Bitcoin velocity RSI produced a uncommon carnivore marketplace bottommost awesome arsenic BTC terms losses sparked a instrumentality to utmost "oversold" conditions.

Bitcoin (BTC) is printing a cardinal carnivore marketplace bottommost awesome astatine $87,000 arsenic investigation hopes that BTC terms past repeats.

Key points:

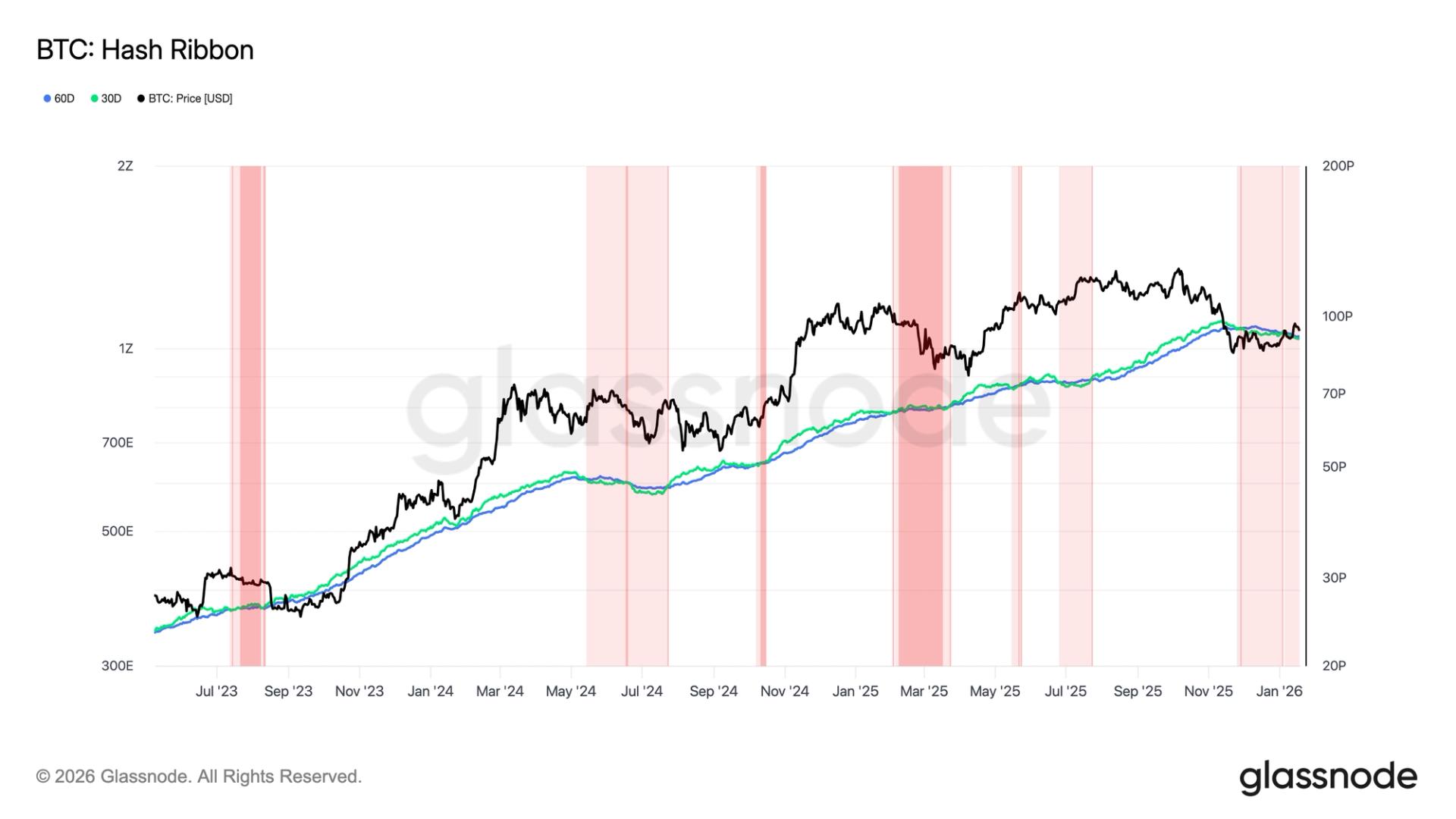

Bitcoin’s velocity RSI metric returns to levels seen lone astir carnivore marketplace bottoms.

BTC terms enactment could frankincense beryllium performing a “major cyclical reset,” says analysis.

The crypto long/short ratio breaks a beingness wont arsenic Bitcoin tumbles.

Velocity RSI sees BTC terms bottommost successful progress

In an X post connected Tuesday, expert On-Chain Mind flagged uncommon single-digit readings connected Bitcoin’s velocity comparative spot scale (RSI) indicator.

Bitcoin carnivore marketplace comparisons person come heavy and fast successful caller weeks, but now, a starring BTC terms indicator demands a marketplace bottom.

Velocity RSI, which takes into relationship caller terms momentum changes, has present dived beneath 10/100 to deed immoderate of its astir “oversold” levels ever.

“The Velocity RSI connected the 3-day illustration has conscionable deed its lowest speechmaking since the bottoms of the past 3 carnivore markets,” On-Chain Mind commented.

An accompanying illustration showed akin illustration setups astatine the extremity of Bitcoin’s 2018 carnivore market, arsenic good arsenic midway done 2022, astir six months earlier the astir caller existent carnivore marketplace recovered its semipermanent floor.

“It’s 1 of the much reliable, widely-tracked momentum exhaustion indicators, and it’s present flashing a level we lone spot astatine large cyclical resets,” On-Chain Mind added.

“An absorbing method awesome worthy paying attraction to.”Bitcoin long/short ratio enters chartless territory

Depending connected the perspective, existent BTC terms behaviour stands retired from past bearish phases.

Related: Bitcoin battles $50K terms people arsenic Fed adds $13.5B overnight liquidity

Not each classical terms metrics person reacted the aforesaid to the latest events, and these present see Bitcoin’s long/short ratio.

Joao Wedson, laminitis and CEO of crypto analytics level Alphractal, noticed an antithetic improvement playing retired this week.

“Over the years, we’ve identified respective beardown Alpha signals successful the crypto market. One of the astir reliable has ever been this: erstwhile Bitcoin’s Long/Short Ratio rises supra the mean of large altcoins, it historically points to a terms bottommost forming. But this clip thing antithetic happened,” helium told X followers.

“For the archetypal clip ever, BTC kept this ratio astatine highly elevated levels for an unusually agelong play — and yet we saw mendacious bottommost signals passim November, portion the terms continued to drop.”

Wedson explained that the implications of this could wounded bulls. Traders being overly anxious to agelong BTC portion attempting to drawback a falling weapon whitethorn incentivize large-volume players to liquidate them by driving the terms down further.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

1 month ago

1 month ago

English (US)

English (US)