There are galore antithetic ways to quantify marketplace sentiment. Looking astatine terms enactment provides a precise crude but effectual gauge of the market’s feelings — if the terms is going down, the market’s astir apt bearish, and vice versa. However, feelings astir the aboriginal are precise analyzable to analyze, particularly erstwhile it comes to Bitcoin, and on-chain data helps america spot done the galore layers of marketplace sentiment.

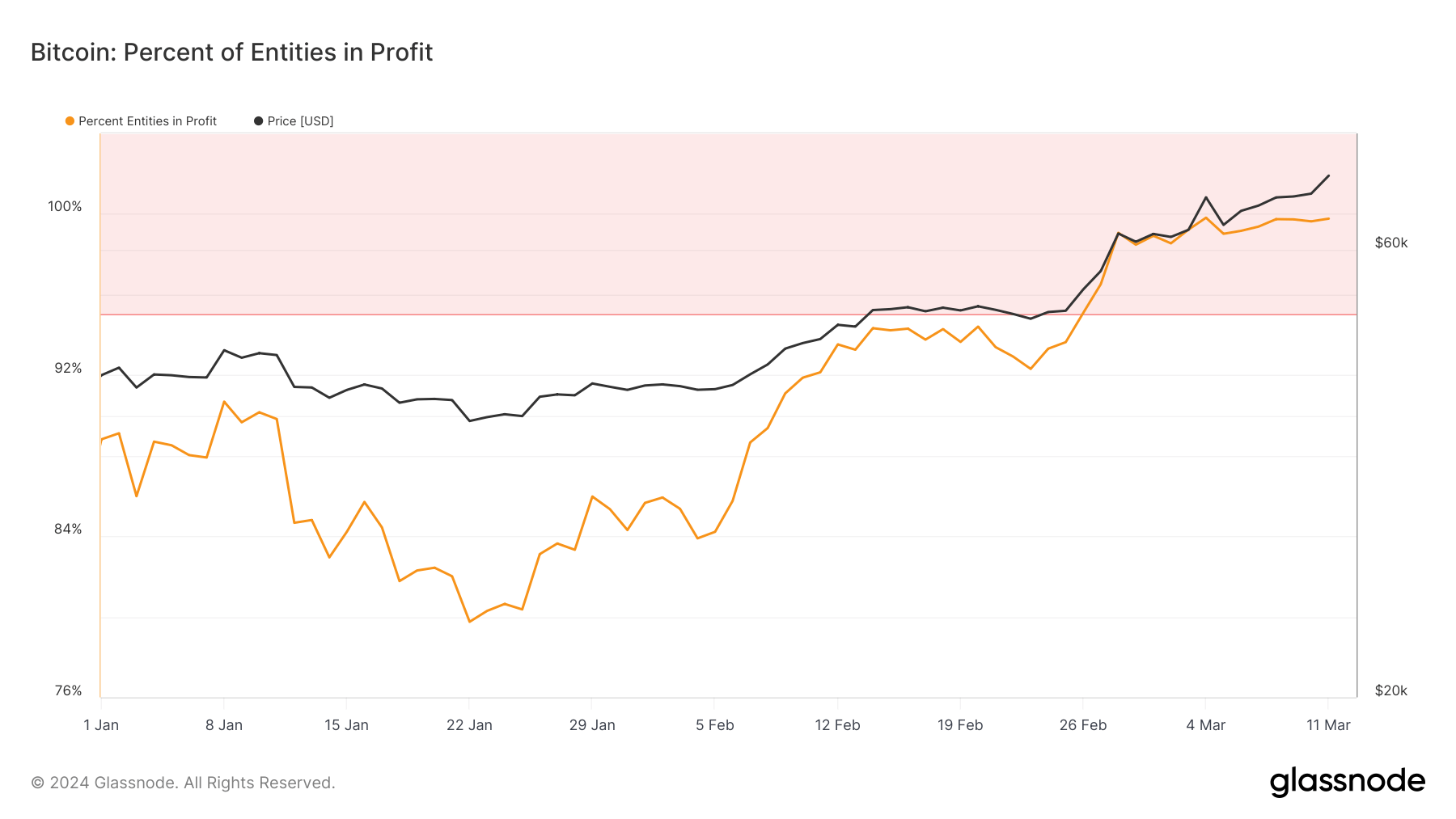

Few on-chain metrics measurement marketplace sentiment amended than the percent of addresses and entities successful profit. These metrics look astatine the percent of unsocial addresses and entities whose funds person an mean bargain terms little than Bitcoin’s existent price. Glassnode defines ‘buy price’ arsenic the terms astatine the clip the coins were transferred into an code oregon entity.

The favoritism betwixt entities and addresses present helps america supply a much nuanced marketplace analysis. Entities, which whitethorn power aggregate addresses, springiness a much close practice of capitalist sentiment and behavior, arsenic focusing connected idiosyncratic addresses fails to supply a implicit representation of the market’s profitability.

According to information from Glassnode, determination person ne'er been much addresses and entities successful nett successful the past of Bitcoin. This morning, with Bitcoin’s terms lasting astatine conscionable supra $72,000, 99.76% of entities and 99.74% of addresses were successful profit. The US Market Open has again created immoderate volatility, wiping retired leverage and causing Bitcoin to commercialized betwixt $72,920 and $70,145.

Graph showing the percent of Bitcoin entities successful nett from Jan. 1 to Mar. 11, 2024 (Source: Glassnode)

