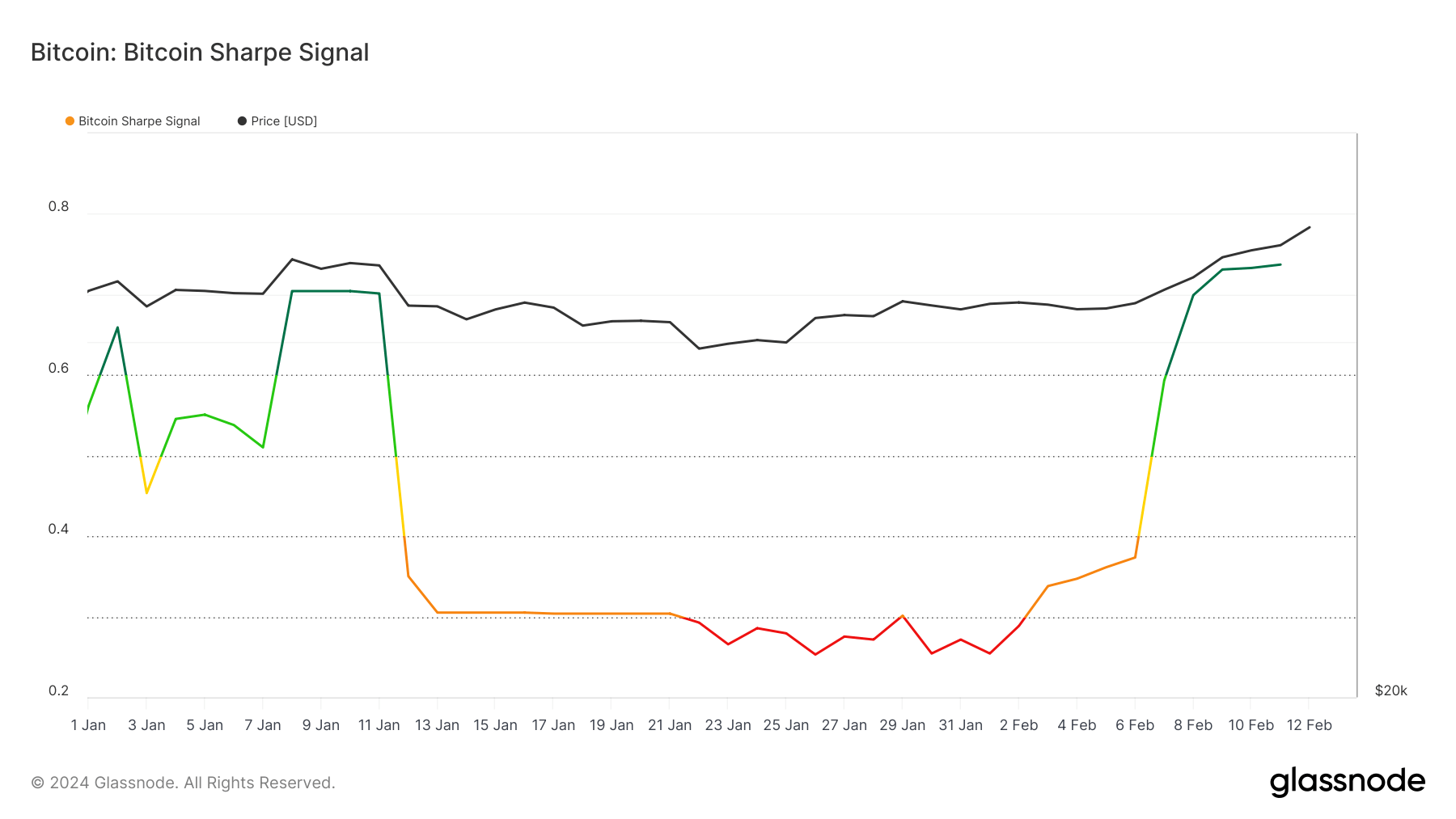

On Jan. 26, Glassnode’s Sharpe Signal deed its lowest level since March 2020. It dropped to 0.2531 from a precocious of 0.7042 connected Jan. 10. However, by Feb. 11, arsenic Bitcoin’s terms crossed $48,000, the Sharpe Signal accrued to 0.7371.

Graph showing Bitcoin’s Sharpe Signal from Jan. 1 to Feb. 12, 2024 (Source: Glassnode)

Graph showing Bitcoin’s Sharpe Signal from Jan. 1 to Feb. 12, 2024 (Source: Glassnode)This crisp spike successful the Sharpe Signal has profound implications for the crypto market, indicating a perchance lucrative signifier for investors attuned to risk-adjusted metrics.

To afloat grasp the value of the signal’s fluctuations, it’s indispensable to recognize the Sharpe ratio.

