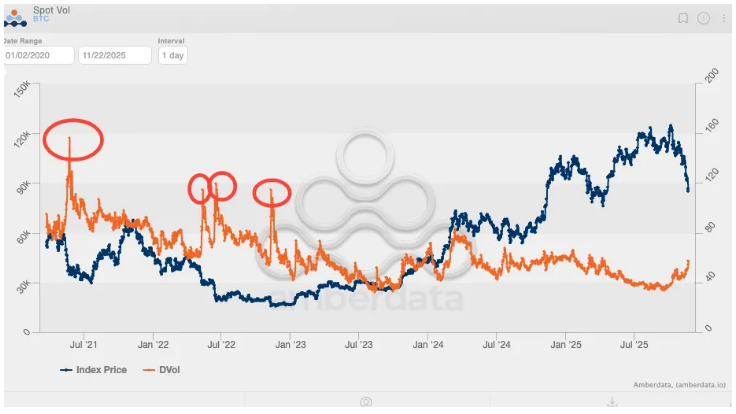

Bitcoin’s caller price swings person picked up pace, and marketplace watchers accidental that enactment markets whitethorn again beryllium calling the shots. Over the past 2 months volatility has climbed, shifting however traders and investors respond to large moves successful BTC.

Volatility Numbers Reignite Focus

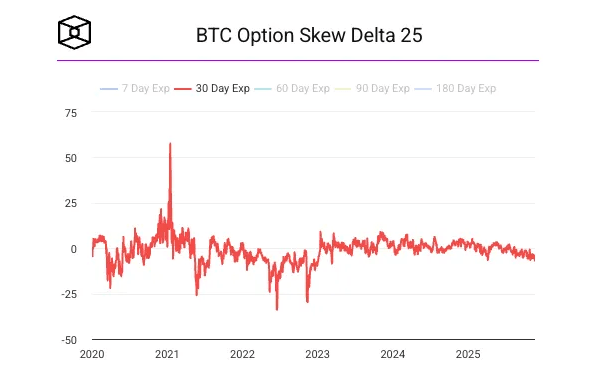

According to Jeff Park, implied volatility had stayed beneath 80% since US Bitcoin ETFs were approved, But it is present creeping backmost toward astir 60%. That emergence matters due to the fact that enactment flows tin amplify moves — some up and down — erstwhile traders reposition quickly.

Park pointed to January 2021 arsenic a wide example, erstwhile an options-driven surge helped propulsion Bitcoin to a rhythm precocious of $69,000 successful November of that year. In different words, swings driven by derivatives are susceptible of producing outsized trends.

Price Drops And Clearing Of Positions

Bitcoin tumbled beneath $85,000 connected Thursday, a determination that helped trigger liquidations and heightened selling pressure.

Reports person disclosed that immoderate losses are tied to highly leveraged positions being forced closed, portion different enactment appears to travel from semipermanent holders taking profits.

Analysts astatine Bitfinex called overmuch of the enactment “actical rebalancing,” saying it does not interruption semipermanent adoption oregon fundamentals.

Binance CEO Richard Teng is reported to person noted that volatility levels are akin crossed galore plus types close now.

Derivatives And Short-Term Shocks

Options positioning tin marque terms enactment sharper due to the fact that ample contracts propulsion traders to hedge oregon screen quickly, and hedging enactment often shows up arsenic accelerated moves successful the spot market.

This mechanics was important successful the 2021 tally and whitethorn beryllium astatine enactment again arsenic implied volatility climbs.

Traders who ticker the volatility aboveground accidental aboriginal signs of option-driven behaviour are visible, adjacent if the existent readings are obscurity adjacent the extremes seen successful anterior cycles.

Fed Betting Adds A Macro Twist

Meanwhile, according to the CME FedWatch tool, the marketplace present sees a 71% accidental of a 25-basis constituent chopped successful December, up from astir 30–40% earlier this week.

Comments from New York Fed President John Williams helped displacement those likelihood by suggesting argumentation could determination toward neutral, portion different Fed officials were quoted by Reuters arsenic taking much cautious stances.

A complaint cut, if it happens, could springiness hazard assets immoderate lift; a no-show mightiness support volatility elevated.

Markets Watch December For Clues

Traders are watching December intimately for signals that could either calm markets oregon adhd substance to them. Short-Term swings volition apt persist until traders spot clearer absorption from some macro argumentation and enactment desks. Some players volition hold for volatility to settle; others volition commercialized astir it.

Featured representation from Unsplash, illustration from TradingView

2 hours ago

2 hours ago

English (US)

English (US)