The U.S Bureau of Labor Statistics (BLS) released its nonfarm payroll showing employment had accrued by 528,000 successful July. This was much than doubly Wall Street’s expectations of a 258,000 increase.

According to the figures, U.S unemployment present stands astatine 3.5%, beating analysts’ expectations of a 3.6% unemployment rate.

Stocks and Bitcoin initially reacted negatively pursuing the news.

Fed nether unit to combat inflation

Wage maturation besides jumped higher, with July Average Hourly Earning up 5.2% year-over-year, smashing expectations of a 4.9% increase.

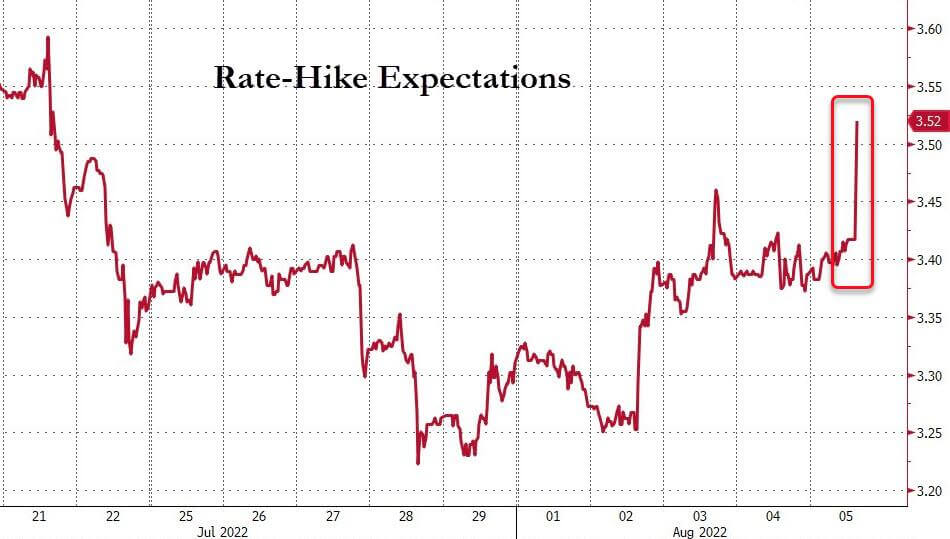

All of which puts further unit connected the Fed to proceed its program of complaint hikes to stave disconnected runaway ostentation – which is moving astatine a 40-year precocious of 9.1%.

Tom Kozlik, the Head of Municipal Research and Analytics astatine HilltopSecurities, commented that the occupation numbers were a surprise. He added that determination is “NO recession yet. Also means much assertive Fed enactment apt to travel arsenic well.”

On July 27, the Fed passed its 2nd consecutive 75 ground constituent hike, taking the benchmark complaint to 2.25%-2.5%. CNBC reported that this was the “most stringent consecutive action” since the aboriginal 1990s.

As a result, galore expected the cardinal slope to enact a little complaint summation successful the 25 – 50 basis-point scope pursuing the FOMC meeting, scheduled for Sept. 20-21.

However, quality of a reddish blistery labour marketplace volition mean the Fed volition apt spell harder with different 75 ground constituent hike. Analysts enactment a 70% accidental of this happening erstwhile Fed officials reconvene aft the summertime break.

Bitcoin and stocks down

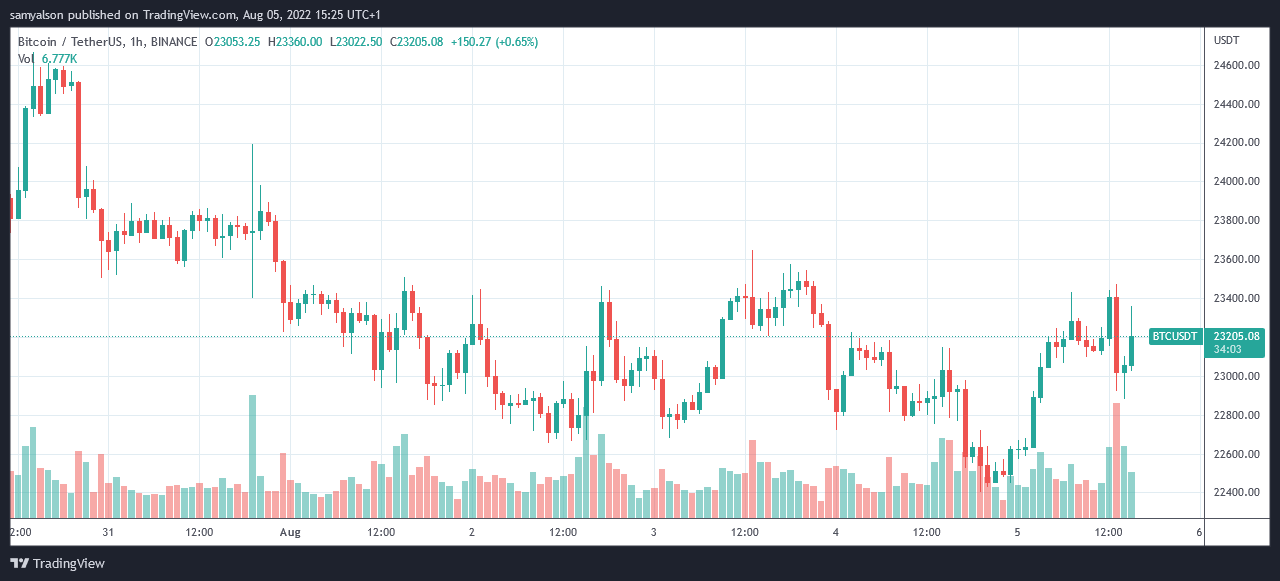

Following the news, Bitcoin saw a 2% plaything to the downside connected the 13:00 (GMT) hourly candle. Since then, a section bottommost of $22,800 was reached, fueling a fightback from bulls to instrumentality BTC astir level to the precocious constituent of the 13:00 candle.

Source: BTCUSDT connected TradingView.com

Source: BTCUSDT connected TradingView.comMeanwhile, the Dow Jones, S&P 500, and Nasdaq are each moving flimsy sell-offs. The quality has sparked expectations that the Fed volition beryllium forced to enactment and clamp down harder connected the overheating economy.

The station Bitcoin sees insignificant merchantability disconnected aft US payroll information beats expectations appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)