Realized nett represents the cumulative nett of each Bitcoins moved on-chain, calculated arsenic the quality betwixt the acquisition and question prices. It’s a nonstop measurement of the profitability for Bitcoin holders, indicating erstwhile investors are apt to merchantability and instrumentality profits.

On the different hand, the realized cap offers a much close practice of the market’s valuation than the accepted marketplace cap. It calculates Bitcoin’s capitalization by valuing each portion astatine the terms erstwhile it was past moved alternatively than the existent price. This metric shows the market’s aggregate outgo basis, revealing the mean acquisition terms of each Bitcoins.

These metrics are captious for knowing the extent of marketplace activity, capitalist sentiment, and the existent economical value down terms movements.

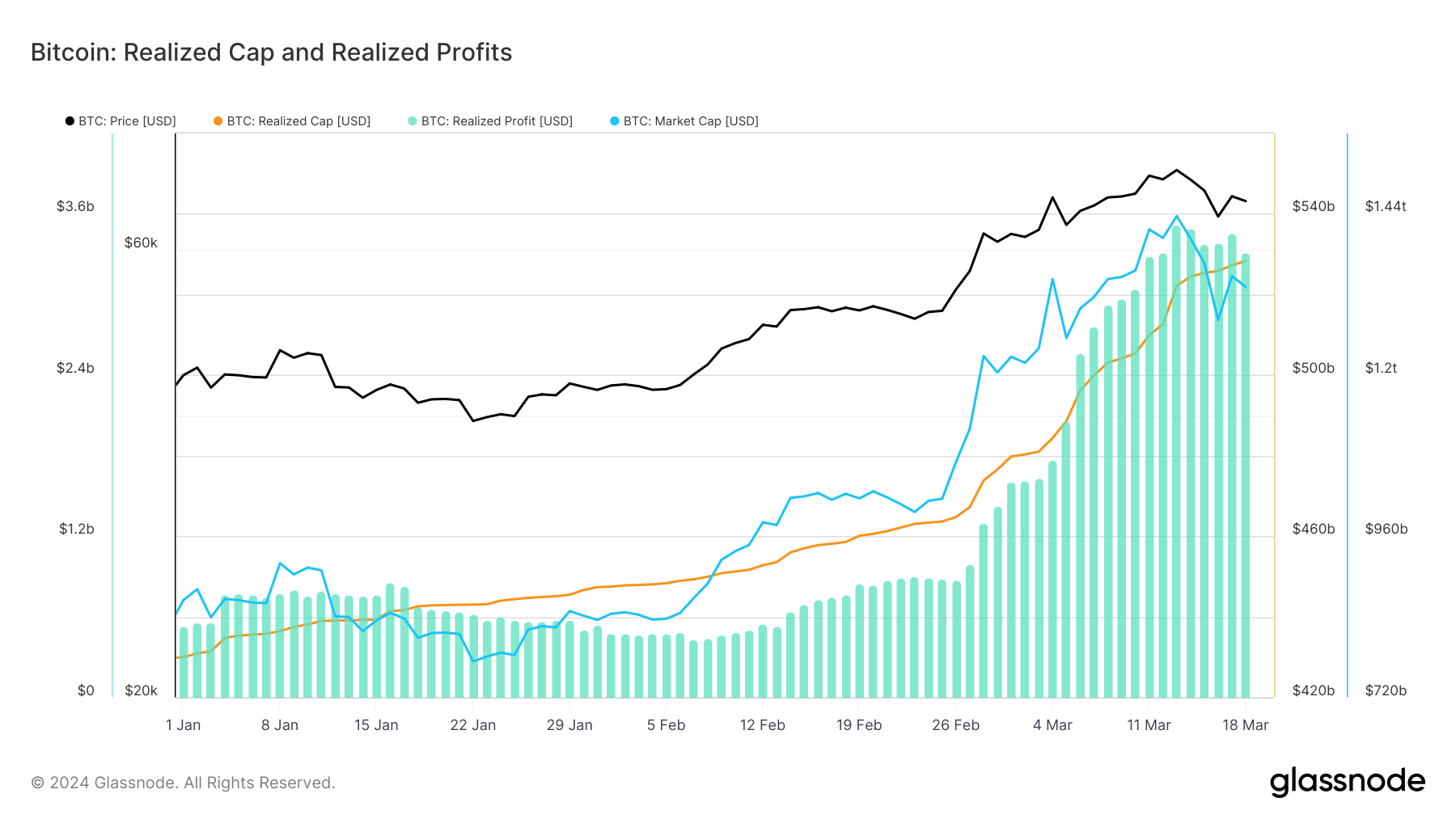

Graph showing Bitcoin’s realized nett (green), realized headdress (orange), and marketplace headdress (blue) from Jan. 1 to Mar. 18, 2024 (Source: Glassnode)

Graph showing Bitcoin’s realized nett (green), realized headdress (orange), and marketplace headdress (blue) from Jan. 1 to Mar. 18, 2024 (Source: Glassnode)Since the opening of the year, Bitcoin’s realized nett has been rising steadily, and a monolithic spike began successful March. Realized nett peaked astatine $3.51 cardinal connected Mar. 13, reaching its all-time high. This spike successful RP came arsenic Bitcoin broke its ATH and traded astatine conscionable supra $73,100 for the day.

It was lone a substance of clip earlier a precocious profit-taking level occurred successful the market. The second-highest realized nett was $3.130 billion, recorded connected Jan. 10, 2021. Bitcoin’s terms volatility successful the pursuing days was astir apt a effect of investors capitalizing connected the terms surge — the diminution to $3.31 cardinal successful realized nett by Mar. 18 suggests a normalization pursuing the sell-off.