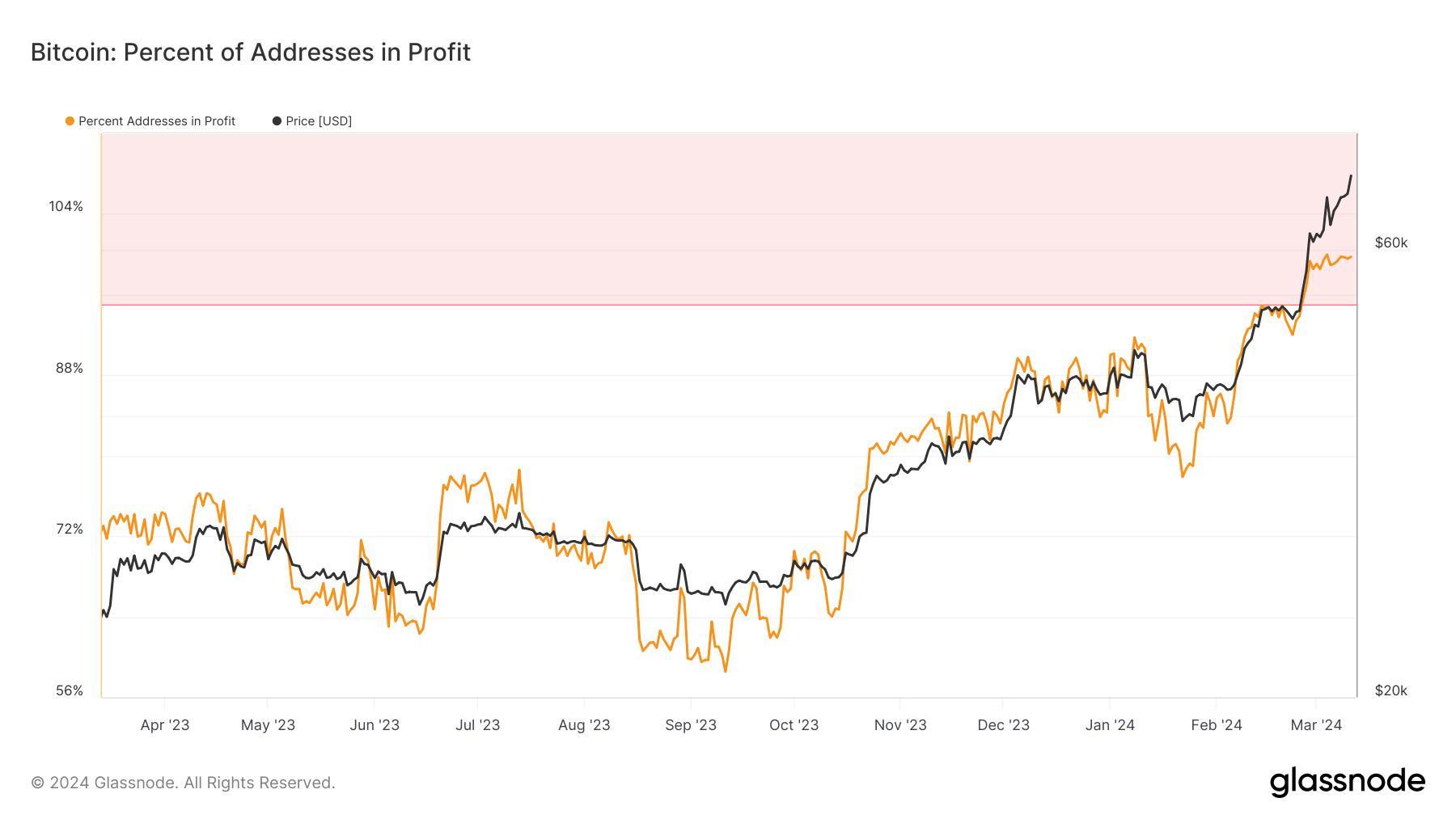

Graph showing the percent of Bitcoin entities successful nett from Jan. 1 to Mar. 11, 2024 (Source: Glassnode) Graph showing the percent of Bitcoin addresses successful nett from Mar. 14, 2023, to Mar. 11, 2024 (Source: Glassnode)

Graph showing the percent of Bitcoin addresses successful nett from Mar. 14, 2023, to Mar. 11, 2024 (Source: Glassnode)Historically, erstwhile the percent of profitable entities and addresses surpassed 95%, it indicated the opening of a mature signifier of a bull cycle, wherever the overwhelming bulk of marketplace participants person accumulated gains. Historical information from Glassnode shows that this profitability threshold was usually maintained for astir a period earlier experiencing a correction. It suggests a signifier wherever highest profitability precedes marketplace retractions, which aligns with the accustomed bull marketplace drawdowns. Corrections often travel periods of accelerated terms appreciation arsenic they usually propulsion a important magnitude of investors to realize their gains, thereby expanding selling pressure.

