The proviso of Bitcoin held by semipermanent holders has accrued importantly successful the past month, present undoubtedly reversing the declining inclination that’s been ascendant since the opening of the year. Long-term holder proviso is simply a precise utile metric for knowing the sentiment of a much blase portion of the market, arsenic it reflects the behavior of investors who are little apt to merchantability their holdings successful effect to short-term terms fluctuations.

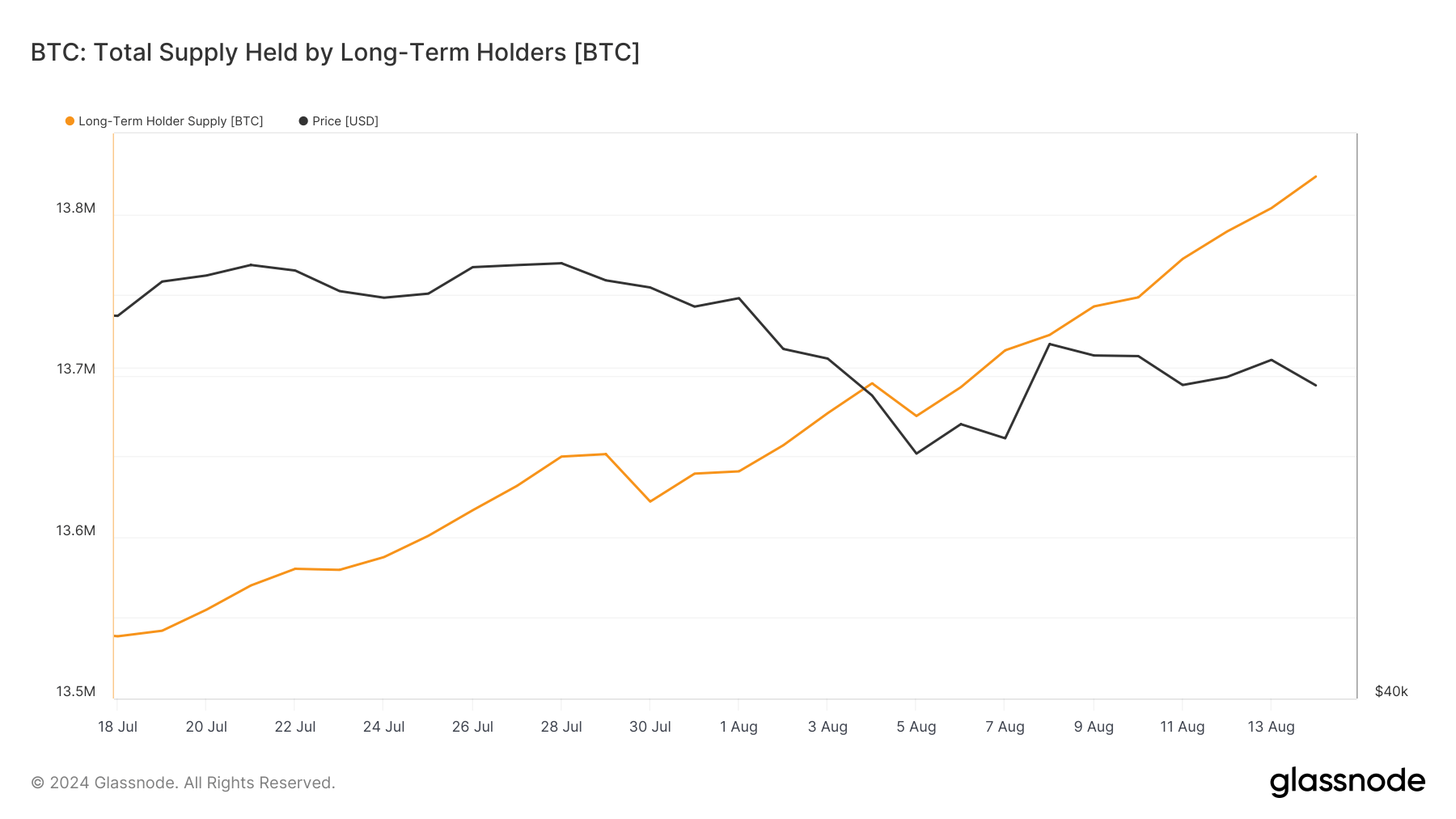

Between Jul. 18 and Aug. 14, the semipermanent holder proviso grew from 13,538,543 to 13,823,283 cardinal BTC, representing a important summation of 284,740 BTC. While this maturation is noteworthy successful itself, it becomes adjacent much important arsenic it comes aft a play of sizeable diminution successful LTH proviso earlier successful the year.

