According to CoinShares’ latest weekly fund travel report, crypto concern products saw their largest inflows successful 5 weeks, with $533 cardinal pouring into the sector.

James Butterfill, caput of probe astatine CoinShares, explained that these inflows followed remarks by US Federal Reserve Chair Jerome Powell astatine the Jackson Hole Symposium past week.

At the event, Powell hinted that the marketplace mightiness expect involvement complaint cuts successful September, which galore marketplace observers suggested were bullish for Bitcoin and different crypto.

This connection besides appeared to person boosted trading volumes, with past week’s measurement reaching $9 billion, importantly higher than successful erstwhile weeks.

Bitcoin, US lead

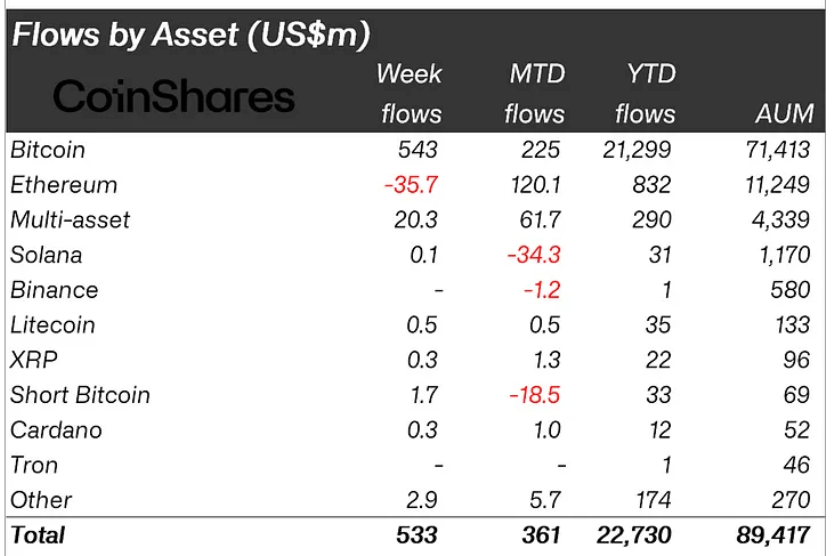

Bitcoin dominated the inflows, with $543 million, astir of which occurred connected Friday aft Powell’s dovish comments. Butterfill stated that this further indicated Bitcoin’s sensitivity to involvement complaint expectations.

Interestingly, the bullish sentiment besides attracted abbreviated trades, with $1.7 cardinal flowing into Short BTC products.

Table showing the YTD, MTD, and play flows for crypto products connected Aug. 26, 2024 (Source: CoinShares)

Table showing the YTD, MTD, and play flows for crypto products connected Aug. 26, 2024 (Source: CoinShares)Conversely, Ethereum faced outflows totaling $36 cardinal past week. This whitethorn beryllium owed to continued investors’ exit from Grayscale’s Ethereum Trust. Butterfill wrote:

“Although caller issuers proceed to spot inflows with the Grayscale Ethereum spot offsetting this with $118 cardinal outflows.”

Despite this, the recently launched Ethereum ETFs successful the US person accumulated $3.1 cardinal successful inflows, which partially offsets the $2.5 cardinal outflow from the Grayscale Trust.

Meanwhile, blockchain equities recorded inflows for the 3rd consecutive week, totaling $4.8 million. Other integer assets similar Solana, XRP, and Litecoin saw combined inflows of astir $1 million.

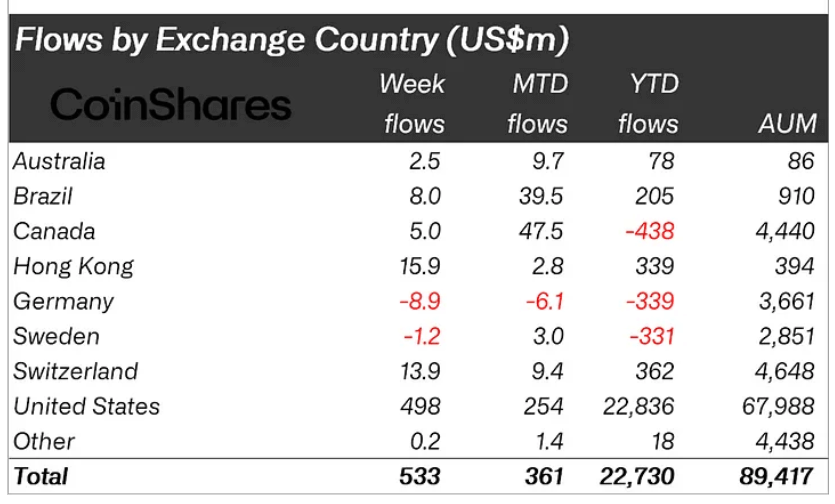

Across regions, the United States unsurprisingly accounted for the bulk of the full inflows, with $498 million. Hong Kong and Switzerland besides saw important inflows, reaching $16 cardinal and $14 million, respectively.

Table showing the YTD, MTD, and play flows for crypto products crossed countries connected Aug. 26, 2024 (Source: CoinShares)

Table showing the YTD, MTD, and play flows for crypto products crossed countries connected Aug. 26, 2024 (Source: CoinShares)In contrast, Germany experienced insignificant outflows totaling $9 million, making it 1 of the fewer countries with a year-to-date nett outflow.

The station Bitcoin sees $543 cardinal successful inflows aft Powell’s dovish remarks appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)