Bitcoin’s yearly realized profit/loss ratio measures the proportionality of realized profits to realized losses implicit a rolling one-year period. It’s an underused but important metric arsenic it tin enactment arsenic an indicator of marketplace sentiment. When the ratio is high, it suggests that much investors are realizing profits than incurring losses, which is typically diagnostic of bull markets. Conversely, a debased ratio indicates that much investors are realizing losses than profits, which is communal successful carnivore markets, which suggests antagonistic marketplace sentiment and a deficiency of assurance successful terms stability.

Additionally, the ratio helps place marketplace trends. High peaks successful the ratio often align with marketplace tops, wherever profit-taking is prevalent, portion debased troughs align with marketplace bottoms, wherever losses are much common. This metric besides reflects the market’s maturity; a unchangeable ratio tin bespeak a mature oregon unchangeable marketplace with balanced buying and selling pressures, portion volatility successful the ratio whitethorn bespeak speculative enactment and imaginable marketplace instability.

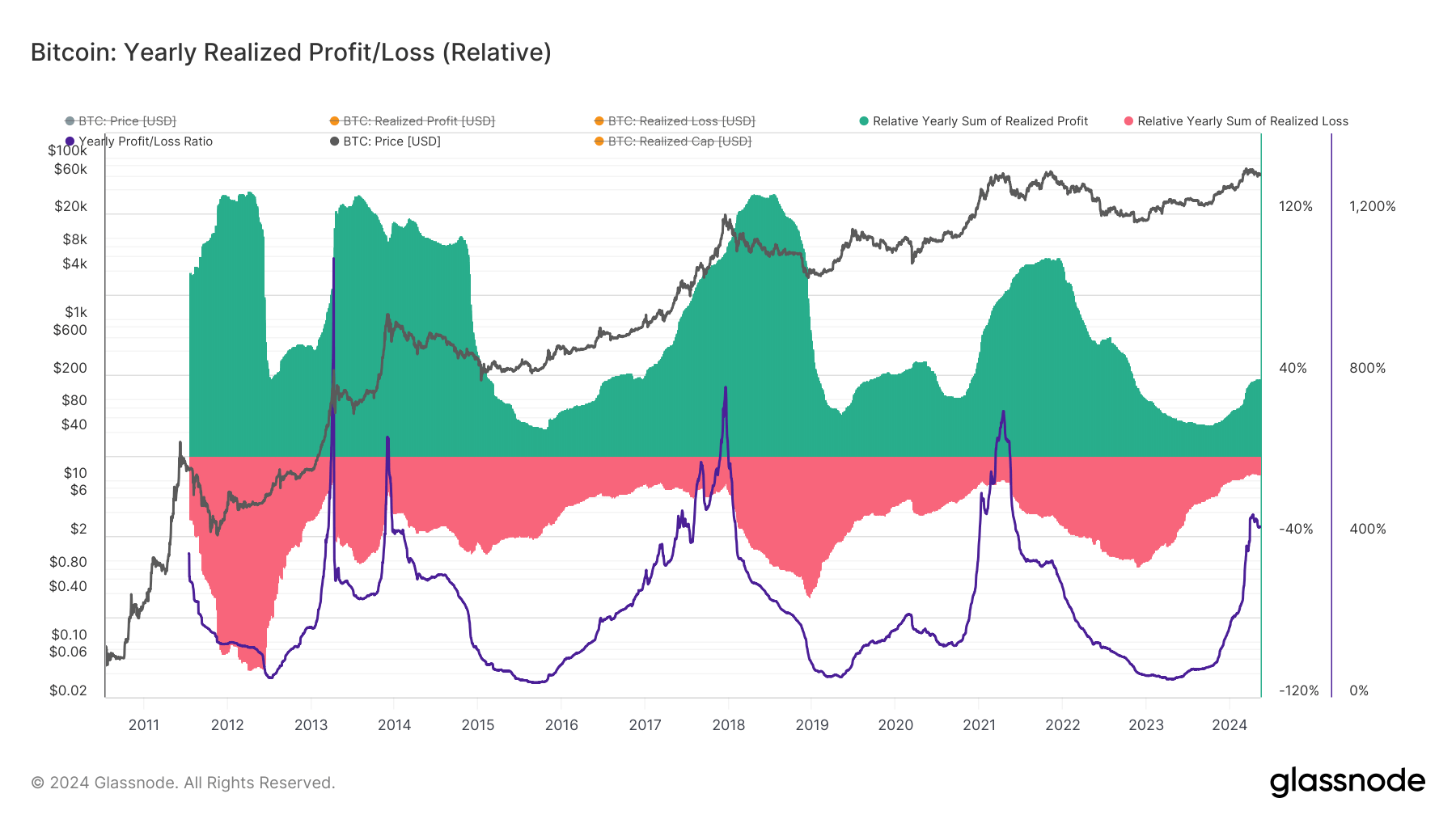

Graph showing Bitcoin’s yearly realized profit/loss ratio from 2011 to 2024 (Source: Glassnode)

Graph showing Bitcoin’s yearly realized profit/loss ratio from 2011 to 2024 (Source: Glassnode)This twelvemonth has been peculiarly volatile regarding the realized profit/loss ratio. The ratio has seen a monolithic summation since the opening of the year, moving from 176.33% connected Jan. 1 to 423.26% connected May 14. The ratio peaked connected April 11 astatine 454.02%—the highest since precocious May 2021.

