Bitcoin fluctuated betwixt $92,000 and $100,000 done precocious December earlier reclaiming $102,000 by Jan. 6. CryptoQuant information suggests that reduced sell-side liquidity, changes successful over-the-counter (OTC) table balances, and a renewed whale accumulation signifier mightiness beryllium factors shaping these fluctuations.

OTC Desk balances decline

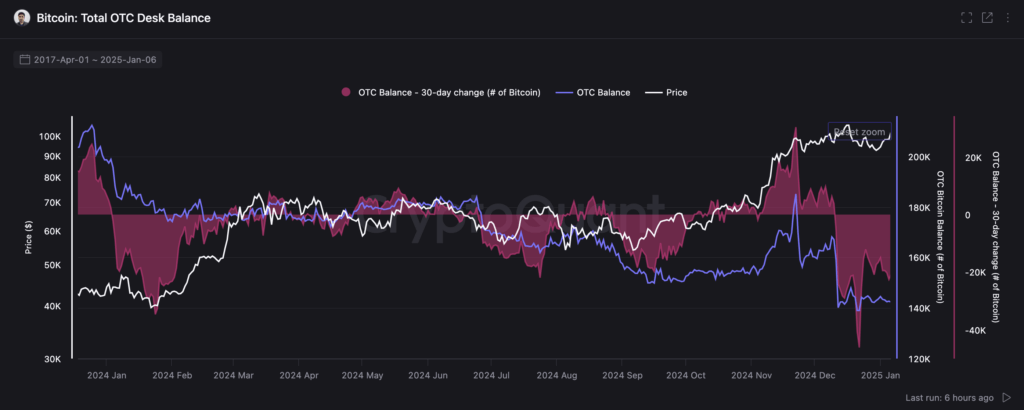

Activity connected OTC desks, tracked done full holdings and 30-day equilibrium changes, reveals declining balances astatine the extremity of 2024 aft rising from October to December. Net outflows from these desks person appeared alongside a rising terms environment, prompting discussions that ample entities could beryllium withdrawing coins from OTC channels and holding them off-exchange.

Per CryptoQuant, the pinkish overlay successful the OTC illustration beneath reflects a antagonistic 30-day change, indicating much BTC outflow than inflow, portion the bluish enactment measuring the wide OTC table equilibrium shows a dependable decrease. Analysts ticker this dynamic due to the fact that it often coincides with organization oregon high-volume buyers removing coins from contiguous circulation, often moving into spot Bitcoin ETFs.

Whales accumulate Bitcoin

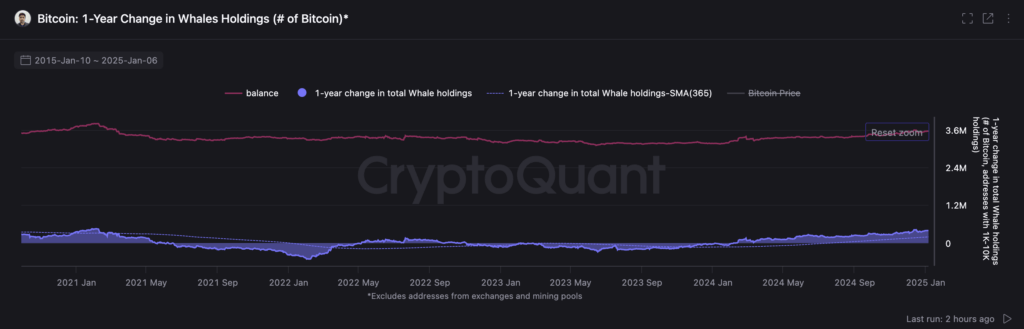

Further insights look from whale behavior. Addresses with 1,000 to 10,000 BTC displayed prolonged nett selling from 2021 to 2023, yet 2024 information showed a displacement toward neutral to somewhat affirmative accumulation, highlighted successful one-year alteration metrics.

These addresses had been distributing implicit a multi-year period, but much caller information points to a reversal. Until 2024, the pinkish enactment representing full whale holdings had plateaued astatine little levels and past moved somewhat higher, portion the bluish enactment measuring 1-year alteration began inching person to zero. Since January 2024, some the whale equilibrium and 1-year alteration person moved positive. This suggests that, astatine slightest successful the aggregate, whales person reduced organisation and are perchance reacquiring coins aft the halving and consequent volatility.

Sell-side liquidity declines

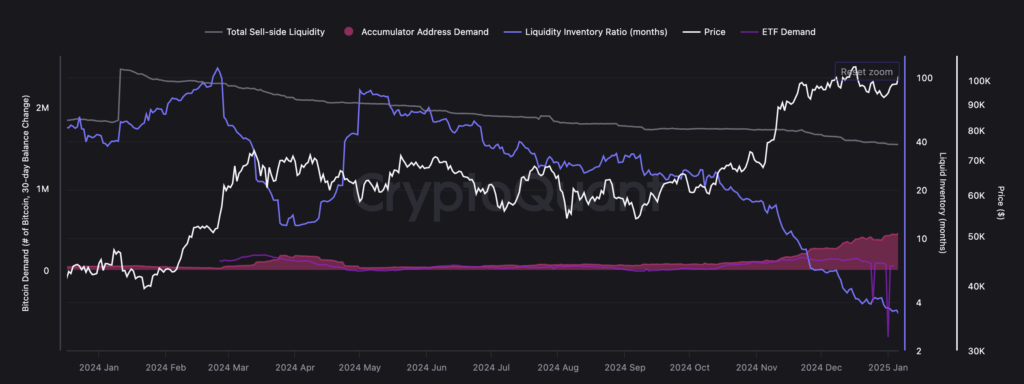

The liquidity inventory ratio and full sell-side liquidity measures adhd further context. The CryptoQuant visualization beneath shows a downward inclination successful the wide liquid supply, suggesting less BTC reside successful wallets known to prosecute successful regular selling.

