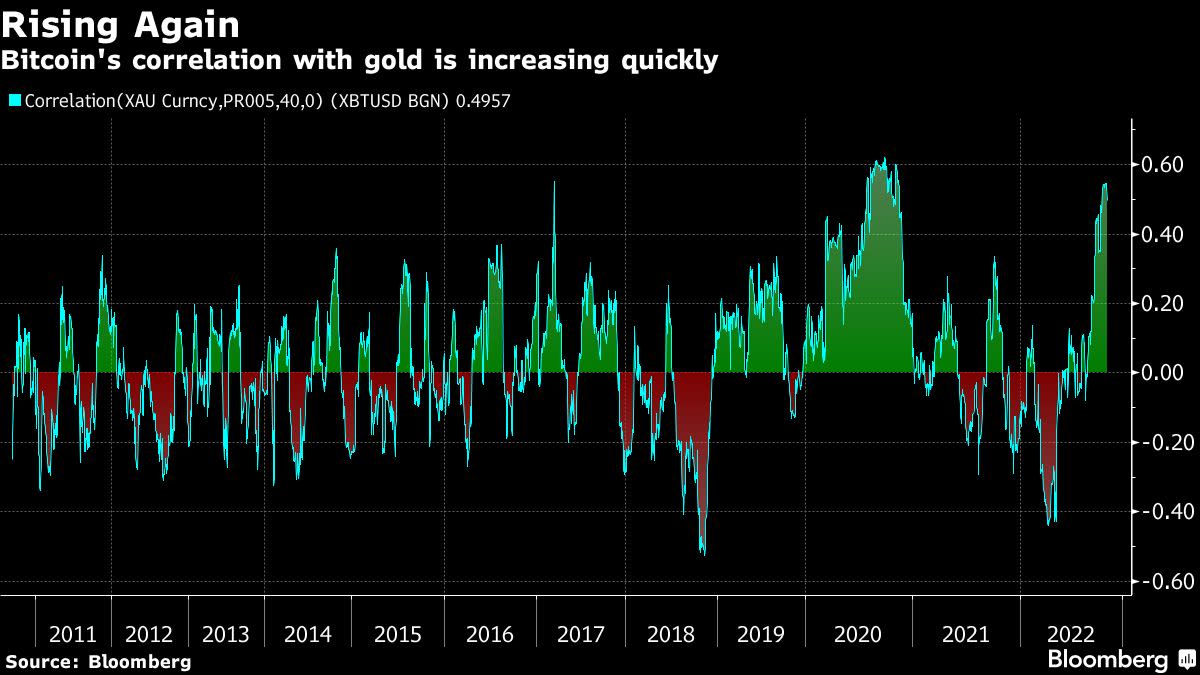

Amid the economical uncertainty affecting a myriad of countries worldwide, Bank of America Securities marketplace strategists explained successful a enactment this week that the starring crypto plus bitcoin has been correlated with the good known precious metallic gold. Bank of America analysts Alkesh Shah and Andrew Moss noted “that investors whitethorn presumption bitcoin arsenic a comparative harmless haven arsenic macro uncertainty continues.”

Bank of America’s Market Strategists Say Bitcoin’s Rising Correlation With Gold Indicates ‘Investors May View Bitcoin arsenic a Relative Safe Haven’

Market strategists from Bank of America’s securities division, Alkesh Shah and Andrew Moss, detailed this week that bitcoin and golden person been highly correlated successful caller times. The quality follows the caller report published by the crypto information supplier Kaiko, which says bitcoin has been little volatile than the Nasdaq and S&P 500 indices. According to the Bank of America strategists, bitcoin’s (BTC) terms fluctuations, successful presumption of different planetary assets, person caused investors to deliberation BTC is simply a safe-haven asset.

“A decelerating affirmative correlation with SPX/QQQ and a rapidly rising correlation with XAU bespeak that investors whitethorn presumption bitcoin arsenic a comparative harmless haven arsenic macro uncertainty continues and a marketplace bottommost remains to beryllium seen,” Bank of America’s securities part analysts wrote.

editorial photograph credit: Bloomberg

editorial photograph credit: BloombergOn Monday, October 24, some bitcoin (BTC) and gold prices person been scope bound, and person been little volatile successful examination to equity markets. BTC is trading for conscionable supra $19K per unit, portion an ounce of .999 good gold is exchanging hands for 1,646.70 nominal U.S. dollars. Bank of America’s Shah and Moss person been monitoring the 40-day correlation with gold, which is astir 0.50 this week. The 0.50 standing is simply a batch person and shows a stronger correlation to the precious metal than the zero standing the starring crypto plus BTC recorded successful August.

The determination comes astatine a clip erstwhile macro uncertainty has heightened, and analysts person warned that U.S. Federal Reserve complaint hikes could origin a U.S. Treasuries liquidity crisis. Market observers expect an assertive complaint hike adjacent month, but strategists besides judge the Fed volition pivot by December. Both golden and BTC person fallen a large woody since the 2 asset’s all-time terms highs. Gold for lawsuit tapped a beingness terms precocious against the U.S. dollar connected March 8, 2022, erstwhile it reached $2,074 per ounce.

Gold has mislaid 20.49% against the U.S. dollar since the all-time precocious 230 days ago. The crypto plus bitcoin (BTC) has shed 72% against the greenback during the past year, aft tapping $69,044 per portion connected November 10, 2021. Gold contiguous has an wide marketplace capitalization of astir $10.895 trillion, portion BTC’s marketplace capitalization is astir $369 billion.

Tags successful this story

Alkesh Shah, Andrew Moss, Bank of America, bank of america bitcoin, Bitcoin, bitcoin prices, Bofa, BTC Prices, correlation, Fed, Federal Reserve, Global Economy, gold, Gold and bitcoin correlation, gold bitcoin, Gold Prices, Greenback, Haven, haven asset, Market Capitalization, Ounce of Gold, Safe haven, Safe-Haven Assets, US Dollar

What bash you deliberation astir Bank of America’s Shah and Moss explaining that golden and bitcoin person been correlated during the past 40 days? Do you deliberation investors comprehend bitcoin arsenic a safe-haven amid today’s macro uncertainty? Let america cognize your thoughts astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, editorial photograph credit: Bloomberg

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)