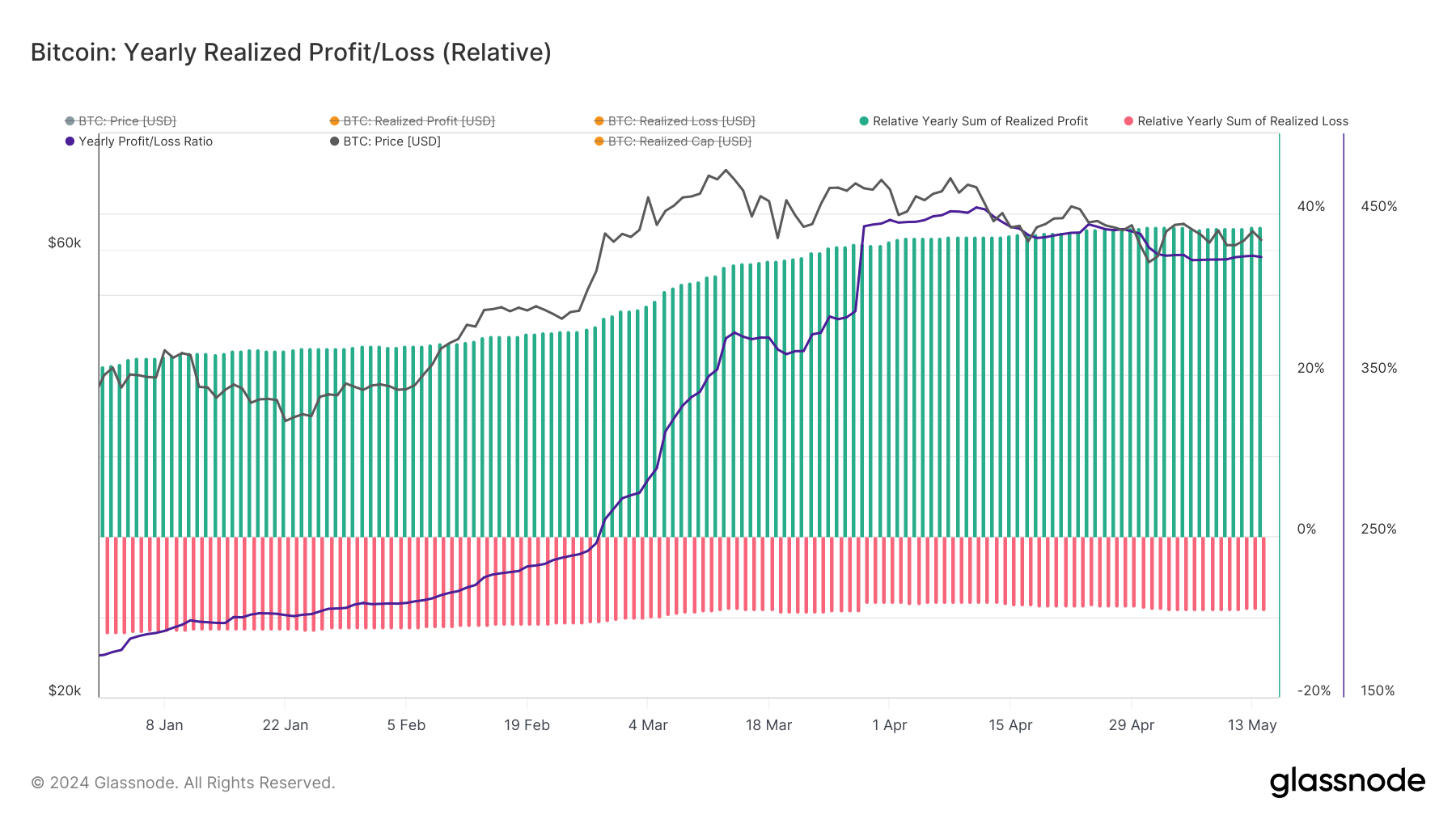

Graph showing Bitcoin’s yearly realized profit/loss ratio from Jan. 1 to May 14, 2024 (Source: Glassnode)

Graph showing Bitcoin’s yearly realized profit/loss ratio from Jan. 1 to May 14, 2024 (Source: Glassnode)In January and February, the unchangeable summation successful the ratio showed traders realizing higher profits than losses, indicative of a caller question of bullish sentiment forming successful the market. The complaint of summation skyrocketed successful April erstwhile the ratio went from a March precocious of 190% to a three-year precocious of 454.02% connected April 11. At the time, Bitcoin’s terms consolidated astatine astir $70,000.

There is simply a notable discrepancy betwixt Bitcoin’s ATH and the ATH successful the realized profit/loss ratio—the ratio peaked connected April 11 alternatively than March 13, contempt BTC posting a caller ATH connected the second date. This tin beryllium attributed to delayed profit-taking, trading volume, liquidity differences, and intelligence factors.

Investor science is often overlooked contempt playing 1 of the astir captious roles successful fiscal markets. The consolidation astatine $70,000 aft BTC saw a driblet to $61,000, which made this terms level a much important intelligence milestone, starring to a question of profit-taking and a highest successful the ratio. In contrast, Bitcoin’s caller ATH acceptable astatine $74,000 mightiness not person had the aforesaid intelligence impact, preventing traders from realizing profits arsenic they hoped for a much extended uptrend.

Investors besides often respond to ATHs with a delay, processing caller terms levels earlier deciding to instrumentality profits. While galore traders could person taken nett connected March 13, the cumulative realized profits and losses implicit the twelvemonth power the ratio. Higher trading volumes astir April 11 compared to March 13 could person resulted successful much realized transactions, impacting the ratio much significantly. The accrued liquidity astatine the clip mightiness person made it easier for ample holders to recognize profits without substantially moving the market, arsenic the terms remained unchangeable astatine astir $70,000. The creation of marketplace participants mightiness person besides varied astatine the time, with much retail investors engaging astir April 11, who are typically much prone to realizing profits.

The ratio’s stableness successful the past week oregon truthful reflects BTC’s deficiency of volatility. The importantly higher realized nett ratio shows that investors are realizing profit astatine a unchangeable complaint each day. This is particularly absorbing fixed Bitcoin’s terms hovering betwixt $60,000 and $63,000 successful the past week.