The liquidity ratio, often expressed successful months, compares disposable BTC successful liquid addresses to ongoing demand, and a falling ratio indicates that caller request could much rapidly outstrip accessible supply. Meanwhile, the accumulator code request metric shows incremental inflows to addresses known for semipermanent holding. These inflows person steadily accrued since November 2024 alternatively than spiking dramatically. That signifier whitethorn correspond a dependable but not explosive question of “buy-and-hold” behavior, which tin tighten marketplace conditions combined with falling liquid supply.

Sell-side liquidity successful detail

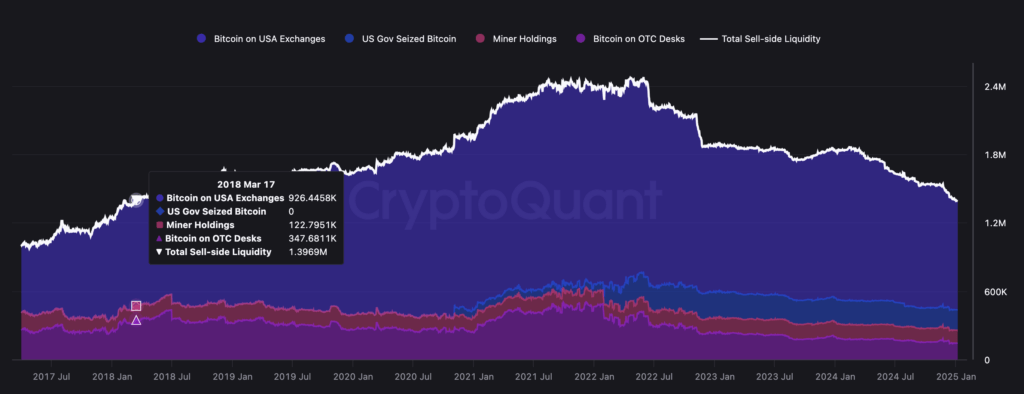

The aggregated information beneath tracks this changing organisation of BTC crossed large categories: U.S. exchanges, OTC desks, miner holdings, and coins seized by authorities entities. Per CryptoQuant, the full fig of BTC connected U.S. exchanges dropped from peaks supra 2 cardinal successful 2021 to astir 1.39 cardinal today. The past clip this fig was this debased was successful March 2018.

This diminution mostly aligns with broader manufacture trends showing reduced speech balances, perchance influenced by rising consciousness of self-custody and organization strategies that favour off-exchange storage. The OTC portion, portion smaller, echoes the downward signifier seen successful standalone OTC charts, stressing the anticipation that ample buyers person migrated coins distant from easy accessible pools of liquidity.

Miner holdings person shown constricted volatility, though occasional shifts successful their equilibrium tin awesome the interaction of operational costs oregon broader marketplace pressures. These fluctuations did not overshadow the driblet successful full sell-side liquidity, which had stood successful the multi-million coin scope earlier declining arsenic participants moved assets to backstage wallets. Government-held BTC, which occasionally emerges from auctions of seized coins, remains a tiny constituent of the full proviso but is tracked by on-chain analysts who enactment periodic spikes successful that metric tied to large-scale ineligible actions.

Bitcoin terms past successful 2024

Bitcoin’s terms past done precocious 2024 into aboriginal 2025 provides a backdrop for interpreting these on-chain observations. It rallied from astir $93,400 connected Nov. 13 to repeated all-time highs successful December, breaking $100,000 connected Dec. 5 and reaching $108,300 connected Dec. 17. The consequent pullback to astir $93,000 connected Dec. 20 did not erase the broader uptrend, and each rally brought proviso conditions backmost into focus.

As CryptoQuant information shows, the interplay of speech equilibrium declines, OTC table outflows, and whale accumulation suggests that proviso unit remains a cardinal power connected marketplace structure. Traders person pointed to the dependable request from accumulators, mean miner selling, and reduced speech reserves arsenic grounds that the interval of disposable coins continues to shrink.

Observers enactment that these developments followed the April 2024 halving, which reduced artifact rewards to 3.125 BTC each 10 minutes, adding different magnitude to proviso constraints. By November 2024, the U.S. statesmanlike predetermination effect coincided with a swift terms surge that saw Bitcoin attack $100,000, a psychologically important threshold.

Bitcoin remains adjacent six figures, with on-chain information suggesting that the circulating proviso excavation remains tight. The reaccumulation by larger holders, nett outflows from OTC desks, and incremental additions to accumulator addresses converge to reenforce the conception that circulating BTC whitethorn beryllium little plentiful than successful erstwhile cycles.

The station Bitcoin sell-side liquidity hits lowest level since 2018 fueling BTC rally appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)