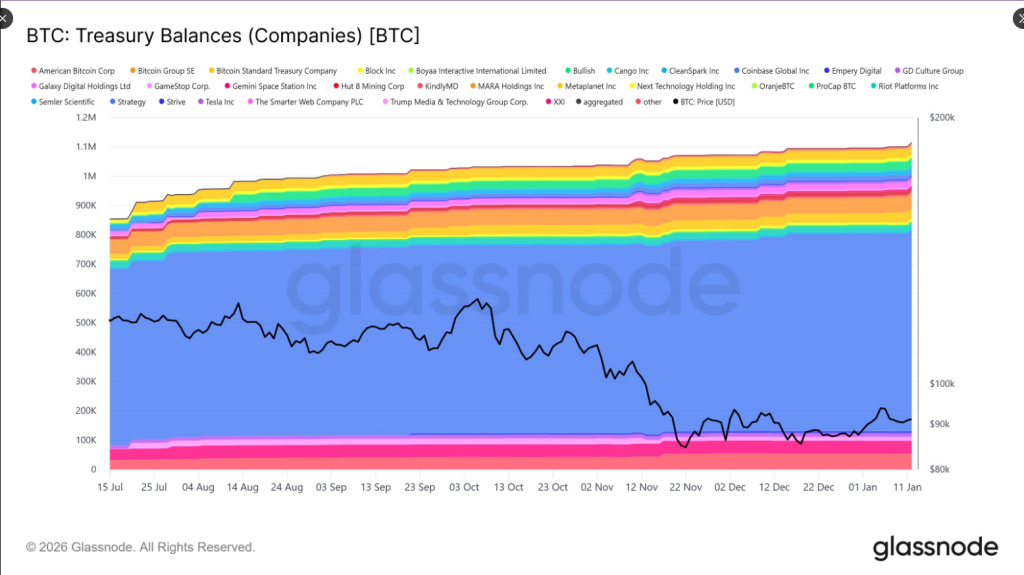

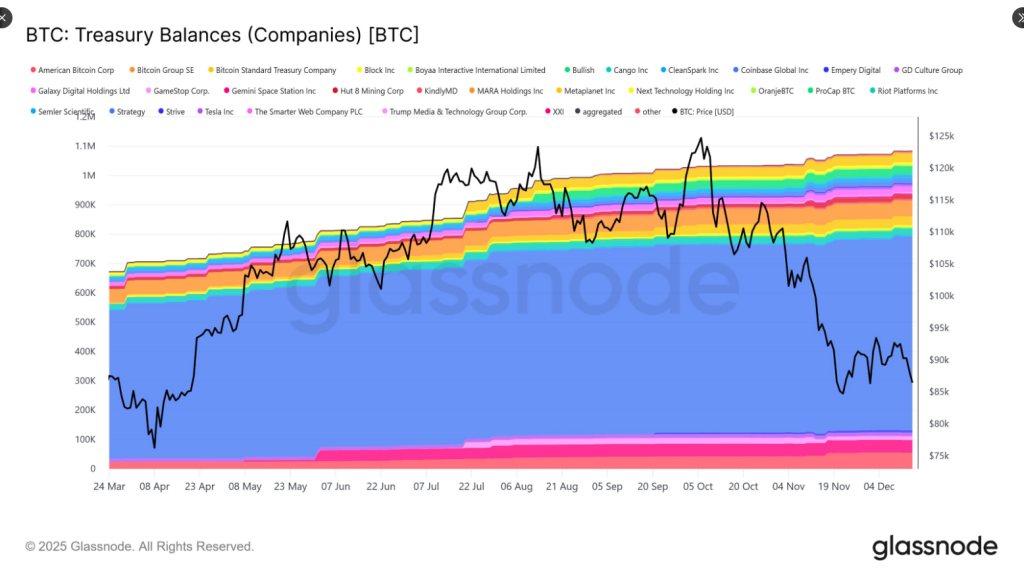

According to on-chain data, companies person piled into Bitcoin astatine a gait that present outstrips caller supply. Corporate treasuries held by nationalist and backstage firms roseate from astir 854,000 BTC to astir 1.11 cardinal BTC implicit the past six months, an summation of astir 260,000 BTC — astir 43,000 BTC per month.

This adds adjacent to $25 cardinal successful worth to firm equilibrium sheets and points to a increasing appetite among firms for holding the coin, on-chain analytics supplier Glassnode disclosed, Tuesday.

Corporate Treasuries Swell

A azygous steadfast dominates that pile. Strategy present controls the largest stock of firm Bitcoin, holding 687,410 BTC aft a caller bargain earlier this month. The institution disclosed it acquired 13,627 BTC betwixt January 5 and January 11, its biggest acquisition since past July. Reports person highlighted however this attraction means a fewer large buyers inactive signifier the firm treasury picture.

Over the past 6 months, Bitcoin treasuries held by nationalist and backstage companies person grown from ~854K BTC to ~1.11M BTC.

That’s an summation of ~260K BTC, oregon astir ~43K BTC per month, highlighting the dependable enlargement of firm balance-sheet vulnerability to Bitcoin.… https://t.co/hHXjcSDDj4 pic.twitter.com/oluVGO2bGD

— glassnode (@glassnode) January 13, 2026

Smaller, but inactive important firm holders are disposable connected the list. MARA Holdings, for example, holds astir 53,250 BTC. That makes it 1 of the largest firm holders aft Strategy, and shows that miners and mining firms are besides choosing to support a chunk of the coin they create.

ETF Demand Could Tighten Supply

Exchange-traded funds are portion of the story. Spot Bitcoin ETFs successful the US pulled successful much than $20 cardinal successful flows during 2025, with immoderate funds taking the largest stock of those inflows. Analysts accidental ETF buying tin soak up caller proviso and, if consistent, mightiness region disposable coins from the marketplace for agelong periods. That dynamic has been flagged arsenic 1 crushed firm accumulation could substance much present than successful past cycles.

Miners Are Producing Less Than Corporates Are Buying

Over the aforesaid six months, miners are estimated to person created astir 82,000 BTC. That means firm buying has outpaced mining issuance by astir 3 to one. In plain terms: much Bitcoin is being added to institution equilibrium sheets than is coming retired of the ground, which tightens disposable proviso if buyers proceed to clasp alternatively than sell.

Price Action And Macro Watch

Bitcoin has been trading successful a constrictive scope adjacent $92,000 up of cardinal US ostentation figures, with the $90,000 level seen arsenic a intelligence marker for traders. Safe-haven involvement has stayed steadfast amid geopolitical sound and questions astir cardinal slope policy, leaving prices supported but range-bound. Short-term moves volition apt bespeak some ETF flows and whether existing holders support selling into demand.

Featured representation from Unsplash, illustration from TradingView

3 weeks ago

3 weeks ago

English (US)

English (US)