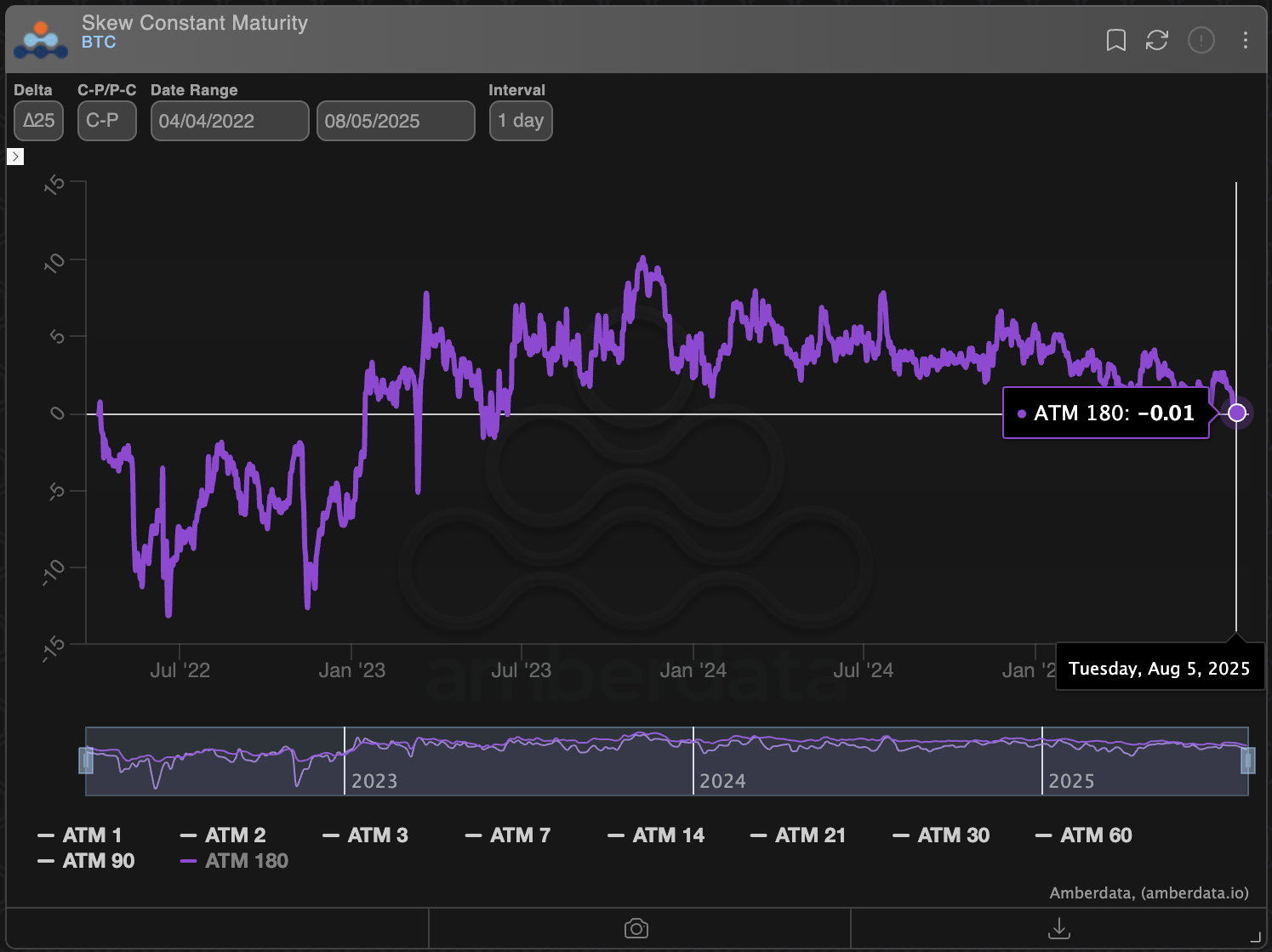

That's evident from the 180-day skew, measuring the quality successful implied volatility (pricing) betwixt Deribit-listed out-of-the-money telephone and enactment options. The metric has precocious retreated to zero, according to information root Amberdata, indicating that semipermanent marketplace sentiment has shifted from bullish to neutral. The displacement comes arsenic immoderate analysts pass of a carnivore marketplace successful 2026.

A akin reset occurred astatine the onset of the erstwhile bitcoin carnivore market, according to Griffin Ardern, caput of options trading and probe astatine crypto fiscal level BloFin.

"I've noticed a alternatively worrying motion with the caller marketplace pullback. Bitcoin's bullish sentiment for the far-month options has vanished, and it is present firmly neutral," Ardern told CoinDesk. "This means the options marketplace believes it's hard for BTC to found a semipermanent uptrend, and the likelihood of caller highs successful the coming months is decreasing."

"A akin concern past occurred successful Jan and Feb 2022," helium added.

A enactment enactment offers security against terms drops successful the underlying asset, portion a telephone provides an asymmetric bullish exposure. A affirmative skew implies a bias towards calls, indicating bullishness successful the market, whereas a antagonistic skew suggests the opposite.

The neutral displacement successful the 180-day skew could beryllium partially driven by structured products selling higher onslaught telephone options to make further output connected apical of the spot marketplace holdings.

The popularity of the alleged covered telephone strategy could beryllium driving the telephone implied volatility little comparative to puts.

Macro jitters

BTC fell implicit 4% past week, astir investigating its erstwhile grounds precocious of $11,965, arsenic the halfway PCE, the Fed's preferred ostentation measure, roseate successful June, portion nonfarm payrolls disappointed, stoking concerns astir the economy.

The terms driblet has pushed short-term skews beneath zero, a motion of traders seeking downside extortion done puts.

According to Ardern, the inflationary effects of "supply concatenation impulses" are already showing up successful economical data.

"Although falling car prices successful the past CPI study offset rising prices for different goods, 1 happening is undeniable: the impulse from the West Coast of the Pacific has reached the East Coast, and retailers are already trying to walk connected tariffs and a big of associated costs to consumers. While wholesalers and commodity trading firms are moving to creaseless proviso chains, terms increases volition inactive occur, albeit much moderately oregon "delayed by respective months," Ardern noted, explaining the renewed neutrality of the semipermanent BTC options.

According to JPMorgan, President Donald Trump's tariffs are apt to elevate ostentation successful the 2nd fractional of the year.

"Global halfway ostentation is projected to summation to 3.4% (annualized rate) successful the 2nd fractional of 2025, mostly owed to a tariff-related U.S. spike," analysts astatine the concern slope noted, adding that outgo pressures volition apt beryllium concentrated successful the U.S.

An uptick successful ostentation could marque it harder for the Fed to chopped rates. Trump has repeatedly criticized the cardinal slope for keeping rates elevated astatine 4.25%.

Traders volition person the ISM non-manufacturing PMI aboriginal Tuesday, providing insights into ostentation successful the work sector, which accounts for a important information of the U.S. economy. It volition beryllium followed by July CPI and PPI releases aboriginal this week.

Read more: Bitcoin Still connected Track for $140K This Year, But 2026 Will Be Painful: Elliott Wave Expert

2 months ago

2 months ago

English (US)

English (US)