Bitcoin's (BTC) terms has surged to grounds highs, sparking optimism among investors. However, expected hedging activities of marketplace makers/dealers, often an invisible force, astatine definite terms levels, whitethorn dilatory the ascent.

The starring cryptocurrency topped the $111,000 people during the Asian hours, with analysts anticipating stronger demand.

"The OTC proviso whitethorn beryllium drying up, driving up prices. This would not beryllium reflected successful speech trading volumes oregon the derivatives market. If this is the case, get acceptable for a chaotic ride, arsenic much request is coming connected committee with a competitory bitcoin firm treasury situation and, perhaps, a little elastic OTC spot market," Alexander S. Blume is the founder and CEO of Two Prime, an SEC-Registered Investment Advisor, said successful a Telegram chat.

Blume explained that firm treasuries coming connected committee person been buying over-the-counter "en masse," and rumors are that sovereign request for the cryptocurrency has picked up.

Ryan Lee, main expert astatine Bitget, said BTC could rally to $180,000 by the extremity of the year, led by spot ETF inflows, slower post-halving proviso maturation and increasing organization adoption.

"Moody’s caller downgrade of the U.S. sovereign recognition standing to Aa1 is different cardinal macro catalyst, sparking renewed involvement successful BTC and ETH arsenic hedges against fiat risk. BTC’s quality to clasp supra $103,000 amid volatility highlights the market’s displacement toward crypto arsenic a strategical reserve asset," Lee said.

Focus connected $115K

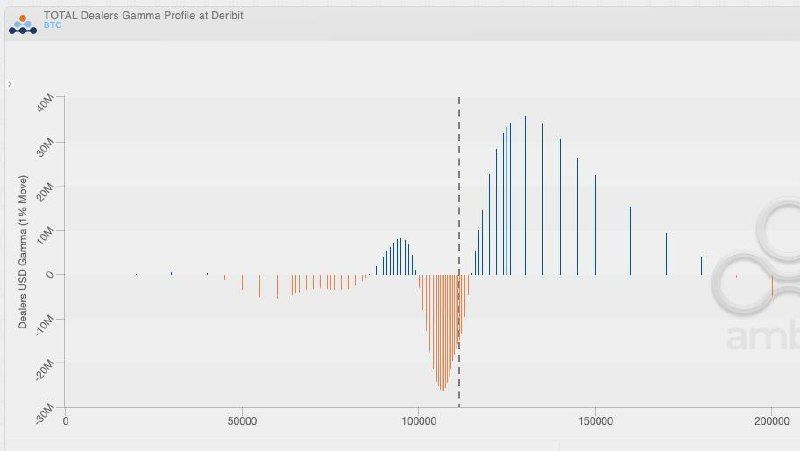

While the way of slightest absorption is connected the higher side, the gait of the bullish determination whitethorn beryllium challenged by imaginable hedging activities of options marketplace makers/dealers astatine astir $115K and higher terms levels, according to Jeff Anderson, caput of Asia astatine STS Digital.

Dealers are entities tasked with creating liquidity successful an exchange's bid book. They are ever connected the other broadside of traders' positions and marque wealth from the bid-ask spread, portion perpetually striving to support a net-price neutral exposure.

Data from Deribit's BTC options market, tracked by Amberdata, shows dealers clasp important "positive gamma" vulnerability astatine $115K and higher onslaught terms levels.

When dealers' gamma is positive, it means they are agelong telephone oregon enactment options. In this case, their delta (market exposure) increases erstwhile the underlying plus increases. Thus, their delta-hedging mandate requires selling much of the underlying plus arsenic the terms rises and vice versa.

The order-flow, therefore, acts arsenic a contrarian force, limiting the terms volatility, Anderson told CoinDesk.

Dealer gamma is importantly positive, from $115K to $150K, acknowledgment to investors' involvement successful selling (overwriting) higher onslaught telephone options to make further output connected apical of their spot holdings.

"There is batch of affirmative gamma successful the marketplace owed to telephone overwriters. They volition beryllium much wary of this breakout, and if we tin wide the pouch of gamma astatine $115K, this [rally] could truly commencement to go," Anderson said.

4 months ago

4 months ago

English (US)

English (US)