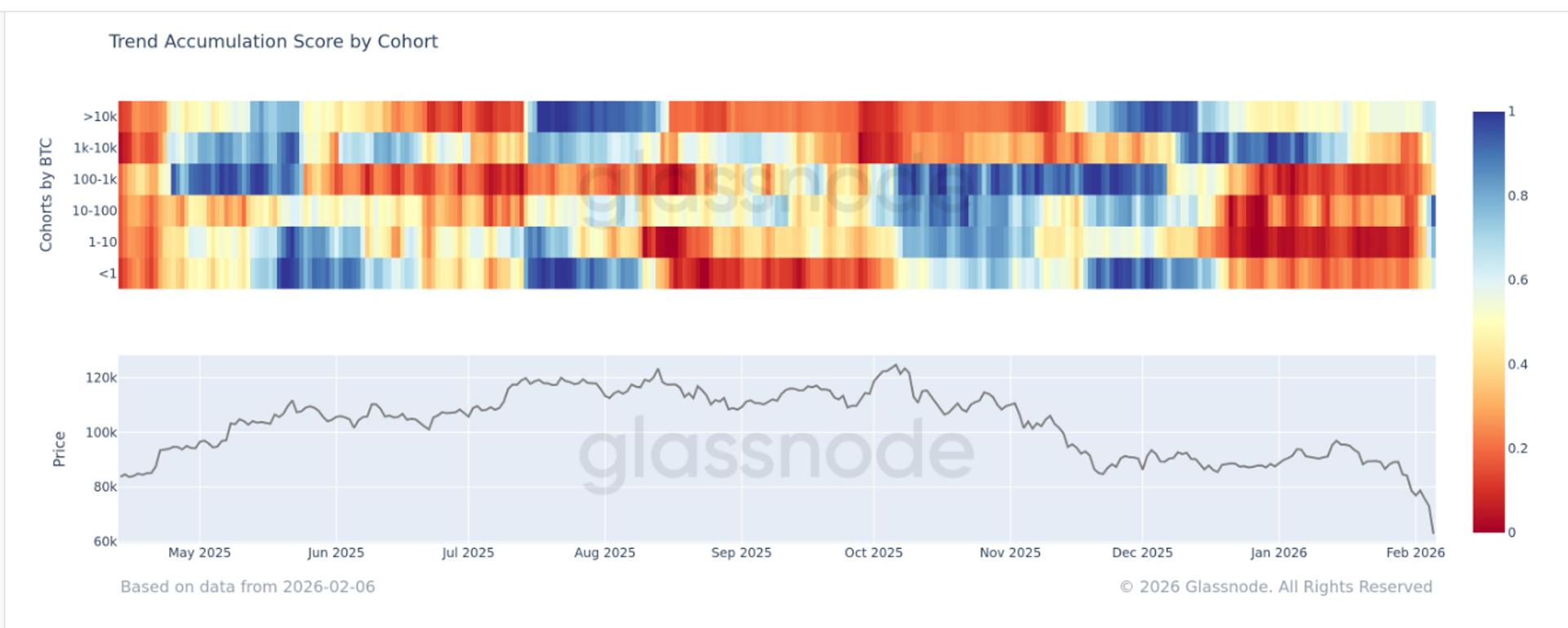

Since the abbreviated compression successful mid-December, Bitcoin has yet to marque immoderate important terms gain, facing aggregate rejections astatine the $90,000 terms zone. The maiden cryptocurrency is presently consolidating wrong the $87,000, portion investors patiently expect a wide marketplace direction. According to pseudonymous expert Sunny Mom, caller on-chain investigation suggests that bearish sentiment volition stay ascendant successful the coming months pursuing the archetypal extended correction successful October and November.

Why Rising Short-Term Bitcoin Supply Is Flashing A Rare Bearish Signal

In a QuickTake post connected December 27, Sunny Mom draws attraction to the BTC HODL waves, which amusement the rising stock of short-term holders coinciding with falling prices, flipping a metric that typically supports bullish narratives. Historically, an summation successful short-term holder (STH) supply, coins held for little than 155 days, suggests caller superior is entering the marketplace up of sustained rallies. However, the expert described the existent determination arsenic “passive bag-holding” alternatively than signaling “new blood.”

This is due to the fact that investors who bought during the $120,000 rally successful October, driven by FOMO, alongside dip buyers successful November, present beryllium connected unrealized losses, thereby creating a terms setup that alters marketplace behavior. Sunny Mom explains that each alleviation rally is met with selling unit arsenic these holders effort to exit astatine breakeven, efficaciously turning the expanding STH cohort into a ceiling alternatively than a floor. Therefore, terms rebounds conflict to summation traction.

Source: CryptoQuant

Source: CryptoQuantThe renowned expert explains that the marketplace is witnessing an affectional toll that is increasing visibly on-chain. Notably, determination person been repeated spikes successful Net Realized Loss (NRL) since October liquidations, suggesting that capitulation is underway, with investors locking successful losses aft months of endurance. Sunny Mom describes the process arsenic a “dull knife” yet cutting deep, an denotation that weaker hands are being forced out, not done a azygous crash, but done prolonged exhaustion.

Bitcoin In Demand Vacuum As Likely Fall Below $80,000 Remains Active

In further analysis, Mom attributes the existent bearish setup to a request vacuum. The marketplace adept explains that speech reserves are sitting adjacent multi-year lows, signaling constricted contiguous sell-side liquidity. At the aforesaid time, semipermanent holders (LTHs) amusement small involvement successful distributing coins, reinforcing the presumption that condemnation superior remains intact.

Therefore, the occupation lies connected the request side. With macro uncertainty inactive elevated, caller buyers look hesitant to measurement in, creating a request vacuum. This besides creates bladed bid books, meaning adjacent humble merchantability unit tin propulsion prices sharply lower.

While immoderate marketplace watchers people a imaginable betterment successful Q1 2026, citing expectations of complaint cuts and improved planetary liquidity. Mom predicts Bitcoin whitethorn request a “final shakeout” to resoluteness the imbalance and reset the marketplace for a bullish breakout. The expert points to a imaginable determination beneath $80,000 arsenic a liquidity hunt that could flush remaining anemic hands and let larger holders to reaccumulate.

Featured representation from Pngtree, illustration from Tradingview

1 month ago

1 month ago

English (US)

English (US)