Bitcoin dropping below $60,000 astatine the opening of May spooked the marketplace and led to important volatility crossed trading products. However, contempt the massive volatility successful derivatives, the spot marketplace seems to person led astir of this recovery, with volumes and inflows helping stabilize BTC astatine astir $66,000 successful mid-May. After a choppy fewer days wherever BTC struggled to interruption done $66,000, we saw a crisp spike connected May 20 that sent it supra $70,000, injecting much-needed optimism into the market. While BTC settled astatine astir $70,100 connected May 21, the important intelligence level remained breached.

This optimism led to a notable summation successful speech activity, evident successful the speedy emergence successful inflows and volume.

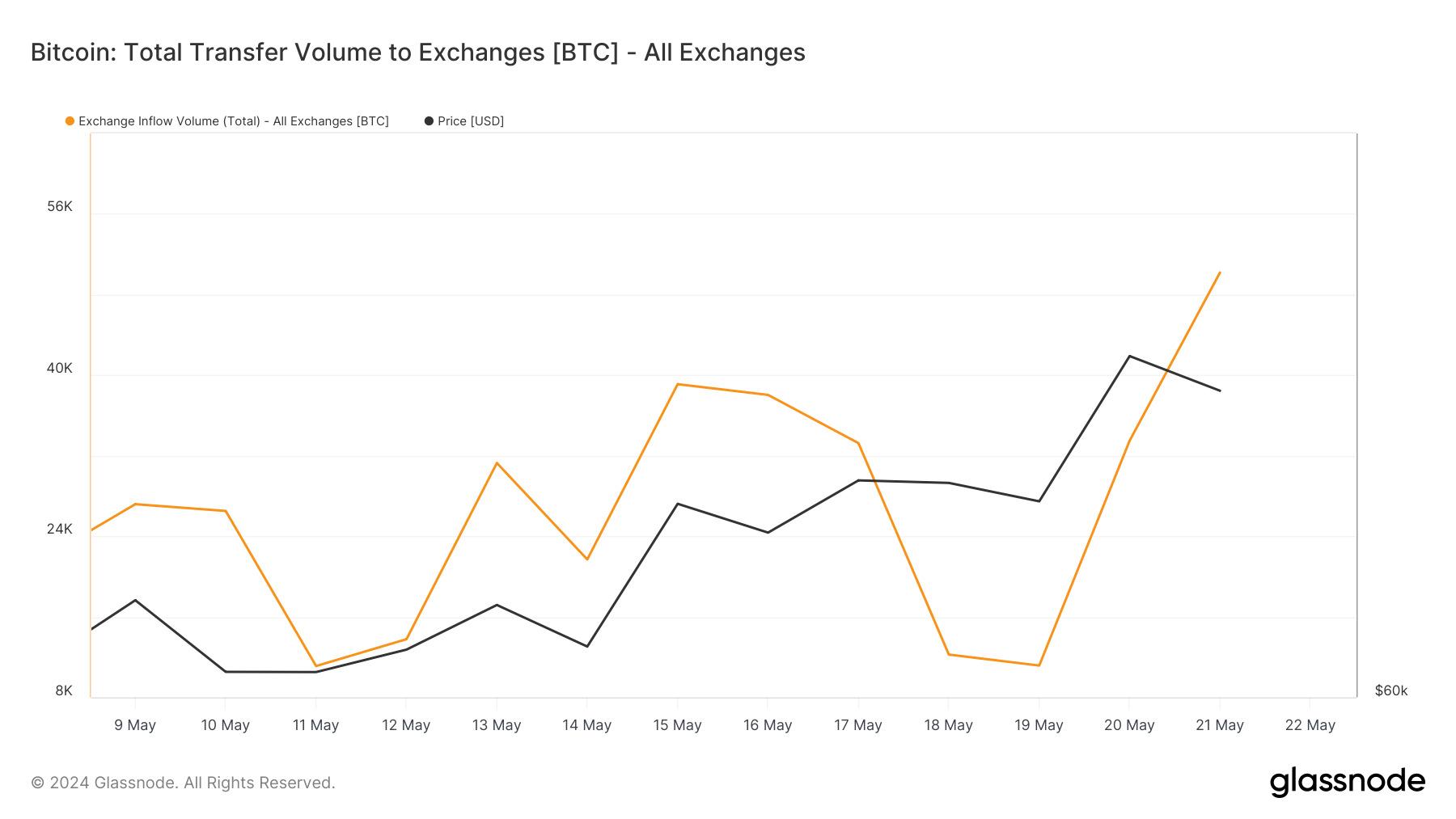

Between May 15 and May 21, we saw rather a spot of volatility successful transportation volumes into exchanges. On May 15, 39,095 BTC was transferred to exchanges, somewhat decreasing to 38,031 BTC connected May 16. The measurement further dropped to 33,242 BTC connected May 17, indicating a inclination of declining transportation volumes. A melodramatic driblet occurred connected May 18, with lone 12,243 BTC transferred to exchanges, followed by an adjacent little 11,156 BTC connected May 19. However, this inclination reversed connected May 20, with a important summation to 33,484 BTC, culminating successful a highest of 50,186 BTC connected May 2. These fluctuations amusement however tiny terms changes pb to important capitalist enactment and sentiment fluctuations.

Graph showing the transportation measurement of Bitcoin to exchanges from May 9 to May 21, 2024 (Source: Glassnode)