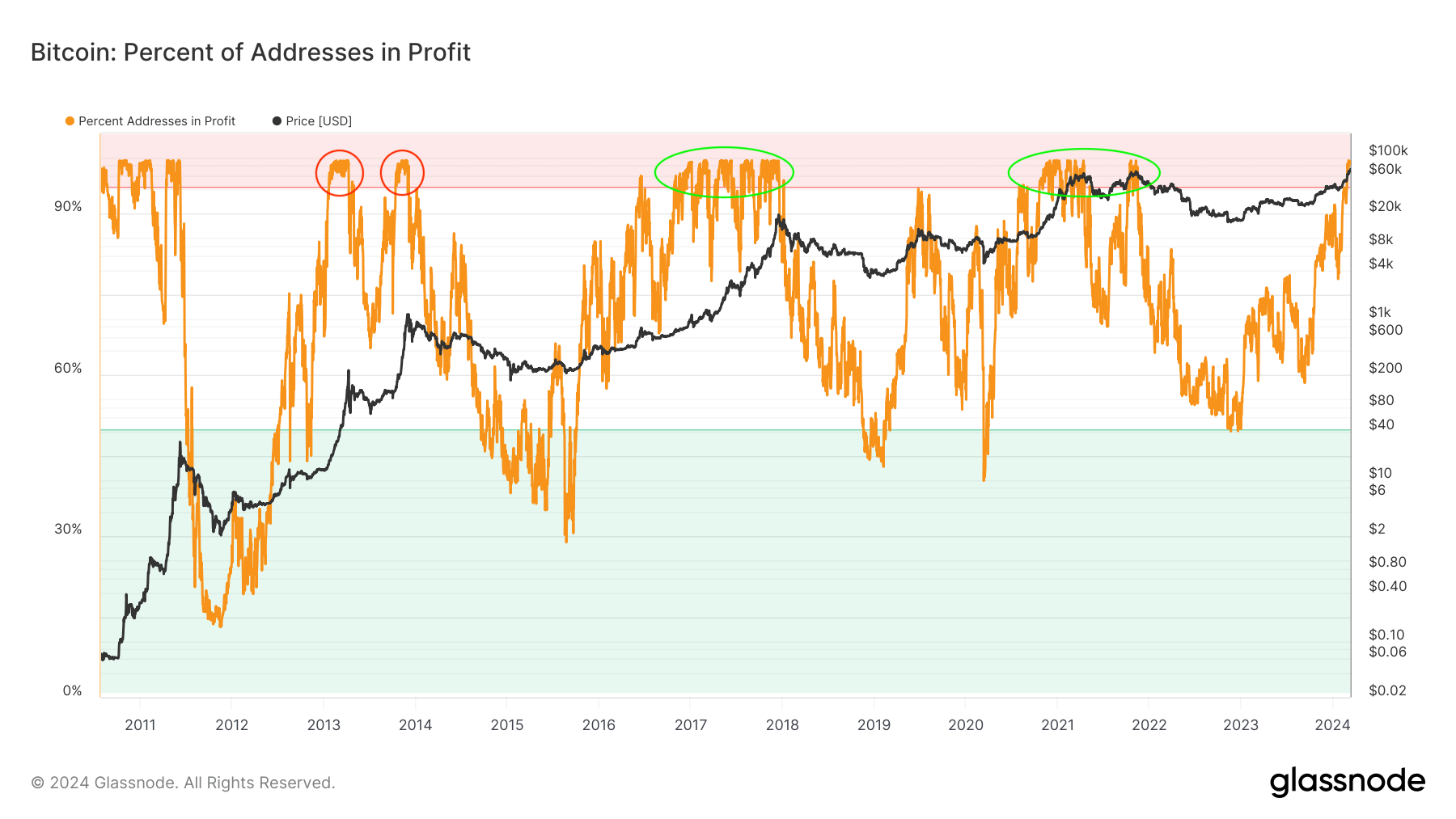

However, zooming retired and looking astatine the 2 erstwhile bull cycles shows that the percent of profitable addresses and entities remained supra 95% for astir a twelvemonth contempt the corrections. These extended periods of profitability apt contributed to establishing a stronger content successful Bitcoin’s semipermanent value, encouraging traders and investors to clasp onto their coins contempt short-term volatility.

Graph showing the percent of Bitcoin addresses successful nett from Aug. 5, 2010, to Mar. 11, 2024 (Source: Glassnode)

Graph showing the percent of Bitcoin addresses successful nett from Aug. 5, 2010, to Mar. 11, 2024 (Source: Glassnode)The existent authorities of the market, with a record-high percent of profitable entities and addresses, shows there’s nary shortage of bullishness. However, fixed that it’s been astir 3 weeks since the profitability has been supra 95%, there’s besides country for caution. Historical patterns amusement that these levels of profitability tin ne'er beryllium sustained for agelong periods of clip without corrections.

Whether the existent rhythm volition reflector the extended profitability periods seen successful the past 2 bull cycles oregon revert to the shorter spans remains to beryllium seen. Nonetheless, the maturity of the market, combined with the accrued organization adoption of Bitcoin owed to spot Bitcoin ETFs, tin perchance disrupt humanities patterns.

The station Bitcoin’s surge to $73k enactment 99.76% of entities successful profit, signaling mature signifier of bull market appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)