This metric, created by Nobel Laureate William F. Sharpe, measures the show of an concern comparative to its risk. The Sharpe ratio compares the expected returns of an concern to the risk-free complaint of return, adjusting for the investment’s volatility. By doing this, the ratio provides a standardized measurement of excess returns per portion of risk. Put simply, it measures however overmuch much wealth you could marque connected an plus riskier than authorities bonds.

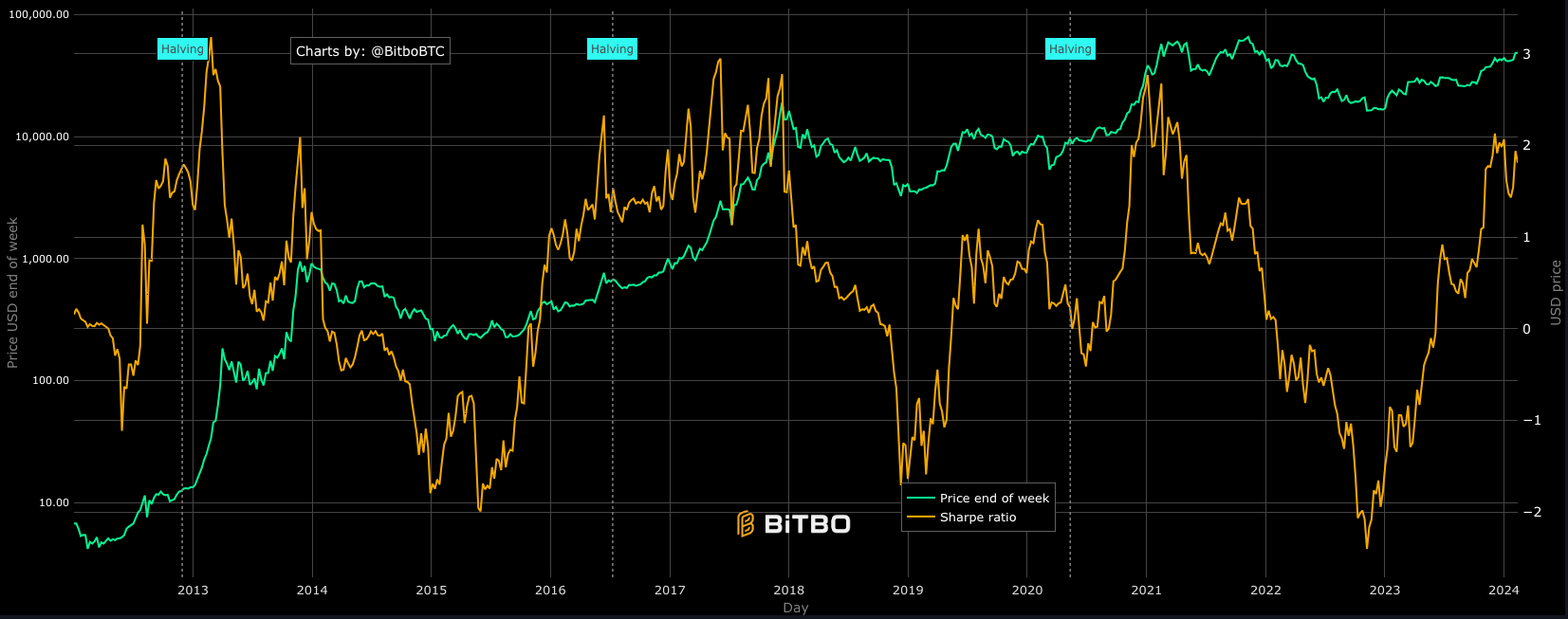

The Sharpe ratio experienced its ain volatility, dropping to 1.43 connected Jan. 22 earlier surging to 1.94 connected Feb. 5 and settling astatine 1.74 arsenic of Feb. 11. These movements connection insights into the changing risk-reward illustration of Bitcoin, with higher ratios indicating a much favorable risk-adjusted return.

Ch Graph showing Bitcoin’s Sharpe ratio from 2012 to 2024 (Source: Bitbo)

Ch Graph showing Bitcoin’s Sharpe ratio from 2012 to 2024 (Source: Bitbo)The Sharpe Signal, derived from Glassnode’s proprietary model, builds connected this conception by incorporating instrumentality learning and on-chain information to foretell Bitcoin’s risk-adjusted instrumentality potential. This awesome is calculated by analyzing humanities data, marketplace trends, and on-chain enactment to gauge the existent risk-reward balance. An summation successful the Sharpe Signal suggests improving risk-adjusted returns, making it a bullish indicator for Bitcoin. Conversely, a alteration signals rising downside hazard oregon diminishing returns comparative to risk, urging caution among investors.

The caller movements successful the Sharpe Signal, peculiarly the rebound from 0.2531 to 0.7371, alongside Bitcoin’s terms increase, amusement a important turnaround successful marketplace sentiment and Bitcoin’s risk-adjusted instrumentality outlook.

