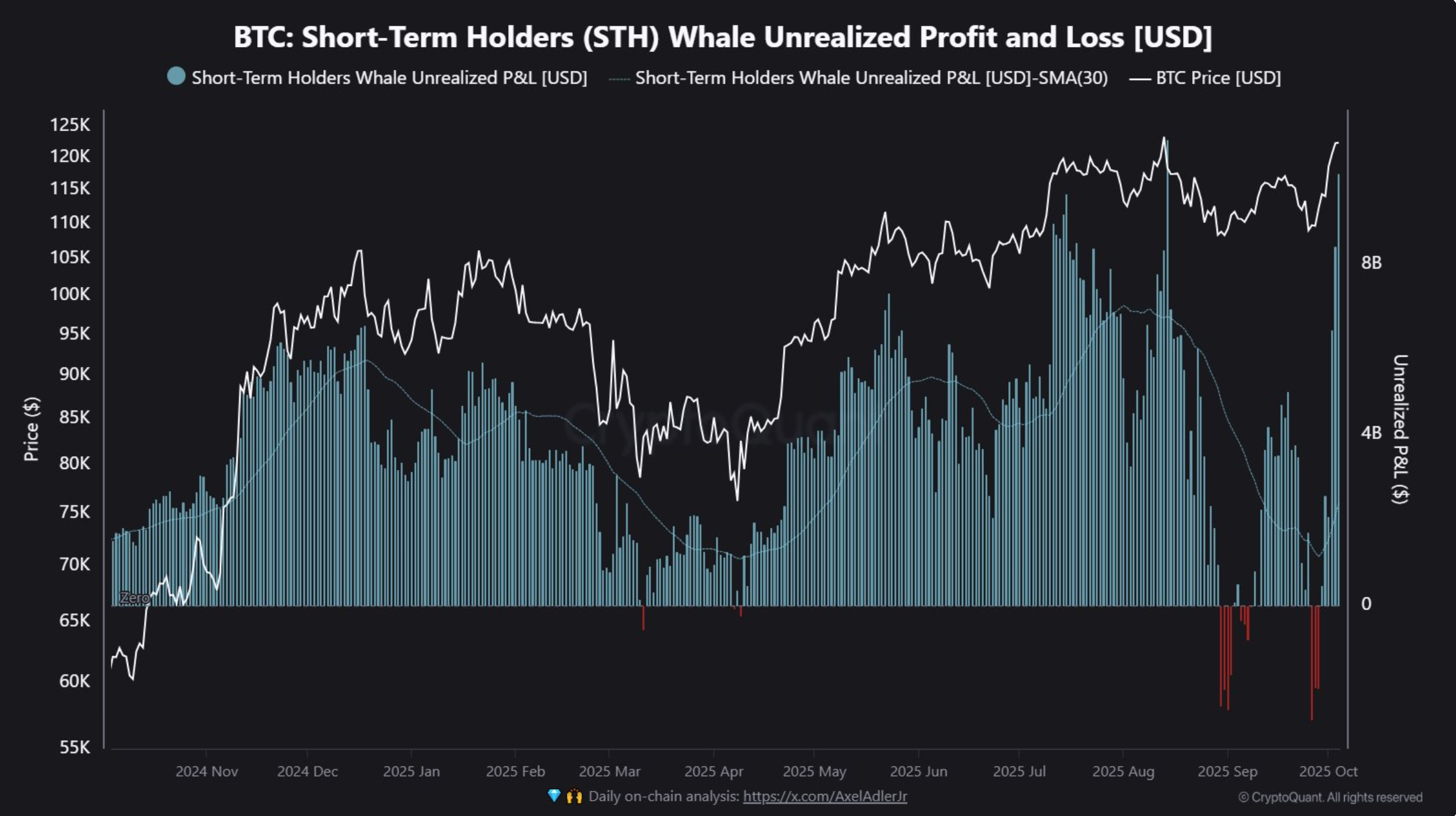

Bitcoin’s latest propulsion done grounds levels has near short-term holder (STH) whales sitting connected their fattest insubstantial profits of the rhythm of astir $10.1 billion, according to CryptoQuant data.

These are entities holding much than 1,000 BTC that lone entered the marketplace successful the past 5 months — the alleged “weak hands” of the cohort who usually fold archetypal erstwhile volatility spikes.

The unrealized nett tally is the highest this cycle, a plaything that reflects however rapidly fortunes tin alteration successful bitcoin. Just weeks ago, precocious September’s dip near this aforesaid radical underwater. Now, acknowledgment to ETF inflows, a U.S. shutdown backdrop, and softer dollar conditions, they’re abruptly sitting connected tens of billions successful gains.

But that’s wherever the hazard comes successful arsenic short-term whales aren’t celebrated for patience.

A $10 cardinal nett excavation is precisely the benignant of setup that tempts immoderate holders to instrumentality chips disconnected the table, investigating however overmuch caller request truly stands down the rally.

Exchange inflow information already showed $5.7 cardinal moving from STH wallets into exchanges earlier this week, marking an aboriginal motion that profit-taking is not a theoretical risk, but an progressive one.

Zooming out, this rhythm has already seen monolithic hand-offs betwixt semipermanent holders (LTHs) and the shorter-term crowd.

Earlier this week, analytics instrumentality Checkonchain pointed retired that 3.45 cardinal BTC person shifted from LTH wallets to STHs since the rhythm began — rivaling the 2016–17 transportation wave, lone this clip astatine prices astir 100 times higher.

Whether that organisation caps momentum oregon simply fuels the churn that keeps rallies live depends connected the bidding unit successful the coming weeks.

For now, that backdrop looks beardown capable to soak up immoderate profit-taking. But if STH whales deed the merchantability fastener en masse, $10.1 cardinal successful unrealized gains could flip into realized unit quickly.

2 months ago

2 months ago

English (US)

English (US)