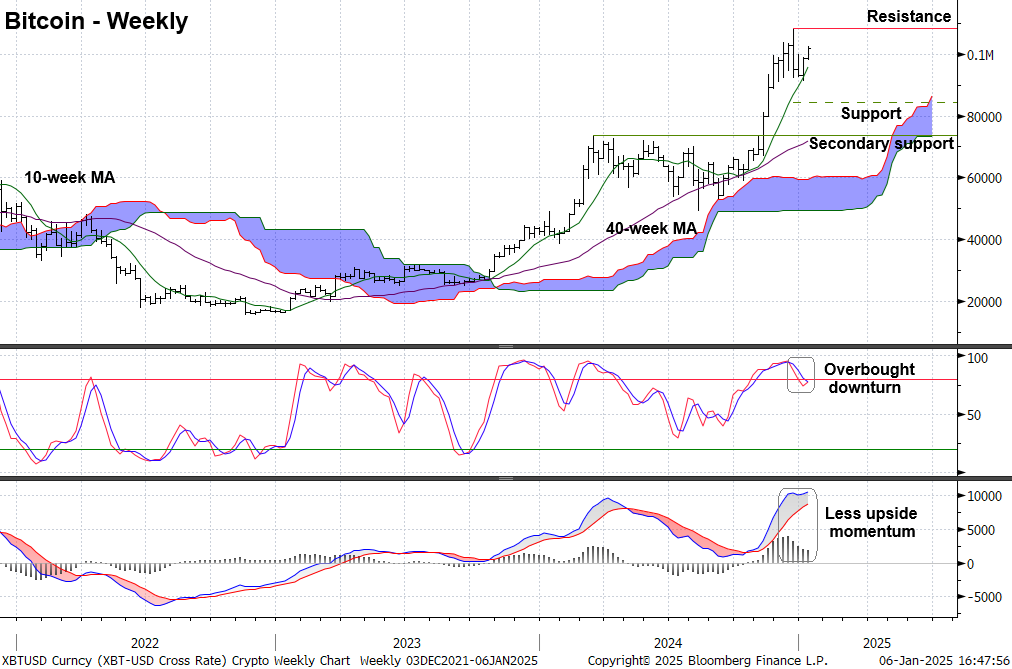

Bitcoin rounded retired an exceptionally beardown 2024 (up 120% yoy) with a whimper, logging the archetypal overbought “sell” awesome connected its play barroom illustration since mid-April according to the stochastic oscillator, which is an indicator of inclination exhaustion. The awesome suggests bitcoin volition stay range-bound, astatine slightest successful the abbreviated word (roughly 2-6 weeks), arsenic different hazard assets (e.g., equities) proceed to propulsion back.

Key method levels to ticker for bitcoin:

Minor absorption is astatine the astir caller high, adjacent $108K, supra which is “uncharted” territory. A breakout would beryllium a bullish development, but the momentum does not look beardown capable to make a breakout astatine this time.

Initial enactment is adjacent $84.5K, defined by the Ichimoku unreality model, which is simply a trend-following exemplary based connected humanities prices. Recent deterioration successful our intermediate-term indicators increases the chances that a pullback volition deepen further, with secondary enactment adjacent $73.8K, reinforced by the rising 200-day (~40-week) moving average.

You're speechmaking Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor. Sign up here to get it successful your inbox each Wednesday.

Despite short- and intermediate-term bearish signals, the semipermanent outlook for bitcoin remains bullish from a method position pursuing the post-election breakout successful November. The breakout to caller highs marked emergence from a several-month downtrend channel, and it helped semipermanent momentum indicators similar the monthly moving mean convergence/divergence (MACD) reaccelerate. Thus, a correction for bitcoin successful Q1 should contiguous an accidental to adhd vulnerability up of different upleg successful bitcoin aboriginal successful 2025.