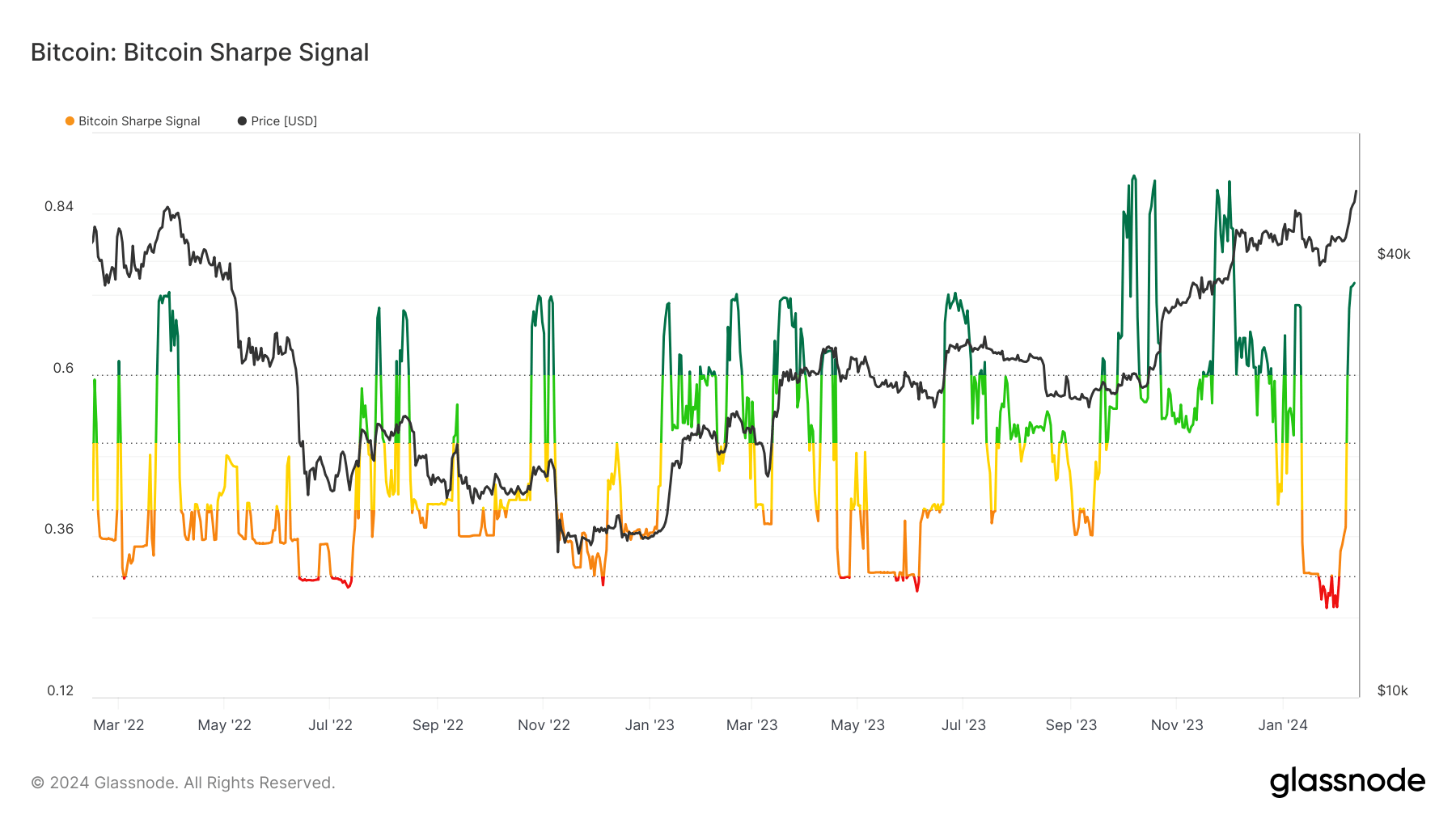

Graph showing Bitcoin’s Sharpe Signal from February 2022 to February 2024 (Source: Glassnode)

Graph showing Bitcoin’s Sharpe Signal from February 2022 to February 2024 (Source: Glassnode)The diminution successful precocious January, caused by the marketplace downturn pursuing the US motorboat of spot Bitcoin ETFs, indicated investors were seeing heightened risk. However, the consequent betterment shows a beardown resurgence successful confidence, fueled by a alteration successful downside hazard and anticipation of upward terms trends.

This summation successful the Sharpe Signal shows that investors are seeing a comparatively debased hazard erstwhile it comes to investing successful Bitcoin. The summation successful the ratio, alongside the emergence successful price, besides shows that the marketplace is gearing up for a further summation successful price.

As the awesome rebounds from its January lows, it brings astir a signifier of importantly improved risk-adjusted returns, which could marque a compelling lawsuit for traders guided by these metrics for strategical concern successful Bitcoin.

The station Bitcoin’s risk-adjusted instrumentality imaginable skyrockets arsenic Sharpe Signal surges appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)