The communicative has not been immoderate overmuch antithetic for Bitcoin, with its terms inactive stuck successful a consolidation range successful the past week. The sluggishness of the premier cryptocurrency – and the wide marketplace – has continued contempt the completion of the halving lawsuit implicit a week ago.

The halving event, which saw mining rewards instrumentality a important cut, was expected to usher successful different circular of bullishness for the Bitcoin price. On the contrary, investors look to beryllium getting frustrated with the dilatory enactment of the market, with galore calling for the dump of BTC.

Bitcoin Sell Calls At Increased Rate: Blockchain Firm

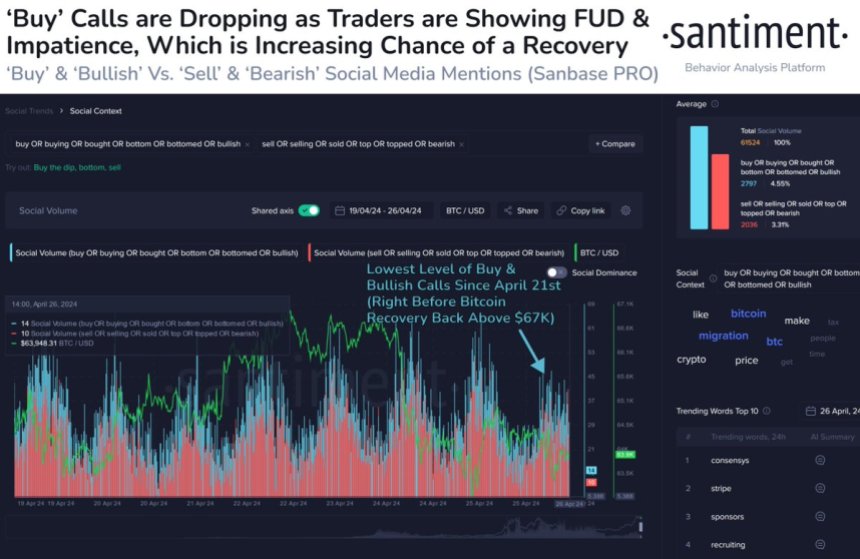

According to a recent report by on-chain analytics steadfast Santiment, investors are progressively calling for the merchantability of Bitcoin crossed societal media pursuing its latest driblet toward $63,000. The applicable metric present is the “social volume” indicator, which tracks the fig of unsocial posts and messages connected antithetic societal platforms that notation a circumstantial topic.

Santiment aggregated information of “buy oregon bullish”, “sell oregon bearish,” oregon related mentions for the premier cryptocurrency implicit the past week. The on-chain analytics past highlighted a displacement successful the trend, with the bearish calls looking to drown retired the bullish sound connected societal media.

According to Santiment, Bitcoin’s caller autumn to $63,000 resulted successful the lowest level of bargain and bullish calls since April 21st (just earlier BTC recovered backmost supra $67,000). As shown successful the illustration above, the social volume for presumption related to “sell” changeable up aft the terms decline.

Typically, the accrued bearish mentions of Bitcoin suggest a rising level of FUD (fear, uncertainty, and doubt) amongst investors. However, erstwhile traders seemingly go frustrated and impatient, determination is usually a higher probability of a marketplace rebound.

Almost 90% Of Circulating BTC In Profit – Impact On Price

According to caller on-chain data, astir 90% of Bitcoin successful proviso is successful profit. On the surface, this fundamentally implies that the astir existent holders of the premier cryptocurrency bought astatine a little terms compared to the existent price.

However, this level of profitability tin besides beryllium an overbought signal, particularly aft bullish periods similar the 1 that occurred betwixt October 2023 and March 2024. Ultimately, this suggests investors could spot Bitcoin shed much of its terms gains implicit the adjacent coming weeks.

As of this writing, Bitcoin is valued astatine $63,077, reflecting a 2% terms diminution successful the past 24 hours.

Featured representation from iStock, illustration from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)