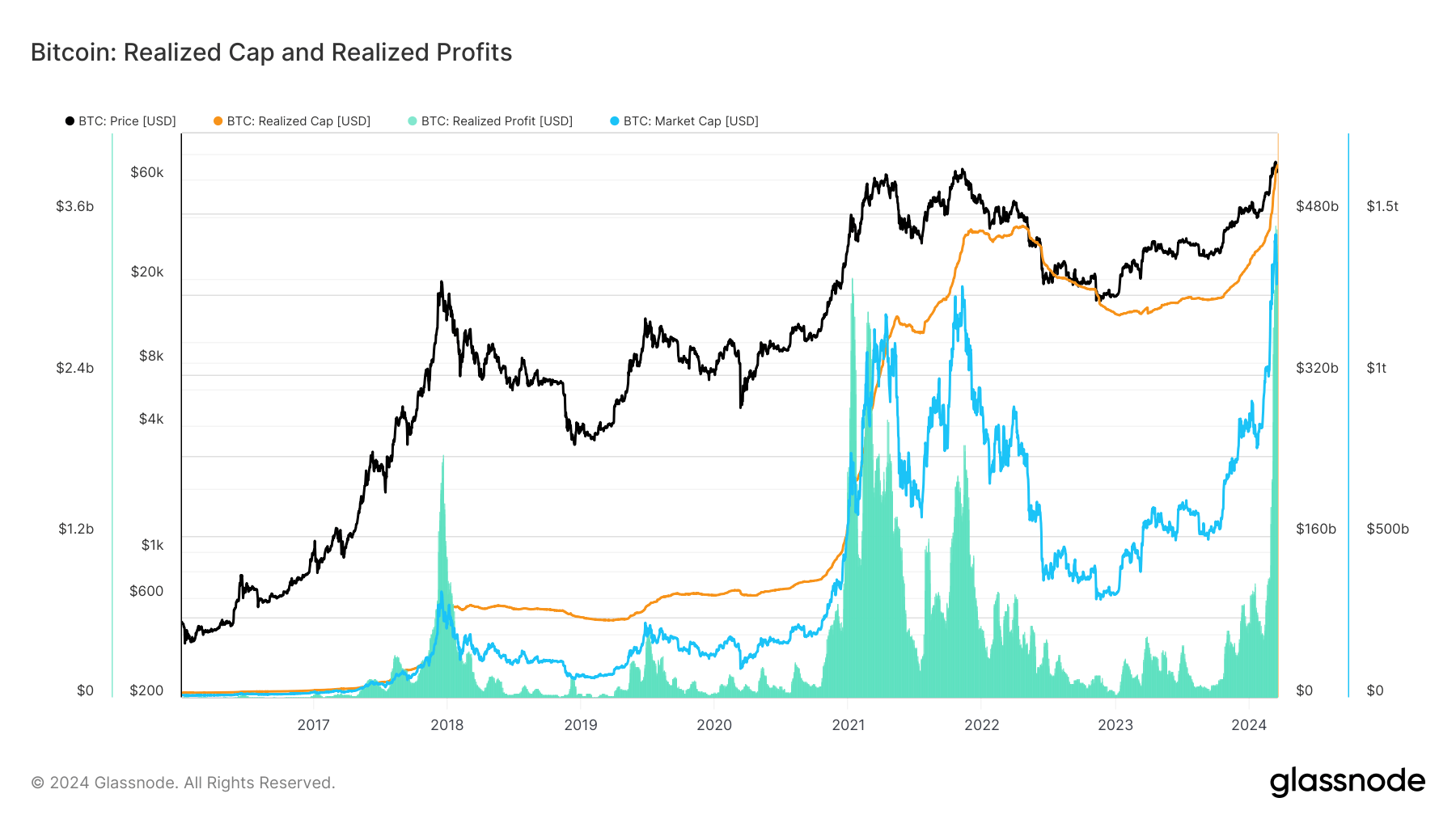

Graph showing Bitcoin’s realized nett (green), realized headdress (orange), and marketplace headdress (blue) from Jan. 1, 2016, to Mar. 18, 2024 (Source: Glassnode)

Graph showing Bitcoin’s realized nett (green), realized headdress (orange), and marketplace headdress (blue) from Jan. 1, 2016, to Mar. 18, 2024 (Source: Glassnode)It’s hard to pinpoint what prevented Bitcoin from slipping beneath further $65,000 connected Mar. 16. While immoderate metrics amusement coagulated enactment was formed astatine that level, it’s besides apt that the continuous accumulation played a important portion successful absorbing overmuch of that selling pressure.

This is seen successful the accordant maturation of Bitcoin’s realized cap, which accrued from $429.97 cardinal astatine the opening of the twelvemonth to $528.32 cardinal connected Mar. 18. This unchangeable maturation contrasts with the changes successful the much volatile marketplace cap, indicating ongoing accumulation contempt terms fluctuations. The dependable summation successful the realized cap, adjacent during terms corrections, shows a robust assurance successful Bitcoin that seems to person established a coagulated instauration for further growth.

This information highlights the market’s resilience, showing that contempt short-term speculative pressures, the underlying inclination is 1 of sustained accumulation and confidence. The divergence betwixt the realized cap’s dependable ascent and the marketplace cap’s volatility highlights a maturing marketplace wherever semipermanent accumulation strategies inactive negociate to prevail implicit short-term speculation.

The station Bitcoin’s realized nett hits ATH but marketplace keeps accumulating appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)