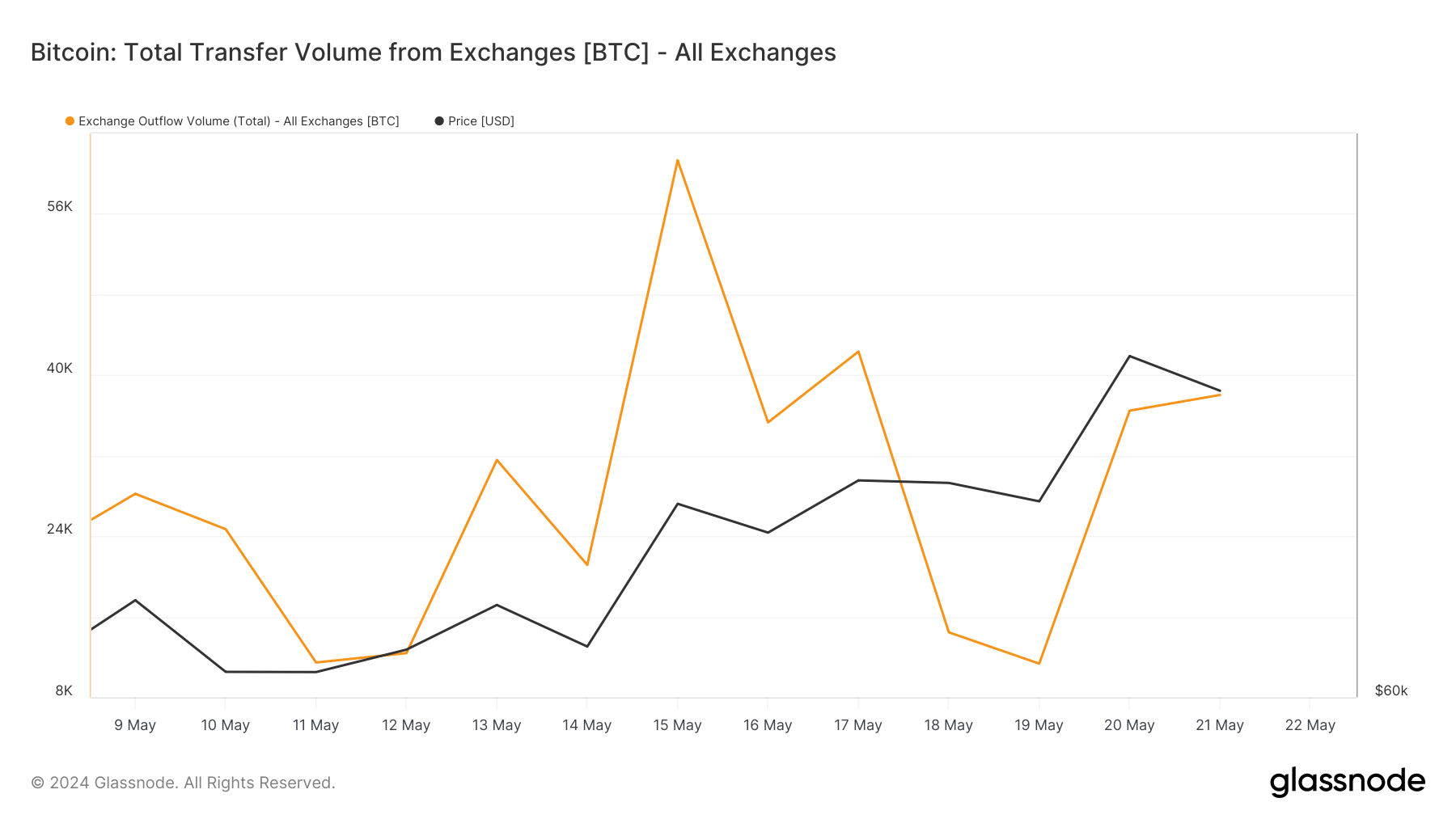

Graph showing the transportation measurement of Bitcoin to exchanges from May 9 to May 21, 2024 (Source: Glassnode)Transfer volumes from exchanges showed akin variations. Between May 15 and May 18, transportation measurement retired of exchanges dropped from 61,232 BTC to 14,454 BTC, followed by a further driblet to 11,347 BTC connected May 19. Similar to the inflow trend, the outflow volumes accrued connected May 20 to 36,468 BTC and somewhat decreased to 38,027 BTC connected May 21.

Graph showing the transportation measurement of Bitcoin from exchanges from May 9 to May 21, 2024 (Source: Glassnode)