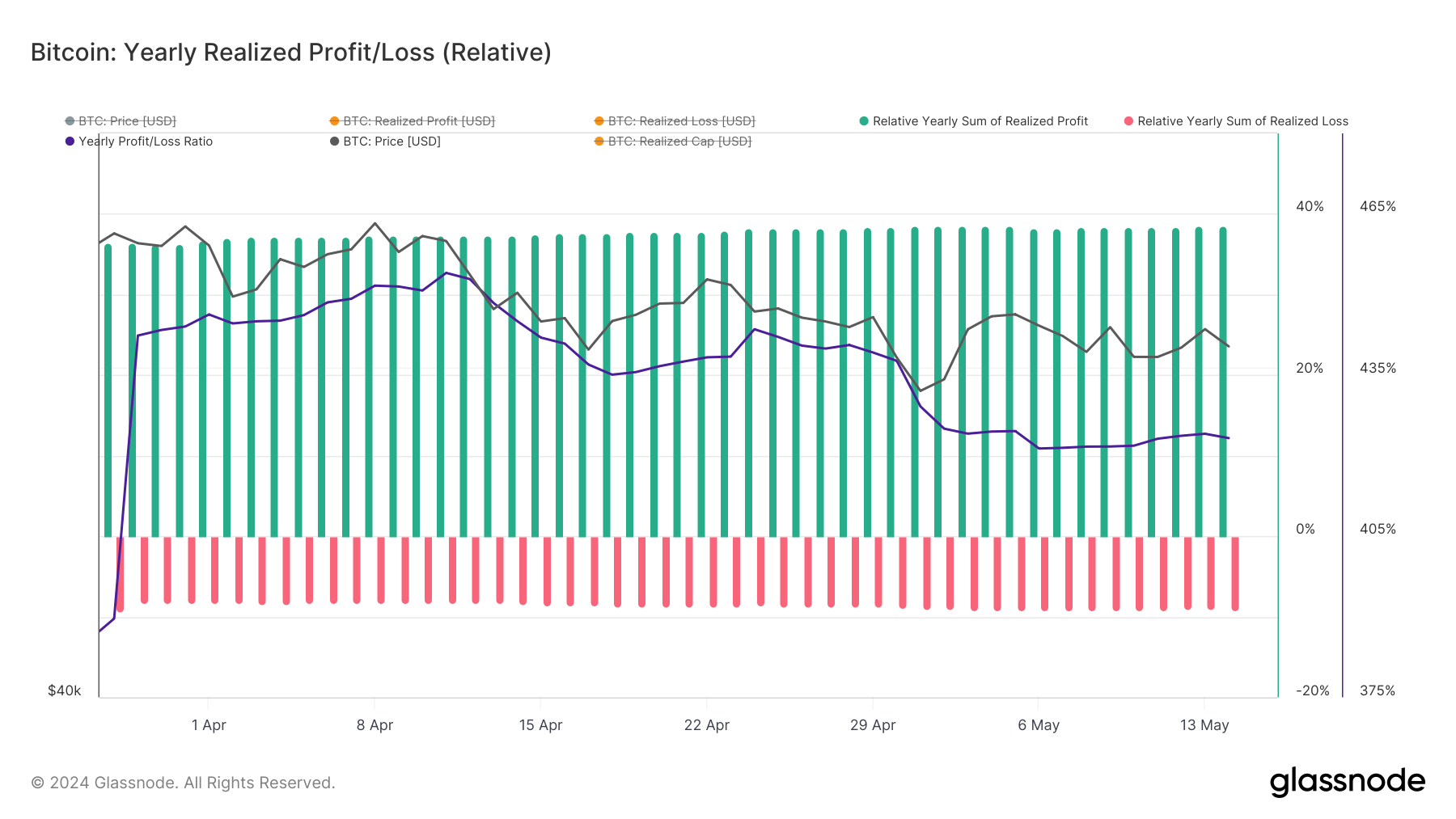

Graph showing Bitcoin’s yearly realized profit/loss ratio from March 29 to May 14, 2024 (Source: Glassnode)

Graph showing Bitcoin’s yearly realized profit/loss ratio from March 29 to May 14, 2024 (Source: Glassnode)A prolonged sideways question similar this suggests the marketplace is successful a consolidation phase, which often follows important terms movements. Historically, consolidation phases person preceded caller marketplace trends, some bullish and bearish.

Price consolidation similar this usually pushes investors to beryllium cautiously optimistic, choosing to clasp onto their BTC alternatively than recognize profits oregon chopped losses. However, the consistently precocious realized nett ratio we’ve seen implicit the past weeks shows the marketplace is satisfied with the existent terms level and is realizing important amounts of profit.

The station Bitcoin’s realized profit/loss ratio shows marketplace restitution with existent terms levels appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)