Financial markets are sending mixed signals arsenic uncertainty reaches caller highs. On Feb. 25, the US indebtedness ceiling was raised from $36.1 trillion to $40.1 trillion, marking different monolithic enlargement successful authorities borrowing.

Following a humanities pattern, the benchmark 10-year Treasury output reacted to the quality by dropping from 4.4% to 4.29%. While this whitethorn look counterintuitive, markets thin to construe indebtedness ceiling resolutions arsenic stabilizing events, reducing near-term uncertainty adjacent if they connote higher borrowing down the line.

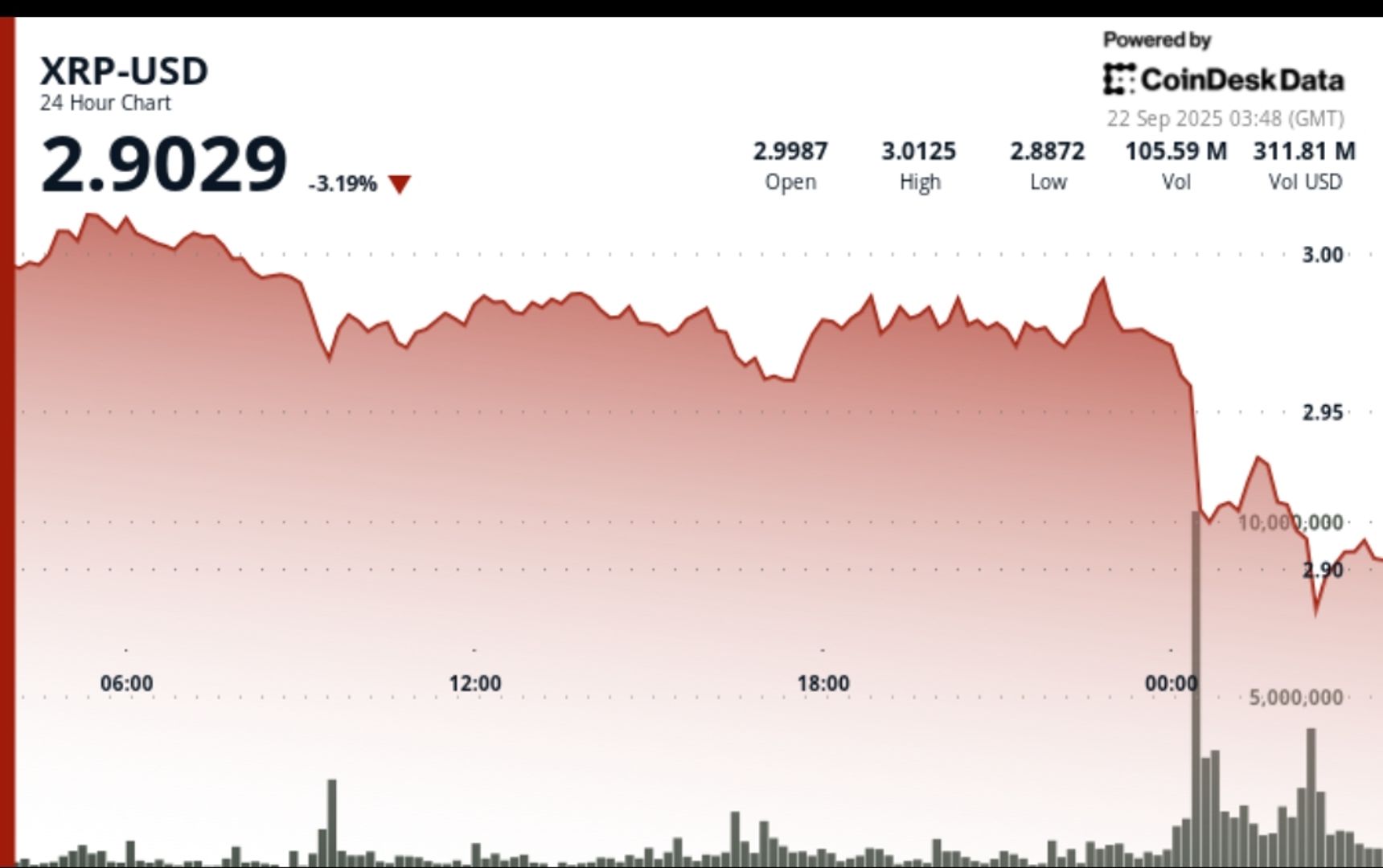

However, the banal and crypto markets, which usually payment from little enslaved yields arsenic superior rotates into hazard assets, person continued their autumn that started past week. Since Feb. 21, the S&P 500 has mislaid 3%, the Nasdaq100 has dropped 5%, and Bitcoin has plunged 16%. The starring cryptocurrency is present trading 26% beneath its all-time precocious reached connected President Donald Trump’s Inauguration Day, efficaciously erasing the Trump pump.

A simultaneous diminution successful stocks and enslaved yields is not emblematic marketplace behaviour and suggests increasing hazard aversion and economical slowdown fears.

