Bitcoin (BTC) appears to beryllium successful the last signifier of a carnivore marketplace characterized by undervaluation and submission, a fashionable method investigation indicator suggests. The denotation comes arsenic the marketplace braces for accelerated liquidity tightening by the U.S. Federal Reserve (Fed).

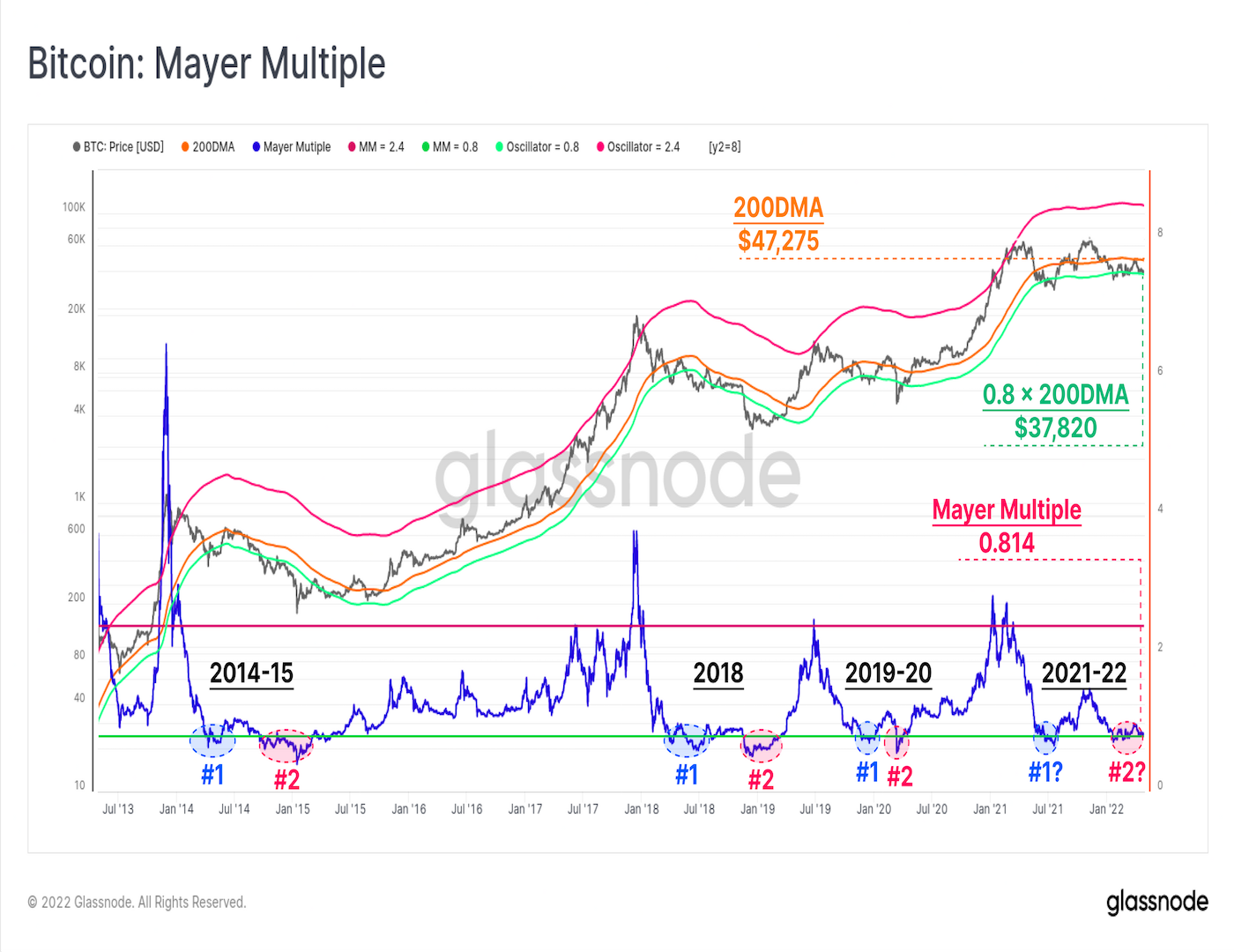

Bitcoin's Mayer Multiple, the ratio of cryptocurrency's terms to the 200-day elemental moving mean (SMA), is conscionable shy of 0.80. In different words, the cryptocurrency is trading astir astatine a 20% discount to its 200-day SMA. Such a terms operation has been comparatively uncommon successful bitcoin's 11- twelvemonth history, making the 0.80 speechmaking connected the Mayer Multiple a constituent of undervaluation.