Graph showing the full Bitcoin proviso held by semipermanent holders from July 18 to Aug. 14, 2024 (Source: Glassnode)

Graph showing the full Bitcoin proviso held by semipermanent holders from July 18 to Aug. 14, 2024 (Source: Glassnode)The inclination reversal began connected May 4 and continued for 2 months, aft which a little two-week alteration successful LTH proviso correlated with Bitcoin’s terms increase.

Tracking LTH proviso is important due to the fact that it provides invaluable insights into imaginable aboriginal terms movements. Long-term holders are typically considered much committed investors who are little apt to merchantability their Bitcoin successful effect to short-term terms fluctuations. As a result, an summation successful LTH proviso mostly indicates a simplification successful the magnitude of Bitcoin disposable for trading, perchance starring to decreased marketplace volatility and accrued terms stability.

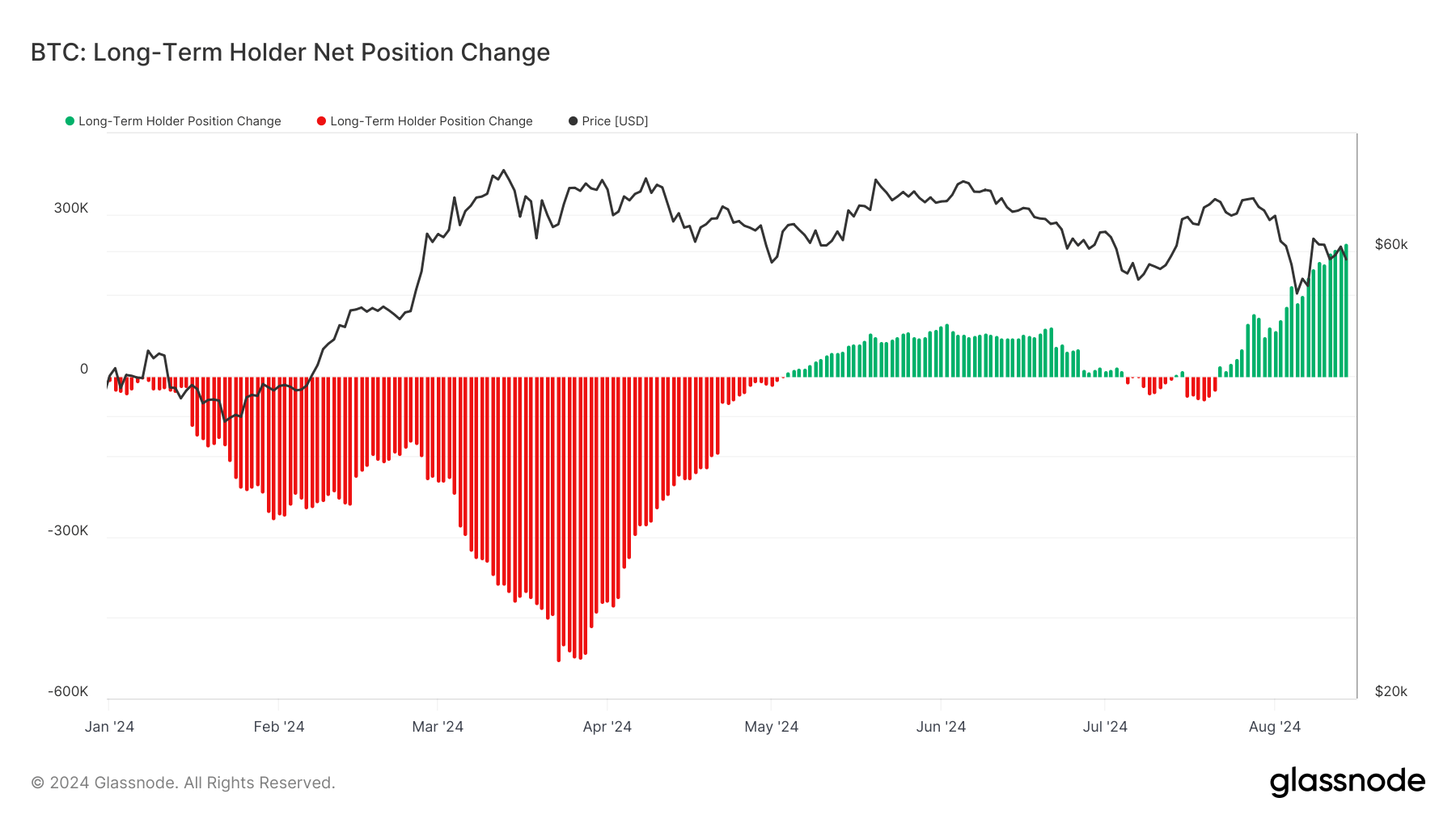

Chart showing the 30-day alteration successful the Bitcoin proviso held by semipermanent holders from Jan. 1 to Aug. 14, 2024 (Source: Glassnode)

Chart showing the 30-day alteration successful the Bitcoin proviso held by semipermanent holders from Jan. 1 to Aug. 14, 2024 (Source: Glassnode)The caller surge successful LTH supply, peculiarly the largest 30-day alteration recorded connected Aug. 14 with 246,196 BTC added, is simply a important improvement that warrants further analysis. This summation shows increasing assurance among investors, who take to clasp onto their Bitcoin for longer periods contempt terms volatility.

