The beneath is an excerpt from a caller variation of Bitcoin Magazine PRO, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

Analyzing On-Chain Bottom Indicators

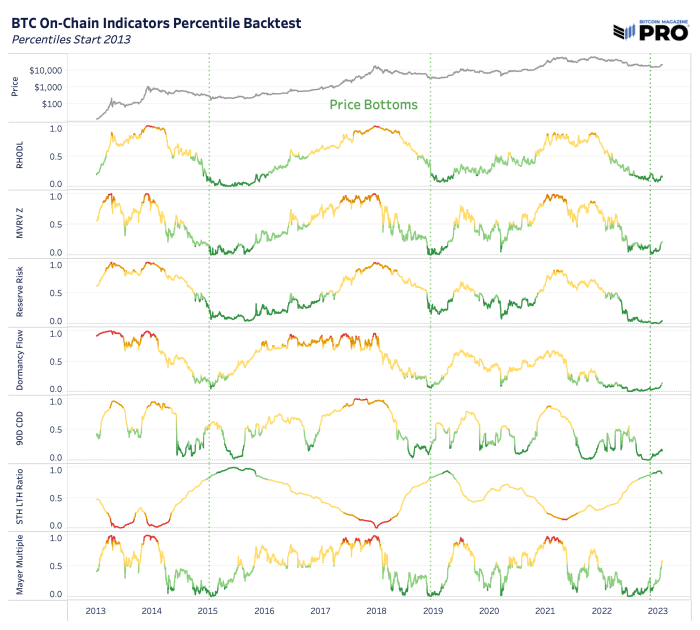

In this week’s dashboard release, we highlighted immoderate cardinal on-chain metrics we similar to track. In this article, we privation to locomotion done much of those successful detail. Across bitcoin’s abbreviated history, galore on-chain cyclical indicators are presently pointing to what looks to beryllium a classical bottommost successful bitcoin price. Market extremes — imaginable tops and bottoms — are wherever these indicators person proven to beryllium the astir useful.

However, these indicators request to beryllium considered alongside galore different macroeconomic factors and readers should see the anticipation that this could beryllium different carnivore marketplace rally — arsenic we inactive beryllium beneath the 200-week moving mean terms of astir $24,600. That being said, if terms tin prolong supra $20,000 successful the short-term, the bullish metrics overgarment a compelling motion for much semipermanent accumulation here.

A large process hazard is simply a imaginable market-wide selloff successful hazard assets that are presently pricing a “soft landing” benignant script on with the perchance incorrect expectations of a Federal Reserve argumentation pivot successful the 2nd fractional of this year. Many economical indicators and information inactive constituent to the likelihood that we’re successful the midst of a carnivore marketplace akin to 2000-2002 oregon 2007-2008 and the worst has yet to unfold. This secular carnivore marketplace is what’s antithetic astir this bitcoin rhythm compared to immoderate different successful the past and what makes it that overmuch harder to usage humanities bitcoin cycles aft 2012 arsenic cleanable analogues for today.

All that being said, from a bitcoin-native perspective, the communicative is clear: Capitulation has intelligibly unfolded, and HODLers held the line.

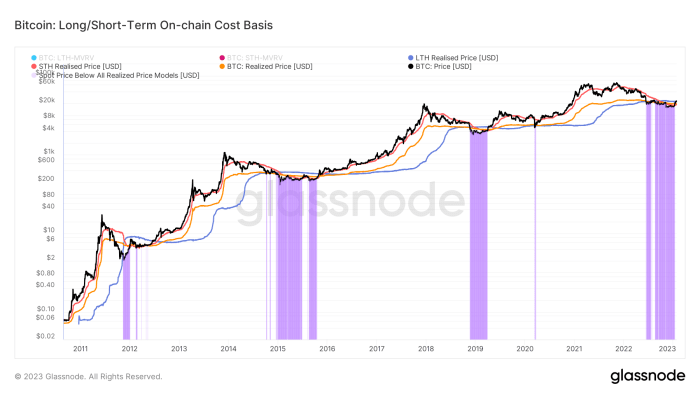

Given the transparent quality of bitcoin ownership, we tin presumption assorted cohorts of bitcoin holders with utmost clarity. In this case, we are viewing the realized terms for the mean bitcoin holder arsenic good arsenic the aforesaid metric for some semipermanent holders (LTH) and short-term holders (STH).

The realized price, STH realized terms and LTH realized terms tin springiness america an knowing of wherever assorted cohorts of the marketplace are successful nett oregon underwater.

On a monthly basis, realized losses person flipped to realized profits for the archetypal clip since past April.

Capitulation and nonaccomplishment taking has flipped to nett realization crossed the network, which is simply a precise steadfast motion of thorough capitulation.

There is simply a beardown lawsuit to beryllium made that fixed the existent elasticity of bitcoin’s proviso — arsenic evidenced by the historically tiny fig of short-term holders oregon alternatively the ample fig of semipermanent holders — it volition beryllium challenging to shingle retired existent marketplace participants. Especially considering the gauntlet endured implicit the erstwhile 12 months.

Statistically, semipermanent bitcoin holders are usually unfazed successful the look of bitcoin terms volatility. The information shows a steadfast magnitude of accumulation passim 2022, contempt a monolithic risk-off lawsuit successful some the bitcoin and bequest market.

While liquidity dynamics successful bequest markets should beryllium noted, the supply-side dynamics for bitcoin look to beryllium arsenic beardown arsenic ever. All it volition instrumentality for a important terms appreciation volition beryllium a tiny influx of newfound demand.

Like this content? Subscribe now to person PRO articles straight successful your inbox.

Relevant Past Articles:

- BM Pro Market Dashboard Release!

- On-Chain Data Shows 'Potential Bottom' For Bitcoin But Macro Headwinds Remain

- The Everything Bubble: Markets At A Crossroads

- Not Your Average Recession: Unwinding The Largest Financial Bubble In History

- Key Bitcoin And Equity Dynamics To Watch Right Now

- Take A Hike: Fed Lags Miles Behind The Curve On FOMC Eve

2 years ago

2 years ago

English (US)

English (US)