Bitcoin was designed to empower the idiosyncratic done the separation of wealth and state. Self-custody wallets are integral successful preserving that goal.

This is an sentiment editorial by Kudzai Kutukwa, a passionate fiscal inclusion advocator who was recognized by Fast Company mag arsenic 1 of South Africa’s top-20 young entrepreneurs nether 30.

The merchandise of the Bitcoin achromatic insubstantial successful 2009 aft the 2008 fiscal situation was 1 the astir important events of the 21st century. For the archetypal clip ever, a trustless, peer-to-peer monetary strategy for the integer property that was autarkic of intermediaries and cardinal banks was present a reality.

Initially, Bitcoin was dismissed arsenic a passing fad and a worthless Ponzi scheme, but 13 years later, nary 1 is laughing astatine Bitcoin anymore. In fact, it’s present being ruthlessly attacked successful aggregate ways. These attacks person included 2021’s prohibition of Chinese bitcoin miners by the Chinese government; the continual denial of a spot Bitcoin exchange-traded money by the U.S. Securities and Exchange Commission (SEC); the framing of Bitcoin arsenic an biology hazard (which aboriginal prompted the EU to see banning proof-of-work mining); and, astir recently, the EU’s onslaught connected “unhosted wallets.” The second is not conscionable an effort astatine the regulatory seizure of Bitcoin, but it’s besides an onslaught connected your fiscal privacy. You tin deliberation of it arsenic the 21st-century mentation of Executive Order 6102.

Financial regulators astir the satellite person been dilatory turning up the vigor and cracking down connected the usage of unhosted wallets, but earlier we proceed immoderate further, we request to code the elephant successful the room, which is the word “unhosted wallet.” What connected Earth is an unhosted wallet anyway? It’s simply a noncustodial wallet (aka self-custody wallet) wherever the idiosyncratic owns the backstage keys and is 100% successful power of their wealth arsenic opposed to handing it implicit to a 3rd enactment for “safekeeping.” A elemental illustration of an unhosted wallet would beryllium your carnal wallet oregon purse which isn’t tied to immoderate fiscal institution, holds arsenic overmuch currency arsenic you privation to enactment into it and is 100% nether your control. What makes this word adjacent much bizarre and unsafe is that it implies that our idiosyncratic fiscal information has to beryllium “hosted” connected idiosyncratic else’s server. The accusation being that self-custody is dangerous, suspicious and wrong.

Introducing the word “unhosted wallet” is simply a subtle but effectual onslaught meant to support the relation of “trusted 3rd parties” that Bitcoin was created to replace. It makes perfectly nary consciousness for a permissionless and trustless strategy to necessitate the greenish airy from gatekeepers earlier it tin beryllium accessed.

Der Gigi expressed this thought perfectly erstwhile he said, “The treatment shouldn’t beryllium astir ‘hosting’ successful the archetypal place. It should beryllium astir control. Who tin entree your funds? Who tin frost your account? Who is the master, and who is the slave? Just similar ‘the unreality is idiosyncratic else’s computer,’ a ‘hosted wallet’ is idiosyncratic else’s wallet.”

There is nary Bitcoin without self-custody, conscionable IOUs from centralized exchanges. This is wherefore “not your keys, not your coins” is much than conscionable a catchphrase, but a reminder to stay financially sovereign.

Since Bitcoin is censorship resistant and cannot beryllium efficaciously banned, the choke points that are present being exploited are the on-ramps and off-ramps into and retired of the currency system. Given the information that the mean idiosyncratic is apt to get bitcoin from a centralized exchange, cognize your lawsuit rules are past enactment into play with the volition of attaching a authorities ID and carnal code to a “Bitcoin address.” The extremity end being a authorities wherever each transaction is tied to an individuality that leaves an audit way for the authorities, done which they tin easy behaviour fiscal surveillance and exert power similar they already bash successful the fiat system. Furthermore, your idiosyncratic information is astatine hazard from information leaks and hackers should the speech get compromised, arsenic is usually the case with centralized databases. A caller illustration of this would beryllium the breaching of the Shanghai Police Department’s database that resulted successful the theft of 1 cardinal people’s idiosyncratic data. Your bitcoin and idiosyncratic information are astatine hazard should this hap to a centralized speech wherever you person a hosted wallet. This is wherefore the usage of misnomers specified arsenic “unhosted wallet” should beryllium seen for what it is: regulatory capture.

This onslaught was switched into cogwheel successful October 2021, erstwhile the Financial Action Task Force (FATF), successful their “Updated Guidance for a Risk-Based Approach to Virtual Assets and Virtual Asset Service Providers,” specified that transactions betwixt unhosted wallets airs circumstantial wealth laundering and violent financing risks and that, nether definite situations, immoderate transactions betwixt unhosted wallets autumn nether the travel rule. In March 2022, regulators successful Canada, Japan and Singapore mandated that centralized exchanges should cod idiosyncratic data, specified arsenic names and carnal addresses of owners of unhosted wallets that person oregon nonstop bitcoin oregon different cryptocurrencies to the customers of these exchanges. These requirements were implemented successful Canada soon aft the authorities had frozen slope accounts and adjacent “hosted wallets” of the truckers who were protesting against COVID-19 mandates. Similar rules to those implemented by Canada, Japan and Singapore went into effect successful the Netherlands connected June 27, 2022.