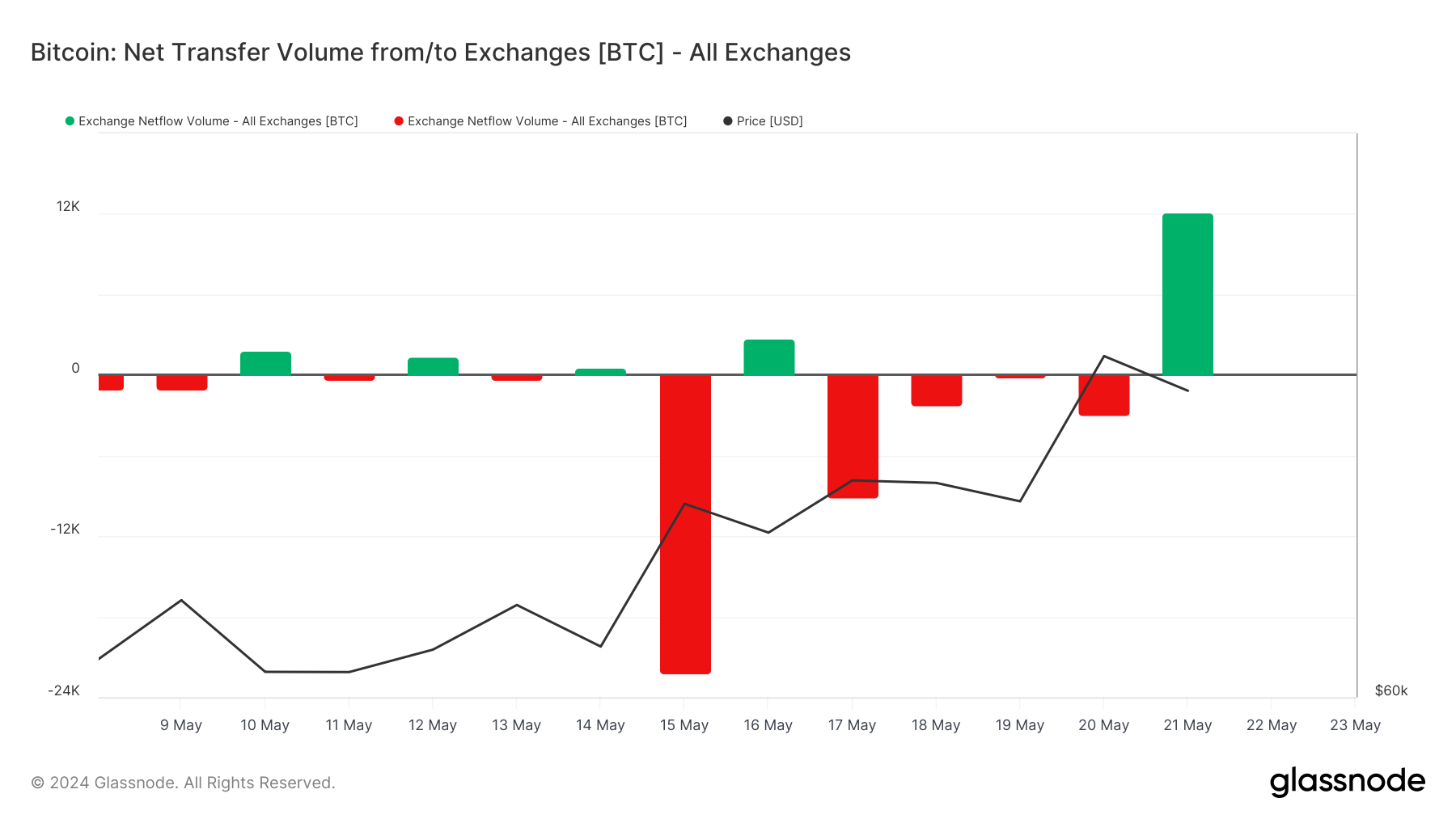

Graph showing the transportation measurement of Bitcoin from exchanges from May 9 to May 21, 2024 (Source: Glassnode)Before the terms surge, from May 15 to May 19, Bitcoin’s terms remained comparatively unchangeable with insignificant fluctuations. During this period, the nett transportation measurement mostly leaned towards outflows, indicating holders’ reluctance to determination assets into exchanges, perchance anticipating a terms rise. The terms surge and its aftermath connected May 20 and 21 led to a notable alteration successful capitalist behavior.