Economic uncertainty looms implicit markets

Recent US economical information released connected Feb. 21 has shown notable signs of weakness. The University of Michigan’s user sentiment scale fell to 64.7 successful February, down from 71.7 successful January. This marks the lowest level since November 2023 and came successful beneath the preliminary estimation of 67.8, which was besides the statement forecast among economists polled by Reuters.

Existing location income dropped 4.9%, and the S&P Global Purchasing Managers’ Index (PMI) fell from 52.7 successful January to 50.4, the lowest since Sept. 2023. PMI tracks manufacturing and services activity, and a speechmaking hardly supra the 50 threshold that separates enlargement from contraction indicates stagnating maturation successful the backstage sector.

Trade tensions adhd to marketplace uncertainty. On Feb. 24, Trump said that tariffs connected Canada and Mexico “will spell forward” aft the deadline for the monthlong hold ends adjacent week. Trump’s program to enforce 25% tariffs connected the European Union, revealed connected Feb. 26, and an further 10% levy connected Chinese goods added to the increasing marketplace anxiety

In commentary to CNBC, Chris Rupkey, Chief Economist astatine FWDBonds, unapologetically said,

“The system is astir to person the rug pulled retired from nether it arsenic Washington policies are causing a accelerated nonaccomplishment of assurance connected the portion of consumers.”Rupkey elaborated, “The system is coming successful for a clang landing this year. Bet connected it. The enslaved marketplace is.”

In the crypto market, the Fear & Greed Index has plunged to 10, oregon Extreme Fear - a stark opposition to the Greed levels seen astatine the opening of February.

Crypto Fear & Greed Index. Source: alternative.me

A tiny situation to warrant quantitative easing?

In January, erstwhile BitMEX CEO Arthur Hayes speculated that a conflict implicit the indebtedness ceiling—combined with a reluctance to walk down the Treasury General Account—could propulsion 10-year Treasury yields supra 5%, triggering a banal marketplace clang and forcing the the Federal Reserve to intervene.

In his view, this could assistance President Trump to unit the Fed into adopting a mode dovish stance. In different words, a tiny situation to warrant the QE and stimulate the economy.

For Hayes, this mini-crisis indispensable hap aboriginal successful Trump’s presidency, during Q1 oregon Q2, truthful helium could blasted it connected the leverage built up during the Biden administration.

“A mini fiscal situation successful the US would supply the monetary mana crypto craves. It would besides beryllium politically expedient for Trump. I deliberation we propulsion backmost to the erstwhile all-time precocious and springiness backmost each of the Trump bump.”Ironically, adjacent though the indebtedness ceiling was raised with minimal drama, and 10-year Treasury yields person really fallen, the banal marketplace inactive dropped. The astir pressing question present is whether this volition pb to involvement complaint cuts.

The Fed remains neutral, with caller economical information providing small crushed for an imminent argumentation shift. The latest CPI study connected Feb. 11 showed ostentation accelerating to 0.5% month-over-month, pushing the yearly complaint to 3%, some exceeding expectations. Fed Chair Jerome Powell has emphasized that the cardinal slope won’t unreserved to chopped rates further. Despite this position, a operation of weakening economical indicators and liquidity enlargement whitethorn yet unit the Fed’s manus aboriginal this year.

Related: Short-term crypto traders sent grounds 79.3K Bitcoin to exchanges arsenic BTC crashed to $86K

Bitcoin terms and M2 changes person antithetic paces

Despite the existent marketplace downturn, not each anticipation is lost, arsenic a monolithic question of liquidity enlargement could beryllium connected the horizon. The expanding M2 planetary liquidity supply could respire caller aerial into the risk-on markets, particularly Bitcoin. However, this mightiness instrumentality immoderate time.

The M2 Global Liquidity Index 3-Month Offset provides a utile model for forecasting liquidity-driven marketplace movements. This indicator shifts M2 wealth proviso information guardant by 3 months to analyse its narration with hazard assets.

Crypto expert Crypto Rover highlighted this connected X, stating:

“Global liquidity strengthening significantly. Bitcoin volition travel soon.”Bitcoin vs M2 Global Liquidity Index (3M offset). Source: CryptoRover

The humanities show shows that BTC usually lags astir 60 days down large planetary liquidity movements. The existent driblet inscribes perfectly into this picture, which besides promises a beardown rebound by June if liquidity trends hold.

Jeff Park, caput of Alpha Strategies astatine Bitwise, echoed the sentiment:

“Bitcoin tin surely spell little successful the abbreviated word arsenic it thrives connected inclination and volatility, some precocious absent. But astute organization investors don’t request to drawback each wave; they conscionable can’t miss the biggest one. And the biggest question of planetary liquidity is coming this year.”Jamie Coutts, a crypto expert from Realvision, besides shared his views connected however liquidity enlargement impacts Bitcoin price.

“2 of 3 halfway liquidity measures successful my model [global wealth proviso and cardinal slope equilibrium sheets] person turned bullish this period arsenic markets dive. Historically, this has been precise favorable for Bitcoin. Dollar is the adjacent domino. Confluence is king.”Macro and Liquidity Dashboard. Source: Jamie Coutts

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

6 months ago

6 months ago

English (US)

English (US)