Not to beryllium outdone successful this statist overreach, the European parliament reached a provisional agreement connected their cryptocurrency bill, dubbed “Markets successful Crypto-Assets (MiCA),” which aims to modulate and spot “unhosted wallets” nether fiscal surveillance. According to a connection released by the parliament successful a press release:

“Transfers of crypto-assets volition beryllium traced and identified to forestall wealth laundering, violent financing, and different crimes, says the caller authorities agreed connected Wednesday. … The rules would besides screen transactions from alleged un-hosted wallets (a crypto-asset wallet code that is successful the custody of a backstage user) erstwhile they interact with hosted wallets managed by CASPs [Crypto Asset Service Providers].”

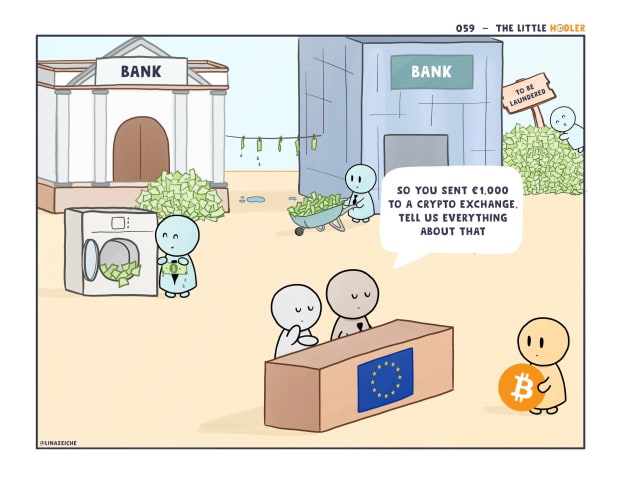

Ernest Urtasun, a subordinate of the European Parliament, posted a celebratory thread connected Twitter outlining immoderate of the cardinal aspects of the measure that “will enactment an extremity to the chaotic westbound of unregulated crypto.” According to 1 of the tweets successful this thread, the caller regulations volition mandate centralized exchanges to unmask the individuality of the proprietor of an unhosted wallet earlier “large” amounts of crypto are sent to them — by large, they mean €1,000 oregon more. In a subsequent statement, helium hailed the caller regulations arsenic being the close remedy for warring wealth laundering and reducing fraud.

The irony of the substance is contempt their “good intentions” successful seeking to curb wealth laundering, an estimated 2–5% of planetary GDP ($1.7 trillion to $4.2 trillion) is laundered globally, mostly via the accepted banking strategy according to the UNODC. More wealth is laundered annually done the banking strategy than the full marketplace headdress ($1 trillion astatine the clip of publication) of each cryptocurrencies combined. It gets worse: The interaction of anti-money laundering laws (AML) connected criminal financing is 0.05% — meaning criminals person a 99.95% occurrence complaint successful laundering wealth — and compliance costs transcend the worth of confiscated illicit funds a 100 times over. Real criminals get a escaped walk portion fiscal institutions and the mean law-abiding national are penalized. According to the Journal of Financial Crime, AML laws are wholly ineffective successful stopping the travel of ill-gotten gains. Between 2010 and 2014, a paltry 1.1% of transgression profits were seized successful the EU, according to a report by Europol. No wonderment AML laws person been dubbed the astir ineffective anti-crime measures anywhere! Yet, the bigger occupation seems to beryllium unhosted wallets and the “wild westbound of unregulated crypto.” Talk astir misplaced priorities.

(Source)

(Source)

Despite the evident failures of AML successful the accepted fiscal system, lawmakers and regulators inactive importune connected targeting unhosted wallets with burdensome and impractical regulations. Not lone volition MiCA stifle innovation wrong the EU, it’s besides going to effect successful superior formation to much Bitcoin-friendly jurisdictions similar El Salvador. One would beryllium forgiven for speculating that laws similar MiCA are a dilatory creep toward the outright prohibition of self-custody wallets and are forerunners that volition pave the mode for the instauration of cardinal slope integer currencies (CBDCs): a much Orwellian signifier of money. The architecture of hosted wallets and that of CBDCs are akin successful that they are some centralized, they are taxable to fiscal surveillance, and they are nether the power of a 3rd party.

In a satellite wherever integer payments are the regularisation and not the exception, it is captious to person outgo systems and tools that are sufficiently decentralized and businesslike successful bid to support the extortion of privacy. The value of having fiscal privateness was summarized perfectly successful Eric Hughes’ “Cypherpunk Manifesto”:

“Privacy is indispensable for an unfastened nine successful the physics age. Privacy is not secrecy. A backstage substance is thing 1 doesn't privation the full satellite to know, but a concealed substance is thing 1 doesn't privation anybody to know. Privacy is the powerfulness to selectively uncover oneself to the satellite … Therefore, privateness successful an unfastened nine requires anonymous transaction systems. Until now, currency has been the superior specified system. An anonymous transaction strategy is not a concealed transaction system. An anonymous strategy empowers individuals to uncover their individuality erstwhile desired and lone erstwhile desired; this is the essence of privacy.”

These words inactive ringing existent today. Once your individuality is paired to a wallet, your privateness is compromised and it becomes easier to way each your on-chain transactions forever. If you don’t power however overmuch you tin person oregon wherever you tin store it, you don’t ain your money. Whoever controls your wealth controls you. Centralized fiscal systems — of which hosted wallets are a portion — are each authoritarian’s imagination and are designed to assistance the powerfulness of fiscal omniscience to the state. Bitcoin was designed to empower the idiosyncratic done the separation of wealth and state. Self-custody wallets are integral successful preserving that.

This is simply a impermanent station by Kudzai Kutukwa. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)