"We person mapped retired a Mayer Multiple of 0.8 (green trace) arsenic a humanities 'undervaluation' level. The ground for this is that little than ~15% of bitcoins trading beingness has been at, oregon beneath this level, providing a much probabilistic view," Glassnode's expert James Check wrote successful a play analytics newsletter published connected Monday.

In the past, the indicator has printed treble bottommost nether 0.80 during carnivore cycles, with the 2nd dip nether the captious level marking capitulation of longs and eventual terms bottom.

The indicator's impending dip nether 0.80 could beryllium the 2nd of the 2021-22 cycle. Capitulation refers to the constituent successful a marketplace downturn erstwhile investors springiness up connected recapturing mislaid gains and merchantability alternatively than clasp a fixed asset.

"Bear marketplace floors of past cycles are typically hammered retired successful 2 phases comparative to the 0.8xMM level, archetypal successful the aboriginal signifier of the carnivore (#1), and past again pursuing a large capitulation lawsuit (#2). The marketplace is presently hovering conscionable supra this cardinal level successful what could beryllium argued to beryllium a portion of the 2021-22 rhythm Phase #2," Check noted.

While the Mayer Multiple is approaching the constituent of undervaluation, it does not needfully connote a speedy bullish displacement successful the momentum, acknowledgment to hawkish Fed expectations.

The Fed is expected to hike the benchmark involvement complaint by 75 ground points (bp) aboriginal connected Wednesday, having kicked disconnected the tightening rhythm with a 25 ground constituent hike past month. The cardinal slope is besides apt to denote quantitive tightening (QT), shrugging disconnected the antagonistic archetypal 4th gross home merchandise print. Quantitive tightening refers to process of reducing the equilibrium expanse size that has much than doubled to astir $9 trillion successful 2 years.

"It would beryllium an unthinkable astonishment if the Fed didn't assistance rates by 50bp astatine this gathering – this is good priced, with the swaps marketplace pricing 51bp of hikes – wherever we bash spot an contented is pricing astir the June FOMC meeting, with a 25% accidental of 75bp hike – this seems a tad lofty, but it has travel down from 50% past week," Chris Weston, caput of probe astatine Pepperstone, wrote successful the Daily Fix newsletter.

Weston added that nether the existent pricing, the marketplace expects the Fed to instrumentality the fed funds complaint supra the neutral complaint of 2.4% and into the restrictive territory by September. That would necessitate a 50 ground constituent hike aboriginal contiguous and akin moves successful June, July and September.

"Within a backdrop of deteriorating economical conditions, a hawkish Fed poses a important menace to crypto markets successful the short-term. And until markets person clarity connected the macro backdrop, superior allocations towards hazard assets volition beryllium limited," CoinDesk's sister interest Genesis Global's newsletter dated May 3 said.

That said, the cryptocurrency could spot a insignificant alleviation rally if the Fed matches the widely-expected, and priced in, 50 ground constituent hike.

"We deliberation that the marketplace is afloat expecting a 50-bp complaint hike and announcement of QT astatine $95b per month. If the FOMC determination is successful enactment with expectations, we whitethorn spot a alleviation rally," Dick Lo, laminitis and CEO of TDX Strategies, said successful a Telegram chat.

"We've seen lawsuit involvement successful buying short-dated upside calls and telephone spreads arsenic a inexpensive mode to nett from a imaginable alleviation rally," Lo added.

Bitcoin was past seen trading adjacent $38,900, representing a 3% summation connected the day, according to CoinDesk data.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)