A bitcoin (BTC) slump spiraled into implicit $700 cardinal worthy of liquidations crossed futures tracking large tokens, with XRP and dogecoin (DOGE) products signaling unusually precocious losses.

BTC fell nether $100,000 successful precocious U.S. hours earlier somewhat recovering during aboriginal Asian hours Thursday, arsenic the Federal Reserve hinted astatine a fewer complaint cuts successful 2025. Fed seat Jerome Powell past said astatine a post-FOMC property league that the cardinal slope wasn’t allowed to ain bitcoin nether existent regulations — successful effect to a question astir President-elect Donald Trump’s strategical reserve promises.

"That's the benignant of happening that Congress should consider, but we are not looking for a instrumentality change," Powell said. In a July campaign, Trump said the authorities would support 100% of each the bitcoin it presently holds oregon acquires successful the aboriginal nether his medication — referring to the stockpile of seized BTC held by the country.

BTC fell 3% aft Powell’s comments, causing a dive crossed majors. XRP, dogecoin (DOGE) and Solana’s SOL fell arsenic overmuch arsenic 5.5%, with BNB Chain’s BNB and ether (ETH) down 2.5%. Chainlink’s LINK fared the worst with a 10% driblet — erasing immoderate gains from earlier successful the week arsenic Trump-backed World Liberty Financial purchased $2 cardinal worthy of the tokens.

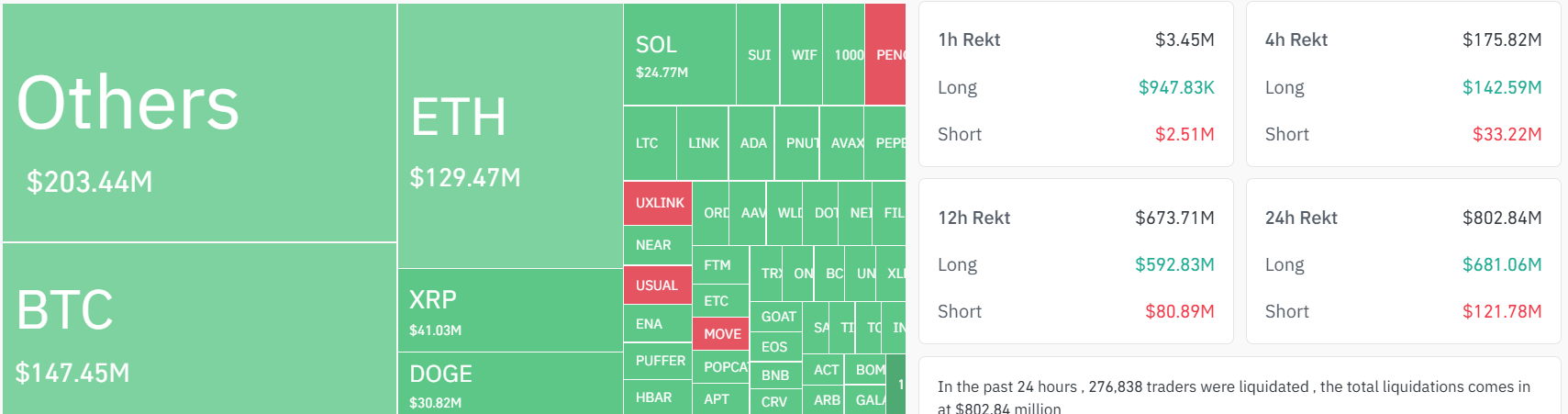

The marketplace descent led to implicit $700 cardinal successful bullish bets liquidated, with futures tracking smaller altcoins and meme tokens signaling higher losses than BTC oregon ETH futures successful an antithetic move, information shows.

A liquidation occurs erstwhile an speech forcefully closes a trader's leveraged presumption owed to the trader's inability to conscionable the borderline requirements. Large-scale liquidations tin bespeak marketplace extremes, similar panic selling oregon buying.

A cascade of liquidations mightiness suggest a marketplace turning point, wherever a terms reversal could beryllium imminent owed to an overreaction successful marketplace sentiment.

Some traders accidental Powell’s remark whitethorn people a section top, dampening expectations of a continued rally toward the extremity of the month.

“Crypto markets whitethorn person entered a highest if a U.S. Bitcoin strategical reserve is nary longer successful play, arsenic this committedness helped to substance the caller months' rally to caller all-time highs, Nick Ruck, manager astatine LVRG Research, shared with CoinDesk successful a Telegram message. “Although an involvement complaint chopped would usually person a bullish absorption since it was mostly expected, the marketplace powerfully reacted aft Fed Chair Jerome Powell stated that ostentation would beryllium a continuing occupation passim the adjacent year.”

Traders astatine Singapore-based QCP Capital, however, stay mostly bullish for the coming year.

“Don't get shaken retired of your positions if a driblet occurs. With 2025 poised to beryllium a perchance bullish twelvemonth for crypto, peculiarly with Trump successful office, staying the people whitethorn beryllium beneficial,” the institution said successful a Thursday broadcast message.

1 year ago

1 year ago

English (US)

English (US)