The crypto marketplace is undergoing a important correction arsenic investors withdrew $584 cardinal from crypto-related concern products past week, according to CoinShares’ latest report.

Additionally, planetary trading volumes for crypto ETPs deed their lowest levels since the US Securities and Exchange Commission approved the motorboat of respective spot Bitcoin exchange-traded funds (ETFs) successful January, totaling conscionable $6.9 cardinal for the week.

This diminution continues a inclination from the erstwhile week, wherever investors pulled retired astir $600 million, bringing the two-week full to astir $1.2 cardinal successful outflows.

James Butterfill, the caput of probe astatine CoinShares, commented:

“We judge this is successful absorption to the pessimism amongst investors regarding the imaginable of involvement complaint cuts by the FED this year.”

Bitcoin and US pb outflows

Bitcoin concern products saw the astir important outflows, totaling $630 million. Bitcoin ETPs experienced six consecutive days of outflows successful the US, chiefly from Grayscale Bitcoin ETF and Fidelity’s FBTC.

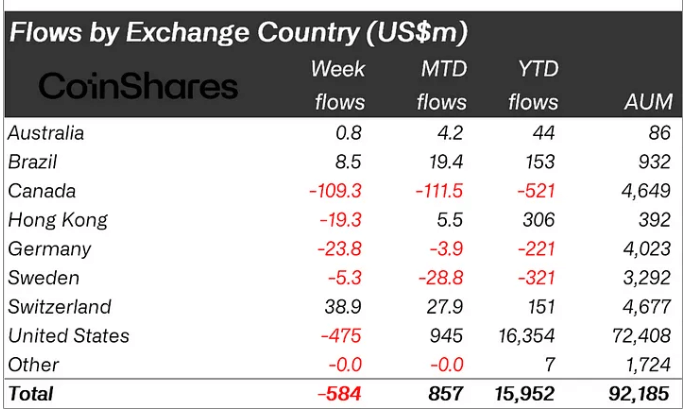

Canada besides witnessed important outflows from crypto ETPs, with $109 cardinal withdrawn. This was followed by Germany and Hong Kong, which saw outflows of $24 cardinal and $19 million, respectively.

Crypto ETP Flows by Country (Source: CoinShares)

Crypto ETP Flows by Country (Source: CoinShares)Conversely, Switzerland and Brazil recorded inflows of $39 cardinal and $48.5 million, respectively, helping to offset the wide outflows.

Investors with bearish sentiments besides withdrew astir $1.2 cardinal from abbreviated Bitcoin products.

Meanwhile, Ethereum joined the outflow trend, seeing its archetypal withdrawals successful weeks, totaling astir $58 million. This reduced its month-to-date travel to astir $23 cardinal from $82 million.

Altcoins beryllium attractive

Despite the outflows from the large integer asset, multi-asset concern products and immoderate altcoins saw important inflows.

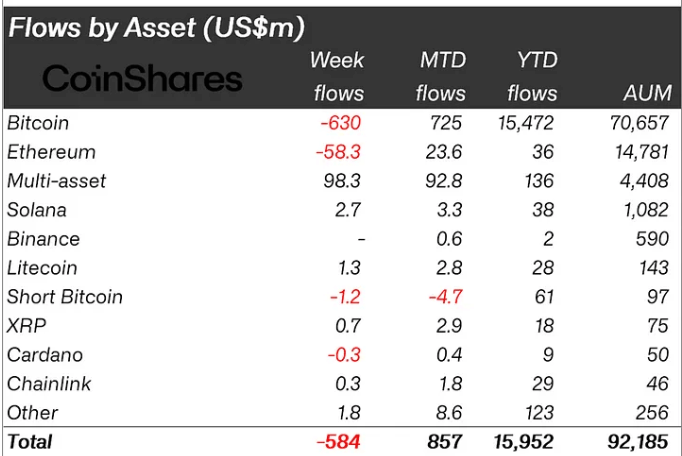

Crypto ETP Flows (Source: CoinShares)

Crypto ETP Flows (Source: CoinShares)According to CoinShares, multi-asset products attracted implicit $98 million, portion Solana, Litecoin, and Polygon received $2.7 million, $1.3 million, and $1 million, respectively.

Butterfill explained that these inflows bespeak a caller capitalist absorption connected altcoins. He stated:

“[These inflows] suggest investors presumption the weakness successful the altcoin marketplace arsenic a buying opportunity.”

The station Bitcoin sees $630 cardinal outflow arsenic crypto ETP trading measurement hits caller debased amid market’s ‘true correction’ appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)