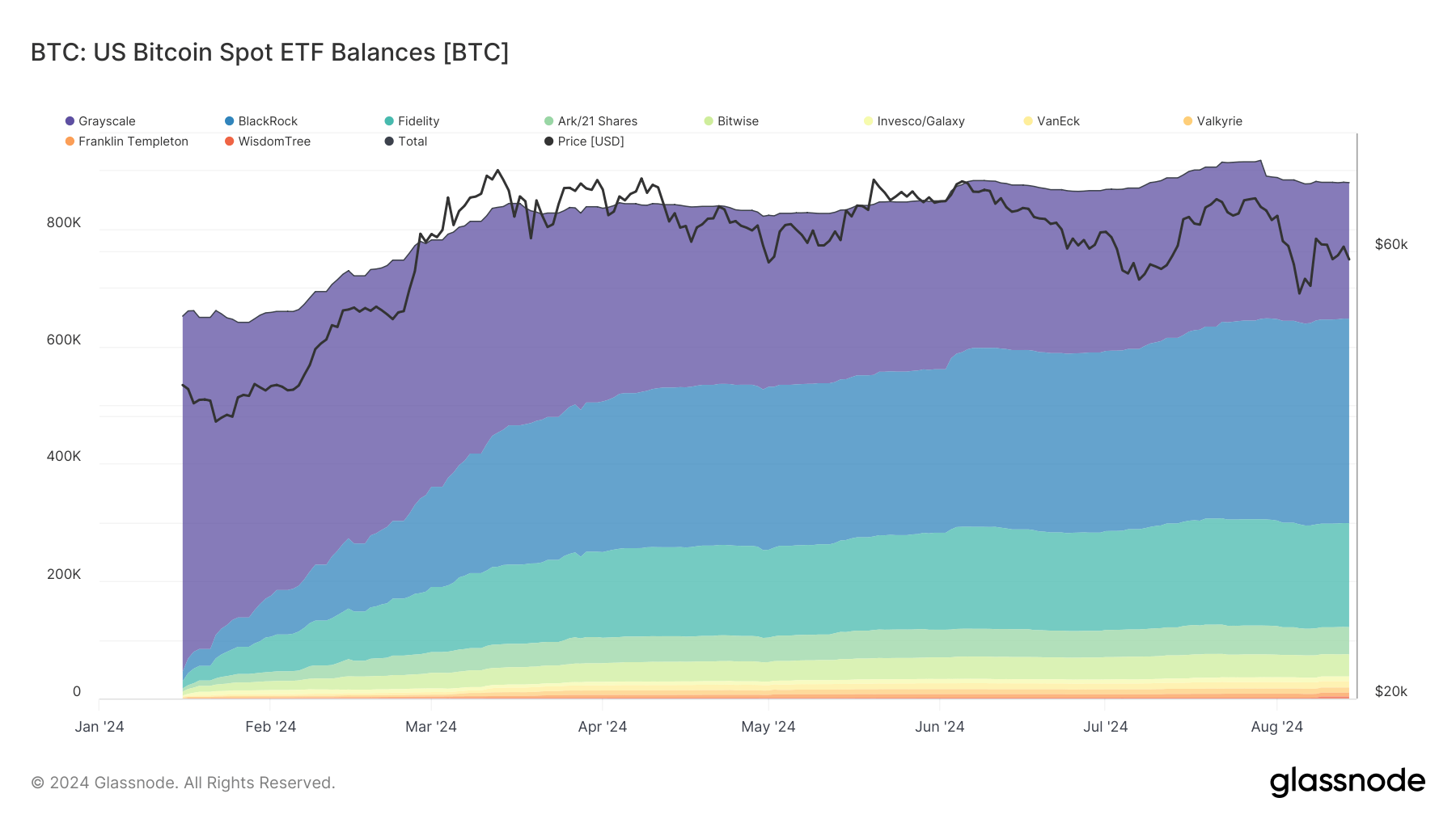

One crushed down this emergence successful LTH proviso could beryllium the maturation of BTC held by spot ETFs. The methodology for calculating LTH proviso considers Bitcoin that has not moved for 155 days oregon much arsenic portion of the semipermanent holder supply. Given that US Bitcoin spot ETF balances person accrued from 651,641 BTC connected Jan.16 to 879,799 BTC connected Aug. 14, a important information of these holdings would present person crossed the 155-day threshold, contributing to the summation successful LTH supply.

Graph showing the balances of the apical 10 US-traded spot Bitcoin ETFs successful 2024 (Source: Glassnode)

Graph showing the balances of the apical 10 US-traded spot Bitcoin ETFs successful 2024 (Source: Glassnode)This mentation aligns with the timing of the increase, arsenic galore of the ETF inflows from earlier successful the twelvemonth would person conscionable reached the 155-day mark. The important maturation successful ETF holdings, amounting to astir 228,158 BTC since the opening of the year, intimately matches the summation successful LTH supply.

This suggests institutional investors are adopting a semipermanent concern strategy for Bitcoin done spot ETFs. The marketplace seems to spot this arsenic a ballot of assurance successful Bitcoin’s aboriginal successful the TradFi market, which could promote different ample investors to travel suit.

Furthermore, the summation successful LTH proviso could perchance pb to a proviso compression successful the market. If much BTC is held by semipermanent investors and ETFs, some of which are little apt to merchantability rapidly and aggressively, the magnitude disposable for progressive trading decreases. If this simplification successful circulating proviso continues, it could, successful theory, pb to accrued terms unit erstwhile we spot different rally.

The resilience shown by semipermanent holders successful the look of caller terms decreases is besides worthy mentioning. Despite Bitcoin’s terms drop, the LTH equilibrium has accrued significantly. This suggests that semipermanent holders and organization investors, done ETFs, support their positions, perchance viewing the existent marketplace conditions arsenic a buying accidental alternatively than a crushed to sell. However, it volition instrumentality different 3 oregon truthful months earlier immoderate assets bought during this terms dip mature to beryllium considered semipermanent holder proviso and beryllium reflected successful on-chain metrics.

The station Bitcoin sees grounds maturation successful semipermanent holder supply appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)