CoinShares’ latest play report highlighted a notable displacement successful crypto concern products, with the assemblage experiencing its astir important outflows successful 3 months.

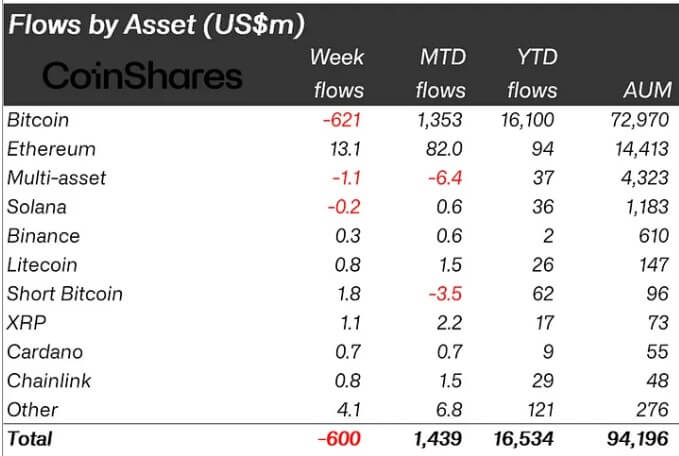

Last week, investors pulled $600 cardinal from the market, with Bitcoin products bearing the brunt, facing $621 cardinal successful outflows.

Meanwhile, short-Bitcoin products saw astir $2 cardinal successful inflows, reflecting the bearish sentiment.

James Butterfill, CoinShares’ caput of research, attributed these shifting sentiments to a “more hawkish-than-expected FOMC meeting.” Last week, the Federal Open Market Committee of the US Federal Reserve decided to support the existent involvement rate, which galore experts suggested meant determination would beryllium lone 1 imaginable complaint chopped this year.

Butterfill explained that this determination has forced investors to trim their vulnerability to fixed-supply assets similar Bitcoin. He added:

“These outflows and caller terms sell-off saw full assets nether absorption (AuM) autumn from supra $100 cardinal to $94 cardinal implicit the week.”

Meanwhile, the bearish inclination successful the US appeared to person impacted different countries. Canada, Switzerland, and Sweden saw outflows of $15 million, $24 million, and $15 million, respectively. On the different hand, Australia, Brazil, and Germany saw humble inflows of $1.7 million, $700,000, and $17.4 million, respectively.

Moreover, the trading measurement for crypto ETPs was $11 cardinal past week, importantly little than the $22 cardinal play average. Despite this, these products accounted for 31% of each trading volumes connected large exchanges.

Inflows proceed successful altcoin.

Despite the bearish inclination for Bitcoin, astir altcoins had a affirmative week, attracting important funds.

Crypto ETP Flows (Source: CoinShares)

Crypto ETP Flows (Source: CoinShares)Ethereum continued its upward trajectory with an further $13.1 cardinal successful inflows, bringing its month-to-date full to $82 million. Its turnaround tin beryllium attributed to the highly anticipated motorboat of spot Ethereum exchange-traded money (ETF) products successful the US, which experts judge would heighten marketplace accessibility for the emerging industry.

Meanwhile, different altcoins similar Cardano and Lido attracted much than $1 million, portion different assets similar Litecoin, Chainlink, and others saw humble flows.

The station Bitcoin sees $621 cardinal outflow arsenic investors respond to Fed’s cautious stance appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)