There’s nary denying that the past 7 unusual months person been extremely bearish for the crypto market, with Bitcoin, the world’s largest cryptocurrency by full marketplace capitalization, lone witnessing year-to-date (YTD) monetary inflows worthy conscionable $14 million.

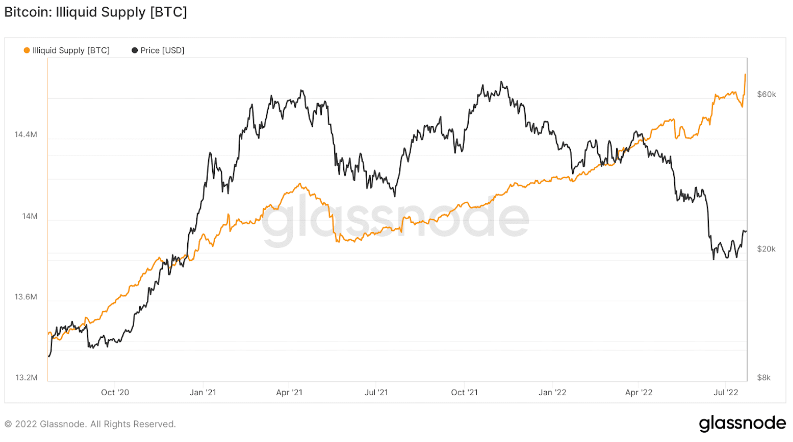

Furthermore, the flagship crypto’s illiquid proviso ratio — i.e., the fig of Bitcoin being moved retired of exchanges and into hardware “cold storage” wallets oregon app-based “hot” wallets — has been connected the emergence since the commencement of 2022.

To elaborate, implicit 14.8 cardinal illiquid BTC tokens presently exist, with this fig having risen rather sharply (by astir 500k) during the archetypal fractional of the twelvemonth alone. This is mostly owed to a big of macroeconomic factors surrounding the planetary system (such arsenic the caller Russian penetration of Ukraine, rising crypto liquidations, surging ostentation and involvement levels, etc.).

It is besides pertinent to enactment that the full fig of BTC successful circulation presently stands astatine astir 19 million, with astir 900 coins being mined and added to the currency’s full proviso excavation per day.

In all, it is estimated that 76% of the cryptocurrency’s full proviso is presently classifiable arsenic illiquid, which is rather staggering considering that much than 90% of each Bitcoin that tin ever beryllium has already been mined.

Bitcoin illiquid proviso (via Glassnode)

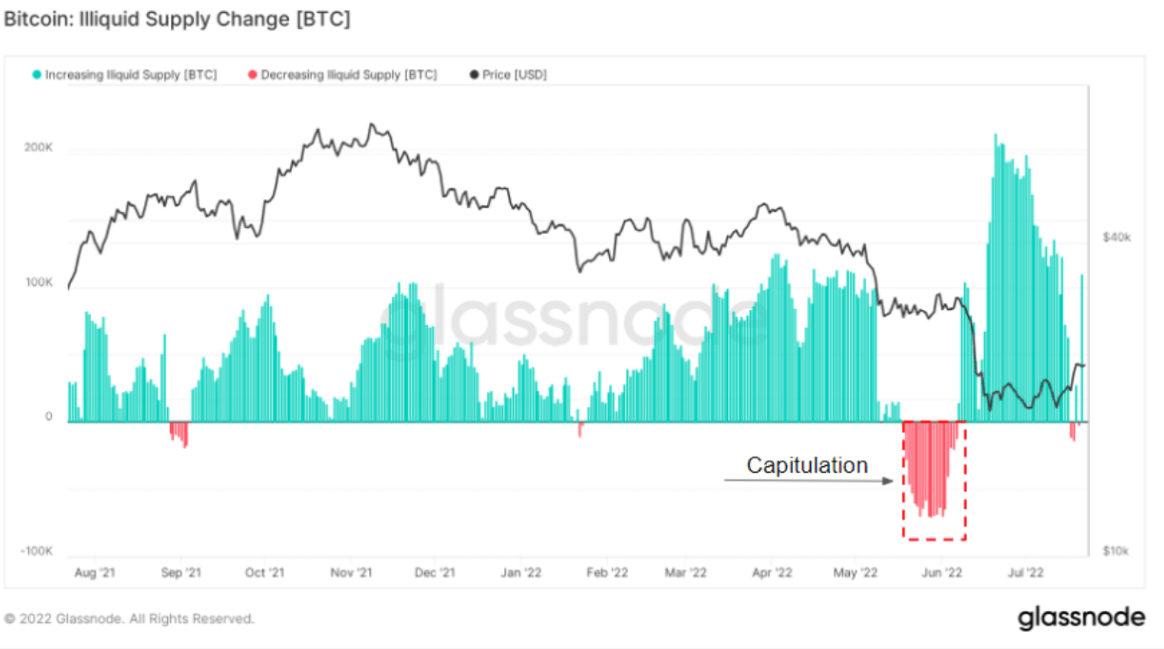

Bitcoin illiquid proviso (via Glassnode)This emergence successful illiquid proviso is besides supported by associated metrics specified arsenic Bitcoin’s ‘illiquid proviso change,’ which is the monthly (30-day) nett alteration successful the proviso of the integer currency held by illiquid entities. This is important due to the fact that the caller macro-level events surrounding the marketplace — specified arsenic the insolvencies of cardinal marketplace players similar Three Arrows Capital, Celsius, Vauld, and Zipmex — person resulted successful consumers learning the value of self-custody (ala ‘not your keys, not your coins’).

To this point, the graph beneath intelligibly shows that the wide inclination surrounding investors moving their Bitcoin into outer wallets has been connected the rise, particularly aft the above-stated capitulations successful June.

Bitcoin illiquid proviso alteration (via Glassnode)

Bitcoin illiquid proviso alteration (via Glassnode)Bitcoin’s illiquid proviso has been successful a signifier of continued accumulation for implicit six months, lone to beryllium interrupted past month. However, arsenic disposable above, the inclination is again connected the upturn, with much gusto than ever before. These abrupt surges tin person an adverse effect connected the proviso dynamics of Bitcoin, perchance resulting successful the asset’s terms being faced with a batch of volatility successful the near-to-mid term. Therefore, it remains to beryllium seen what the aboriginal has successful store for Bitcoin.

The station Bitcoin’s rising illiquid proviso tin spur much terms volatility, information suggests appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)