Arthur Hayes, the laminitis of BitMEX, has offered an in-depth investigation of the existent fiscal scenery and its imaginable interaction connected Bitcoin, particularly successful airy of the caller challenges faced by New York Community Bancorp (NYCB) and the broader banking sector.

Hayes’s investigation draws connected the analyzable interplay betwixt macroeconomic policies, banking assemblage health, and the cryptocurrency market. His comments are peculiarly insightful fixed the recent developments with NYCB. The bank’s banal plummeted by 46% owed to an unexpected nonaccomplishment and a important dividend cut, which was chiefly attributed to a tenfold summation successful indebtedness nonaccomplishment reserves, acold exceeding estimates.

This incidental raised reddish flags astir the stableness and vulnerability of US determination banks, peculiarly successful the existent property sector, which is known to beryllium cyclically delicate and susceptible to economical downturns. The banal marketplace reacted negatively to these developments, with determination US slope stocks besides declining owed to NYCB’s performance.

Weekend Rally Ahead For Bitcoin?

Hayes explicitly stated, “Jaypow [Jerome Powell] and Bad Burl Yellen [Janet Yellen] volition beryllium printing wealth precise soon. NYCB annc a ‘surprise’ nonaccomplishment driven by indebtedness nonaccomplishment reserves rising 10x vs. estimates. Guess the banks ain’t fixed.” This remark underscores the persisting fragility of the banking sector, inactive reeling from the shocks of the 2023 banking crisis. He added, “10-yr and 2-yr yields plunged, signaling the marketplace expects immoderate benignant of renewed bankster bailout to hole the rot.”

Furthermore, Hayes highlighted the impending decision of the Federal Reserve’s Bank Term Funding Program (BTFP), which was introduced successful effect to the 2023 banking crisis. The BTFP was a captious instrumentality successful providing liquidity to banks, allowing them to usage a wider scope of collateral for borrowing.

Hayes anticipates marketplace turbulence starring to the Fed perchance reinstating the BTFP oregon introducing akin measures. In a caller statement, helium noted, “If my forecast is correct, the marketplace volition bankrupt a fewer banks wrong that period, forcing the Fed into cutting rates and announcing the resumption of the BTFP.” This scenario, helium argues, would make a liquidity injection that could buoy cryptocurrencies similar Bitcoin.

In his latest station connected X, Hayes drew parallels to the cryptocurrency’s show during the March 2023 banking crisis. He predicts a akin trajectory, suggesting a little dip followed by a important rally:

Expect BTC to swoon a bit, but if NYCB and a fewer others dump into the weekend, expect a caller bailout close quick. Then BTC disconnected to the races conscionable similar March ’23 terms action. […] I deliberation it mightiness beryllium clip to get backmost connected the bid fam. Maybe aft a fewer US banks wound the particulate this weekend.

During the March crisis, Bitcoin’s worth jumped implicit 40%, a absorption attributed to its perceived relation arsenic a integer golden oregon a safe-haven plus amid fiscal instability. On a longer clip skyline and with the Great Financial Crisis from 2008 successful mind, helium further argued, “What did the Fed and Treasury bash past clip US spot prices plunged and bankrupted banks globally? Money Printer Go Brrrr. BTC = $1 million. Yachtzee.”

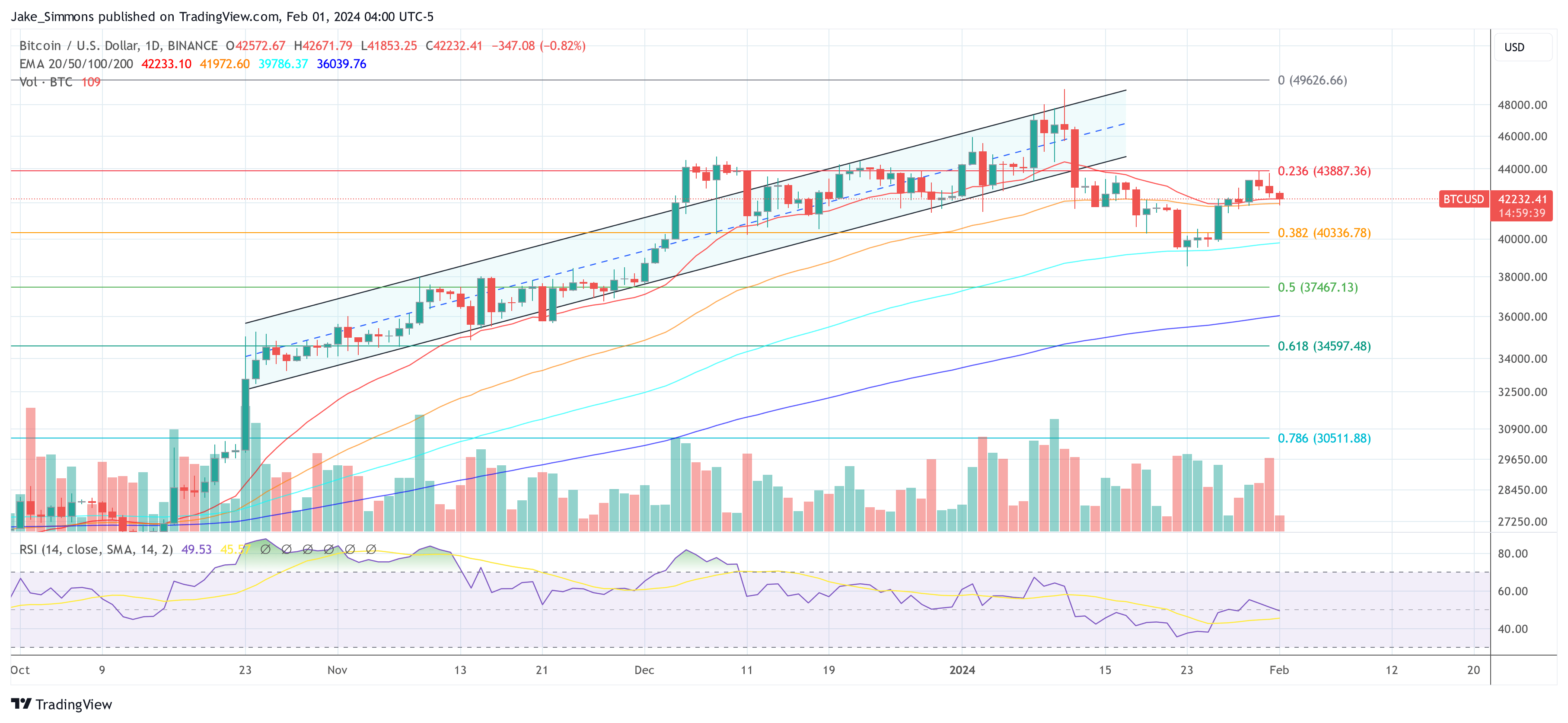

At property time, BTC traded astatine $42,232.

BTC terms got rejected astatine the 0.236 Fib, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC terms got rejected astatine the 0.236 Fib, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

2 years ago

2 years ago

![Crypto News Today [Live] Updates On Feb 10, 2026](https://image.coinpedia.org/wp-content/uploads/2025/12/04161105/Crypto-Market-News-Today-LIVE-Updates-4th-Dec-Ethereum-Fusaka-Upgrade-ETH-ETF-inflows-ETH-Price-Today-1024x536.webp)

English (US)

English (US)