Bitcoin crossed the $57,000 people connected Feb. 27, reaching its highest level since November 2022. This surge, driving the terms from $54,000 to $57,300 wrong 24 hours, led galore to spot it arsenic the opening of a bull rally, particularly important successful a Bitcoin halving year.

Despite the blistering gains, the expected question of liquidations did not travel suit.

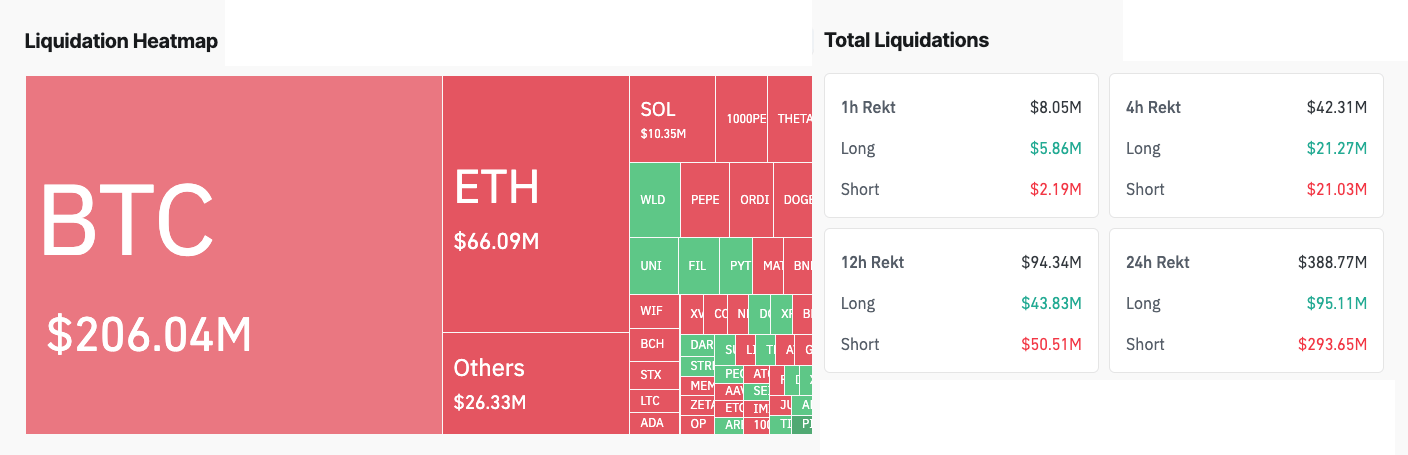

Between Feb. 26 and Feb. 27, 86,351 traders faced liquidation, cumulating to $387.15 cardinal crossed the board. However, Bitcoin-specific liquidations stood astatine astir $206 million. This figure, divided betwixt $175 cardinal successful shorts and $30 cardinal successful longs, indicates a marketplace thatremained resilient against monolithic liquidation triggers contrary to expectations.

Screengrab showing the 24-hour liquidations betwixt Feb. 26 and Feb. 27, 2024 (Source: CoinGlass)

Screengrab showing the 24-hour liquidations betwixt Feb. 26 and Feb. 27, 2024 (Source: CoinGlass)The comparatively muted effect successful presumption of liquidations pursuing Bitcoin’s crisp terms summation tin beryllium attributed to respective factors that cushion the interaction of specified volatile movements connected the market’s derivative segment.

Firstly, the organisation of liquidations indicates that the marketplace was not heavy leveraged. In scenarios wherever the marketplace sentiment is overwhelmingly bullish oregon bearish, a abrupt terms question against the bulk presumption tin trigger a cascade of liquidations.

However, the much balanced positioning successful this lawsuit suggests that traders were not excessively leaning towards a bearish outlook, which would person been much susceptible to being squeezed retired by the terms spike.

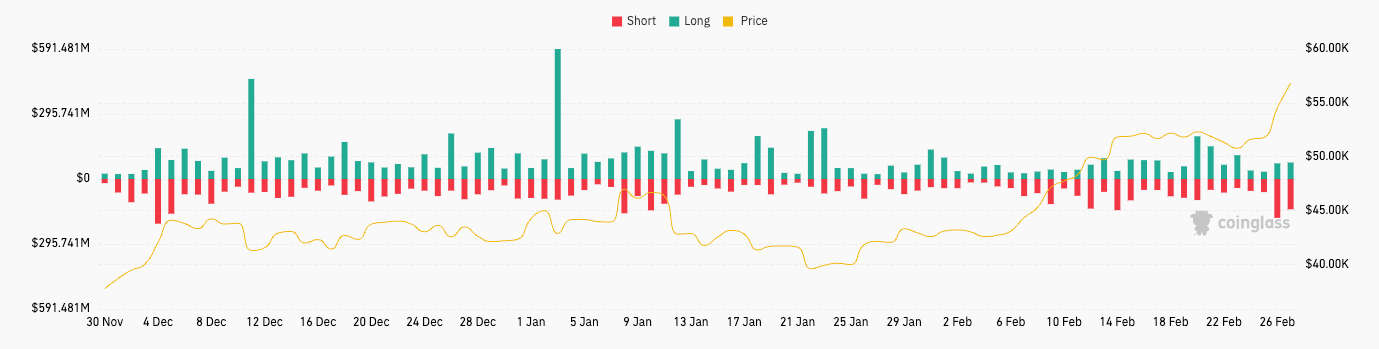

These balanced liquidations are not an outlier but alternatively portion of a accordant signifier observed successful caller weeks. The full magnitude of BTC liquidations connected Feb. 27, though significant, did not deviate markedly from the regular averages seen implicit the erstwhile weeks.

This steadiness suggests a displacement among marketplace participants towards much blimpish leverage levels and a much adjacent organisation crossed bullish and bearish positions. Such strategical positioning inherently buffers the marketplace against the daze of abrupt terms movements, mitigating the hazard of large-scale liquidations.

Graph showing the full Bitcoin liquidations from Nov. 30, 2023, to Feb. 27, 2024 (Source: CoinGlass)

Graph showing the full Bitcoin liquidations from Nov. 30, 2023, to Feb. 27, 2024 (Source: CoinGlass)This is successful enactment with CryptoSlate’s erstwhile analysis of the derivatives market, which recovered an astir adjacent divided betwixt calls and puts successful Bitcoin options. While the emergence successful unfastened involvement successful February signaled a ascendant bullish outlook successful the market, the balanced call-to-put ratio showed caution among traders.

This caution, seen successful the noticeable uptick successful antiaircraft strategies and bearish bets, was apt what prevented a domino effect of cascading abbreviated liquidations that could person eroded Bitcoin’s gains for the day.

The station Bitcoin’s surge to $57K did not effect successful liquidation storm, defying expected trend appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)