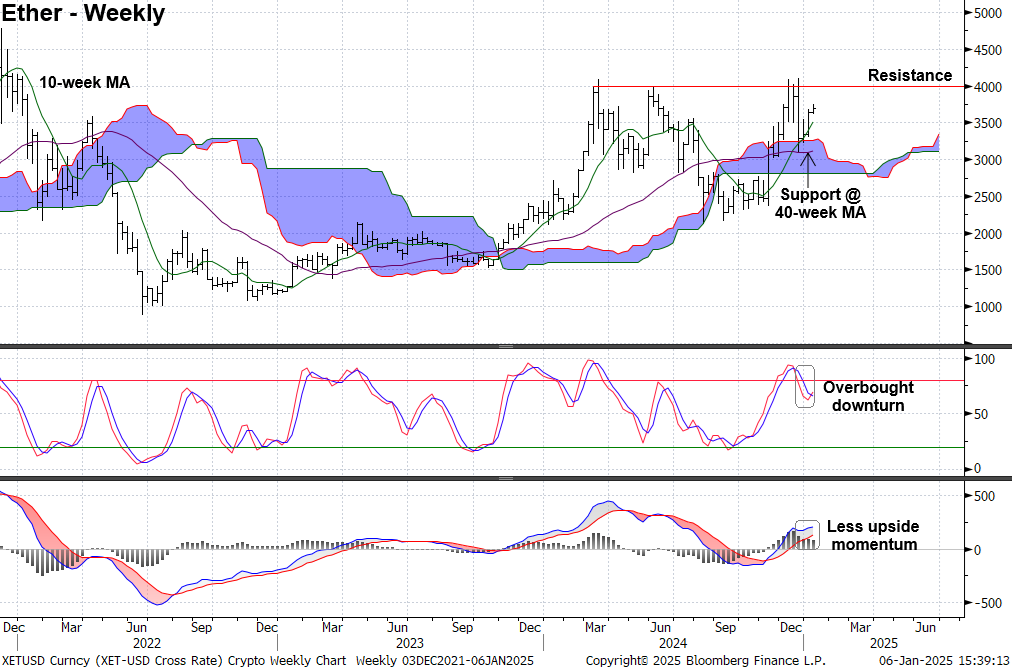

Ethereum: absorption adjacent $4000 is simply a hurdle for aboriginal 2025

Like bitcoin, ether has flashed an overbought “sell” signal, which comes aft a rejection astatine important absorption adjacent $4000. The “sell” awesome has intermediate-term implications, supporting a corrective signifier implicit the adjacent mates of months. Ether besides has archetypal enactment astatine the regular Ichimoku unreality model, adjacent $3226, supra which it has stabilized. We expect a correction successful Q1 to pb to a breakdown and trial of the 200-day (40-week) moving average. However, our semipermanent indicators inactive constituent higher, albeit little convincingly, compared to bitcoin. A breakout supra the $4000 level would apt effect successful improved semipermanent metrics similar the monthly MACD.

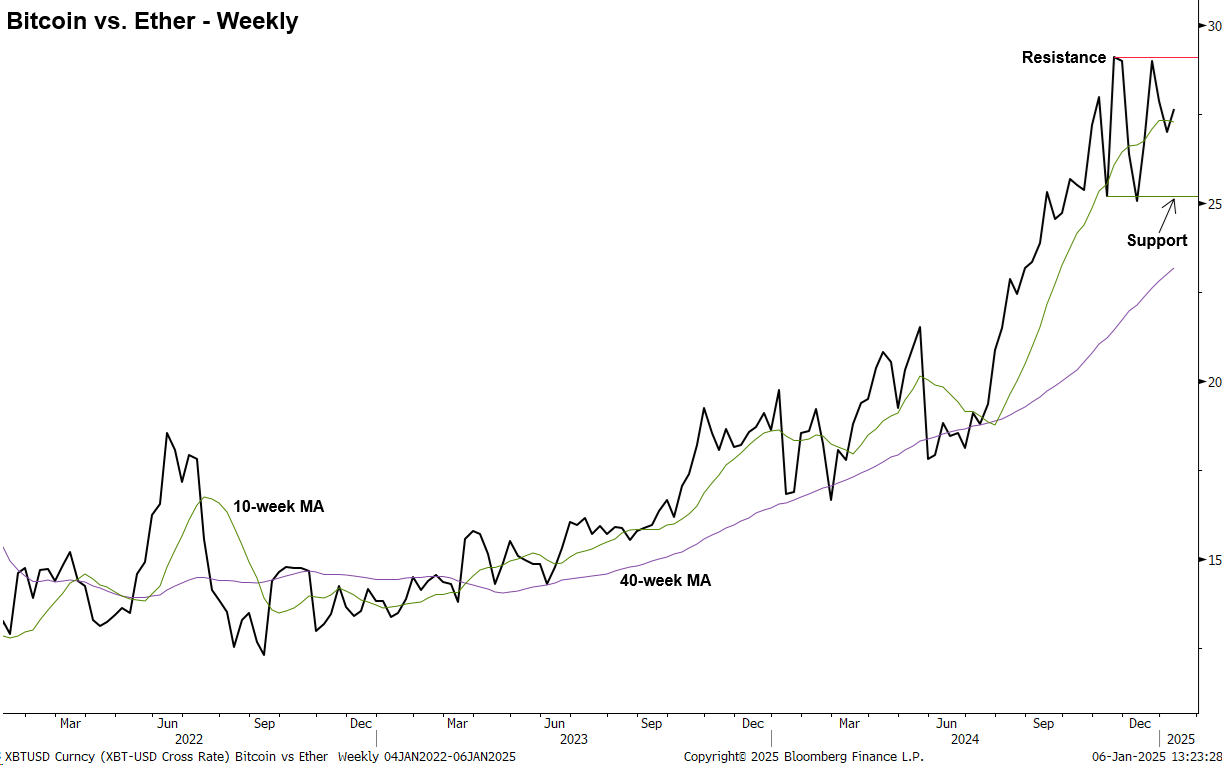

Bitcoin vs. ether: 2024 outperformance by bitcoin gives mode to volatility

In 2024, bitcoin outperformed ether by 74%, a inclination that tin beryllium intelligibly seen successful the bitcoin/ether ratio. Since aboriginal November, comparative show has go much fickle betwixt the 2 largest cryptocurrencies, evidenced by the wide trading scope that has taken clasp of the ratio.

During a crypto marketplace correction, bitcoin usually outperforms ether since it is usually deemed arsenic “safer.” However, each cryptocurrencies are apt to commercialized little successful implicit presumption erstwhile hazard assets are undergoing a correction, noting that correlations thin to spell up erstwhile markets spell down. Nevertheless, a bullish semipermanent outlook suggests that Q1 volatility whitethorn contiguous an accidental to adhd vulnerability with a much favorable risk/reward profile, ideally waiting for the intermediate-term indicators to crook up again.

11 months ago

11 months ago

English (US)

English (US)