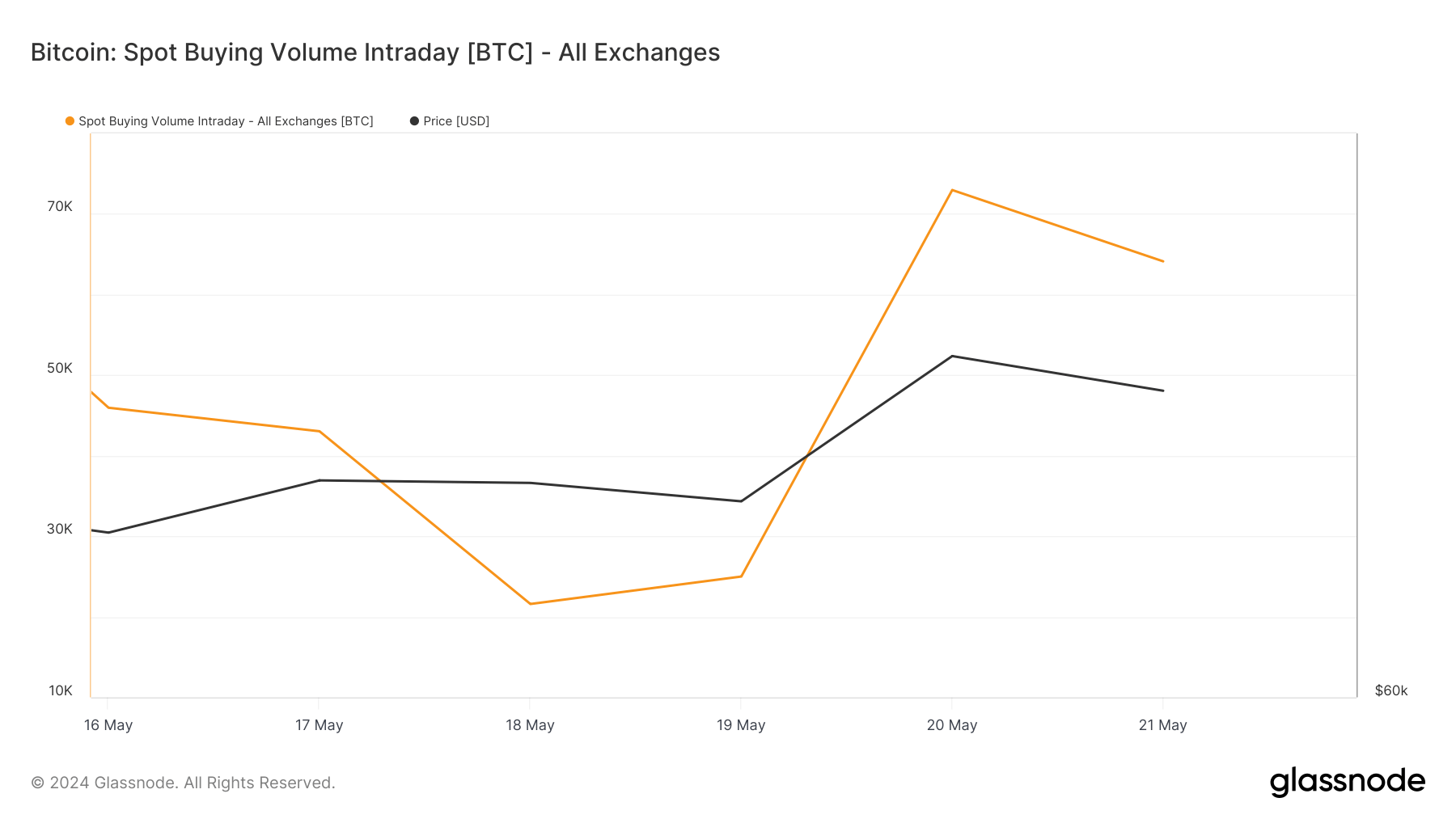

On May 20, Bitcoin’s terms surged to $71,409, starring to the accrued transportation measurement to exchanges (33,484 BTC) and a precocious spot buying measurement (72,971 BTC). However, determination was besides important outflow from exchanges (36,468 BTC), showing that portion immoderate investors capitalized connected the terms surge by selling, others continued buying, driven by bullish sentiment. On May 21, the inclination reversed with a nett inflow of 12,159 BTC.

Chart showing the nett travel of Bitcoin into/out of exchanges from May 9 to May 21, 2024 (Source: Glassnode)

