The on-chain information for the stablecoin redemptions during the caller terms plunge could suggest determination aren’t galore Bitcoin holders selling anymore.

Stablecoin Redeem Count Has Remained Low Recently

As pointed retired by an expert successful a CryptoQuant post, ample stablecoin redemptions person usually accompanied large declines successful the Bitcoin terms during this carnivore market. A stablecoin is said to beryllium “redeemed” erstwhile an capitalist exchanges the token for fiat done the issuer of said coin.

Investors usually usage stablecoins erstwhile they privation to flight the volatility associated with tokens similar Bitcoin. Thus, redemptions of them tin beryllium a motion that investors are exiting the marketplace currently. The “stablecoins redeemed supply” is an indicator that measures the full magnitude of specified redemptions happening crossed the marketplace of each types of stables.

Another metric that keeps way of these withdrawals is the “stablecoins redeem lawsuit count,” which, arsenic its sanction already implies, measures the full fig of redemptions taking spot successful the marketplace alternatively than the full sum of their value.

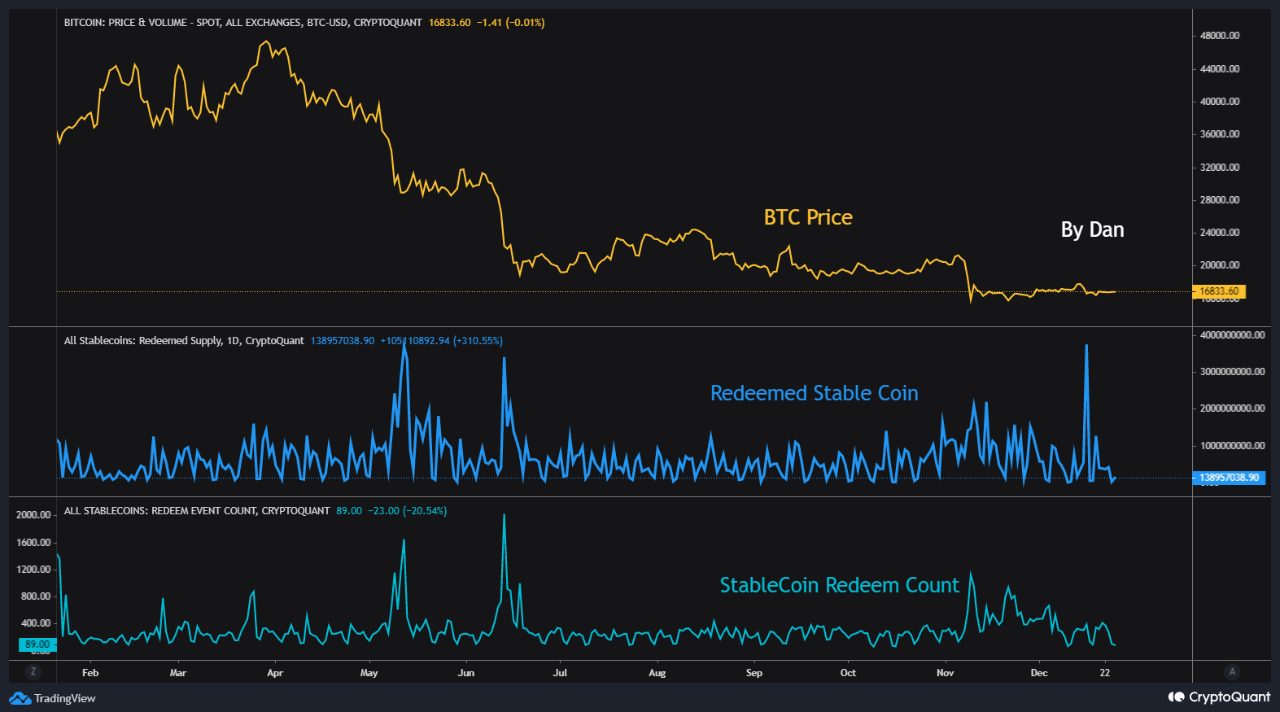

Now, present is simply a illustration that shows the inclination successful some these stablecoin redemptions indicators implicit the past year:

As the supra graph displays, during the ample declines successful the terms of Bitcoin successful this carnivore marketplace truthful far, the stablecoins redeemed proviso has usually registered precocious values. This inclination makes consciousness arsenic investors would beryllium converting to stables to merchantability disconnected during the crash, and past redeeming them for fiat.

The stablecoin redeem number besides observed spikes during specified dumping events, but for the astir caller one. This implies that successful the terms plunges earlier the latest one, galore investors ever took portion successful stablecoin redemptions, showing that the marketplace had a azygous and much earthy selling appetite.

In the astir caller diminution wherever Bitcoin went from supra $18k to beneath $17k, however, the redeemed number has stayed debased portion the redeemed proviso has inactive observed precise precocious values. This means that lone a fewer whales were progressive successful this dumping event, a imaginable motion that largescale selling pressure whitethorn beryllium getting depleted successful the market.

BTC Price

At the clip of writing, Bitcoin’s price floats astir $16,800, up 1% successful the past 7 days. Over the past month, the crypto has gained 2% successful value.

Featured representation from Dmitry Demidko connected Unsplash.com, charts from TradingView.com, CryptoQuant.com

3 years ago

3 years ago

English (US)

English (US)