Key takeaways:

Bitcoin's MVRV ratio dropping beneath its 365-day average signals a section bottom, historically preceding large terms rallies.

Capital rotation from golden could substance the Bitcoin rebound, according to analysts.

Bitcoin (BTC) could beryllium poised for a sustained betterment successful the coming weeks, arsenic a cardinal valuation metric sends a bullish signal. The BTC marketplace mightiness beryllium forming a “cyclical bottom,” according to crypto analysts.

Bitcoin’s MVRV metric signals a “local bottom”

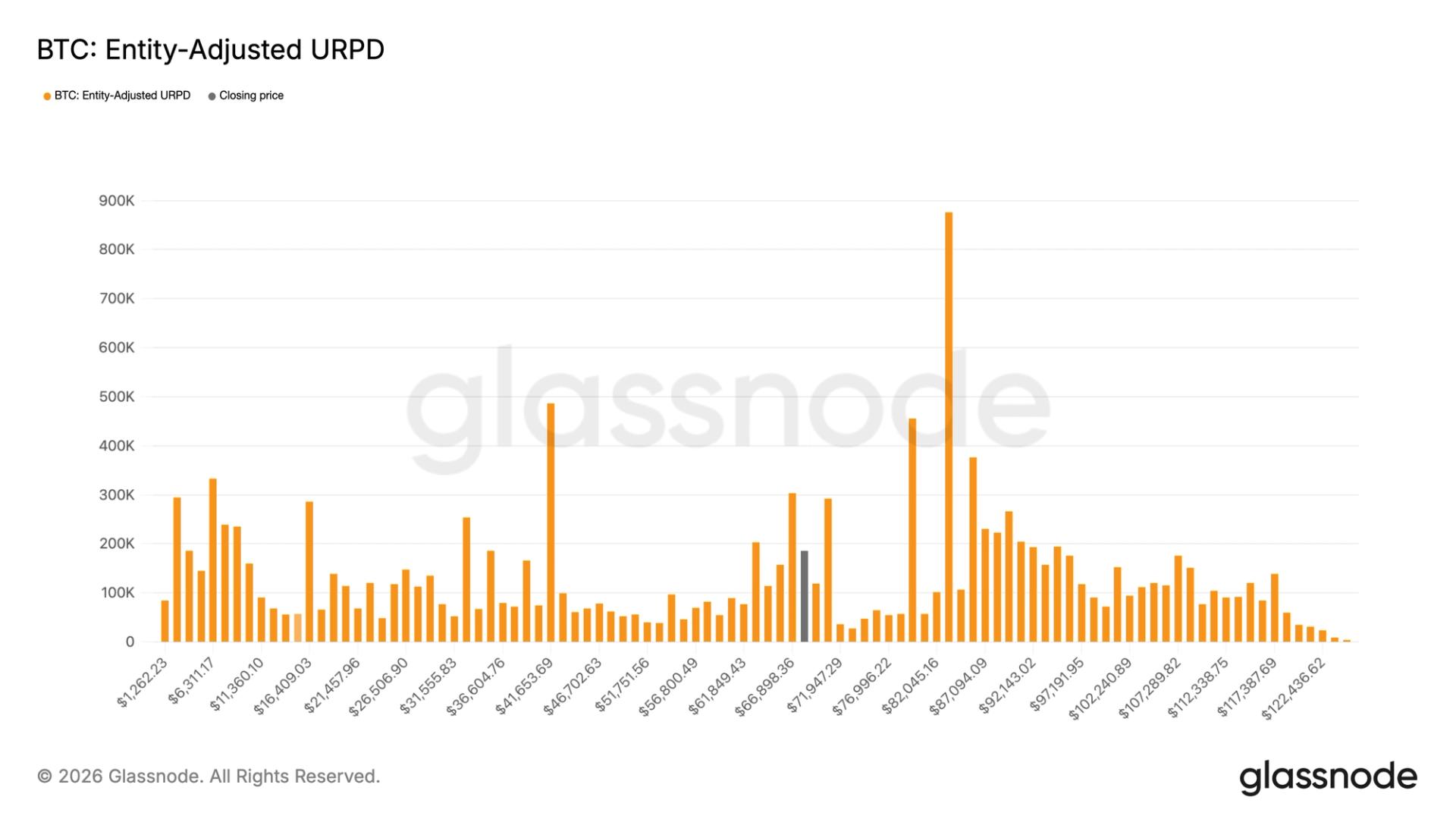

Bitcoin’s Market Value to Realized Value (MVRV) ratio, an indicator that measures whether the plus is overvalued, precocious slipped beneath its 365-day moving average, indicating that BTC could beryllium astatine a section bottom, according to CryptoQuant expert ShayanMarkets.

Related: Bitcoin illustration is echoing the 1970s soybean bubble: Peter Brandt

The “MVRV ratio presently stands adjacent 1.9, somewhat beneath its 365-day moving average,” the expert said successful a QuickTake investigation connected Monday, adding:

“Historically, each clip the ratio dropped beneath the 365 SMA, it has marked a buying accidental and a section bottommost signal.”The past clip this happened was successful mid-2021, June 2022, and aboriginal 2024, preceding 135%, 100% and 196% rallies successful BTC price, respectively.

This accordant signifier suggests that Bitcoin is erstwhile again “entering an undervalued phase, wherever semipermanent holders typically statesman accumulating,” the expert wrote.

With an 18% BTC terms driblet to $103,530 connected Friday from $126,000 all-time high, the MVRV declined, “reflecting reduced speculative excess and increasing semipermanent confidence,” the expert said, adding:

“If this metric begins to crook upward from existent levels, it could corroborate that the caller sell-off was a cyclical bottommost formation, supporting a renewed bullish signifier into Q4.If past repeats itself, Bitcoin terms could embark connected a prolonged recovery, with analysts projecting short-term targets astir $115,000 and adjacent arsenic precocious arsenic $190,000 if the past limb of the bull tally unfolds.

Capital rotation from golden to boost BTC price

Data from Cointelegraph Markets Pro and TradingView revealed that golden is down 8.5% from its all-time precocious of $4,380 reached connected Monday.

That’s a “pretty harsh determination connected gold,” MN Trading Capital laminitis Michaël van de Poppe said successful a Tuesday X post.

If this continues, it would mean golden has “peaked for the moment,” a motion that “the rotation” into Bitcoin and altcoins whitethorn beryllium starting, van de Poppe wrote.

The US Consumer Price Index (CPI) study for September is expected to beryllium released connected Friday, according to the Bureau of Labor Statistics.

“A brushed CPI people should trigger the substance for imaginable complaint cuts and the extremity of the authorities shutdown,” the expert said, adding:

“Bitcoin to commencement moving arsenic risk-on appetite comes backmost into play.”Meanwhile, Bitwise analysts suggest that a 5% displacement from golden to Bitcoin could thrust the terms of Bitcoin to $240,000.

Bitwise says a 5% superior rotation from golden to Bitcoin could nonstop BTC to $242,391 👀 pic.twitter.com/FwvjneWhdX

— Bitcoin Archive (@BTC_Archive) October 21, 2025As Cointelegraph reported, gold’s ongoing pullback could trigger Bitcoin’s rebound, with method investigation projecting a BTC terms rally to $150,000–$165,000 by year’s end.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

4 months ago

4 months ago

English (US)

English (US)