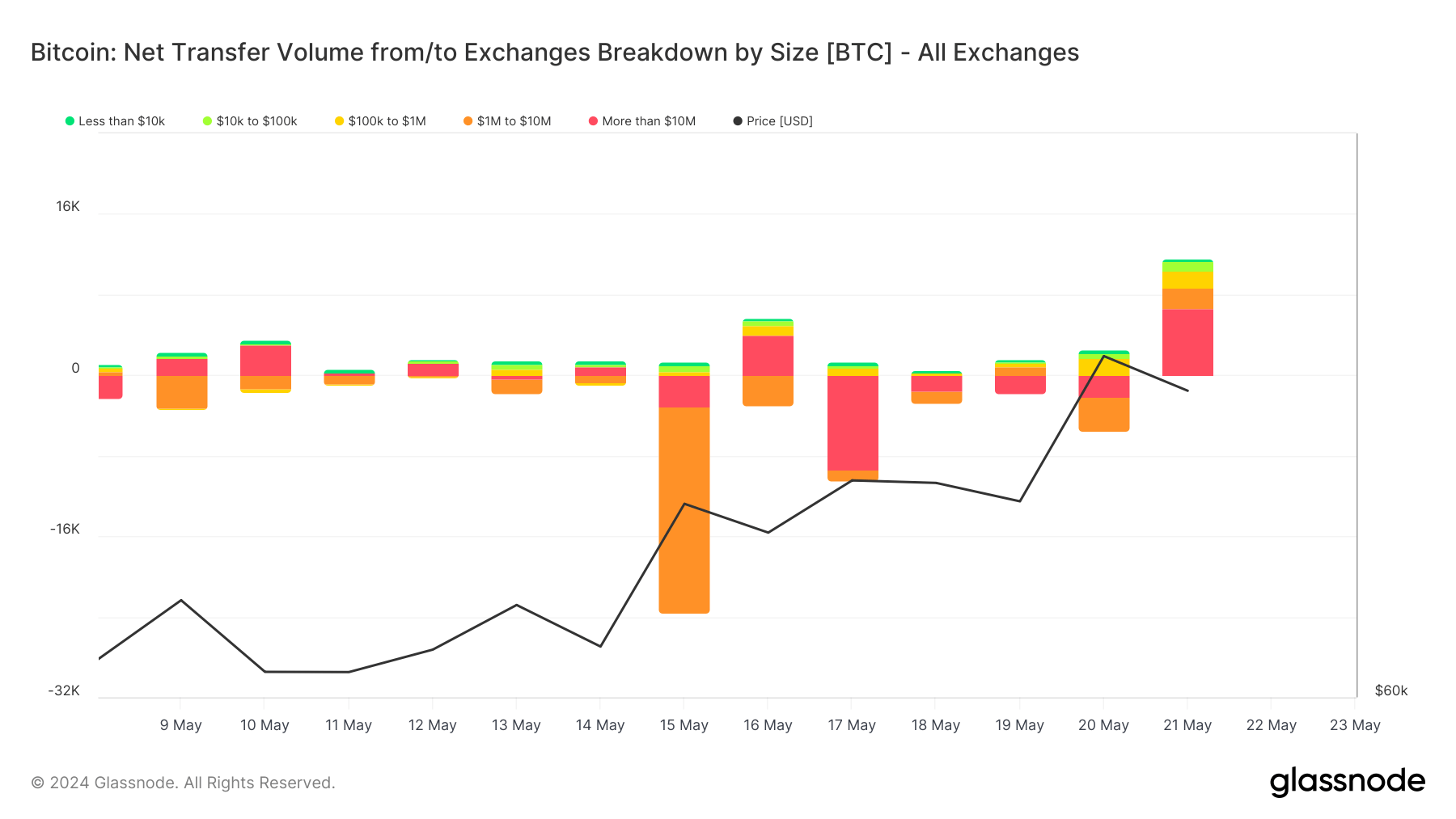

Chart showing the nett travel of Bitcoin into/out of exchanges from May 9 to May 21, 2024 (Source: Glassnode)The size breakdown of speech transportation volumes helps america amended recognize what benignant of traders are moving the spot market. The comparatively tiny nett inflows successful transfers of little than $100,000 suggest that retail investors were cautious but gradually accrued their holdings, reflecting increasing assurance successful the terms stableness oregon imaginable for aboriginal gains. Consistent inflows successful the $100,000 to $1 cardinal class connected some May 20 and May 21 amusement progressive information from larger retail and smaller organization investors, who apt perceived the surge arsenic a buying opportunity.

The nett outflow of -3,336 BTC successful the $1 cardinal to $10 cardinal class connected May 20 implies that immoderate ample holders took vantage of the terms highest to liquidate portions of their holdings. However, the reversal to a nett inflow of 2,109 BTC connected May 21 suggests that different ample investors oregon the aforesaid entities reinvested, perchance indicating a little profit-taking play followed by renewed accumulation. The important nett outflow of -2,183 BTC successful the transfers supra $10 cardinal connected May 20 contrasts sharply with the important inflow of 6,604 BTC connected May 21. This melodramatic displacement highlights strategical repositioning by precise ample investors, who initially sold into the terms highest but rapidly moved backmost into the market, perchance signaling semipermanent bullish sentiment oregon the usage of blase trading strategies to maximize profits.

Chart showing the breakdown of the nett travel of BTC into/out of exchanges by the USD worth of the transactions from May 9 to May 21, 2024 (Source: Glassnode)

Chart showing the breakdown of the nett travel of BTC into/out of exchanges by the USD worth of the transactions from May 9 to May 21, 2024 (Source: Glassnode)The market’s reactions to these flows are evident successful the intraday spot buying and selling volumes. On May 15, the spot buying measurement was 69,519 BTC, decreasing to 21,585 BTC connected May 18. A important summation occurred connected May 20, with the spot buying measurement peaking astatine 72,971 BTC earlier somewhat decreasing to 61,119 BTC connected May 21.

Graph showing the intraday spot Bitcoin buying measurement from May 16 to May 21, 2024 (Source: Glassnode)

