The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

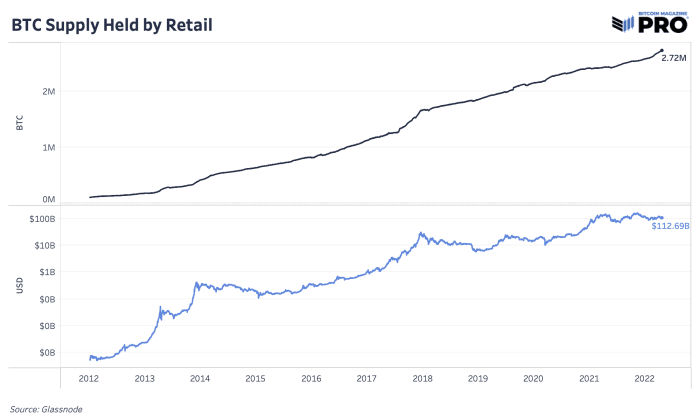

Retail Holds 14% Of Supply

One of the astir communal Bitcoin fear, uncertainty and uncertainty (FUD) critiques is that the bulk of proviso is heavy concentrated successful the hands of the few. Like each fiscal strategy oregon plus people that exists today, determination is immoderate information to that benignant of organisation but it’s astir ever exaggerated successful Bitcoin’s case.

Bitcoin’s stock of proviso held by estimated retail individuals has been taking much stock of the web each year. It’s 1 of the lone assets successful the satellite wherever anyone with an net transportation and a smartphone tin obtain, having incredibly debased adoption friction for the communal individual.

Many critics mention an code illustration similar this one and telephone it truth. The information is that tracking proviso distributions crossed addresses is incredibly nuanced and it’s a cardinal crushed wherefore Glassnode has utilized a suite of heuristics and clustering algorithms to estimation entities, alternatively than addresses, connected the network.

What Glassnode recovered successful their investigation a twelvemonth ago, is that:

“We tin deduce that astir 2% of web entities power 71.5% of each Bitcoin. Note that this fig is substantially antithetic from the often propagated ‘2% power 95% of the supply.’”

And that 71.5% was an precocious bound, i.e., a precocious estimation of the proviso organisation concentration. There are galore reasons wherefore the retail stock is apt larger due to the fact that of bitcoin with custodians, proviso connected exchanges, mislaid coins, and a blimpish methodology to place entities.

When digging into the entities proviso organisation information today, we find a wide inclination of retail (entities holding little than 10 BTC) expanding their stock of circulating proviso from 1.51% successful 2012 to 13.90% successful 2022 connected average. The largest stock maturation of proviso comes from entities holding 1-10 BTC and 0.1 - 1 BTC.

Final Note

The information contributes to the lawsuit that Bitcoin is simply a wealth designed for and accessible to the communal planetary individual. Although institutions and organization superior flowing into the web is apt the adjacent large terms catalyst and volition interaction proviso share, we proceed to spot the web stock of retail emergence arsenic anyone successful the satellite tin get and store bitcoin themselves.

It’s been a first-of-its-kind lawsuit survey wherever for once, retail and individuals are capable to entree assets and economical wealthiness earlier institutions.

3 years ago

3 years ago

English (US)

English (US)