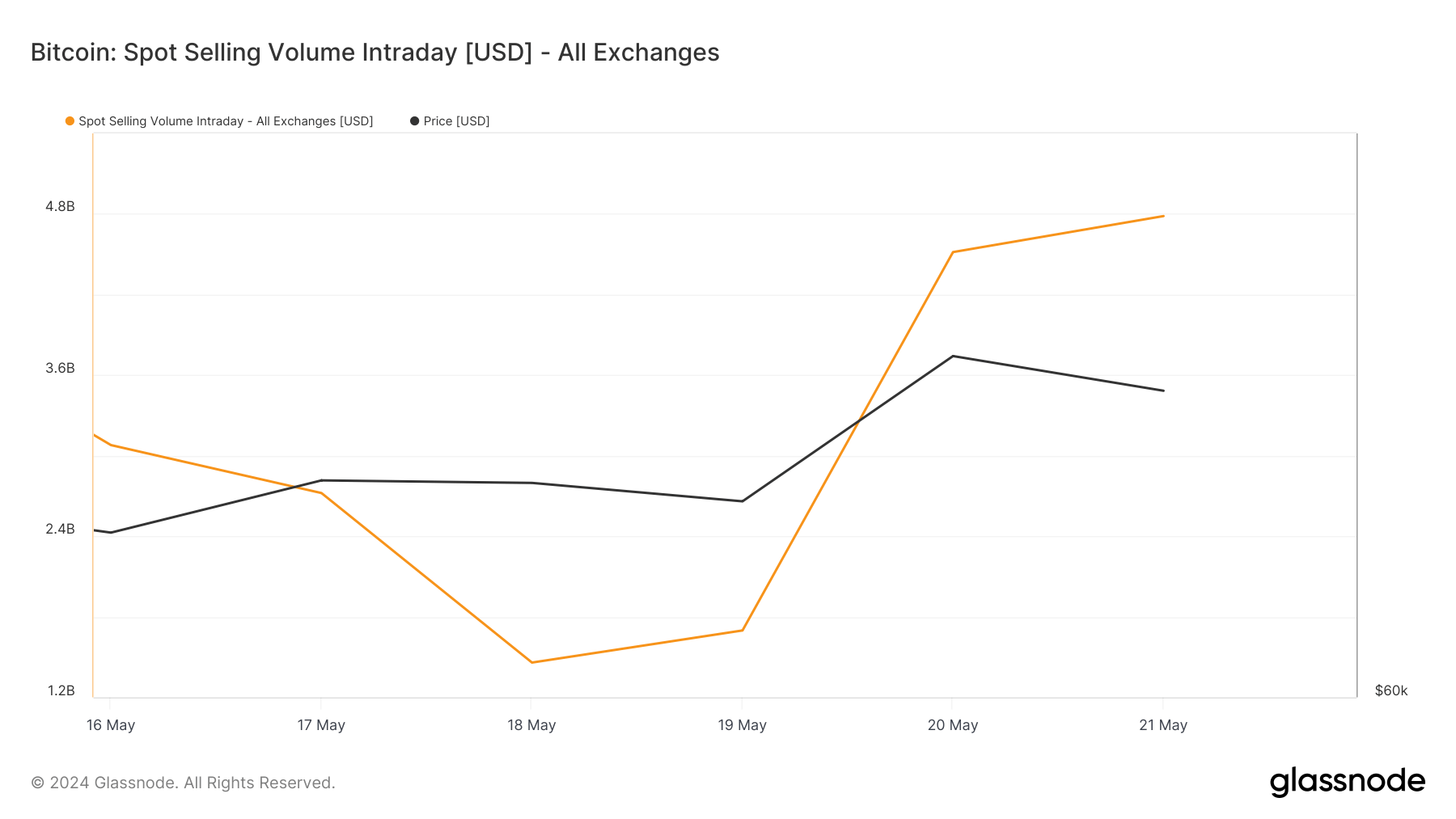

Graph showing the intraday spot Bitcoin buying measurement from May 16 to May 21, 2024 (Source: Glassnode)Spot selling volumes decreased from conscionable implicit $4 cardinal connected May 15 to $1.458 cardinal connected May 18. By May 20, the spot selling measurement accrued importantly to $4.516 cardinal and further to $4.784 cardinal connected May 21. While the accrued spot buying measurement reflects a emergence successful bullish sentiment, the corresponding precocious selling volumes amusement that a sizeable portion of the marketplace capitalized connected the terms increase.

Graph showing the intraday spot Bitcoin selling measurement from May 16 to May 21, 2024 (Source: Glassnode)

Graph showing the intraday spot Bitcoin selling measurement from May 16 to May 21, 2024 (Source: Glassnode)Glassnode’s information shows the marketplace is tense and acceptable to respond rapidly to insignificant changes successful Bitcoin’s price. While this absorption is emblematic for the derivatives market, we’ve besides begun seeing a likewise assertive effect successful the spot market. The swift reentrance to the marketplace from ample holders shows it lone takes a small upward volatility to reignite the content successful Bitcoin’s potential. Retail investors’ cautious accumulation points to a gradual build-up of confidence, perchance mounting the signifier for much sustained terms movements successful the future.

The station Bitcoin’s surge supra $70k sparked speech inflows appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

![Crypto News Today [Live] Updates On Feb 14, 2026](https://image.coinpedia.org/wp-content/uploads/2025/10/10162458/Crypto-News-Today-Live-Updates-October-10-1024x536.webp)

English (US)

English (US)